Stock Market Valuations: BofA's Reasons For Investor Calm

Table of Contents

BofA's Argument for Moderate Valuations

BofA's assessment of current stock market valuations rests on several pillars, suggesting that while risks exist, the market isn't drastically overvalued. Their analysis points to a more nuanced picture than headlines might suggest.

Earnings Growth Outpacing Inflation

One of BofA's core arguments centers on the resilience of corporate earnings. Their analysis indicates that corporate earnings growth is exceeding inflation, a crucial factor in mitigating concerns about overvaluation. This suggests that companies are effectively managing inflationary pressures and maintaining profitability.

- Strong corporate profit margins despite inflationary pressures: Many companies have demonstrated surprising resilience in maintaining profit margins, even with rising input costs. This is partly due to successful pricing strategies.

- Increased pricing power for many companies: Companies in certain sectors have been able to pass increased costs onto consumers, preserving profit margins. This pricing power is a key factor in supporting earnings growth.

- Resilient consumer spending contributing to earnings growth: Despite economic headwinds, consumer spending has remained relatively robust in many key sectors, bolstering corporate revenue and supporting earnings growth. This indicates underlying strength in the economy. BofA's research highlights specific sectors exhibiting this resilience.

Positive Corporate Guidance

BofA's optimism extends beyond current earnings, encompassing future corporate earnings based on company guidance. Their analysis of forward-looking statements from major corporations paints a relatively positive picture.

- Analysis of forward-looking statements from major corporations: BofA's analysts meticulously review statements from companies about their future expectations. This provides valuable insight into the market outlook.

- Sectors exhibiting robust growth projections: Certain sectors, driven by technological innovation or strong underlying demand, show particularly robust growth projections. This supports BofA's overall positive assessment.

- Impact of technological advancements on earnings forecasts: Technological advancements are playing a significant role in shaping earnings forecasts for several key sectors, contributing positively to future growth expectations.

Interest Rate Impacts and Valuation Adjustments

The impact of interest rate hikes on stock market valuations is a key consideration. BofA acknowledges the influence of interest rates but believes that the market has already largely adjusted to the current monetary policy environment.

- Analysis of interest rate sensitivity across various sectors: BofA's analysis shows varying degrees of sensitivity to interest rate changes across different market sectors. Some sectors are more affected than others.

- Impact on discounted cash flow models and valuation metrics: Changes in interest rates directly impact discounted cash flow models, a key method for evaluating stock market valuations. BofA's analysis incorporates these effects.

- The role of the Federal Reserve's monetary policy in shaping market valuations: The Federal Reserve's actions significantly influence market valuations. BofA closely monitors the Fed's policies and incorporates their expected impact into their analysis.

Addressing Key Investor Concerns

Despite their relatively optimistic view, BofA acknowledges key investor concerns and addresses them within their valuation analysis.

Concerns about High Inflation

High inflation remains a significant concern for investors. BofA's analysis incorporates inflation forecasts and examines how companies are managing inflationary pressures.

- BofA's inflation forecasts and their impact on earnings: BofA's economists provide inflation forecasts that feed into their valuation models, helping to gauge the impact on earnings.

- Strategies companies are employing to manage inflationary pressures: The report highlights the various strategies companies are using – from pricing adjustments to cost-cutting measures – to navigate the inflationary environment.

- The historical context of inflation and its effect on the market: BofA provides historical context, comparing current inflation levels with past inflationary periods and their impact on the market.

Geopolitical Risks and Their Impact

Geopolitical risks are another factor influencing stock market valuations. BofA incorporates geopolitical risk assessment into its analysis.

- Specific geopolitical events and their potential market consequences: The report considers specific geopolitical events and evaluates their potential impact on the market. This includes scenarios and potential outcomes.

- BofA's risk assessment methodologies: BofA employs sophisticated risk assessment methodologies to quantify the potential impact of geopolitical events on the market.

- Strategies for mitigating geopolitical risks in investment portfolios: The report might suggest strategies for investors to mitigate the impact of geopolitical risks on their portfolios.

Conclusion

BofA's analysis suggests that while challenges like inflation and geopolitical risks exist, current stock market valuations aren't necessarily cause for extreme alarm. Factors like earnings growth exceeding inflation, positive corporate guidance, and the seemingly already-priced-in impact of interest rate hikes contribute to their relatively calm outlook. However, investors should remain vigilant and continue to monitor these factors closely. Understanding stock market valuations is crucial for informed investment decisions. Stay informed about the latest analysis from reputable sources like BofA and adjust your portfolio strategy accordingly to navigate the complexities of stock market valuations effectively. Don't let market volatility lead to rash decisions; instead, use this information to make calculated and informed choices regarding your investments and portfolio diversification.

Featured Posts

-

Analyzing Jonathan Groffs Tony Award Prospects For Just In Time

May 24, 2025

Analyzing Jonathan Groffs Tony Award Prospects For Just In Time

May 24, 2025 -

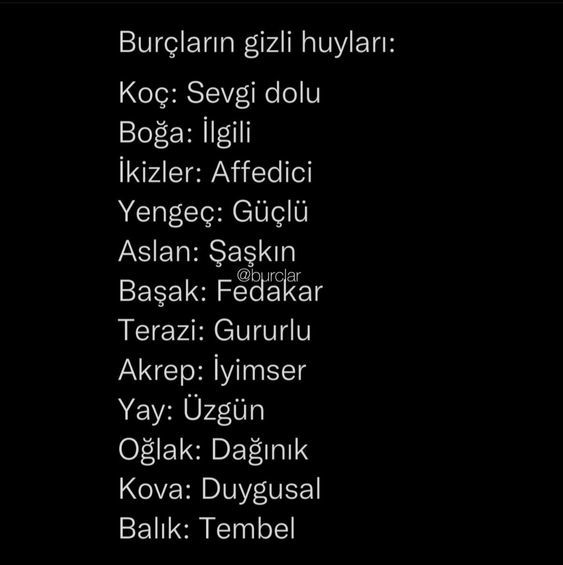

Seytan Tueyuene Sahip Burclarin Gizli Cekim Guecue

May 24, 2025

Seytan Tueyuene Sahip Burclarin Gizli Cekim Guecue

May 24, 2025 -

Chto Udalos Nashemu Pokoleniyu Dostizheniya I Uroki Proshlogo

May 24, 2025

Chto Udalos Nashemu Pokoleniyu Dostizheniya I Uroki Proshlogo

May 24, 2025 -

Porsche Investicijos I Tvaru Mobiluma Nauja Ikrovimo Stotis Europoje

May 24, 2025

Porsche Investicijos I Tvaru Mobiluma Nauja Ikrovimo Stotis Europoje

May 24, 2025 -

Complete Guide Nyt Mini Crossword Answers March 24 2025

May 24, 2025

Complete Guide Nyt Mini Crossword Answers March 24 2025

May 24, 2025