Stock Market Valuation Concerns: Why BofA Remains Confident

Table of Contents

BofA's Key Arguments for a Positive Market Outlook Despite Valuation Concerns

BofA's confidence stems from a multi-pronged analysis of the current economic and market landscape. Their positive outlook, despite acknowledging existing stock market valuation concerns, rests on several key pillars.

Strong Corporate Earnings and Profitability

BofA's analysis points towards robust corporate earnings as a key mitigating factor against prevalent stock market valuation concerns. Their research highlights several sectors exhibiting exceptional performance, contributing significantly to overall market strength. Key metrics like EPS (earnings per share) growth, revenue growth, and profit margins are showing positive trends.

- Strong Performance Sectors: Technology, healthcare, and consumer staples have demonstrated particularly strong earnings growth.

- Examples of Strong Performers: (Insert examples of companies with strong recent earnings reports, citing specific data points like percentage growth in EPS or revenue). For instance, Company X saw a 15% year-over-year increase in EPS, while Company Y reported a 10% surge in revenue.

- Impact on Market Valuations: These strong earnings demonstrate the underlying profitability of many companies, suggesting that current market valuations, while potentially high in certain sectors, are at least partially justified by strong fundamentals and future growth potential, mitigating some stock market valuation concerns.

Resilient Consumer Spending and Economic Growth

A resilient consumer sector is another cornerstone of BofA's positive outlook. Continued consumer spending, fueled by robust employment numbers and relatively low unemployment rates, significantly boosts company revenues and supports current valuations.

- Key Economic Indicators: Positive GDP growth, low unemployment rates, and rising consumer confidence indices all point to a healthy economy. (Insert specific data points here, e.g., "GDP grew by X% in the last quarter," "Unemployment is at Y%").

- Impact on Market: Sustained consumer spending translates directly into higher company revenues, supporting current stock market valuations and lessening stock market valuation concerns. BofA projects continued, albeit potentially moderated, economic growth in the coming quarters, further solidifying their positive view.

Favorable Interest Rate Environment (or potential adjustments)

BofA's perspective on interest rates and their impact on market valuations is crucial to their overall assessment. While interest rate hikes can impact stock valuations negatively, BofA's analysis suggests that the current interest rate environment (or projected adjustments) is manageable and won't derail market growth significantly.

- Potential Scenarios: BofA anticipates (insert BofA's projected interest rate trajectory here, e.g., a gradual increase or a pause in rate hikes). They have also considered the potential impact of alternative scenarios (e.g., quicker increases or rate cuts).

- Impact on Investor Behavior: The bank acknowledges that interest rate changes affect investor behavior and stock prices, but their analysis suggests that the projected increases (or lack thereof) are priced into the market and won't significantly alter the long-term outlook.

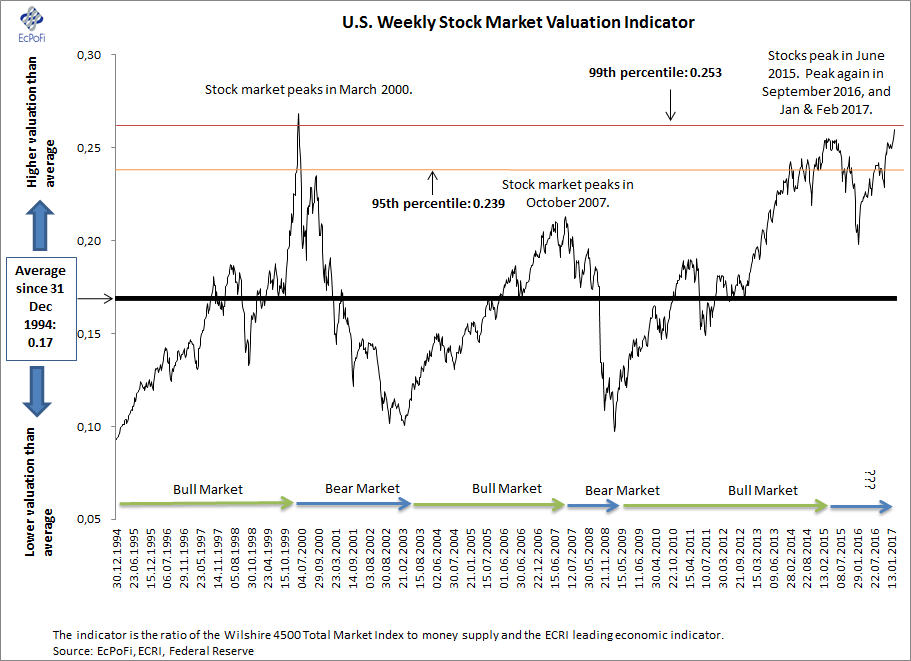

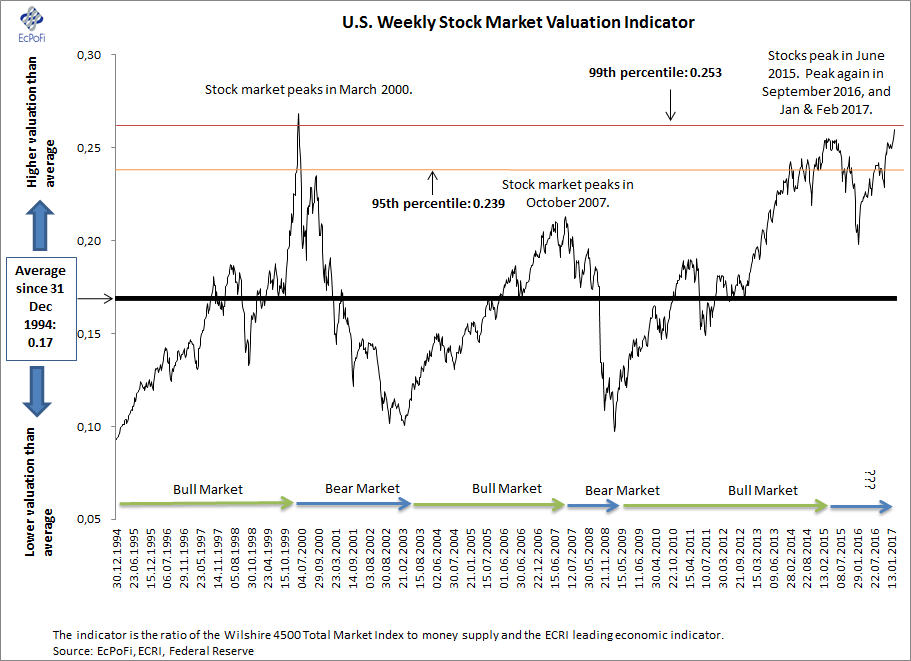

Addressing Specific Valuation Metrics

BofA's analysis incorporates a careful examination of key valuation metrics to address common stock market valuation concerns. They acknowledge that some metrics, such as the P/E ratio, might appear high compared to historical averages. However, their analysis considers factors such as:

- Forward-Looking Metrics: Instead of solely relying on trailing P/E ratios, BofA likely emphasizes forward-looking metrics, considering projected earnings growth.

- Sectoral Variations: They understand that valuation multiples vary widely across sectors and industries. Therefore, they assess valuations on a sector-specific basis, recognizing that higher valuations might be justified in high-growth sectors.

- Comparison to Peers: BofA likely benchmarks current valuations against those of comparable companies and industries, providing context for current market capitalization levels. (Include visual representations like charts or graphs if possible to illustrate the comparison).

Conclusion: Understanding Stock Market Valuation Concerns and BofA's Perspective – A Call to Action

BofA's confidence in the market stems from a combination of strong corporate earnings, resilient consumer spending, and a considered view of the interest rate environment. While acknowledging the existence of stock market valuation concerns, their analysis suggests that these concerns are mitigated by the underlying strength of the economy and corporate profits. Understanding various perspectives on stock market valuations, including those of major financial institutions like BofA, is crucial for informed investment decision-making.

It's important to conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Learn more about navigating stock market valuation concerns and understanding BofA's strategic outlook to develop a robust investment strategy tailored to your risk tolerance and financial goals. Staying informed on the latest market analyses is vital in effectively addressing stock market valuation concerns and making sound investment choices.

Featured Posts

-

Retailers Sound Alarm Tariff Induced Price Increases Wont Stay Away

May 01, 2025

Retailers Sound Alarm Tariff Induced Price Increases Wont Stay Away

May 01, 2025 -

Numerique Et Thes Dansants Simplifier L Organisation Et Attirer Plus De Participants

May 01, 2025

Numerique Et Thes Dansants Simplifier L Organisation Et Attirer Plus De Participants

May 01, 2025 -

Community Mourns After Four Die Including Children In After School Camp Car Crash

May 01, 2025

Community Mourns After Four Die Including Children In After School Camp Car Crash

May 01, 2025 -

Fouad L En De Erasmusschotpartij Waarom Geen Tbs Bij Een Levenslange Gevangenisstraf

May 01, 2025

Fouad L En De Erasmusschotpartij Waarom Geen Tbs Bij Een Levenslange Gevangenisstraf

May 01, 2025 -

Nintendos Action Forces Ryujinx Emulator Development To Cease

May 01, 2025

Nintendos Action Forces Ryujinx Emulator Development To Cease

May 01, 2025