Stock Market Valuations: BofA's Reassuring Take For Investors

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

BofA's recent report suggests that while valuations are not historically low, they are not excessively high either, offering a degree of reassurance to investors. Their core argument hinges on a nuanced understanding of current market conditions and future growth prospects. Key conclusions from their analysis include:

- Moderate P/E Ratios: BofA found that current Price-to-Earnings (P/E) ratios, a crucial valuation metric, are elevated compared to historical averages but are justified by expectations of strong future earnings growth. They suggest that the market is pricing in anticipated growth, rather than being irrationally exuberant.

- Sector-Specific Variations: The report highlights significant variation in market multiples across different sectors. Some sectors appear relatively overvalued, while others offer potentially attractive entry points based on their equity valuation. This calls for a more granular approach to investment decisions.

- Strong Earnings Growth Projections: BofA’s analysis incorporates projections of robust corporate earnings growth over the next few years, bolstering their case for the current stock market valuations. These projections are based on their assessment of macroeconomic factors.

Understanding the Methodology Behind BofA's Valuation Analysis

BofA's valuation analysis employs a robust methodology combining both fundamental analysis and quantitative analysis. Their approach involves:

- Discounted Cash Flow (DCF) Modeling: A core element of their analysis is the use of DCF models to project the intrinsic value of companies based on their future cash flows. This is a sophisticated method that considers the time value of money.

- Comparative Company Analysis: BofA uses comparative company analysis, benchmarking companies within the same sector to determine relative valuations and identify potential mispricings. This involves comparing key valuation metrics like P/E ratios, Price-to-Book (P/B) ratios, and others.

- Data Sources: The analysis relies on a wide range of data sources, including financial statements, industry reports, macroeconomic forecasts, and proprietary data.

Factors Contributing to BofA's Positive Outlook on Stock Market Valuations

Several factors underpin BofA's relatively positive outlook on stock market valuations:

- Robust Corporate Earnings: Strong corporate earnings reports in recent quarters are a key driver of their positive assessment. This suggests that companies are successfully navigating economic challenges and maintaining profitability.

- Interest Rate Expectations: While interest rates have risen, BofA's analysis incorporates expectations of interest rate increases slowing, providing support for continued economic growth.

- Inflation Outlook: While inflation remains a concern, BofA's analysis projects a gradual decline in inflation rates, reducing pressure on corporate earnings and potentially easing market concerns.

- Resilient Market Sentiment: Despite recent market volatility, BofA observes a relatively resilient market sentiment, suggesting that investor confidence, while cautious, is not overly pessimistic.

Potential Risks and Cautions Regarding Stock Market Valuations

While BofA presents a reassuring perspective, it's crucial to acknowledge potential risks:

- Market Volatility: The stock market remains susceptible to periods of increased market volatility, driven by factors outside of BofA's projections.

- Geopolitical Risk: Geopolitical uncertainties, such as the ongoing war in Ukraine, pose a significant risk to global economic stability and could negatively impact stock market valuations.

- Recessionary Fears: Persistent inflation and rising interest rates have fueled concerns about a potential recession, which could lead to a significant downward correction in stock market valuations.

- Unexpected Inflation Spikes: A resurgence in inflation, exceeding BofA’s projections, could significantly impact corporate profitability and market sentiment, increasing investment risk.

How to Interpret BofA's Stock Market Valuation Report

BofA's report shouldn't be interpreted as a definitive buy or sell signal. Instead, it provides a valuable framework for investors to consider. To effectively utilize this information:

- Diversify Your Portfolio: Maintain a diversified investment portfolio to mitigate risk across various asset classes.

- Implement a Long-Term Strategy: Focus on a long-term investment strategy rather than attempting to time the market based on short-term fluctuations in stock market valuations.

- Conduct Your Own Research: BofA's report is just one piece of the puzzle. Conduct your own thorough research, considering multiple perspectives and factors relevant to your individual investment goals.

- Adjust Asset Allocation: Based on your risk tolerance and the insights gained from BofA's analysis and your own research, adjust your asset allocation accordingly.

Conclusion: Actionable Insights on Stock Market Valuations Based on BofA's Assessment

BofA's analysis offers a measured and reassuring perspective on current stock market valuations, highlighting the importance of understanding the nuances of market conditions rather than relying on simplistic interpretations. While acknowledging potential risks like market volatility and geopolitical uncertainty, their findings suggest that the market isn't excessively overvalued and that strong corporate earnings growth may support current levels. Don't let uncertainty about stock market valuations paralyze you. Learn more, conduct thorough research, and make informed decisions today! Use BofA's insights to build a robust investment strategy that aligns with your risk tolerance and long-term financial goals.

Featured Posts

-

Red Wings And Tigers Games Fox 2 Simulcast Schedule

May 05, 2025

Red Wings And Tigers Games Fox 2 Simulcast Schedule

May 05, 2025 -

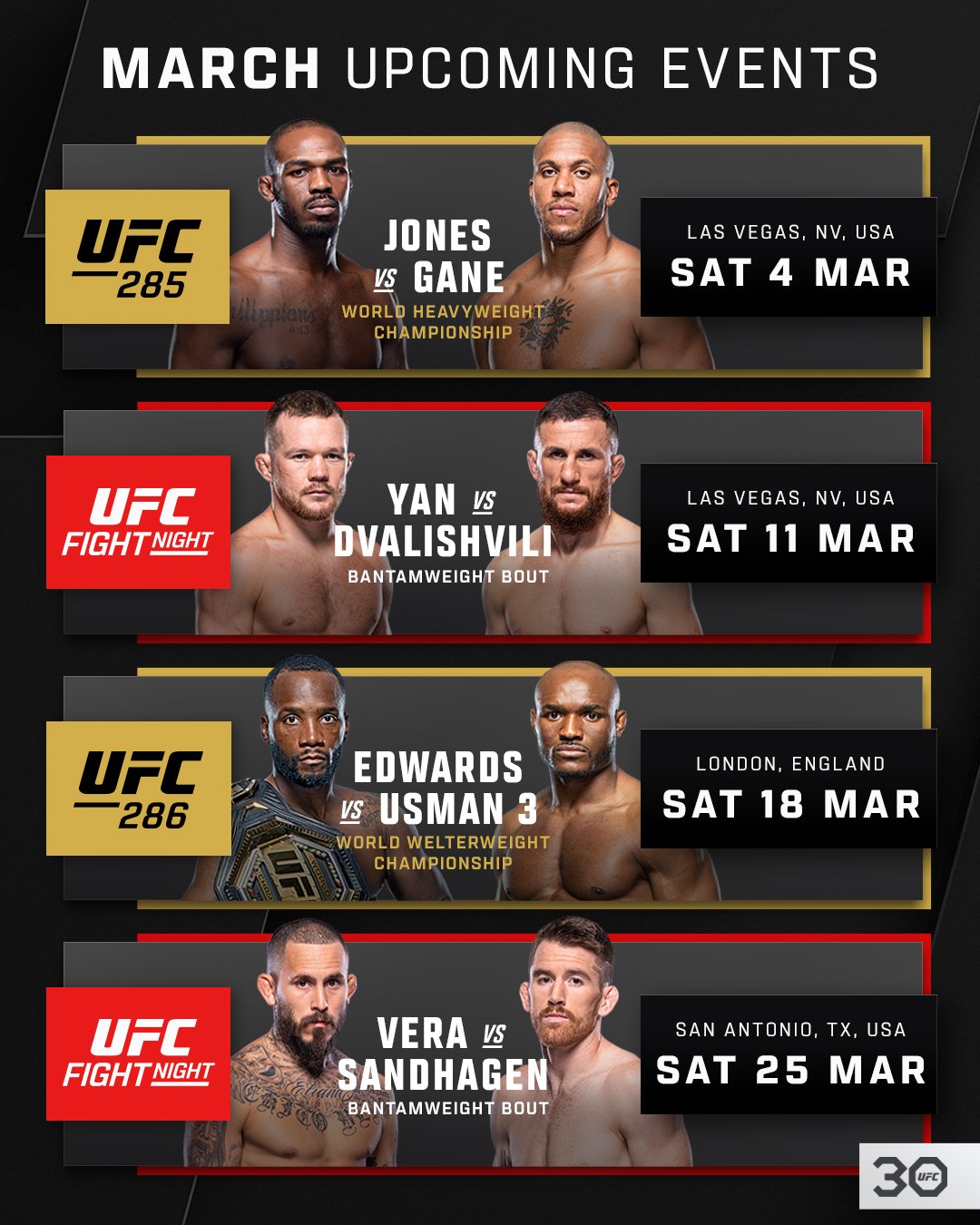

Complete Ufc Schedule May 2025 Events Featuring Ufc 315

May 05, 2025

Complete Ufc Schedule May 2025 Events Featuring Ufc 315

May 05, 2025 -

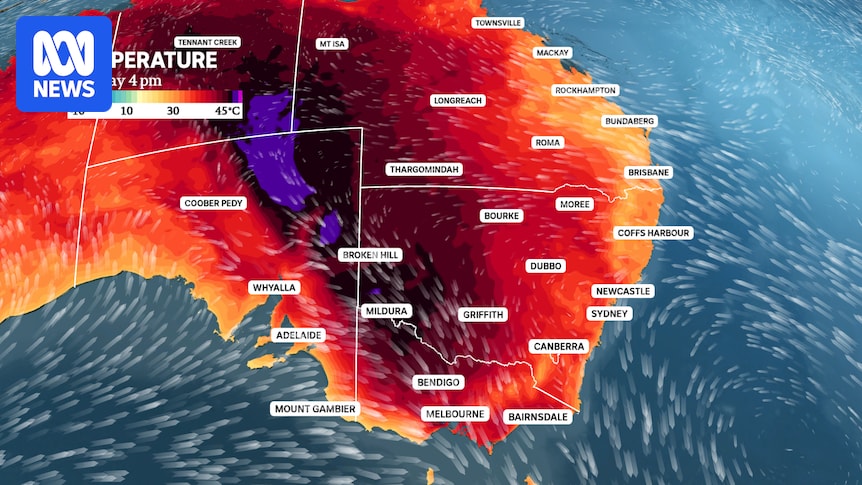

Bengal Braces For Cold Snap Latest Weather Update And Forecast

May 05, 2025

Bengal Braces For Cold Snap Latest Weather Update And Forecast

May 05, 2025 -

Kolkata Weather Update Temperatures To Exceed 30 Degrees Celsius In March

May 05, 2025

Kolkata Weather Update Temperatures To Exceed 30 Degrees Celsius In March

May 05, 2025 -

New Lizzo Single A Fiery Anthem Of Confidence And Power

May 05, 2025

New Lizzo Single A Fiery Anthem Of Confidence And Power

May 05, 2025