Stock Market Valuations: BofA's Reassuring View For Investors

Table of Contents

BofA's Core Argument: Valuations are Not Overly Expensive

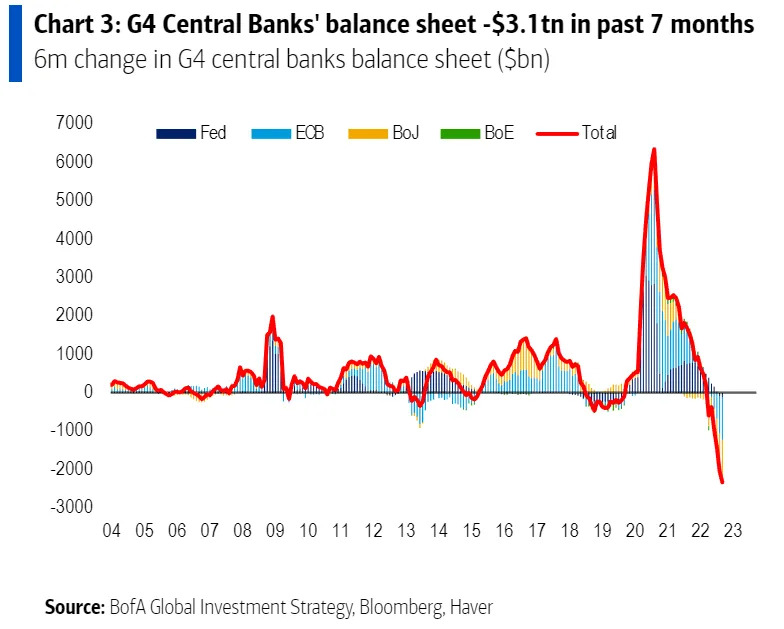

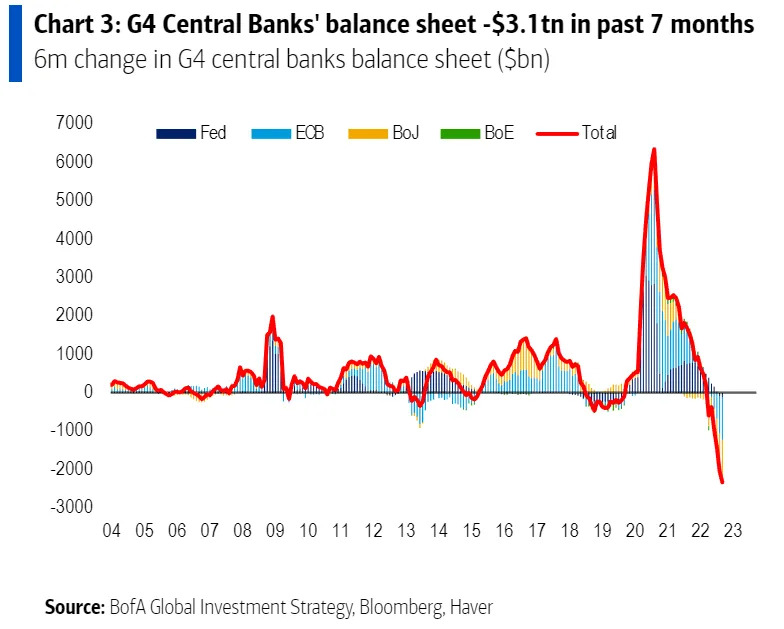

Bank of America's assessment of stock market valuations isn't based on gut feeling; it's rooted in a robust methodology. Their analysts employ a variety of tools to gauge market health, including widely accepted metrics like price-to-earnings ratios (P/E ratios), discounted cash flow (DCF) models, and comparative valuation analyses across different sectors. These models consider not just current earnings but also projected future earnings growth, incorporating long-term economic forecasts and industry-specific trends.

BofA doesn't paint a universally rosy picture. Their analysis identifies specific sectors and market segments where valuations appear relatively attractive, suggesting opportunities for discerning investors. They believe that a nuanced approach, considering individual company performance alongside broader market trends, is crucial for accurate valuation assessments.

- BofA's assessment considers long-term earnings growth potential: Their models project future earnings, factoring in expected growth rates for individual companies and the broader economy.

- They factor in interest rate impacts on future valuations: Rising interest rates can impact corporate profitability and discount rates used in valuation models, a factor BofA explicitly incorporates into their analysis.

- Specific examples of undervalued sectors according to BofA's analysis: While BofA’s specific recommendations are often reserved for their clients, their research frequently points towards undervalued opportunities in cyclical sectors or those experiencing a temporary downturn that is expected to rebound, after careful analysis of their financial health and future prospects.

- Comparison of current valuations to historical averages: BofA's analysis often involves comparing current P/E ratios and other valuation metrics to historical averages, helping to determine whether current valuations are significantly above or below typical ranges.

Addressing Concerns About Inflation and Interest Rates

Inflation and interest rates are undeniably significant factors impacting stock market valuations. BofA's models explicitly incorporate inflation expectations and projected interest rate trajectories. They acknowledge the risks associated with rising rates, including potential impacts on corporate earnings and investor sentiment. However, their analysis suggests that the market has already priced in much of the anticipated increases.

- BofA's view on the sustainability of current inflation levels: Their economists track inflation indicators and attempt to predict its future path, influencing their valuation estimates.

- Impact of interest rate hikes on corporate earnings and stock prices: They analyze the potential for interest rate increases to squeeze corporate profit margins and thereby impact stock prices.

- Strategies for mitigating risks in a high-interest-rate environment: BofA might suggest strategies such as focusing on companies with strong balance sheets and pricing power, or diversifying investments across different asset classes.

- BofA's predictions for future interest rate movements: Though predictions are inherently uncertain, BofA's economists contribute forecasts that are factored into their overall valuation assessments.

Opportunities and Investment Strategies Based on BofA's Analysis

BofA's analysis translates into actionable investment strategies. Based on their research, specific sectors or asset classes might be presented as potentially promising investments. However, it's crucial to remember that this is not financial advice, and you should conduct your own research before making any decisions.

- Specific investment recommendations (with disclaimers – this is not financial advice): While BofA may highlight attractive sectors in their reports, individual stock selection should be based on further due diligence.

- Diversification strategies to mitigate risk: A well-diversified portfolio spread across different sectors and asset classes is a common recommendation to reduce risk.

- Importance of long-term investment horizons: BofA emphasizes that a long-term perspective is crucial when dealing with market fluctuations.

- Potential benefits of dollar-cost averaging: Dollar-cost averaging, which is consistently investing a set amount of money at regular intervals regardless of price, is often mentioned as a strategy to mitigate the risk of market timing.

Understanding the Limitations of BofA's Analysis

It's essential to understand the limitations of any valuation model, including BofA's. No model can perfectly predict the future, and unforeseen events can significantly impact market valuations.

- Unforeseen geopolitical events and their impact on valuations: Global events can drastically affect investor sentiment and market performance.

- The influence of market sentiment and investor psychology: Market behavior isn't purely rational; investor sentiment and psychology can drive significant price swings.

- Potential for unexpected shifts in economic data: Unforeseen economic data releases could challenge assumptions built into valuation models.

- The importance of conducting your own due diligence: Ultimately, investors are responsible for their own decisions and must always conduct thorough research before making investments.

Conclusion

This article has examined Bank of America's assessment of current stock market valuations. BofA's analysis suggests that despite recent volatility, valuations are not excessively high, particularly in certain sectors. They've considered factors like inflation and interest rates, offering a relatively reassuring outlook for investors. However, it's crucial to remember that all valuation models have limitations, and individual circumstances should always be considered.

While BofA’s perspective on stock market valuations provides valuable insight, thorough research and a well-defined investment strategy are crucial. Further your understanding of stock market valuations and make informed decisions to navigate the market effectively. Consult with a financial advisor for personalized guidance.

Featured Posts

-

Ea Fc 24 Fut Birthday Team Tier List Of The Best Players

May 21, 2025

Ea Fc 24 Fut Birthday Team Tier List Of The Best Players

May 21, 2025 -

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025

Liverpool Juara Liga Inggris 2024 2025 Prediksi Dan Daftar Juara Premier League 10 Tahun Terakhir

May 21, 2025 -

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025

Ing Group 2024 Annual Report Form 20 F Released

May 21, 2025 -

Sandylands U Episode Guide And Air Times

May 21, 2025

Sandylands U Episode Guide And Air Times

May 21, 2025 -

Is A Truly Enduring Logitech Mouse Possible

May 21, 2025

Is A Truly Enduring Logitech Mouse Possible

May 21, 2025