Strengthened Capital Market Links: Pakistan, Sri Lanka, And Bangladesh Agreement

Table of Contents

The Agreement's Key Provisions

This groundbreaking agreement outlines several key initiatives designed to foster deeper integration of the capital markets of Pakistan, Sri Lanka, and Bangladesh. These initiatives aim to create a more fluid and efficient flow of capital across borders, stimulating economic growth and development.

- Enhanced Information Sharing: The agreement prioritizes the seamless exchange of crucial market information among the three countries. This includes real-time data on securities trading, regulatory announcements, and investor protection measures. Improved transparency builds trust and encourages cross-border investment.

- Facilitating Investment Flows: The agreement establishes clear mechanisms to streamline the process of cross-border investments. This involves simplifying regulatory procedures, reducing bureaucratic hurdles, and promoting investor-friendly policies. This aims to attract both foreign direct investment (FDI) and portfolio investment.

- Infrastructure Development: Significant investments are planned in upgrading technological infrastructure to support the enhanced connectivity. This includes developing sophisticated trading platforms, implementing secure data transfer systems, and providing comprehensive training programs for market professionals to ensure smooth operation and effective regulatory oversight.

Regulatory Harmonization and Challenges

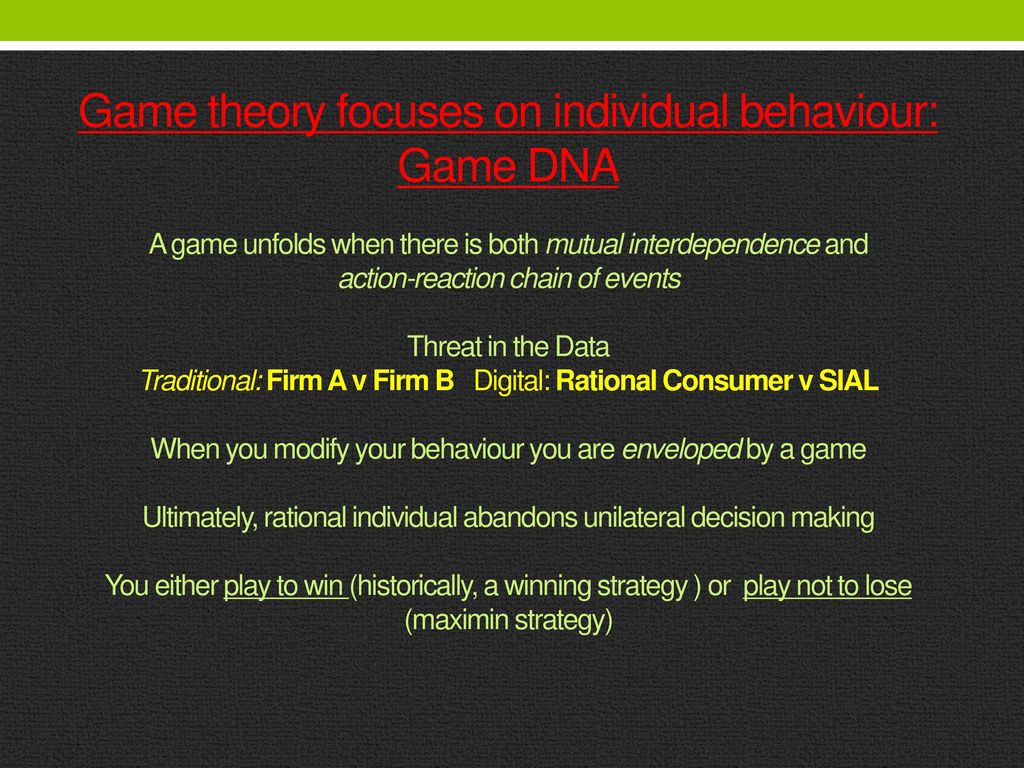

Harmonizing regulations across the three countries presents significant challenges. Achieving regulatory convergence in areas like securities laws, corporate governance, and accounting standards is crucial for fostering trust and confidence among investors. Obstacles include differing legal frameworks and varying levels of regulatory capacity. Solutions involve collaborative efforts to establish common standards, technical assistance programs, and ongoing dialogue between regulatory bodies to ensure effective cross-border investment and seamless market integration.

Investor Protection and Dispute Resolution

Robust investor protection is paramount for successful market integration. The agreement includes provisions for strengthening legal frameworks, establishing transparent dispute resolution mechanisms, and enhancing investor confidence. This includes clear guidelines for protecting investor rights, establishing independent arbitration bodies, and ensuring fair and efficient resolution of cross-border investment disputes. Strong investor confidence is essential for attracting foreign capital and promoting sustainable economic growth.

Economic Benefits and Potential Growth

The strengthened capital market links are poised to deliver significant economic benefits to Pakistan, Sri Lanka, and Bangladesh.

- Increased FDI Inflow: Improved market access will attract a considerable increase in foreign direct investment (FDI) inflow, fueling economic growth and creating jobs. This increased capital mobilization will support infrastructure development and boost industrial production.

- Portfolio Diversification: The agreement opens up opportunities for investors in all three countries to diversify their investment portfolios. This reduces risk and enhances returns by providing access to a wider range of investment options across different markets.

- Regional Economic Cooperation: The strengthened capital market links will significantly contribute to regional economic stability and cooperation. This fosters a more integrated South Asian economic landscape, promoting collaborative development and reducing economic disparities.

Impact on Small and Medium-Sized Enterprises (SMEs)

This agreement offers a particularly promising boost for SMEs. Access to broader capital markets through improved SME financing and venture capital opportunities will empower entrepreneurs, foster innovation, and drive economic diversification. This access to capital will enable SMEs to expand their operations, create jobs, and contribute significantly to overall economic growth.

Challenges and Future Outlook

While the potential benefits are substantial, several challenges must be addressed for successful implementation.

- Political Risk and Economic Uncertainty: Political instability and economic volatility in any of the three countries could negatively impact investor confidence and hinder the integration process. Careful risk assessment and mitigation strategies are crucial.

- Performance Evaluation: Ongoing monitoring and evaluation of the agreement’s effectiveness is essential to identify areas for improvement and adapt to changing circumstances. Regular assessments will ensure the initiative remains relevant and effective in achieving its objectives.

- Regional Expansion: The future success of this initiative may depend on its potential expansion to include other countries in the South Asian region. This would create a larger, more integrated capital market, unlocking even greater economic opportunities.

Conclusion

The strengthened capital market links between Pakistan, Sri Lanka, and Bangladesh represent a significant step towards regional economic integration. While challenges exist, the potential benefits – including increased FDI inflow, portfolio diversification, and enhanced SME financing – are substantial. This agreement promises a new era of economic growth and prosperity for the participating nations. Explore the opportunities presented by strengthened capital market links, stay informed about the progress of this initiative, and understand the implications of this agreement for South Asian economic integration. The future of economic development in this region hinges on the successful implementation and continued growth of this crucial agreement.

Featured Posts

-

Stephen Kings Comments On Stranger Things And Its Similarities To It

May 10, 2025

Stephen Kings Comments On Stranger Things And Its Similarities To It

May 10, 2025 -

Increased Rent After La Fires A Selling Sunset Star Speaks Out Against Price Gouging

May 10, 2025

Increased Rent After La Fires A Selling Sunset Star Speaks Out Against Price Gouging

May 10, 2025 -

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025

Thailands Transgender Community A Fight For Equality In The Spotlight

May 10, 2025 -

Exploring Four Game Changing Theories About Stephen Kings Randall Flagg

May 10, 2025

Exploring Four Game Changing Theories About Stephen Kings Randall Flagg

May 10, 2025 -

Find Live Music And Events In Lake Charles For Easter Weekend

May 10, 2025

Find Live Music And Events In Lake Charles For Easter Weekend

May 10, 2025