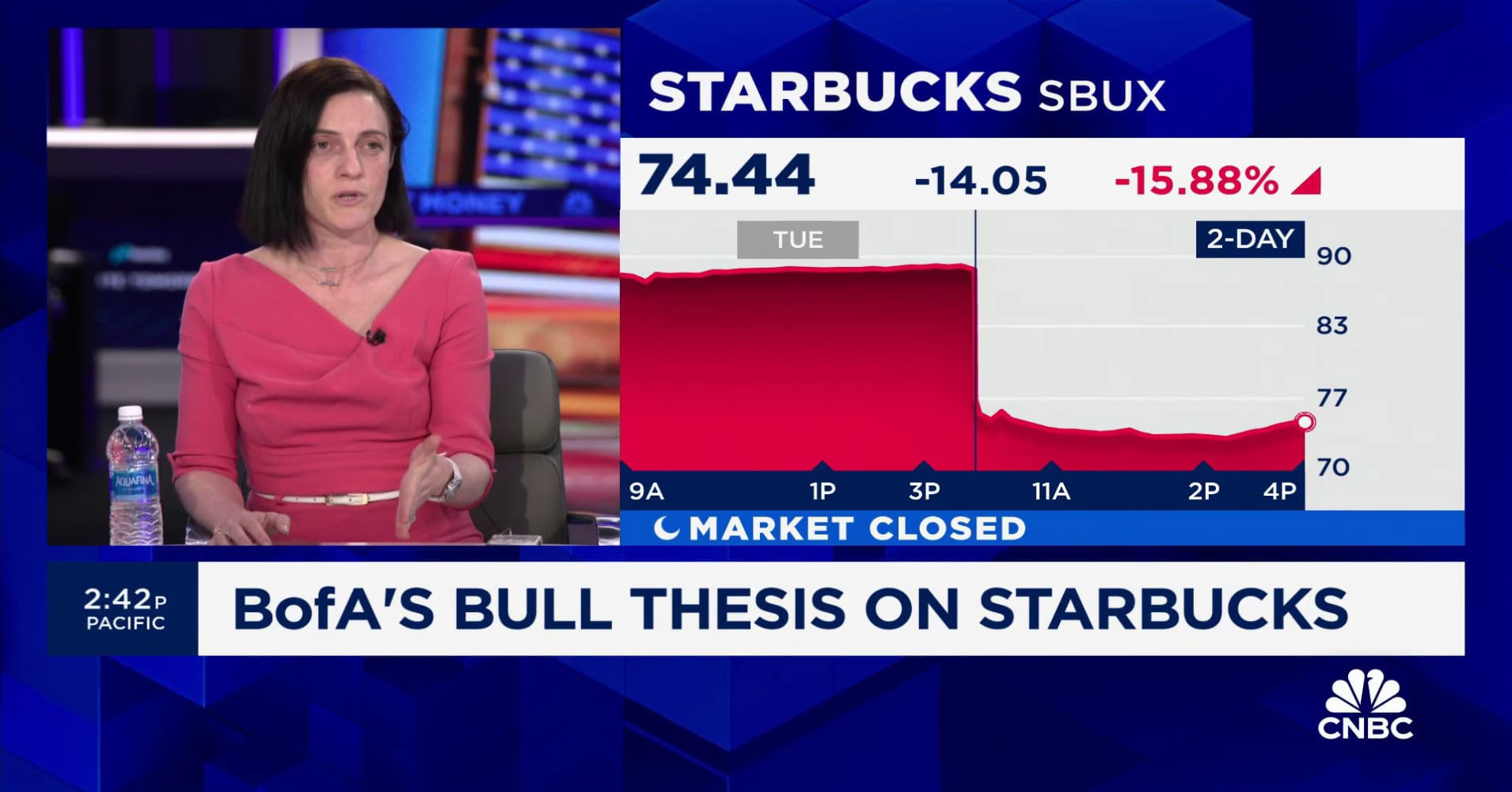

Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Rationale: Why Current Valuations Aren't Overblown

BofA's analysts utilize a multi-faceted approach to assess stock market valuations, incorporating various metrics and models to paint a comprehensive picture. Their methodology relies heavily on established tools like Price-to-Earnings (P/E) ratios and discounted cash flow (DCF) models, comparing current figures to historical data and projected future growth. Their conclusion? While valuations are elevated, they are not excessively so, considering several key factors:

-

Strong Corporate Earnings Growth Projections: BofA forecasts robust earnings growth for many sectors in the coming years, driven by technological innovation and sustained consumer demand. This projected growth helps to justify current price levels, even when viewed through the lens of traditional valuation metrics.

-

Low Interest Rates Supporting Higher Valuations: Historically low interest rates continue to support higher stock valuations. Lower borrowing costs incentivize investment and increase the present value of future earnings, making companies appear more attractive to investors.

-

Technological Advancements Driving Future Growth: Breakthroughs in artificial intelligence, biotechnology, and other sectors promise substantial long-term growth, further supporting BofA's view that current stock market valuations are not detached from underlying fundamentals.

-

Comparison to Historical Valuation Multiples: BofA's analysis shows that current valuation multiples, while above historical averages in some sectors, are still within a reasonable range considering the anticipated growth trajectory. This historical context helps to mitigate concerns of an unsustainable bubble.

Addressing Common Investor Concerns About Stock Market Valuations

Many investors harbor anxieties about current market conditions. Let's address some of the most prevalent concerns:

The "Overvalued Market" Myth: Debunking Misconceptions Surrounding High Valuations

The term "overvalued market" is often thrown around without proper context. While some individual stocks might be overvalued, BofA's analysis indicates that the overall market isn't necessarily in bubble territory. Their data-driven approach refutes the simplistic notion that high valuations automatically translate to an impending crash. Investors need to look beyond headline figures and engage in more nuanced analysis of individual companies and sector performance.

Inflationary Pressures and Stock Market Performance: How BofA Anticipates the Impact of Inflation

Inflation remains a significant concern. However, BofA's projections incorporate inflation's potential impact, acknowledging its effect on corporate earnings and interest rates. Their analysis suggests that while inflation poses a risk, it doesn't automatically invalidate the potential for continued stock market growth. The impact will vary across sectors, requiring a careful and sector-specific approach to investing.

Geopolitical Risks and Market Volatility: BofA's Assessment of the Impact of Global Uncertainties

Geopolitical risks and global uncertainties are undeniably present. However, BofA incorporates these factors into its risk assessments. Their analysis acknowledges the potential for increased market volatility, but emphasizes the importance of long-term perspectives and a diversified investment strategy to mitigate these risks. Focusing on high-quality, fundamentally strong companies can help to weather short-term fluctuations.

Long-Term Investment Strategies in the Face of High Stock Market Valuations

BofA advises investors to maintain a long-term perspective, focusing on consistent investment strategies rather than reacting to short-term market fluctuations. This approach entails:

-

Diversification of Investment Portfolios: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) helps to reduce overall portfolio risk.

-

Importance of Risk Tolerance Assessment: Understanding your own risk tolerance is crucial for making informed investment decisions. Conservative investors might opt for a more diversified approach with lower risk assets.

-

Dollar-Cost Averaging Strategies: Regularly investing a fixed amount of money at set intervals, regardless of market conditions, can help to mitigate risk and reduce the emotional impact of market volatility.

-

Choosing Quality Companies Over Speculative Investments: Focus on companies with strong fundamentals, consistent earnings growth, and a history of delivering shareholder value.

Conclusion: Why You Shouldn't Worry (Yet) About Stock Market Valuations – BofA's Perspective

BofA's analysis suggests that while stock market valuations are high, they aren't necessarily overblown. Strong earnings growth projections, low interest rates, technological advancements, and a historical context all contribute to their relatively optimistic outlook. While acknowledging the risks associated with inflation and geopolitical uncertainty, BofA stresses the importance of long-term investing, portfolio diversification, and risk management. Don't let anxieties over stock market valuations derail your long-term investment goals. Review BofA's research, consult with a financial advisor, and develop a robust investment strategy today! Remember to consider your own risk tolerance and engage in thorough research before making any investment decisions. Understanding stock market valuations is key to navigating the market effectively.

Featured Posts

-

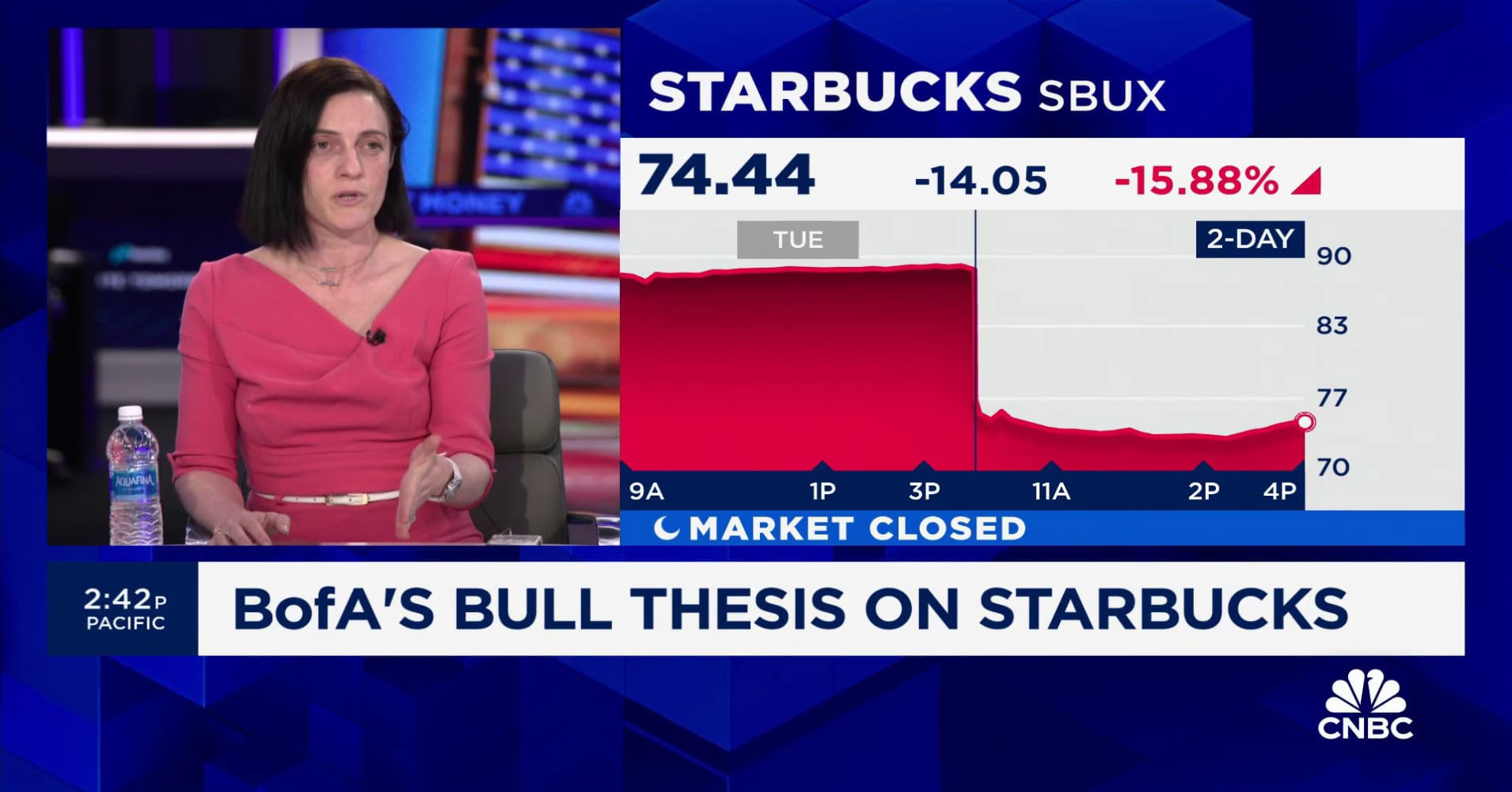

Analyzing The Us China Contest For Influence A Critical Military Base

Apr 26, 2025

Analyzing The Us China Contest For Influence A Critical Military Base

Apr 26, 2025 -

Discover The Countrys Top New Business Locations

Apr 26, 2025

Discover The Countrys Top New Business Locations

Apr 26, 2025 -

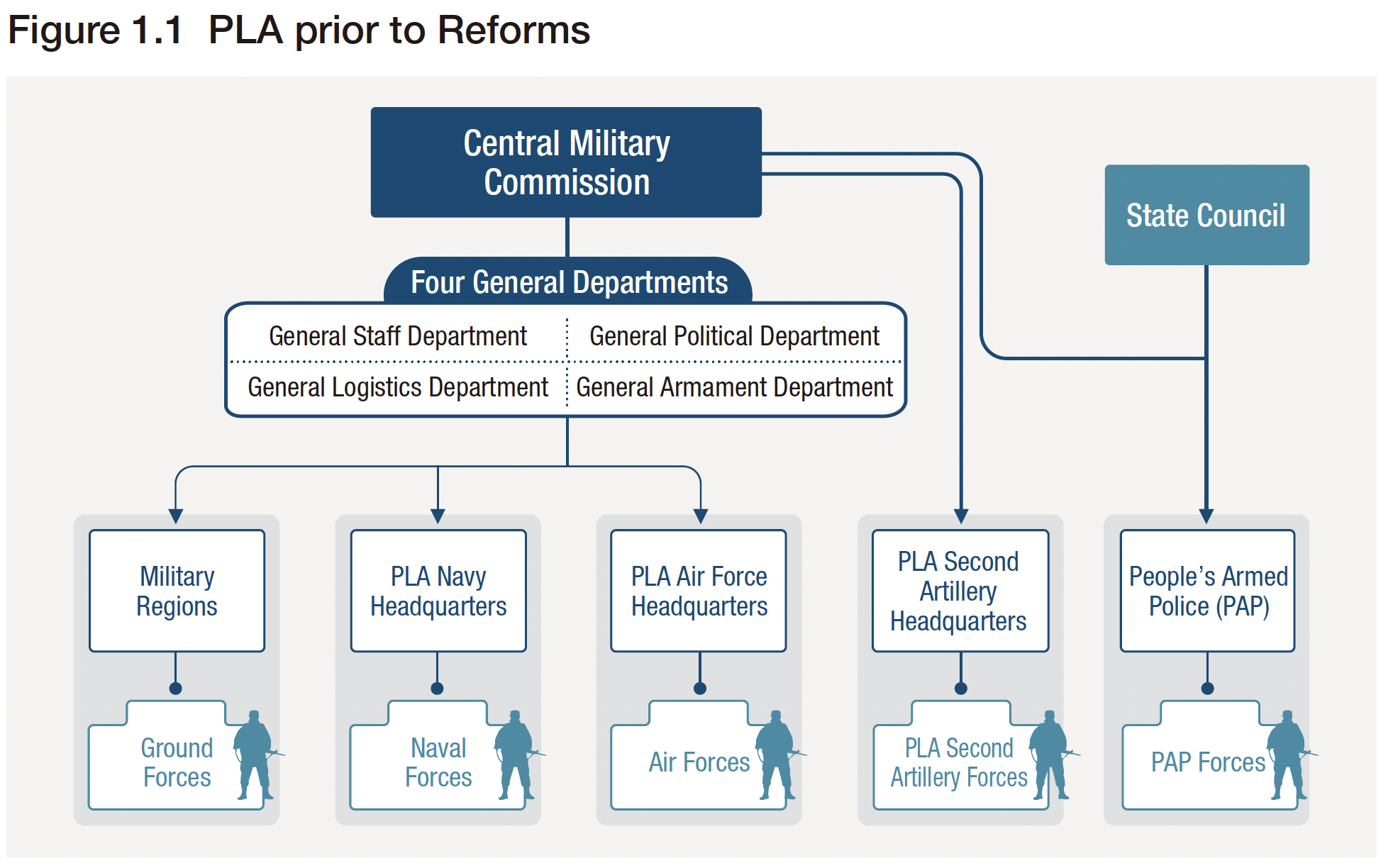

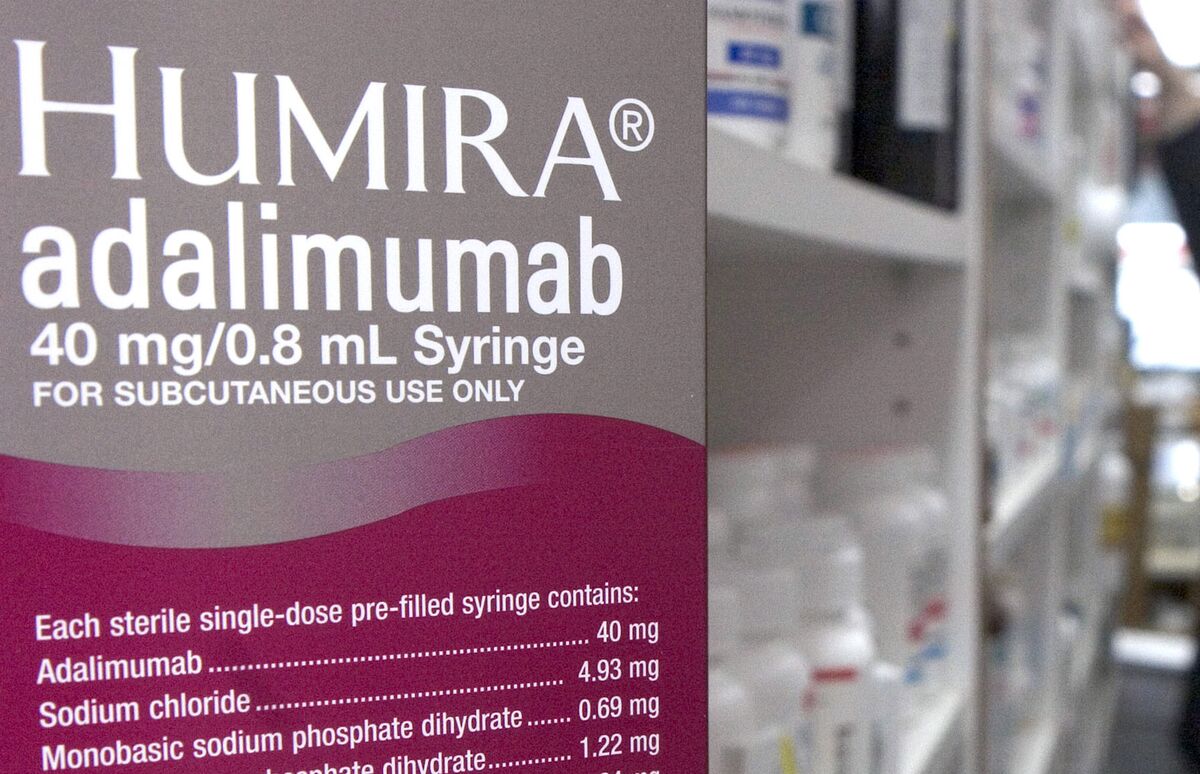

Abb Vie Abbv Increased Profit Guidance Reflects Success Of Newer Drugs And Strong Sales

Apr 26, 2025

Abb Vie Abbv Increased Profit Guidance Reflects Success Of Newer Drugs And Strong Sales

Apr 26, 2025 -

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025

A Conservative Harvard Professors Plan To Save Harvard University

Apr 26, 2025 -

Auto Carrier Estimates 70 Million Impact From Increased Us Port Fees

Apr 26, 2025

Auto Carrier Estimates 70 Million Impact From Increased Us Port Fees

Apr 26, 2025