Strong Performance Of Emerging Market Equities: Overcoming US Downturn

Table of Contents

Diversification Benefits: Reducing Portfolio Volatility

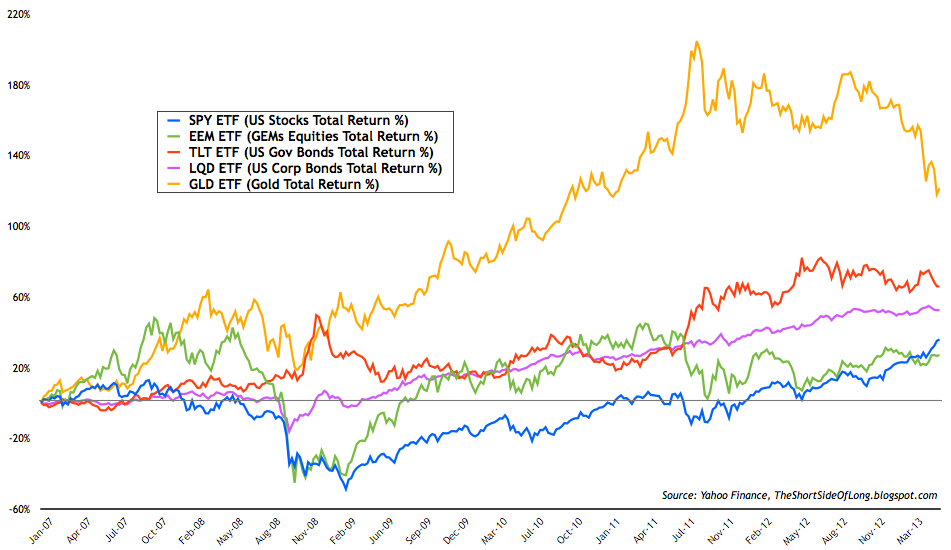

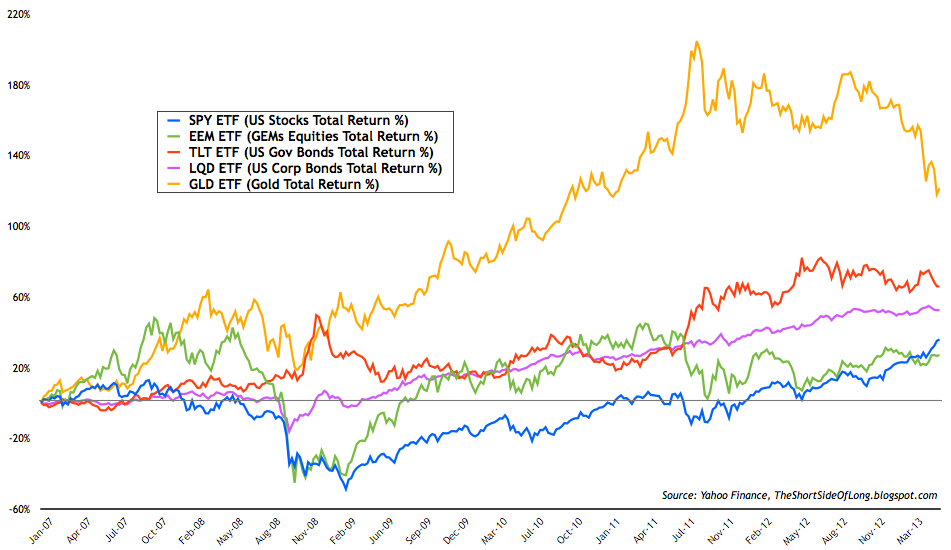

Investing solely in US markets exposes your portfolio to significant risks. Diversifying into emerging market equities offers a powerful hedge against this vulnerability.

Reduced Correlation with US Markets

Emerging market equities often exhibit lower correlation with US stocks. This means their performance isn't as directly tied to the ups and downs of the American economy. This decreased correlation acts as a powerful buffer during US market downturns.

- Reduced overall portfolio risk: Diversification lowers the impact of any single market's volatility on your overall returns.

- Smoother returns even during US economic slowdowns: While US markets might experience corrections, emerging markets could potentially offer stability or even growth.

- Opportunity for positive returns even when US markets decline: This uncorrelated performance offers a chance for portfolio growth even in a bearish US market. This is a key benefit of emerging market investments.

Accessing Untapped Growth Potential

Many emerging markets boast rapidly growing economies and burgeoning middle classes, creating significant investment opportunities not found in mature markets.

- High growth potential in sectors like technology, infrastructure, and consumer goods: These sectors are often experiencing explosive growth in emerging economies.

- Exposure to a wider range of industries and companies: Diversification across various sectors and geographies reduces reliance on any single market's performance.

- Potential for higher returns compared to developed markets: While risk is higher, the potential for reward is often greater in emerging economies.

Specific Emerging Market Strengths: Identifying Key Opportunities

While all emerging markets aren't created equal, identifying regions with specific strengths is vital.

Stronger Fundamentals in Certain Regions

Some emerging markets demonstrate robust economic fundamentals, including low debt levels, positive growth forecasts, and improving governance. This makes them less vulnerable to global economic shocks.

- Focus on specific regions with strong growth prospects (e.g., Southeast Asia): Thorough research is crucial to identify these regions.

- Analyze macroeconomic indicators and country-specific risks before investing: Due diligence is essential to make informed investment choices.

- Consider emerging market exchange-traded funds (ETFs) for diversified exposure: ETFs offer a simple way to gain broad exposure to various emerging markets.

Competitive Advantages and Innovation

Many emerging markets are hubs of innovation and technological advancement, presenting opportunities in sectors like fintech, e-commerce, and renewable energy.

- Investing in companies at the forefront of technological disruption: Emerging markets are often at the forefront of new technologies and business models.

- Identifying regions with strong governmental support for innovation: Government policies can significantly influence a country's innovative capacity.

- Thorough due diligence is crucial to identify promising companies: Researching individual companies and their growth potential is crucial for successful investing.

Managing Risks in Emerging Markets: A Cautious Approach

Investing in emerging markets comes with inherent risks that require careful consideration.

Political and Geopolitical Risks

Political instability, currency fluctuations, and regulatory uncertainty are inherent risks in emerging markets. Investors need a strategic approach to mitigate these.

- Diversification across multiple countries and sectors: Spreading investments reduces the impact of any single country's political instability.

- Thorough research into political and economic stability: Understanding the political landscape is crucial for mitigating political risk.

- Consider hedging strategies against currency fluctuations: Currency risk can significantly impact returns, so hedging may be necessary.

Liquidity and Market Access

Liquidity can be lower in some emerging markets, making it harder to buy and sell investments quickly.

- Choose liquid ETFs or mutual funds for easier trading: ETFs and mutual funds provide greater liquidity than individual stocks.

- Employ a long-term investment horizon: A long-term outlook reduces the impact of short-term market fluctuations.

- Consider the transaction costs associated with trading in emerging markets: Transaction costs can be higher in emerging markets compared to developed markets.

Conclusion

Emerging market equities offer a powerful tool for diversification and potentially higher returns, even when the US market experiences a downturn. By carefully considering the opportunities and managing the risks involved, investors can successfully leverage the strength of emerging markets to build robust and resilient portfolios. Don't miss out on the potential of emerging market equities – start exploring your options today to diversify your investments and potentially enhance your portfolio's performance. Consider consulting with a financial advisor to determine the best strategy for incorporating emerging market equities into your investment portfolio.

Featured Posts

-

Bitcoin Btc Reacts To Trumps Trade Initiatives And Federal Reserve Moves

Apr 24, 2025

Bitcoin Btc Reacts To Trumps Trade Initiatives And Federal Reserve Moves

Apr 24, 2025 -

New John Travolta Action Movie Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025

New John Travolta Action Movie Exclusive High Rollers Poster And Photo Preview

Apr 24, 2025 -

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025 -

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 24, 2025

Lab Owner Pleads Guilty To Falsifying Covid Test Results

Apr 24, 2025 -

Blue Origin Scraps Rocket Launch Due To Technical Issue

Apr 24, 2025

Blue Origin Scraps Rocket Launch Due To Technical Issue

Apr 24, 2025