Stock Market Valuations: BofA's Reassuring Analysis For Investors

Table of Contents

BofA's Methodology and Key Findings

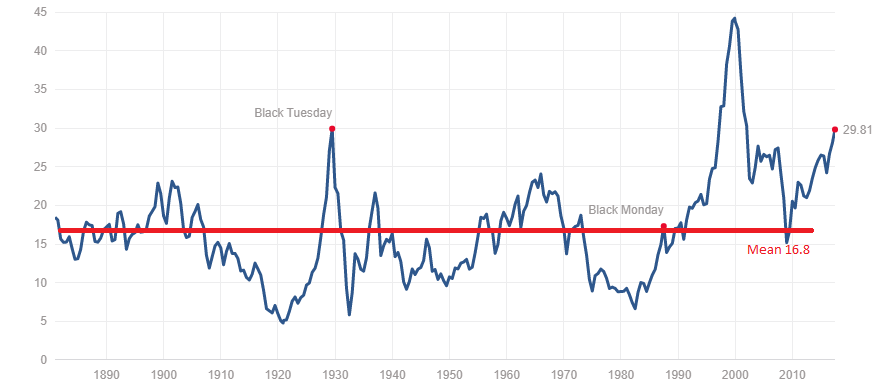

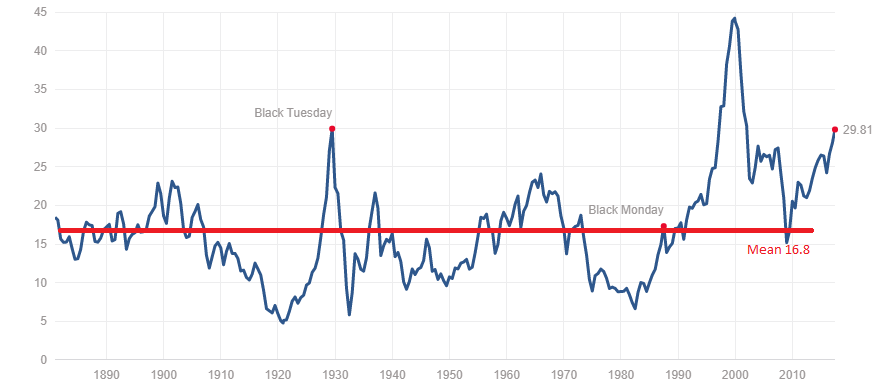

BofA's assessment of stock market valuations employed a multi-faceted approach, incorporating several widely used metrics. Their analysis heavily relied on traditional valuation tools such as price-to-earnings ratios (P/E) and the cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller PE ratio, a measure that smooths out short-term fluctuations in earnings. This comprehensive methodology allows for a more nuanced understanding of market valuation than relying on a single metric.

BofA's key findings, based on their detailed analysis of various market segments and economic indicators, suggested that while valuations were not exceptionally low, they were not excessively high either. The report found that current valuations, while above historical averages in certain sectors, were within a reasonable range considering prevailing macroeconomic conditions. Specific data points from the report would need to be referenced for a precise interpretation, but the overall tone suggested a cautiously optimistic outlook.

- Specific valuation metrics used by BofA: P/E ratios, CAPE ratios, price-to-sales ratios (P/S), and dividend yield.

- Key conclusions from BofA's analysis regarding current market conditions: Valuations are relatively fair, considering current economic factors and future growth expectations. Certain sectors appear more attractive than others based on their valuation multiples.

- Comparison of current valuations to historical averages: Current valuations are above long-term historical averages but below peak levels seen during previous market bubbles.

Factors Influencing BofA's Assessment

BofA's assessment wasn't made in a vacuum; it considered numerous macroeconomic factors that significantly impact stock valuations. These factors played a crucial role in shaping their overall conclusions.

- Impact of interest rate hikes on stock valuations: Higher interest rates generally increase the discount rate used in valuation models, leading to lower present values of future earnings and thus potentially lower stock valuations. BofA likely factored in the Federal Reserve's monetary policy tightening and its potential impact on corporate profitability and investor sentiment.

- Influence of inflation on market multiples: Persistent inflation erodes purchasing power and can impact corporate earnings, affecting profit margins and consequently stock valuations. BofA's analysis likely incorporated inflation projections and their impact on earnings growth.

- Effect of potential recessionary scenarios on stock prices: The threat of a recession significantly impacts investor sentiment and market valuations. BofA's analysis likely included various recessionary scenarios and their potential effects on stock prices. This incorporated analysis of various economic indicators and potential triggers for a recession.

Implications for Investors: What BofA's Analysis Means for Your Portfolio

BofA's analysis offers valuable insights for investors, informing strategic decision-making. While the report doesn't explicitly advocate for "buy," "sell," or "hold," its findings suggest a more nuanced approach.

- Investment strategies suggested based on BofA's findings: A balanced approach, considering both potential risks and opportunities, might be recommended. Investors may consider focusing on undervalued sectors or companies with strong fundamentals.

- Sectors or asset classes that BofA might recommend: The specific sectors would vary based on BofA's detailed findings, but generally, sectors exhibiting strong growth potential despite relatively lower valuations may be favored.

- Risk management considerations for investors: Diversification across various asset classes remains crucial to mitigate risk. Investors should maintain a well-diversified portfolio suited to their individual risk tolerance and investment objectives.

Alternative Perspectives on Stock Market Valuations

It's crucial to acknowledge that opinions on stock market valuations are not monolithic. Other reputable financial institutions and analysts may hold differing views. Some might argue that current valuations remain elevated, considering lingering economic uncertainties, while others may see opportunities in specific sectors deemed undervalued.

- Summary of opposing views on market valuations: Some analysts might emphasize the risks associated with high inflation and potential recession, suggesting caution.

- Reasons for differing opinions: These differences stem from varying assumptions regarding future economic growth, inflation trajectories, and corporate earnings.

- Importance of diversified investment strategies: Regardless of differing opinions, maintaining a diversified portfolio is crucial to mitigate risk and capitalize on opportunities.

Conclusion: Understanding Stock Market Valuations – The BofA Perspective and Next Steps

BofA's analysis provides a valuable perspective on current stock market valuations, suggesting that while not alarmingly high, they are not exceptionally low either. This highlights the importance of considering multiple perspectives and conducting thorough due diligence before making any investment decisions. Remember, while BofA's insights are valuable, they should be considered alongside your own research and consultation with financial advisors.

To make well-informed investment decisions, understand stock market valuations thoroughly. Assess your portfolio based on your risk tolerance and investment goals, and consider BofA's insights as one piece of the puzzle. Stay informed about future analyses from BofA and other reputable sources to navigate the ever-evolving landscape of stock market valuations. Consult with a financial advisor to create a personalized investment strategy tailored to your needs.

Featured Posts

-

Bread Price Fixing Scandal 500 Million Settlement Hearing Scheduled For May

Apr 22, 2025

Bread Price Fixing Scandal 500 Million Settlement Hearing Scheduled For May

Apr 22, 2025 -

Open Ai Facing Ftc Investigation Data Privacy And Ai Concerns

Apr 22, 2025

Open Ai Facing Ftc Investigation Data Privacy And Ai Concerns

Apr 22, 2025 -

Chinas Economy Assessing The Risks Of Rising Tariffs On Exports

Apr 22, 2025

Chinas Economy Assessing The Risks Of Rising Tariffs On Exports

Apr 22, 2025 -

Secret Service Closes White House Cocaine Investigation

Apr 22, 2025

Secret Service Closes White House Cocaine Investigation

Apr 22, 2025 -

South Sudan Us Collaborate On Deportees Repatriation

Apr 22, 2025

South Sudan Us Collaborate On Deportees Repatriation

Apr 22, 2025