Stock Market Valuations: BofA Explains Why Investors Shouldn't Panic

Table of Contents

The recent market volatility has left many investors wondering about stock market valuations and whether a crash is imminent. Bank of America (BofA), a leading financial institution, has offered insights suggesting that panic selling may be an overreaction. This article delves into BofA's assessment, exploring their reasoning and offering guidance for navigating the current market landscape. We'll examine their methodology, address concerns about market corrections, and highlight opportunities for long-term investors.

BofA's Assessment of Current Market Valuations

BofA employs a multifaceted approach to assessing market valuations, considering various metrics beyond simple price-to-earnings (P/E) ratios. Their methodology incorporates a range of valuation tools, including:

- Price-to-Earnings Ratio (P/E): A fundamental metric comparing a company's stock price to its earnings per share. BofA analyzes P/E ratios across different sectors and compares them to historical averages and industry benchmarks.

- Price-to-Sales Ratio (P/S): This ratio compares a company's market capitalization to its revenue, offering insights even for companies with negative earnings.

- Discounted Cash Flow (DCF) Analysis: A more complex model that projects future cash flows and discounts them back to their present value to estimate intrinsic value.

Based on their recent research, BofA has found that while some sectors exhibit elevated valuations, others appear relatively undervalued. Specific data points from their reports, while constantly evolving, often highlight these discrepancies. For example:

- High Valuations: Certain technology and growth stocks might show high P/E ratios reflecting investor enthusiasm for future growth potential. However, BofA's analysis may contextualize these valuations considering projected earnings growth.

- Low Valuations: Conversely, value stocks in cyclical sectors might appear undervalued according to BofA’s metrics, suggesting potential investment opportunities.

- Inflation & Interest Rates: BofA's analysis explicitly accounts for the impact of inflation and rising interest rates on equity valuations, adjusting their models accordingly. These adjustments are crucial for a realistic assessment of market conditions.

Addressing Concerns about Market Volatility and Potential Corrections

Recent market volatility, driven by factors like inflation, rising interest rates, and geopolitical uncertainties, has understandably raised concerns about a potential market correction. However, BofA argues that a significant market crash is unlikely, citing several key factors:

- Underlying Economic Strength: While challenges exist, the underlying strength of the economy, in BofA’s view, provides a cushion against a dramatic downturn.

- Corporate Earnings: Despite headwinds, corporate earnings, in many sectors, remain relatively robust, supporting market valuations.

- Historical Context: BofA’s analysis often emphasizes historical market corrections and recoveries, highlighting that periods of volatility are a normal part of market cycles. They typically underscore that past corrections have been followed by periods of growth.

Factors Contributing to Volatility:

- Inflation: Persistent high inflation erodes purchasing power and increases uncertainty about future economic growth.

- Interest Rates: Rising interest rates increase borrowing costs for businesses and consumers, impacting investment and spending.

- Geopolitical Events: Global conflicts and political instability introduce uncertainty and can trigger market reactions.

BofA's analysis attempts to quantify the influence of these factors on market valuations, helping investors understand the context of current market conditions.

Opportunities for Long-Term Investors in the Current Market

Despite the volatility, BofA identifies several opportunities for long-term investors:

- Undervalued Sectors: BofA's research often highlights sectors that appear undervalued based on their valuation models. These could offer attractive entry points for long-term investors.

- Dividend-Paying Stocks: Companies with a history of consistent dividend payments can provide a steady income stream, mitigating some of the risks associated with market fluctuations.

- Growth Potential: Focusing on companies with strong fundamentals and long-term growth potential can outweigh short-term market volatility.

The key takeaway is that a long-term investment strategy, focused on diversified holdings and a buy-and-hold approach, can potentially weather market fluctuations and benefit from long-term growth.

The Importance of a Balanced Investment Strategy

Navigating the complexities of stock market valuations requires a balanced investment strategy, including:

- Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps mitigate risk. This is consistently emphasized by BofA and other financial professionals.

- Risk Management: Understanding your risk tolerance and setting realistic investment goals are crucial for making informed decisions.

- Professional Advice: For complex investment decisions or those lacking investment experience, seeking professional financial advice is strongly recommended. Tailoring an investment plan based on individual needs is crucial.

Asset Classes to Consider for Diversification:

- Equities (Stocks): Offer potential for high growth but come with higher risk.

- Fixed Income (Bonds): Generally considered less risky than stocks but offer lower potential returns.

- Real Estate: Can provide diversification and potential for long-term appreciation.

Conclusion

BofA's assessment of current stock market valuations suggests that while volatility exists, a major market crash is unlikely based on their analysis. Their methodology considers multiple valuation metrics, accounts for macroeconomic factors, and highlights both potential risks and opportunities. Investors shouldn't panic but should instead maintain a long-term perspective, employ a diversified investment strategy, and, if needed, seek professional advice. Understanding the nuances of stock market valuations is key to making informed decisions. Don't let market fluctuations dictate your long-term investment strategy; instead, carefully evaluate your portfolio and adjust as needed based on sound financial planning and a thorough understanding of stock market valuations. Learn more about managing your investments effectively during periods of market volatility and build a strong foundation for your financial future.

Featured Posts

-

March 27th Cavaliers Spurs Game Complete Injury Report From Fox Sports 1340 Wnco

May 07, 2025

March 27th Cavaliers Spurs Game Complete Injury Report From Fox Sports 1340 Wnco

May 07, 2025 -

Rihanna Shares A Sweet Moment With Fan After Paris Fenty Beauty Event

May 07, 2025

Rihanna Shares A Sweet Moment With Fan After Paris Fenty Beauty Event

May 07, 2025 -

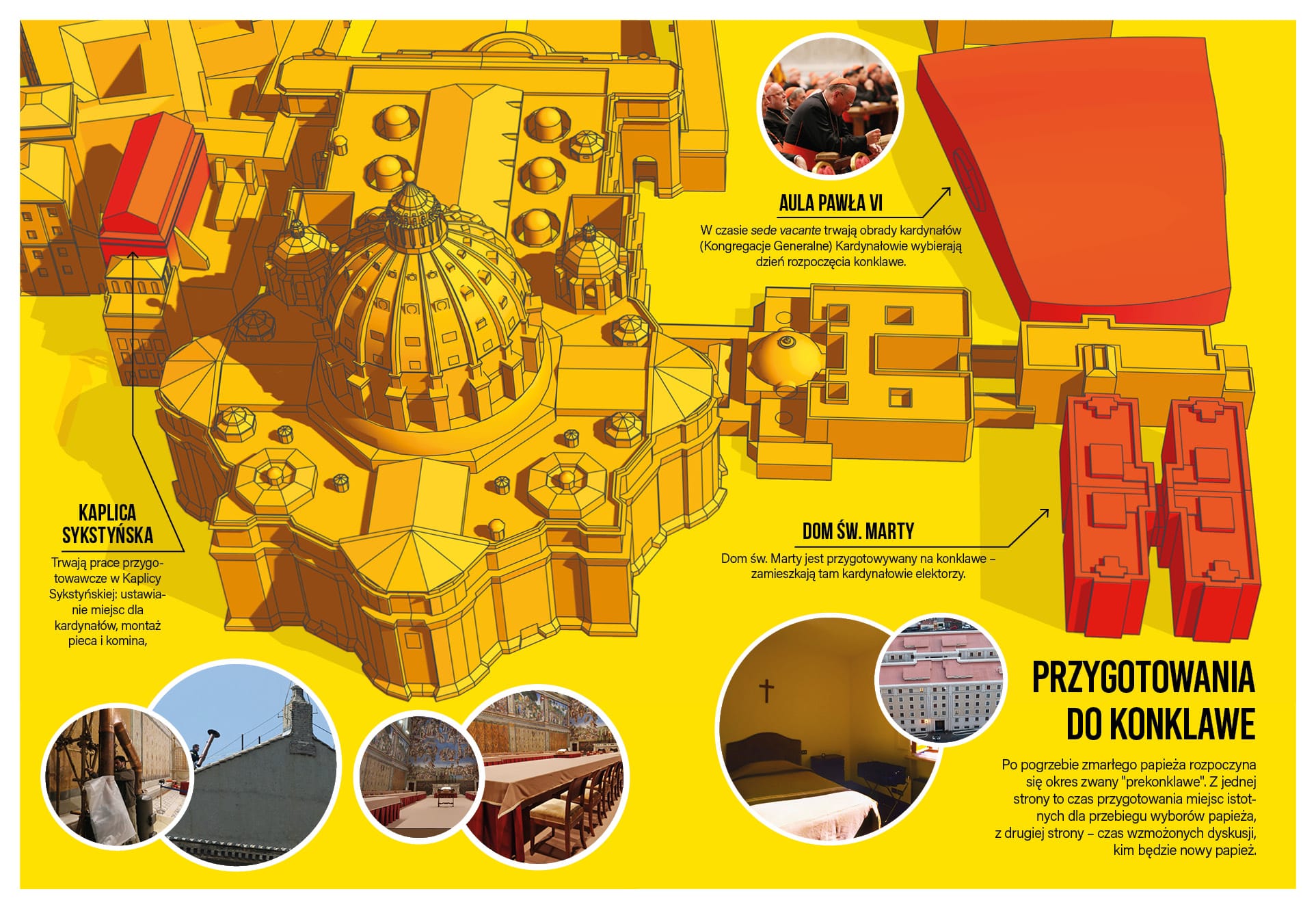

Ks Sliwinski Prezentuje Konklawe Tajemnice Wyborow Papieskich Warszawa

May 07, 2025

Ks Sliwinski Prezentuje Konklawe Tajemnice Wyborow Papieskich Warszawa

May 07, 2025 -

Alex Ovechkins Pre Pittsburgh Trip Lucky Sub Cheetos And More

May 07, 2025

Alex Ovechkins Pre Pittsburgh Trip Lucky Sub Cheetos And More

May 07, 2025 -

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 07, 2025

5880 Rally Projected Altcoin Poised To Outperform Xrp

May 07, 2025