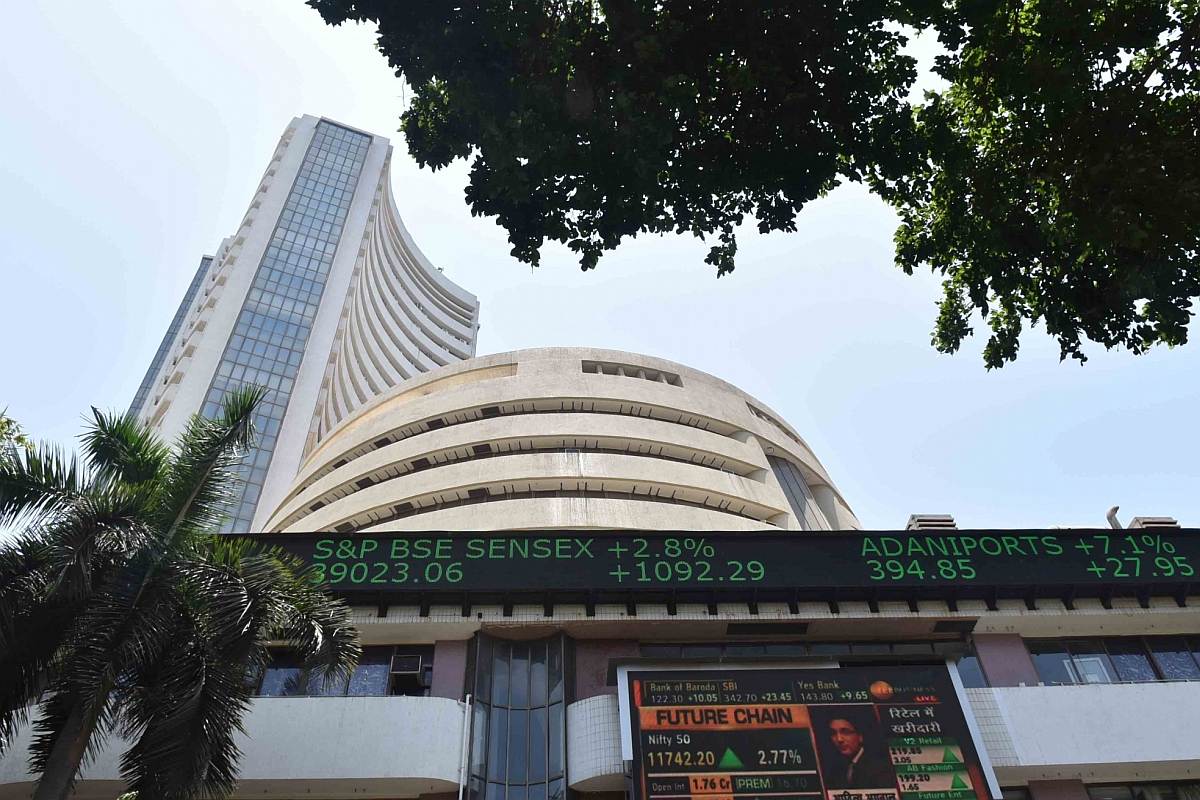

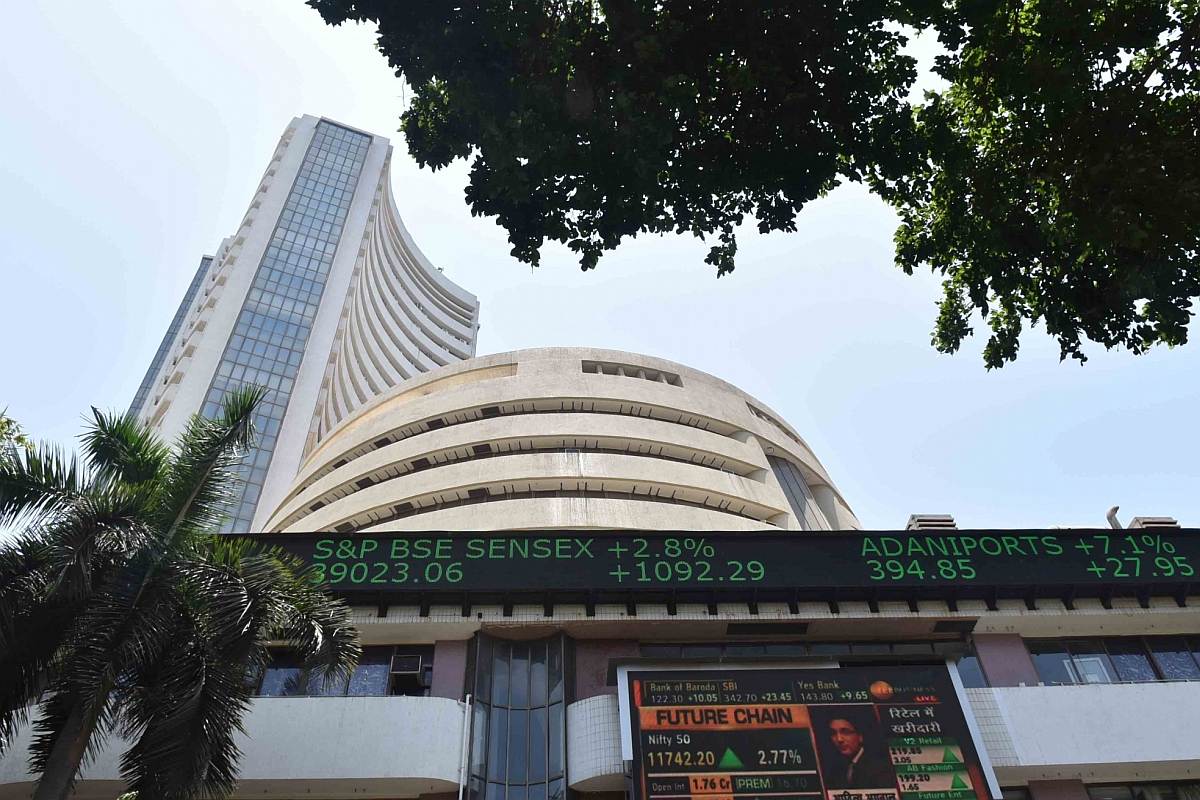

Stocks Up 10%+ On BSE: Sensex Rally Detailed

Table of Contents

Key Drivers Behind the Sensex Rally

Several interconnected factors contributed to this significant jump in the BSE Sensex. Let's break down the key drivers:

Positive Global Market Sentiment

The global economic landscape played a crucial role in fueling the BSE Sensex rally. Positive indicators from major economies influenced investor confidence, triggering a ripple effect across global markets, including India.

- Easing inflation concerns: Signs of cooling inflation in the US and Europe boosted investor optimism, reducing fears of aggressive interest rate hikes.

- Strong corporate earnings reports: Positive earnings reports from multinational corporations indicated robust economic growth, further bolstering investor confidence.

- Increased investor confidence: A general improvement in global investor sentiment led to increased capital inflows into emerging markets like India.

Domestic Economic Factors Contributing to the Surge

Simultaneously, positive domestic economic indicators within India contributed significantly to the BSE Sensex rally.

- Positive IIP data: Robust Industrial Production Index (IIP) data signaled strong manufacturing activity and overall economic growth.

- Government's infrastructure spending plans: Announcements of increased government spending on infrastructure projects boosted investor confidence in future growth prospects.

- Improved consumer sentiment: Rising consumer confidence indicated increased domestic demand, further fueling economic optimism.

Sector-Specific Performance

The rally wasn't uniform across all sectors. Certain sectors significantly outperformed others, driving the overall Sensex surge.

- Technology sector boosted by strong earnings reports: The IT sector saw a 15% increase, driven by strong earnings reports from major Indian IT companies and increased global demand for technology services.

- Financials fueled by positive credit growth projections: The banking and financial services sector witnessed a 12% rise, fueled by positive credit growth projections and expectations of higher interest rates.

- Pharmaceuticals benefited from global demand: The pharmaceutical sector also saw considerable gains, driven by strong global demand for Indian-manufactured drugs.

Impact of the Sensex Rally on Investors

The BSE Sensex rally had a significant impact on investors, creating both opportunities and challenges:

Gains for Investors

The sudden surge in the Sensex resulted in substantial gains for many investors, particularly those holding a diversified portfolio of BSE-listed stocks. Many saw their portfolio values increase significantly overnight.

Investment Strategies in the Aftermath

Following such a dramatic market surge, investors need to carefully reassess their investment strategies.

- Increased portfolio value: Investors experienced significant gains, creating opportunities for profit booking or rebalancing their portfolios.

- Opportunities for profit booking: The rally presents an opportunity for investors to book profits on some holdings and reduce risk.

- Importance of long-term investment strategies: Despite the short-term gains, maintaining a long-term investment strategy remains crucial for long-term success. Risk management and diversification are paramount.

Analyzing the Sustainability of the Rally

While the recent BSE Sensex rally is impressive, its sustainability remains a key question:

Factors Supporting Continued Growth

Several factors could support the continuation of this positive market trend:

- Continued global economic recovery: A sustained global economic recovery could continue to fuel investor confidence and capital inflows into India.

- Government reforms and policies: Further government reforms and supportive policies could encourage domestic investment and growth.

- Strong corporate earnings: Continued strong corporate earnings from major Indian companies would maintain the positive momentum.

Potential Risks and Challenges

However, several risks and challenges could potentially reverse the current positive trend:

- Geopolitical instability: Escalating geopolitical tensions could negatively impact investor sentiment and lead to capital outflows.

- Inflationary pressures: Resurgence of inflationary pressures could trigger aggressive interest rate hikes, dampening economic growth.

- Global economic uncertainty: Unforeseen global economic events could negatively impact the Indian stock market.

Navigating the BSE Sensex Rally - Future Outlook and Call to Action

The significant BSE Sensex rally of October 26th, 2023, was driven by a confluence of positive global and domestic factors, resulting in substantial gains for investors. However, understanding the sustainability of this rally requires careful consideration of both supporting factors and potential risks. Maintaining a diversified investment portfolio, practicing risk management, and staying informed about market trends are crucial for navigating the ever-changing landscape of the BSE Sensex. Stay informed on future BSE Sensex movements and leverage this understanding to make savvy investment choices. Keep an eye on our daily market updates for more insights into BSE stock performance.

Featured Posts

-

Venezia Napoles Como Ver El Partido En Directo

May 15, 2025

Venezia Napoles Como Ver El Partido En Directo

May 15, 2025 -

Dzho Bayden Na Vistavi Ta Inavguratsiyi Analiz Yogo Zovnishnogo Viglyadu

May 15, 2025

Dzho Bayden Na Vistavi Ta Inavguratsiyi Analiz Yogo Zovnishnogo Viglyadu

May 15, 2025 -

Game 3 Update Tatum And Brown In Holiday Out

May 15, 2025

Game 3 Update Tatum And Brown In Holiday Out

May 15, 2025 -

Stanley Cup Playoffs Nhls New Partnership With Ndax In Canada

May 15, 2025

Stanley Cup Playoffs Nhls New Partnership With Ndax In Canada

May 15, 2025 -

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 15, 2025

Cubs Vs Padres Spring Training Preview Mesa March 4th 2 05 Ct

May 15, 2025