Stock Market Valuations And Investor Sentiment: BofA's Assessment

Table of Contents

BofA's Current Valuation Metrics

BofA's assessment of current stock market valuations utilizes a range of key metrics to gauge the overall health and potential of the market. Let's examine their findings:

Price-to-Earnings Ratio (P/E)

BofA's analysis likely incorporates a detailed examination of Price-to-Earnings (P/E) ratios across various sectors. The P/E ratio is a fundamental valuation metric, representing the price an investor pays for each dollar of a company's earnings. A high P/E ratio might suggest overvaluation, while a low ratio could indicate undervaluation. However, it's crucial to consider the context; a high P/E ratio in a high-growth sector might be justified, while a low P/E in a declining industry might signal trouble.

- Examples (Hypothetical BofA findings): The technology sector might show a high P/E, reflecting investor optimism about future growth, while the energy sector might have a lower P/E due to recent market volatility.

- Comparison to Historical Averages: BofA's analysis likely compares current P/E ratios to historical averages to determine if the market is trading at a premium or discount relative to its past. A significantly elevated P/E compared to historical norms might suggest overvaluation.

- Significance and Limitations: The P/E ratio is simple to calculate and widely used, but it has limitations. It's sensitive to accounting practices and doesn't account for future growth potential.

Cyclically Adjusted Price-to-Earnings Ratio (CAPE)

BofA likely also considers the Cyclically Adjusted Price-to-Earnings Ratio (CAPE), also known as the Shiller P/E ratio. The CAPE ratio smooths out earnings fluctuations over a 10-year period, providing a longer-term perspective on valuation. This is particularly useful for long-term investors.

- BofA's Assessment (Hypothetical): BofA might find that the CAPE ratio suggests a less extreme valuation picture than the standard P/E, implying that long-term investors might see opportunities despite short-term market fluctuations.

- Comparison to Historical Averages: Comparing the current CAPE ratio to its historical average provides insights into whether the market is overvalued or undervalued in a longer-term context.

- Risks and Opportunities: A high CAPE ratio might signal caution, but it doesn't always predict a market crash. It's crucial to consider other factors before making investment decisions.

Other Valuation Metrics

BofA's comprehensive assessment probably extends beyond P/E and CAPE to include other valuable metrics:

- Price-to-Sales Ratio (P/S): This compares a company's market capitalization to its revenue, useful for valuing companies with negative earnings. BofA's findings regarding this metric would provide additional context.

- Price-to-Book Ratio (P/B): This measures the market value relative to the book value of assets. It offers a perspective on a company’s net asset value.

- Dividend Yield: The dividend yield is the annual dividend payment relative to the stock price, offering insights into the income potential of an investment.

Investor Sentiment Analysis by BofA

Understanding investor sentiment is as crucial as analyzing valuation metrics. BofA's research likely delves into various indicators to assess prevailing sentiment:

Bullish vs. Bearish Sentiment

BofA's analysis probably assesses whether investor sentiment is predominantly bullish (optimistic) or bearish (pessimistic). This can significantly impact market movements.

- Indicators: BofA likely uses various indicators such as investor surveys, options trading volume and put/call ratios, and fund flows into various asset classes (e.g., equity funds, bond funds) to gauge sentiment.

- Impact on Market Movements: A predominantly bullish sentiment can fuel rallies, while bearish sentiment can lead to market declines.

Risk Appetite and Volatility

BofA’s assessment should consider investor risk appetite and market volatility.

- Risk Appetite: High risk appetite means investors are willing to take on more risk for potentially higher returns. Low risk appetite leads to a preference for safer investments.

- Volatility Indicators: The VIX index, a measure of market volatility, is a key indicator used by BofA and others. High VIX indicates increased uncertainty and volatility.

- Relationship to Valuations: High volatility and low risk appetite can lead to lower valuations, while high risk appetite and low volatility can push valuations higher.

Impact of Macroeconomic Factors

Macroeconomic factors profoundly influence both valuations and investor sentiment. BofA's analysis will likely consider these factors:

- Inflation: High inflation can erode purchasing power and negatively impact corporate earnings, affecting stock valuations.

- Interest Rates: Rising interest rates generally increase borrowing costs for companies and can reduce investment returns, affecting stock prices.

- Geopolitical Events: Geopolitical instability can create uncertainty and lead to market volatility.

Conclusion

BofA's assessment of stock market valuations and investor sentiment provides crucial insights for investors. Their analysis, likely encompassing P/E ratios, CAPE ratios, other valuation metrics, and various indicators of investor sentiment and macroeconomic factors, offers a comprehensive perspective on the current market landscape. The interplay between valuations, investor sentiment, and macroeconomic conditions determines the overall market direction. By understanding these dynamics and considering BofA's findings, investors can make more informed decisions. Remember, staying informed about stock market valuations and investor sentiment is paramount. Conduct further research on stock market valuation analysis techniques to refine your investment strategy and make well-informed decisions. Understanding these concepts is key to successful long-term investing.

Featured Posts

-

Selena Gomezs High Waisted Suit A Timeless Office Style Statement

May 03, 2025

Selena Gomezs High Waisted Suit A Timeless Office Style Statement

May 03, 2025 -

Poppy Atkinson Remembering A Beloved Manchester United Fan

May 03, 2025

Poppy Atkinson Remembering A Beloved Manchester United Fan

May 03, 2025 -

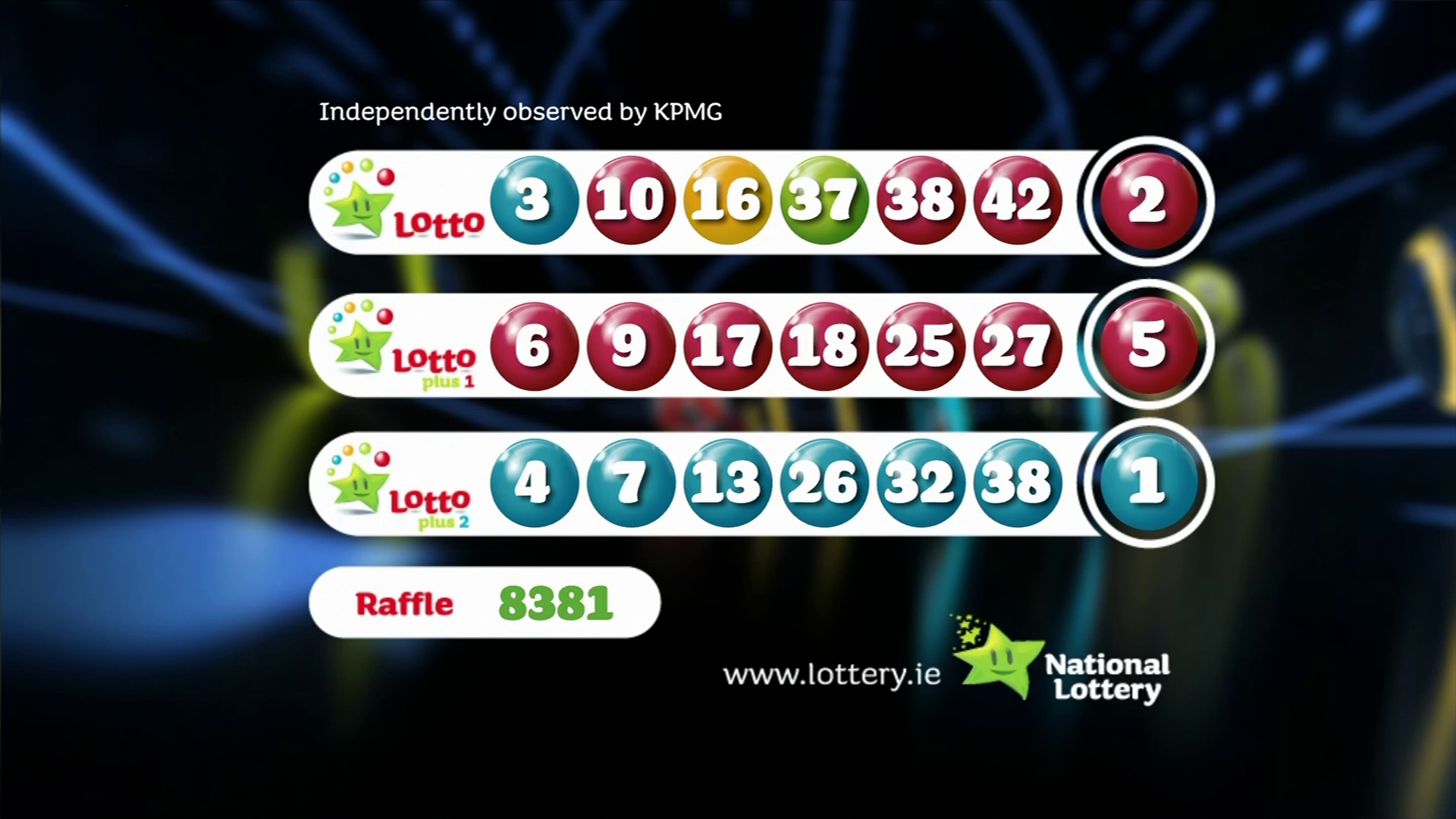

Lotto Plus 1 And Lotto Plus 2 Results Check The Winning Numbers

May 03, 2025

Lotto Plus 1 And Lotto Plus 2 Results Check The Winning Numbers

May 03, 2025 -

157 Gola Aleksandr Lakazet Pishe Istoriya Vv Frenskoto Prvenstvo

May 03, 2025

157 Gola Aleksandr Lakazet Pishe Istoriya Vv Frenskoto Prvenstvo

May 03, 2025 -

Is The Eco Flow Wave 3 The Best Portable Climate Control Solution A Review

May 03, 2025

Is The Eco Flow Wave 3 The Best Portable Climate Control Solution A Review

May 03, 2025