Stock Market Valuations: Why BofA Believes Investors Shouldn't Be Concerned

Table of Contents

BofA's Argument: Interest Rates and Valuation Metrics

BofA's analysis hinges on the interplay between interest rates and traditional valuation metrics. They argue that the impact of rising interest rates on stock market valuations is less significant than many fear. Their assessment incorporates several key valuation metrics:

-

Price-to-Earnings Ratio (P/E): BofA analyzes the P/E ratio across various sectors, comparing current levels to historical averages, adjusted for interest rate environments. They contend that while P/E ratios might appear high in isolation, they are not historically unprecedented when considered in the context of prevailing interest rates.

-

Shiller PE Ratio (CAPE): This cyclically adjusted price-to-earnings ratio, which smooths out earnings fluctuations over a longer period, is also a key metric in BofA's analysis. Their research suggests that even the CAPE ratio, often cited as a more robust indicator of long-term valuation, doesn't signal imminent market collapse when considered alongside other factors like earnings growth.

-

Impact of Rising Interest Rates: BofA's research suggests that while rising interest rates increase the discount rate used in valuation models, the effect is mitigated by several factors, including strong corporate earnings growth (discussed below) and continued long-term growth projections. Simply put, higher rates are somewhat offset by the potential for higher future earnings. Data supporting this claim, though not readily publicly available without direct access to BofA's research, would likely show a less dramatic correlation between interest rate hikes and valuation decreases than widely perceived.

The Role of Corporate Earnings Growth in Justifying Valuations

A cornerstone of BofA's argument is the projected strength of corporate earnings growth. They believe that robust earnings growth can justify seemingly high stock market valuations. Their analysis covers various sectors, highlighting the following:

-

Projected Earnings Growth Rates: BofA's projections, which are likely based on their in-house research and forecasts, indicate healthy earnings growth across many sectors, particularly in technology and healthcare. These projections would form the basis for their valuation arguments, suggesting that higher earnings can support the current valuation levels.

-

Strong Earnings Justify Valuations: The argument is simple: If companies are generating significantly more profits, a higher valuation becomes more sustainable. BofA's analysis likely demonstrates that projected earnings growth outweighs the impact of higher interest rates on discounted cash flow models used for valuation.

-

Sector Performance: BofA’s research likely highlights specific sectors experiencing particularly robust earnings growth, further bolstering their overall optimistic outlook on stock market valuations. These strong performers could be offsetting the weaker performance of other sectors, contributing to a more balanced overall picture.

Addressing Long-Term Growth Potential and Technological Innovation

BofA's valuation analysis doesn't solely focus on short-term metrics. They explicitly consider long-term growth prospects and the transformative impact of technological innovation:

-

Impact of Technological Innovation: Disruptive technologies are reshaping industries, driving significant future earnings growth. BofA's assessment likely focuses on sectors poised to benefit most from these advancements, potentially highlighting specific companies positioned for substantial growth.

-

Sectors Benefiting from Innovation: Sectors like artificial intelligence, renewable energy, and biotechnology are likely cited as key drivers of future earnings growth, showcasing that current valuations reflect not just present performance, but the promise of future innovations.

-

Positive Outlook Despite High Valuations: By factoring in long-term growth potential fueled by technological innovation, BofA concludes that even with current valuation levels, the market outlook remains positive, provided these growth trajectories are met.

Addressing Potential Risks and Counterarguments

While BofA presents a positive outlook, it's crucial to acknowledge potential risks and counterarguments:

-

Potential Market Corrections or Downturns: Market corrections are inherent risks; BofA's analysis doesn't guarantee immunity from market volatility. Their perspective likely acknowledges this risk but argues that current valuations don't inherently signify an imminent crash.

-

Limitations of BofA's Analysis: Like any financial analysis, BofA's research has limitations. Their assumptions and projections are subject to inherent uncertainties. It's crucial to acknowledge this limitation.

-

Potential Biases: It's important to be aware of the potential for inherent bias in any financial institution's analysis. While BofA's research is valuable, it's beneficial to consider alternative viewpoints and conduct independent research.

Conclusion: Should You Be Worried About Stock Market Valuations? BofA Says No

BofA's analysis suggests that current stock market valuations, while seemingly high, are justifiable when considering factors such as strong projected corporate earnings growth, the potential for long-term growth driven by technological innovation, and the less-than-expected impact of rising interest rates on valuation metrics. While potential market risks and limitations to their analysis exist, their overall optimistic view provides valuable context for investors. While this analysis from BofA offers valuable insight, remember to conduct your own thorough research and develop an investment strategy that aligns with your personal risk tolerance. Don't let anxieties about stock market valuations hinder your long-term investment goals.

Featured Posts

-

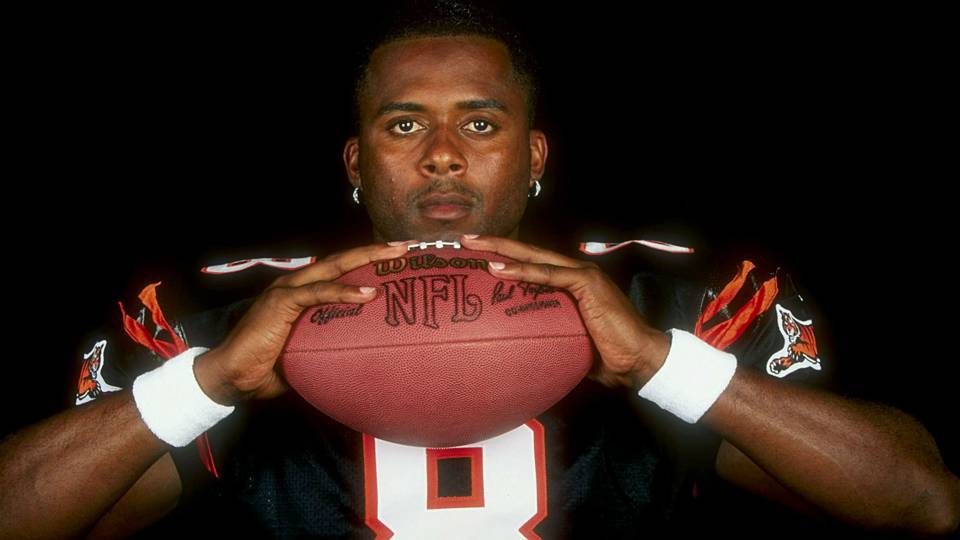

Japanese Baseball Former Nfl Qb Makes Unlikely Play Taking Fly Ball From Max Muncy

May 16, 2025

Japanese Baseball Former Nfl Qb Makes Unlikely Play Taking Fly Ball From Max Muncy

May 16, 2025 -

Srochno Masshtabnaya Ataka Rossii Na Ukrainu Bolee 200 Raket I Dronov

May 16, 2025

Srochno Masshtabnaya Ataka Rossii Na Ukrainu Bolee 200 Raket I Dronov

May 16, 2025 -

Rockets Vs Warriors Game 6 Jimmy Butlers Picks And Betting Predictions

May 16, 2025

Rockets Vs Warriors Game 6 Jimmy Butlers Picks And Betting Predictions

May 16, 2025 -

Jiskefets Absurdistische Erfenis Een Verdiende Nipkowschijf

May 16, 2025

Jiskefets Absurdistische Erfenis Een Verdiende Nipkowschijf

May 16, 2025 -

Bahia Vence Al Paysandu 1 0 Resumen Completo Del Encuentro

May 16, 2025

Bahia Vence Al Paysandu 1 0 Resumen Completo Del Encuentro

May 16, 2025