Stock Market Valuations: BofA Explains Why Investors Shouldn't Be Concerned

Table of Contents

BofA's Perspective on Current Stock Market Valuations

Bank of America's recent reports and analyses suggest a more nuanced view of current stock market valuations than many pessimistic forecasts. Instead of signaling an imminent crash, BofA argues that several factors justify the current levels. Their research considers a range of metrics to paint a complete picture.

-

Key Arguments from BofA: BofA emphasizes the importance of considering factors beyond simple price-to-earnings ratios (P/E). They highlight the strong earnings growth projected for many companies and the potential for continued innovation to drive future returns. Their analyses also incorporate the impact of low interest rates and the relative strength of the global economy.

-

Metrics Used by BofA: BofA utilizes a variety of valuation metrics, including the traditional P/E ratio, the cyclically adjusted price-to-earnings ratio (Shiller PE), and forward-looking earnings estimates. Their analysis often compares current valuations to historical averages, adjusting for economic cycles and inflationary pressures. Their findings suggest that while valuations may be elevated compared to historical norms, they are not necessarily at unsustainable levels.

-

BofA vs. Pessimistic Views: Unlike some analysts predicting an immediate market correction, BofA acknowledges the elevated valuations but emphasizes the mitigating factors that justify, to a degree, the higher price tags. This more optimistic outlook is based on a thorough consideration of economic fundamentals and future growth prospects.

Understanding the Factors Influencing Current Valuations

Several macroeconomic factors contribute to the current stock market valuations. A comprehensive understanding of these factors is crucial for investors to assess the overall market picture accurately.

-

Low Interest Rates: Persistently low interest rates make bonds less attractive, driving investors towards higher-yielding assets like stocks. This increased demand contributes to higher stock prices and valuations.

-

Strong Corporate Earnings: Many companies have reported strong earnings growth, justifying higher valuations based on future profit expectations. This robust performance supports the argument that current prices are not entirely detached from fundamentals.

-

Technological Innovation and Growth Sectors: Rapid innovation in technology and other growth sectors continues to drive investment and attract capital. The potential for future growth in these sectors can support higher valuations for companies within those spaces.

-

Geopolitical Factors: Global geopolitical events invariably impact market sentiment. While uncertainty can cause volatility, positive geopolitical developments can boost investor confidence and drive up valuations. BofA carefully considers these factors in its assessment.

These factors, considered collectively, contribute to a more complex picture of stock market valuations than a simple "high" or "low" designation might suggest.

Addressing Common Investor Concerns about High Valuations

Many investors harbor legitimate concerns about high stock market valuations. Let's address some common anxieties.

-

Debunking the Crash Myth: While high valuations can precede market corrections, it's crucial to avoid assuming an inevitable crash. Market timing is notoriously difficult, and reacting emotionally to perceived "high" valuations can lead to poor investment decisions.

-

Justified High Valuations: High valuations aren't always a bad thing. In periods of strong economic growth and technological advancements, higher valuations can reflect the potential for future growth and profitability. BofA's analysis acknowledges this possibility.

-

Long-Term Investing and Diversification: A long-term investment strategy that emphasizes diversification is key to navigating market fluctuations. Focusing on the long-term potential of investments helps mitigate the impact of short-term volatility.

-

Avoiding Emotional Reactions: Emotional decision-making is a significant risk in investing. Sticking to a well-defined investment plan and avoiding impulsive reactions to market swings is vital for long-term success.

The Importance of a Long-Term Investment Strategy

Navigating market volatility requires a well-defined long-term investment strategy. Short-term fluctuations should not dictate long-term investment decisions.

-

Market Corrections as Normal: Market corrections are a natural part of the investment cycle. They provide opportunities for long-term investors to acquire assets at discounted prices.

-

Dollar-Cost Averaging: Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals, helps mitigate the risk of buying high and selling low.

-

Seeking Professional Advice: Consulting with a qualified financial advisor can provide personalized guidance and support in developing an investment strategy aligned with your risk tolerance and financial goals.

Conclusion

BofA's analysis suggests that while stock market valuations may appear high, several factors – including strong corporate earnings, low interest rates, and technological innovation – provide context and justification. Understanding the macroeconomic landscape, avoiding emotional reactions to market swings, and adopting a long-term investment strategy are crucial for investors. The current situation isn't necessarily cause for alarm. Don't let concerns about stock market valuations derail your investment plans. Understand the nuances of market analysis from reputable sources like BofA and develop a sound, long-term investment strategy. Learn more about navigating stock market valuations and make informed investment decisions today.

Featured Posts

-

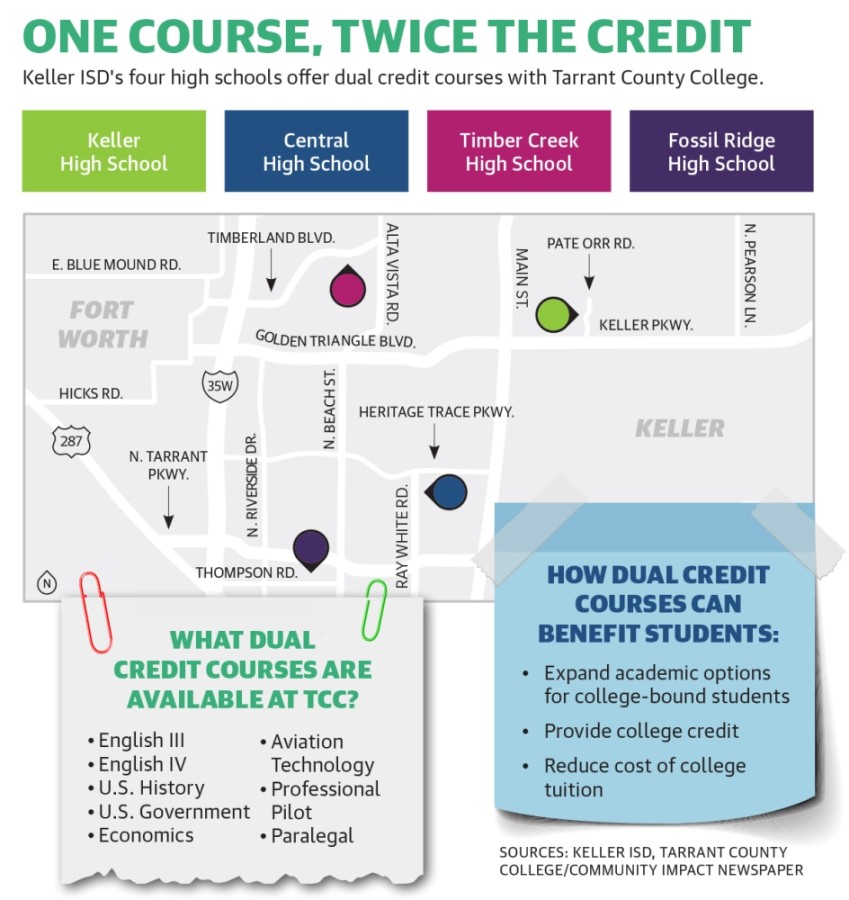

The Negative Impact Of Dividing Keller Independent School District

May 02, 2025

The Negative Impact Of Dividing Keller Independent School District

May 02, 2025 -

Three Supreme Court Cases Under John Roberts A Shifting Landscape Of Church And State

May 02, 2025

Three Supreme Court Cases Under John Roberts A Shifting Landscape Of Church And State

May 02, 2025 -

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 02, 2025

Epic Games Sued Allegations Of Large Scale Deceptive Practices In Fortnite

May 02, 2025 -

Poppy Atkinson Fundraiser In Kendal Surpasses Goal After Tragic Events

May 02, 2025

Poppy Atkinson Fundraiser In Kendal Surpasses Goal After Tragic Events

May 02, 2025 -

1 Mayis Emek Ve Dayanisma Guenue Nuen Oenemi Ve Guencelligi

May 02, 2025

1 Mayis Emek Ve Dayanisma Guenue Nuen Oenemi Ve Guencelligi

May 02, 2025