Stock Market Valuations: BofA's Case For Calm Amidst High Prices

Table of Contents

BofA's Rationale: A Deeper Dive into Their Valuation Analysis

BofA's relatively sanguine view stems from a rigorous valuation analysis employing several key methodologies. Their approach involves a combination of quantitative and qualitative factors to assess the intrinsic value of the market. Central to their analysis are discounted cash flow (DCF) models, which project future earnings and discount them back to their present value. This method considers factors like expected earnings growth, interest rates, and risk premiums. In addition to DCF, BofA also utilizes price-to-earnings (P/E) ratios, comparing current market capitalization to reported earnings, to gauge relative valuation against historical averages and industry peers. The P/E ratio, a key metric in equity valuation, helps determine if the market is overvalued or undervalued compared to its own history and other asset classes.

- BofA's preferred valuation models: DCF analysis, P/E ratio comparisons, and relative valuation benchmarks against historical data.

- Key assumptions underpinning their analysis: Projected earnings growth rates, long-term interest rate forecasts, and anticipated inflation levels.

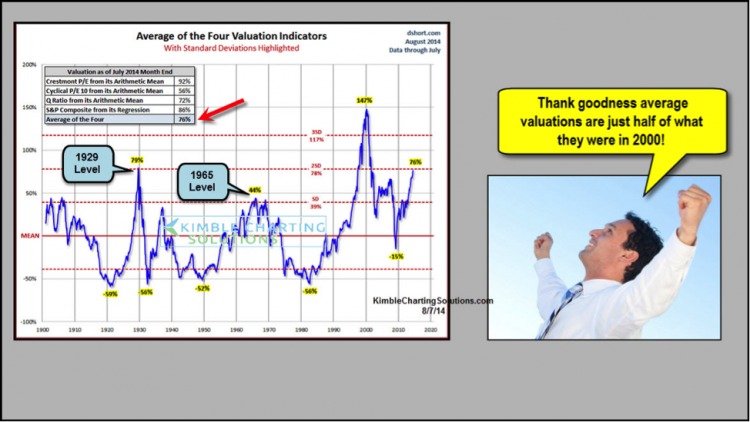

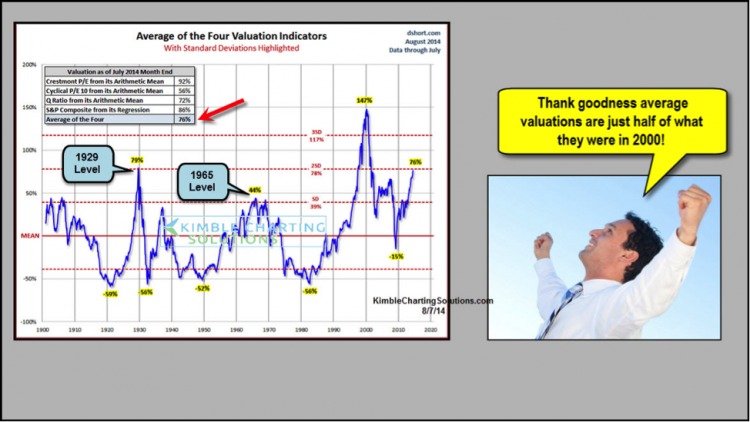

- Comparison of current valuations to historical averages: BofA likely compares current P/E ratios to long-term averages to determine if current levels represent an overvaluation or are within historical norms, adjusted for economic factors.

- Discussion of potential biases in their analysis: Acknowledging limitations inherent in forecasting future earnings and interest rates, and potential model limitations.

Addressing the Concerns: High Inflation and Interest Rate Hikes

The current macroeconomic environment presents undeniable challenges. High inflation and the Federal Reserve's aggressive interest rate hikes are major concerns for investors. These actions aim to curb inflation but risk slowing economic growth or triggering a recession. BofA's analysis incorporates these headwinds, acknowledging their potential negative impact on corporate earnings. However, their projections suggest that the impact may be less severe than some fear.

- BofA's predictions for inflation and interest rates: They likely project a gradual decline in inflation and a potential pause or slowdown in interest rate hikes as the effects of monetary policy take hold.

- Assessment of the impact of these factors on corporate earnings: BofA likely models the impact of higher interest rates on borrowing costs and consumer spending, factoring these into their earnings projections.

- Discussion of potential mitigating factors: Factors like resilient consumer spending, robust corporate balance sheets, or potential government intervention might be considered as mitigating the negative impact of rising interest rates.

- Analysis of recession probabilities and their effect on valuations: BofA likely assigns a probability to a recession and models its potential impact on earnings and market valuations, offering insights into the risk associated with current valuations.

Sector-Specific Outlooks: Where BofA Sees Opportunities and Risks

BofA's analysis doesn't stop at a broad market valuation. They offer sector-specific outlooks, identifying potential winners and losers in the current environment. This granular approach allows for more strategic stock picking, leveraging sector rotation strategies. Understanding the relative valuations within different market sectors can guide investment decisions, allowing investors to focus on undervalued stocks within promising sectors.

- Detailed overview of BofA's top picks and avoids: This would include specific examples of sectors and companies, outlining their valuation rationale.

- Rationale behind their sector-specific recommendations: This explains the reasons behind their choices, such as expected growth prospects, competitive advantages, or sensitivity to interest rate changes.

- Discussion of potential risks and opportunities within each sector: This acknowledges potential downside risks and highlights opportunities for growth and outperformance.

- Examples of specific companies and their valuations: Illustrative examples of companies within each sector, comparing their valuations to industry peers and historical norms.

Conclusion

BofA's relatively calm stance on stock market valuations, despite current high prices, is grounded in a thorough valuation analysis incorporating various models and considering macroeconomic headwinds. Their methodology incorporates discounted cash flow analysis, P/E ratio comparisons, and sector-specific assessments to arrive at a balanced view. While acknowledging the risks associated with inflation and interest rate hikes, their analysis suggests that these factors may not be as detrimental as some predict. However, it's crucial to remember that any analysis carries inherent uncertainties, and future performance is never guaranteed.

Understanding stock market valuations is crucial for informed investment strategies; carefully assess your risk tolerance and diversify your portfolio accordingly. Conduct your own thorough research and consider seeking professional financial advice before making any investment decisions. Remember that navigating the complexities of stock market valuations requires continuous monitoring and adaptation to changing market dynamics.

Featured Posts

-

Hugh Jackman And Sutton Foster Is Their Romance Cooling

May 28, 2025

Hugh Jackman And Sutton Foster Is Their Romance Cooling

May 28, 2025 -

The Future Of Family Planning Over The Counter Birth Control And Its Role Post Roe V Wade

May 28, 2025

The Future Of Family Planning Over The Counter Birth Control And Its Role Post Roe V Wade

May 28, 2025 -

Nathan Broadheads Goal Gives Ipswich Vital Win Over Bournemouth

May 28, 2025

Nathan Broadheads Goal Gives Ipswich Vital Win Over Bournemouth

May 28, 2025 -

Cek Cuaca Jawa Timur Besok 24 3 Peringatan Hujan

May 28, 2025

Cek Cuaca Jawa Timur Besok 24 3 Peringatan Hujan

May 28, 2025 -

Padres And Dodgers Extend Winning Streaks Nl West Report

May 28, 2025

Padres And Dodgers Extend Winning Streaks Nl West Report

May 28, 2025