Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Current Market Assessment

BofA generally holds a cautiously optimistic, or neutral-to-bullish, stance on the current stock market environment. While acknowledging the challenges posed by inflation and geopolitical uncertainty, they believe that current valuations, in many sectors, are not overly inflated and present opportunities for long-term investors. This assessment is not uniformly positive across all sectors; BofA's analysts highlight specific areas of strength and weakness in their reports.

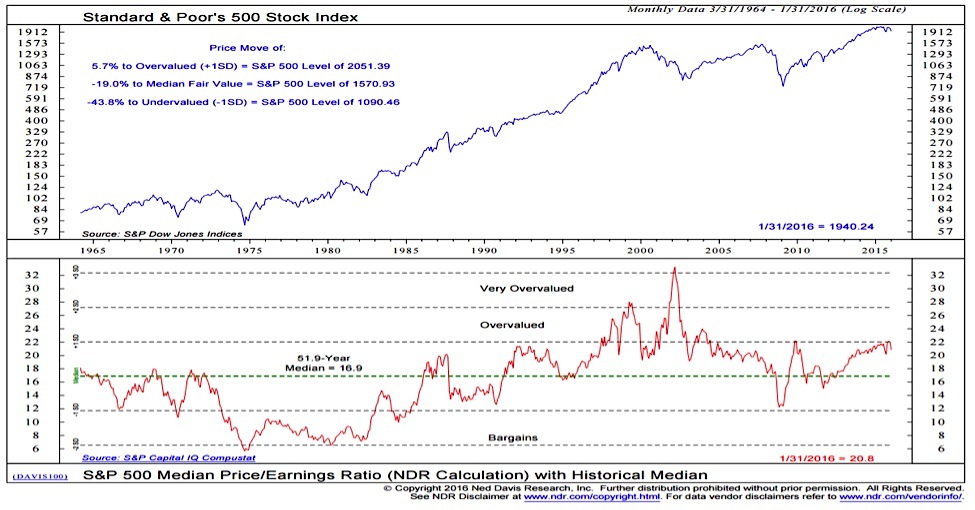

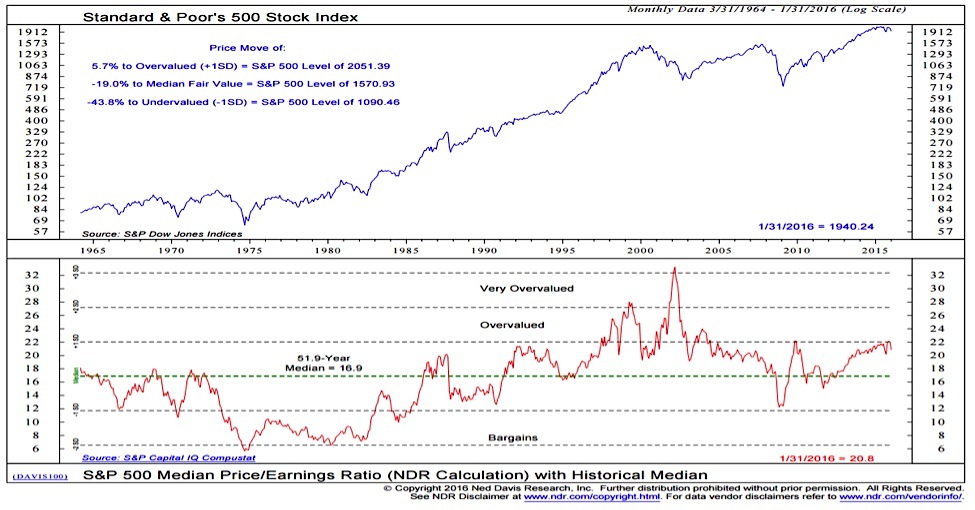

- Key Metrics: BofA utilizes a range of metrics to support their assessment, including Price-to-Earnings (P/E) ratios, dividend yields, market capitalization, and various growth indicators. They compare these metrics to historical averages and industry benchmarks.

- Strong Sectors: BofA often highlights sectors like technology (specific sub-sectors showing strong growth and innovation) and healthcare (driven by aging populations and technological advancements) as potentially strong performers.

- Weak Sectors: Conversely, sectors highly sensitive to interest rate changes or commodity prices may be viewed as relatively weaker in the short term. This is constantly evolving based on economic indicators and geopolitical events.

- Economic Indicators: Inflation, interest rate hikes by central banks, unemployment rates, and consumer confidence all play a crucial role in BofA's analysis. They carefully monitor these indicators to refine their market outlook and valuation models.

Understanding BofA's Valuation Models

BofA employs a variety of sophisticated valuation models to analyze stocks and the broader market. These models are not a simple crystal ball, but tools for understanding the potential future value of assets.

- Discounted Cash Flow (DCF) Analysis: This model predicts a company's future cash flows and discounts them back to their present value, providing an estimate of intrinsic value.

- Comparable Company Analysis: This method compares a company's valuation metrics (P/E ratio, etc.) to those of similar companies in the same industry to identify potential over or undervaluation.

- Assumptions and Limitations: All models rely on assumptions about future growth rates, interest rates, and other economic factors. These assumptions can be subject to significant uncertainty, and inaccuracies in the assumptions directly impact the model's outcome. Furthermore, unforeseen events can dramatically shift valuations.

- Contribution to Investor Calm: BofA's use of diverse valuation models, coupled with their consideration of various economic indicators, provides a more robust and nuanced perspective on market valuations, mitigating the impact of short-term market volatility. Their analysis aims to identify long-term value rather than reacting to daily price fluctuations.

Addressing Key Investor Concerns

Investors often grapple with anxieties surrounding several factors. BofA addresses these concerns directly in their reports and communications.

- Inflation: BofA acknowledges the impact of inflation but may argue that current valuations already incorporate the anticipated inflation rate or that certain sectors are less affected.

- Recession Fears: BofA analyzes economic data and assesses the likelihood of a recession, offering counterarguments based on their findings and highlighting potentially resilient sectors.

- Geopolitical Risks: BofA incorporates geopolitical risks into its analysis, assessing their potential impact on various sectors and markets, often suggesting hedging strategies to mitigate these risks.

- Counterarguments: BofA often provides alternative narratives, suggesting that market pessimism may be overblown or that certain concerns are already priced into asset values. This helps provide a balanced view and context to the current situation.

BofA's Recommendations for Investors

Based on their valuation analysis and assessment of market risks, BofA generally offers strategic investment advice, encouraging a long-term perspective.

- Asset Allocation: BofA might recommend a diversified portfolio, including equities (with a focus on specific sectors), bonds (to manage risk), and potentially other asset classes like real estate.

- Investment Time Horizon: A longer-term investment horizon is often suggested to weather short-term market fluctuations and benefit from long-term growth.

- Risk Management: Diversification across asset classes, sectors, and geographies is a key risk management strategy that BofA emphasizes.

Maintaining Calm Amidst Stock Market Valuations – BofA's Perspective

BofA's core message centers on maintaining a calm and reasoned approach to investing, emphasizing long-term value creation over short-term market reactions. Their analysis, while acknowledging risks, suggests that many current stock market valuations are not excessively high and present opportunities for patient investors. Key takeaways include the importance of diversified portfolios, long-term investment strategies, and a careful consideration of BofA's valuation models and economic assessments. Understanding stock market valuations is crucial for informed investment decisions. Utilize BofA's analysis, coupled with your own research and consultation with a financial advisor, to navigate the current market and build a robust investment portfolio that aligns with your risk tolerance and financial goals. Remember that this information is for general knowledge and does not constitute financial advice. Always conduct thorough research and seek professional guidance before making any investment decisions.

Featured Posts

-

Ford Remains Exclusive Automotive Partner Of The Kentucky Derby

May 04, 2025

Ford Remains Exclusive Automotive Partner Of The Kentucky Derby

May 04, 2025 -

Exclusive Are Kanye West And Bianca Censori Giving Marriage Another Try

May 04, 2025

Exclusive Are Kanye West And Bianca Censori Giving Marriage Another Try

May 04, 2025 -

Ufc 314 Results Volkanovski Vs Lopes Full Fight Card Winners And Losers

May 04, 2025

Ufc 314 Results Volkanovski Vs Lopes Full Fight Card Winners And Losers

May 04, 2025 -

Count Of Monte Cristo A Review Of The Enduring Swashbuckler

May 04, 2025

Count Of Monte Cristo A Review Of The Enduring Swashbuckler

May 04, 2025 -

Sandhagen Vs Figueiredo Your Ultimate Ufc Fight Night Preview

May 04, 2025

Sandhagen Vs Figueiredo Your Ultimate Ufc Fight Night Preview

May 04, 2025