Stocks Power Global Risk Rally Amidst U.S.-China Truce

Table of Contents

The Impact of the U.S.-China Truce on Global Markets

The easing of trade tensions between the US and China has significantly reduced economic uncertainty, a key driver of the global risk rally. The prolonged U.S.-China trade war injected considerable volatility into the stock market, creating apprehension among investors. However, the truce, even if temporary, has boosted investor confidence, leading to increased investment in stocks across various sectors. Keywords like U.S.-China Trade War, Trade Deal, Economic Uncertainty, Market Sentiment, and Investor Confidence are crucial here.

- Reduced tariffs and trade barriers lead to increased global trade: Lower tariffs mean cheaper goods and increased consumer spending, stimulating economic activity.

- Improved business outlook for multinational corporations: Companies operating across both markets now face reduced operational uncertainties, allowing for better planning and investment.

- Increased foreign direct investment (FDI) flows: Reduced geopolitical risk makes emerging markets more attractive to foreign investors, leading to increased capital inflows.

- Positive impact on supply chains and global manufacturing: Smoother trade relations streamline supply chains, reducing disruptions and improving efficiency.

- Lower geopolitical risk premiums: The reduced risk of further escalation in the trade war has led to lower risk premiums reflected in asset prices.

Analysis of the Global Risk Rally: Sectors and Performance

The global risk rally hasn't impacted all sectors equally. A "risk-on" sentiment has driven investment into previously riskier assets, leading to notable performance variations. This section analyzes the stock market performance across various sectors, highlighting the winners and losers. Keywords such as Stock Market Performance, Sectoral Performance, Risk-On Sentiment, Emerging Markets, and Technology Stocks are essential for SEO.

- Outperformance of technology stocks driven by renewed growth expectations: The tech sector has seen significant gains, fueled by optimism regarding future growth and innovation.

- Strong performance in emerging market equities: Emerging markets, previously considered riskier, have benefited from increased investor appetite, driven by improved global sentiment.

- Increased investor appetite for higher-yielding assets: Investors are increasingly seeking higher returns, driving investment in assets previously perceived as more volatile.

- Volatility reduction in several key markets: The reduced uncertainty has led to calmer markets, encouraging more risk-seeking behavior.

- Re-evaluation of previously discounted assets: Assets previously deemed undervalued due to trade war uncertainties are now being re-evaluated and attracting investment.

Understanding the Underlying Factors Fueling the Stock Market Surge

The stock market surge isn't solely attributable to the U.S.-China truce. Several macroeconomic factors have contributed to this global risk rally. This section explores the interplay of monetary policy, interest rates, inflation, and economic growth, focusing on how investor behavior plays a role. Relevant keywords include Monetary Policy, Interest Rates, Inflation, Economic Growth, and Investor Behavior.

- Central bank actions supporting economic growth: Accommodative monetary policies in many countries have provided liquidity to markets and supported economic growth.

- Positive economic data from major economies: Positive economic indicators from key economies reinforce the optimism fueling the rally.

- Falling inflation rates reducing concerns about interest rate hikes: Lower inflation reduces the likelihood of aggressive interest rate hikes, supporting market stability.

- Improved corporate earnings reports boosting investor confidence: Strong corporate earnings further solidify investor confidence and encourage continued investment.

- Speculative investment driven by fear of missing out (FOMO): The rally itself can create a self-fulfilling prophecy as investors fear missing out on further gains.

Potential Risks and Cautions for Investors

While the current global risk rally offers exciting opportunities, it's crucial to acknowledge potential downsides. Investors need to be aware of the risks associated with this market surge. Keywords such as Market Correction, Volatility, Geopolitical Instability, Economic Slowdown, and Investment Risks are crucial for SEO optimization.

- The rally may be unsustainable in the long term: The current optimism might not be sustained, leading to a potential market correction.

- Geopolitical risks remain, including ongoing tensions in other regions: Geopolitical instability outside the US-China relationship could disrupt the current positive trend.

- Economic indicators might not sustain the current positive trajectory: Economic growth could slow down, potentially leading to a market downturn.

- Potential for increased inflation in the future: Inflationary pressures could lead to interest rate hikes, potentially dampening market enthusiasm.

- The possibility of a market correction or sharp downturn: A sudden shift in market sentiment could trigger a significant market correction.

Conclusion

The U.S.-China truce has undeniably fueled a significant global risk rally, driving substantial gains in stock markets worldwide. The improved geopolitical climate and supportive macroeconomic factors offer a positive outlook. However, investors should remain cautious and aware of potential risks, including the possibility of a market correction and lingering geopolitical uncertainties. Understanding the dynamics of this global risk rally is crucial for navigating the complexities of the current market. Stay informed about the latest developments and adapt your investment strategy accordingly to leverage the opportunities presented by the global risk rally and stock market performance. Consider consulting a financial advisor to help you make informed decisions about your investment portfolio in the current climate.

Featured Posts

-

Newcastle News Premier League Defender Deal Expected To Fail

May 14, 2025

Newcastle News Premier League Defender Deal Expected To Fail

May 14, 2025 -

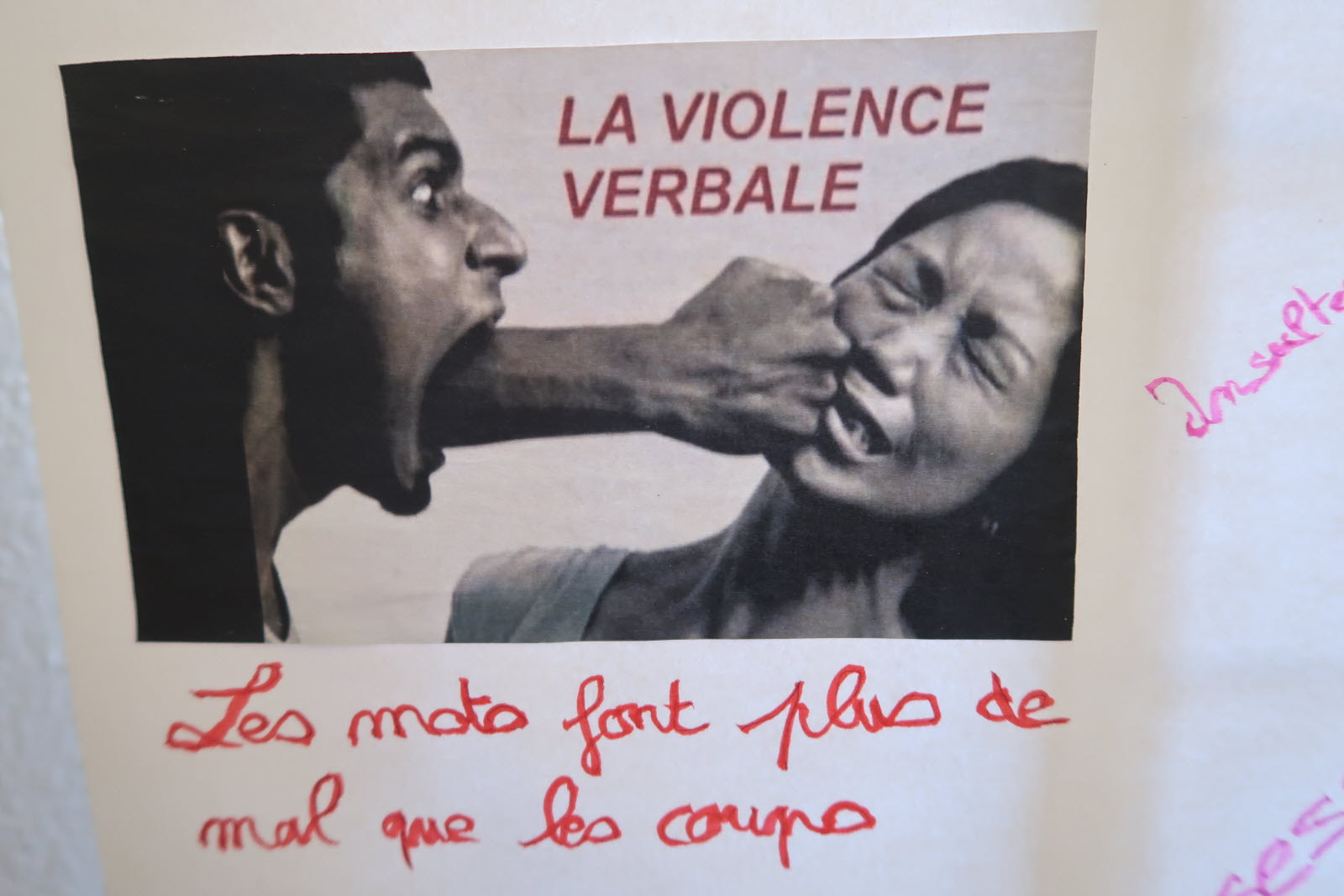

Haiti La Cocaine Un Carburant Pour La Violence Selon Le President Colombien

May 14, 2025

Haiti La Cocaine Un Carburant Pour La Violence Selon Le President Colombien

May 14, 2025 -

Eurojackpotin Voitonumerot Taessae Viikon Oikea Rivi Ja Miljoonapottia

May 14, 2025

Eurojackpotin Voitonumerot Taessae Viikon Oikea Rivi Ja Miljoonapottia

May 14, 2025 -

Captain America Brave New World Release Date Confirmed For Disney

May 14, 2025

Captain America Brave New World Release Date Confirmed For Disney

May 14, 2025 -

Mission Impossible 7 40 Below Zero Shoot In Svalbard Cruise And Atwell Reveal Brutal Filming

May 14, 2025

Mission Impossible 7 40 Below Zero Shoot In Svalbard Cruise And Atwell Reveal Brutal Filming

May 14, 2025