Stock Market Valuations: BofA Says Don't Worry

Table of Contents

BofA's Rationale Behind Their Optimistic Outlook on Stock Market Valuations

BofA's optimistic outlook on stock market valuations isn't based on blind faith. Their analysis points to several key factors that support their relatively bullish stance despite the high valuations. These factors act as counterbalances to the perceived risks associated with elevated market prices.

-

Strong Corporate Earnings Growth: BofA highlights the robust earnings growth of S&P 500 companies. These companies have consistently exceeded expectations, demonstrating resilience and justifying, to some extent, the higher price tags. This sustained earnings growth provides a solid foundation for current valuations. Further analysis suggests this trend is likely to continue in the near future, bolstering the bank's optimistic forecast.

-

Low Interest Rates: Historically low interest rates continue to play a significant role in supporting higher price-to-earnings (P/E) ratios. Lower borrowing costs make equities more attractive compared to bonds, driving up demand and consequently, valuations. BofA's models incorporate the impact of low interest rates on discounted cash flow valuations, suggesting that current levels are not necessarily overvalued in this context.

-

Technological Innovation: The bank cites ongoing technological advancements as a crucial driver of future growth. The emergence of disruptive technologies and their potential to transform various sectors justifies, in BofA's view, the premium valuations assigned to many growth stocks. This perspective emphasizes the long-term growth potential embedded within the current market valuations.

Understanding Current Stock Market Valuations: Metrics and Context

Assessing stock market valuations requires understanding key metrics. These metrics provide valuable insights into whether the market is appropriately priced or potentially overvalued.

-

P/E Ratio (Price-to-Earnings Ratio): The Price-to-Earnings ratio (P/E) compares a company's stock price to its earnings per share (EPS). A high P/E ratio generally suggests investors are willing to pay more for each dollar of earnings, often indicating expectations of future growth. Currently, many sectors show higher than average P/E ratios compared to historical data, but not necessarily unprecedented levels in the context of low interest rates.

-

Price-to-Sales Ratio (P/S): The Price-to-Sales (P/S) ratio compares a company's market capitalization to its revenue. This metric is particularly useful for valuing companies with negative earnings, providing an alternative valuation measure. Comparing current P/S ratios to historical averages offers further context for evaluating overall market valuations.

-

PEG Ratio (Price/Earnings to Growth Ratio): The PEG ratio takes into account a company's earnings growth rate, allowing for a more nuanced evaluation of valuation compared to a simple P/E ratio. A lower PEG ratio generally suggests a stock is undervalued relative to its growth prospects.

By analyzing these metrics across various sectors and comparing them to historical averages and industry benchmarks, investors can gain a comprehensive understanding of current market valuations. (Charts and graphs comparing current valuations to historical averages would be included here in a published article).

Potential Risks and Considerations Regarding Stock Market Valuations

While BofA's outlook is positive, it's crucial to acknowledge potential risks associated with high valuations. Ignoring these would be imprudent.

-

Interest Rate Hikes: Rising interest rates could significantly impact valuations by making bonds a more attractive alternative investment. Higher rates increase borrowing costs for companies, potentially impacting earnings growth and reducing the appeal of equities.

-

Inflationary Pressures: High inflation erodes corporate earnings and reduces investor confidence. If inflation persists, it could lead to a market correction as investors reassess valuations based on decreased profitability.

-

Geopolitical Uncertainty: Global political instability can create market volatility and negatively affect valuations. Unexpected geopolitical events can trigger sell-offs and significantly impact investor sentiment.

Diversification and Risk Management Strategies

Given the potential risks, diversification and risk management are paramount. Investors should carefully consider their risk tolerance and construct a portfolio that aligns with their individual circumstances. This includes diversifying across asset classes (stocks, bonds, real estate, etc.) and sectors to mitigate the impact of market fluctuations. Regularly reviewing and rebalancing your portfolio is also a crucial element of effective risk management.

Navigating Stock Market Valuations Wisely

BofA's report offers a reassuring perspective on current stock market valuations, emphasizing factors such as strong corporate earnings growth and low interest rates. However, understanding key valuation metrics like the P/E and P/S ratios, along with acknowledging potential risks such as interest rate hikes and geopolitical uncertainty, is crucial for informed decision-making. While BofA's optimism provides valuable context, investors should conduct thorough due diligence and develop a personalized investment strategy that aligns with their risk tolerance. Don’t hesitate to consult a financial advisor to further understand current stock market valuations and how they impact your portfolio. Remember, responsible investing involves a comprehensive understanding of both the potential upside and downside of your investment choices.

Featured Posts

-

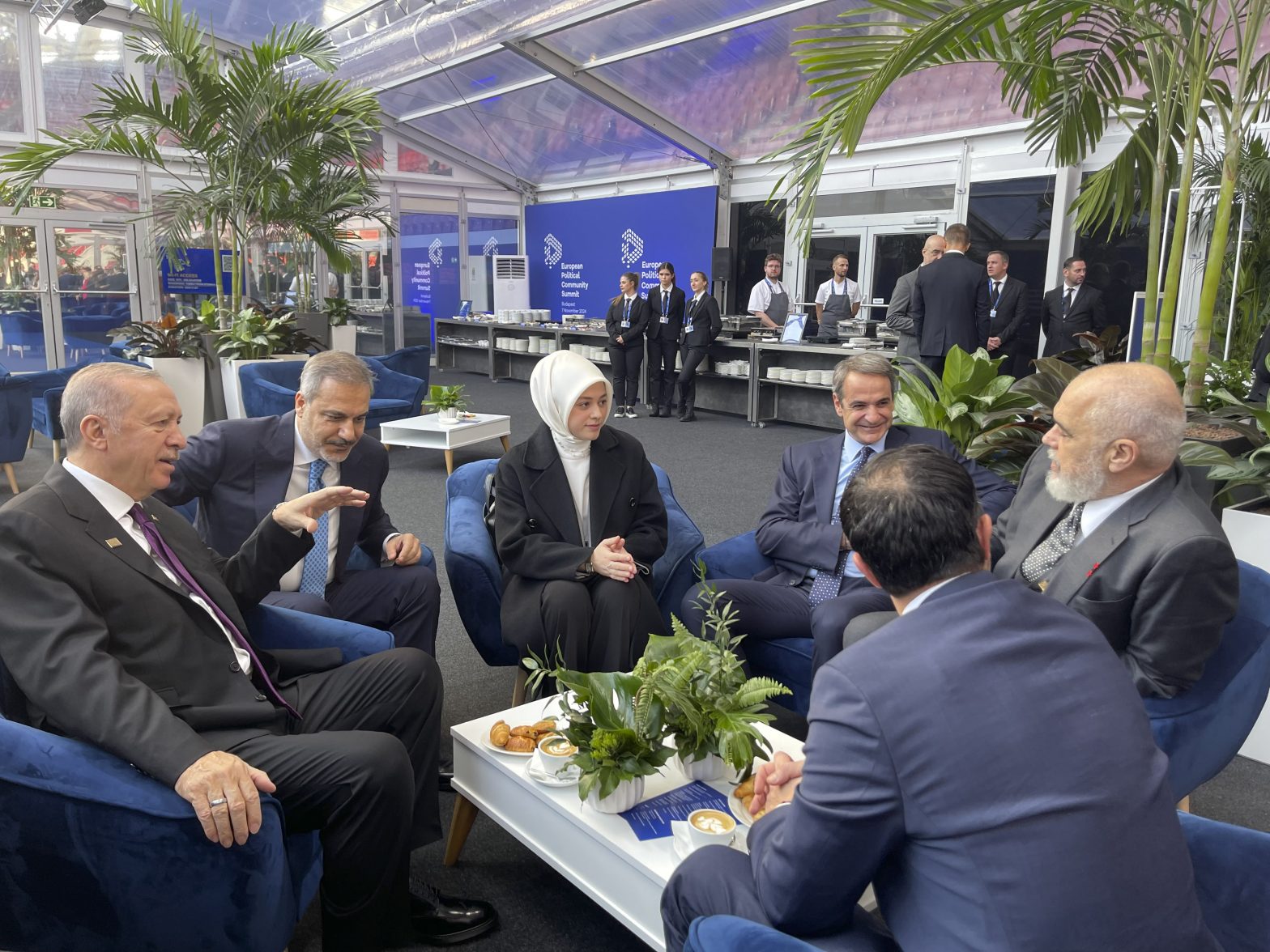

Dimereis Sxeseis Kyproy Oyggarias Syzitiseis Kompoy Sigiarto Gia Kypriako Kai Proedria Ee

May 15, 2025

Dimereis Sxeseis Kyproy Oyggarias Syzitiseis Kompoy Sigiarto Gia Kypriako Kai Proedria Ee

May 15, 2025 -

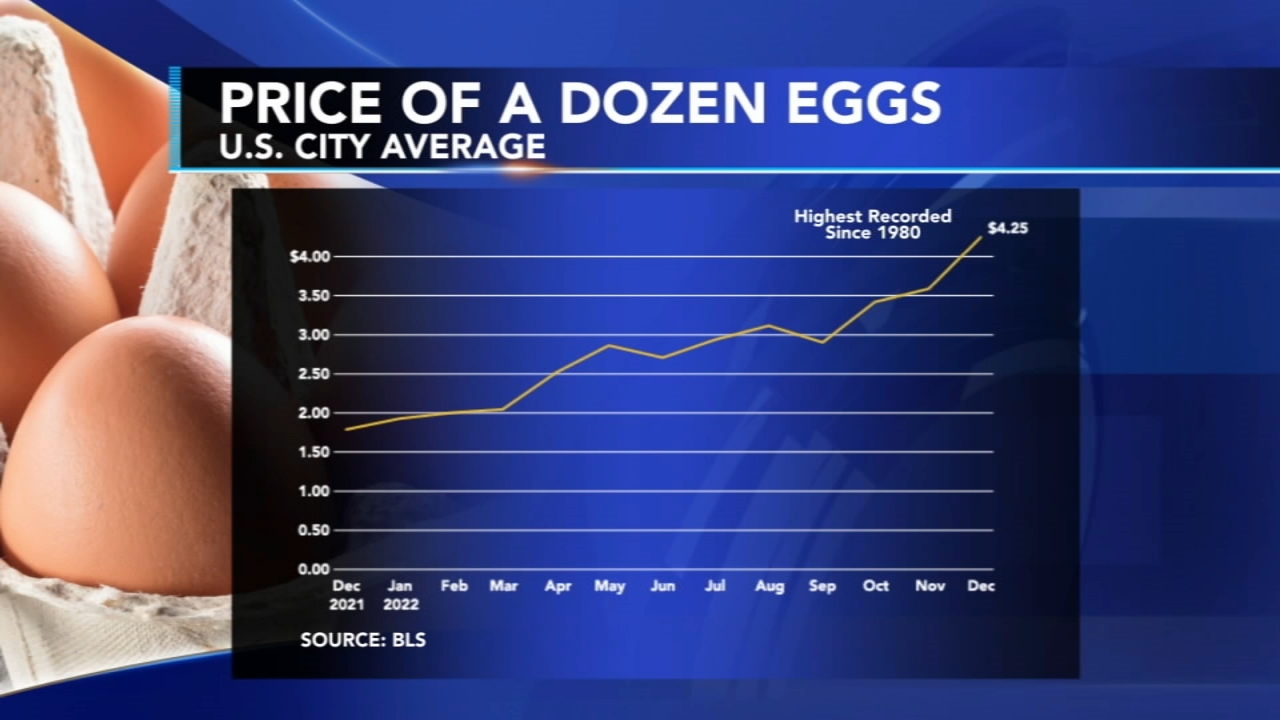

Why Are Egg Prices Down To 5 A Dozen In The U S

May 15, 2025

Why Are Egg Prices Down To 5 A Dozen In The U S

May 15, 2025 -

Boston Celtics Jayson Tatum Praises Knicks Game 1 Effort

May 15, 2025

Boston Celtics Jayson Tatum Praises Knicks Game 1 Effort

May 15, 2025 -

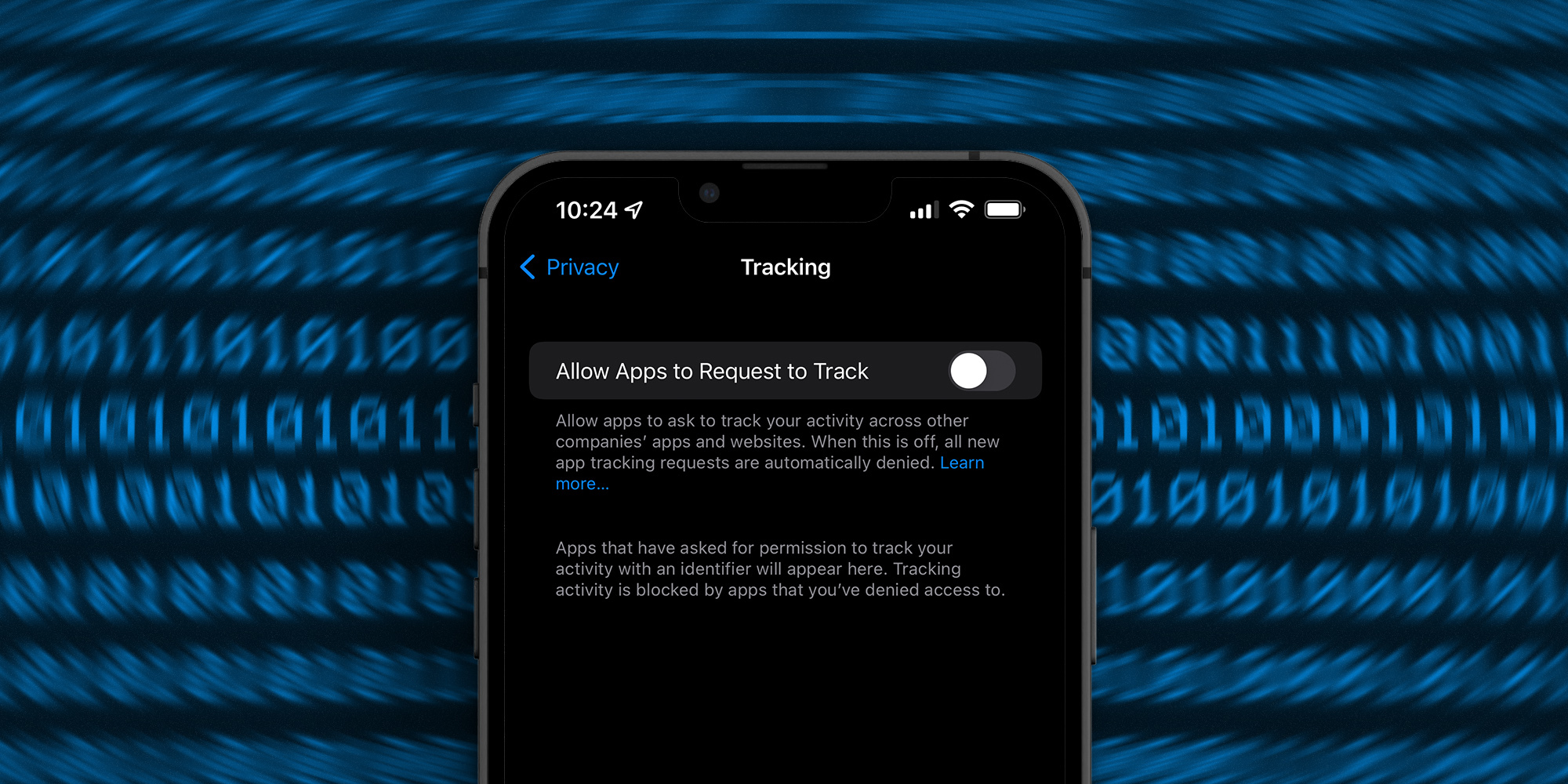

One Unexpected App And The Potential Downfall Of Meta

May 15, 2025

One Unexpected App And The Potential Downfall Of Meta

May 15, 2025 -

Jake Peavy Returns To Padres As Special Assistant To Ceo

May 15, 2025

Jake Peavy Returns To Padres As Special Assistant To Ceo

May 15, 2025