Student Loan Defaults And Their Economic Impact

Table of Contents

The Personal Cost of Student Loan Default

The consequences of student loan default are devastating for individuals, leading to severe financial hardship and long-term negative impacts. Defaulting on student loans has far-reaching repercussions that can significantly hinder an individual's financial well-being for years to come.

Damaged Credit Scores

Defaulting on student loans severely damages your credit score. A drastically reduced credit score makes it incredibly difficult to obtain future loans, mortgages, or even rent an apartment. This can severely limit your financial options and opportunities. Lenders view borrowers with defaulted loans as high-risk, resulting in higher interest rates or outright loan denials. Rebuilding your credit after a default takes significant time and effort.

Wage Garnishment and Legal Action

The legal ramifications of student loan default can be severe. The government can garnish wages, seizing a portion of your earnings to repay the debt. This can lead to significant financial strain and difficulty in meeting basic living expenses. Furthermore, lawsuits and collection agency actions can result in additional fees and legal costs, exacerbating the financial burden.

The Mental Health Toll

The stress and anxiety associated with insurmountable student loan debt can be crippling. The constant pressure of debt collection, wage garnishment, and the fear of financial ruin can take a significant toll on mental health, leading to depression, anxiety, and other mental health challenges. The emotional weight of debt can negatively impact overall well-being and quality of life.

- Difficulty securing future employment due to poor credit.

- Increased difficulty in saving for retirement.

- Potential loss of assets due to legal action.

- Significant strain on personal relationships due to financial stress.

The Macroeconomic Impact of Student Loan Defaults

The impact of student loan defaults extends beyond the individual, significantly affecting the macroeconomic landscape. High default rates contribute to reduced economic activity and increased strain on government resources.

Reduced Consumer Spending

When individuals are struggling to repay student loans, their disposable income decreases. This reduction in disposable income leads to decreased consumer spending, a major driver of economic growth. Lower consumer spending can contribute to slower economic growth and even economic recession.

Impact on the Government Budget

Student loan forgiveness programs and write-offs place a significant financial burden on taxpayers. Government intervention to address defaults requires substantial public funding, diverting resources from other essential programs and contributing to increased national debt. This represents a significant cost to the government and ultimately to taxpayers.

Effects on Higher Education Institutions

High default rates among graduates can negatively impact universities and colleges. Institutions may experience reduced funding, decreased enrollment, and damage to their reputation. This creates a cyclical problem, with the financial strain on institutions potentially leading to further tuition increases, contributing to the problem of student debt.

- Lower overall GDP due to decreased economic activity.

- Increased strain on government resources, diverting funds from other essential services.

- Potential for systemic financial instability as the total debt burden continues to grow.

Factors Contributing to Student Loan Defaults

Several factors contribute to the rising rates of student loan defaults. Understanding these contributing factors is crucial for developing effective mitigation strategies.

The Rising Cost of Higher Education

The escalating cost of tuition and fees is a major driver of increased student debt. The rapid increase in tuition, often outpacing inflation, has made it increasingly difficult for students to finance their education without incurring substantial debt. This has resulted in many graduates entering the workforce with significant debt burdens.

Lack of Financial Literacy Among Students

Many students lack the necessary financial literacy skills to manage their debt effectively. Insufficient understanding of budgeting, loan repayment options, and long-term financial planning can lead to poor financial decisions and ultimately default. Improving financial literacy among students is critical to preventing future defaults.

The Job Market and Underemployment

Graduates entering a competitive job market with limited career prospects often struggle to repay their student loans. Underemployment, low wages, and job insecurity can make it challenging to meet monthly loan payments, increasing the likelihood of default.

- Insufficient financial aid and scholarship opportunities.

- Limited access to financial counseling services and resources.

- The increasing prevalence of predatory student loans with high interest rates and unfavorable terms.

Potential Solutions and Mitigation Strategies

Addressing the issue of student loan defaults requires a multifaceted approach, combining government initiatives, improved financial literacy, and policy changes.

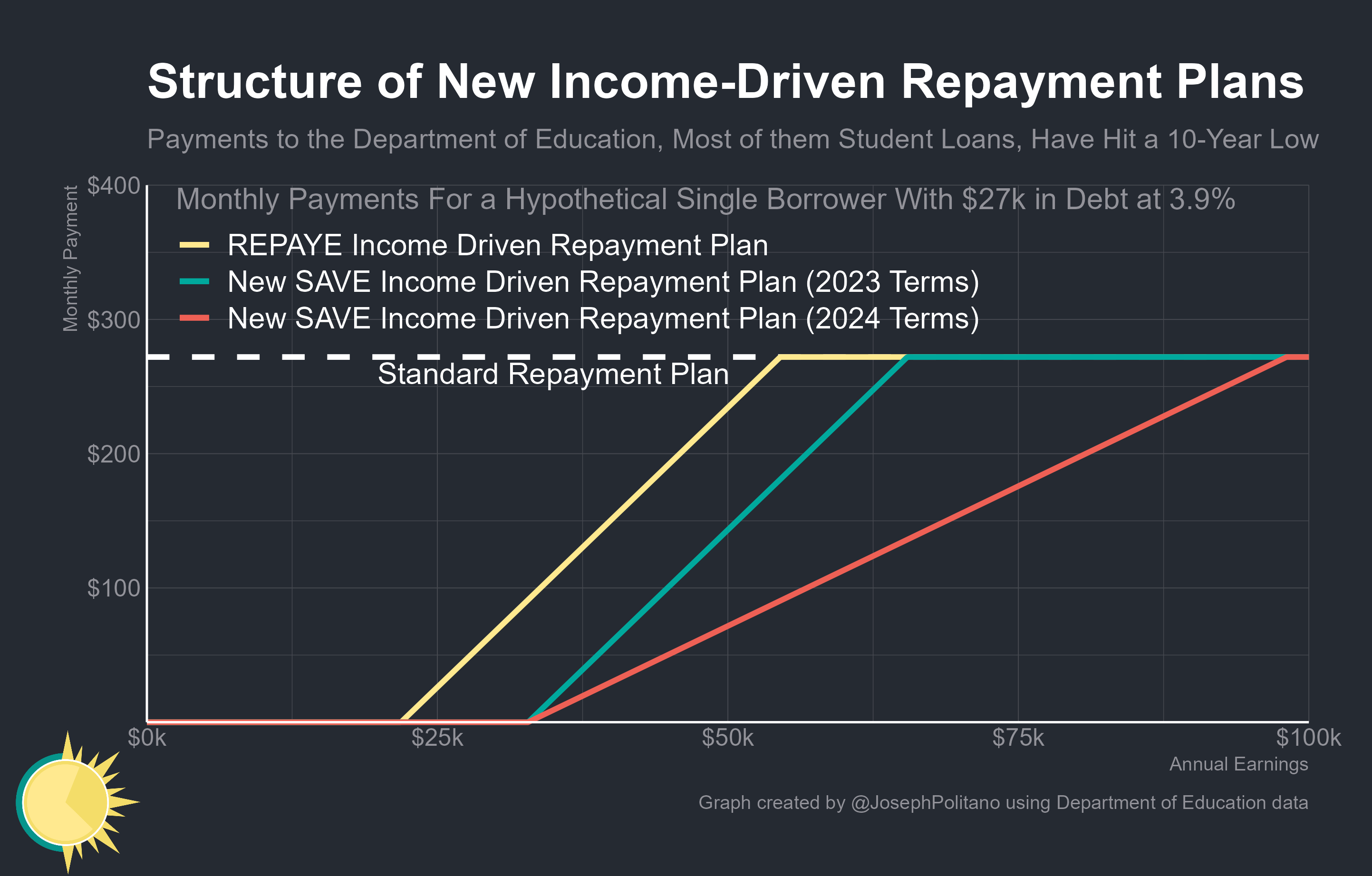

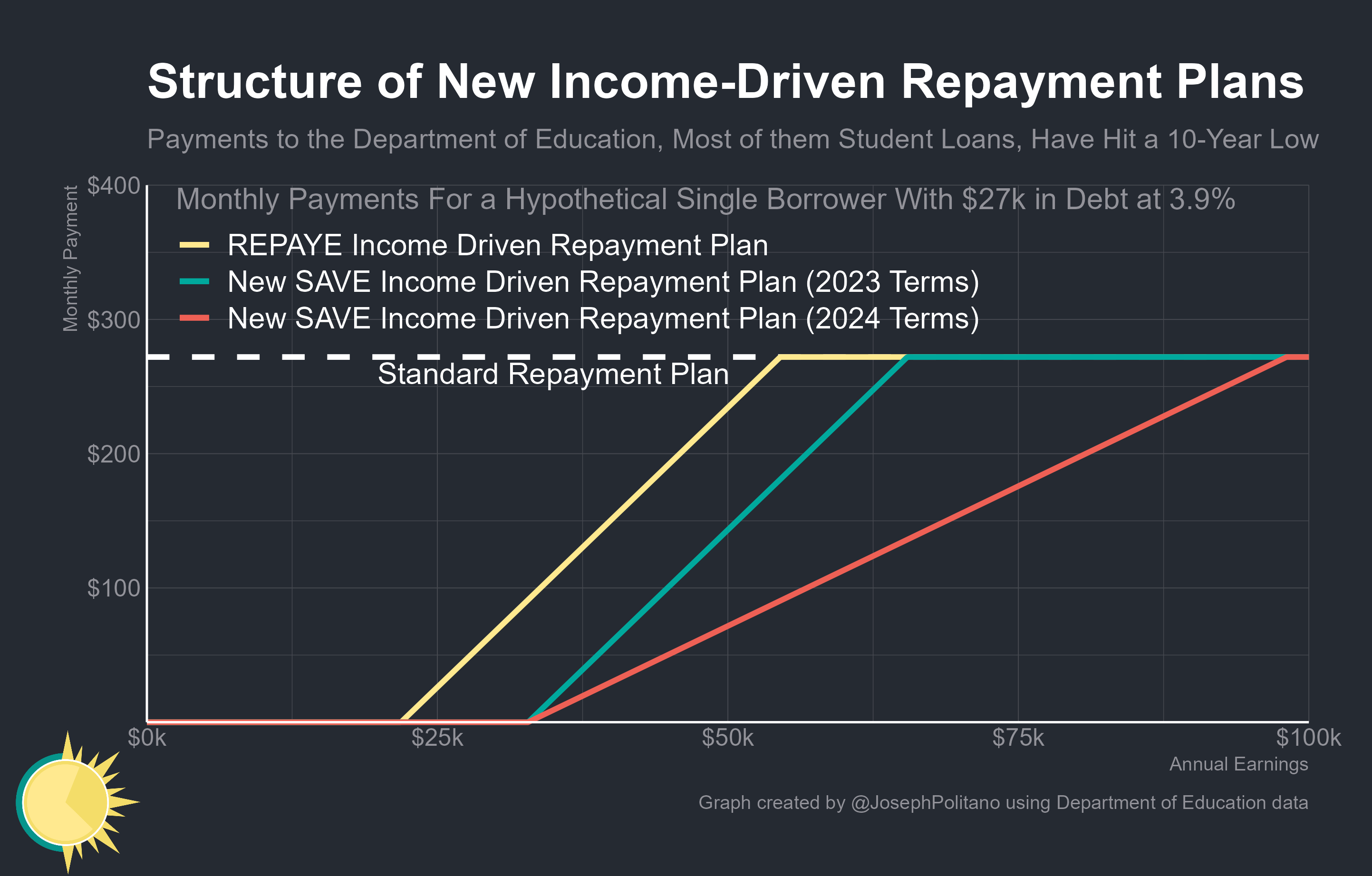

Government Initiatives

Government initiatives such as income-driven repayment plans and debt forgiveness programs can provide relief to struggling borrowers. These programs can make student loan repayment more manageable and reduce the risk of default. However, such programs also require careful consideration of their long-term fiscal impact.

Improved Financial Literacy Education

Strengthening financial literacy programs in schools and colleges is crucial to equip students with the skills to manage their finances effectively. Increased access to financial education resources can help students make informed decisions about borrowing and repayment.

Policy Changes to Reduce Tuition Costs

Policy changes aimed at reducing the cost of higher education are essential for long-term solutions. Government intervention to control tuition increases, increase funding for financial aid, and promote affordability can significantly reduce the overall debt burden on students.

- Implementing more robust income-driven repayment plans tailored to individual circumstances.

- Expanding access to student loan refinancing options to secure lower interest rates.

- Strengthening regulations on predatory lending practices to protect students from exploitative loan terms.

Conclusion

The consequences of student loan defaults are far-reaching, impacting individuals financially and mentally, while also creating a significant strain on the macroeconomic environment. Understanding the personal cost of default, the macroeconomic impact, the contributing factors, and the potential solutions is crucial for addressing this growing crisis. We must advocate for policy changes, increased financial literacy programs, and more effective debt management strategies to prevent future defaults and ensure a more stable economic future. Understanding the gravity of student loan defaults and their economic impact is paramount. Learn more about resources available to manage your student debt and avoid default.

Featured Posts

-

Ronaldo Portekiz Kampinda Neler Yasadi Fenerbahce Heyecani

May 28, 2025

Ronaldo Portekiz Kampinda Neler Yasadi Fenerbahce Heyecani

May 28, 2025 -

Kanye West And Bianca Censori The Fallout And A Sudden Departure From The Country

May 28, 2025

Kanye West And Bianca Censori The Fallout And A Sudden Departure From The Country

May 28, 2025 -

Report Jennifer Lopez To Host The 2025 American Music Awards

May 28, 2025

Report Jennifer Lopez To Host The 2025 American Music Awards

May 28, 2025 -

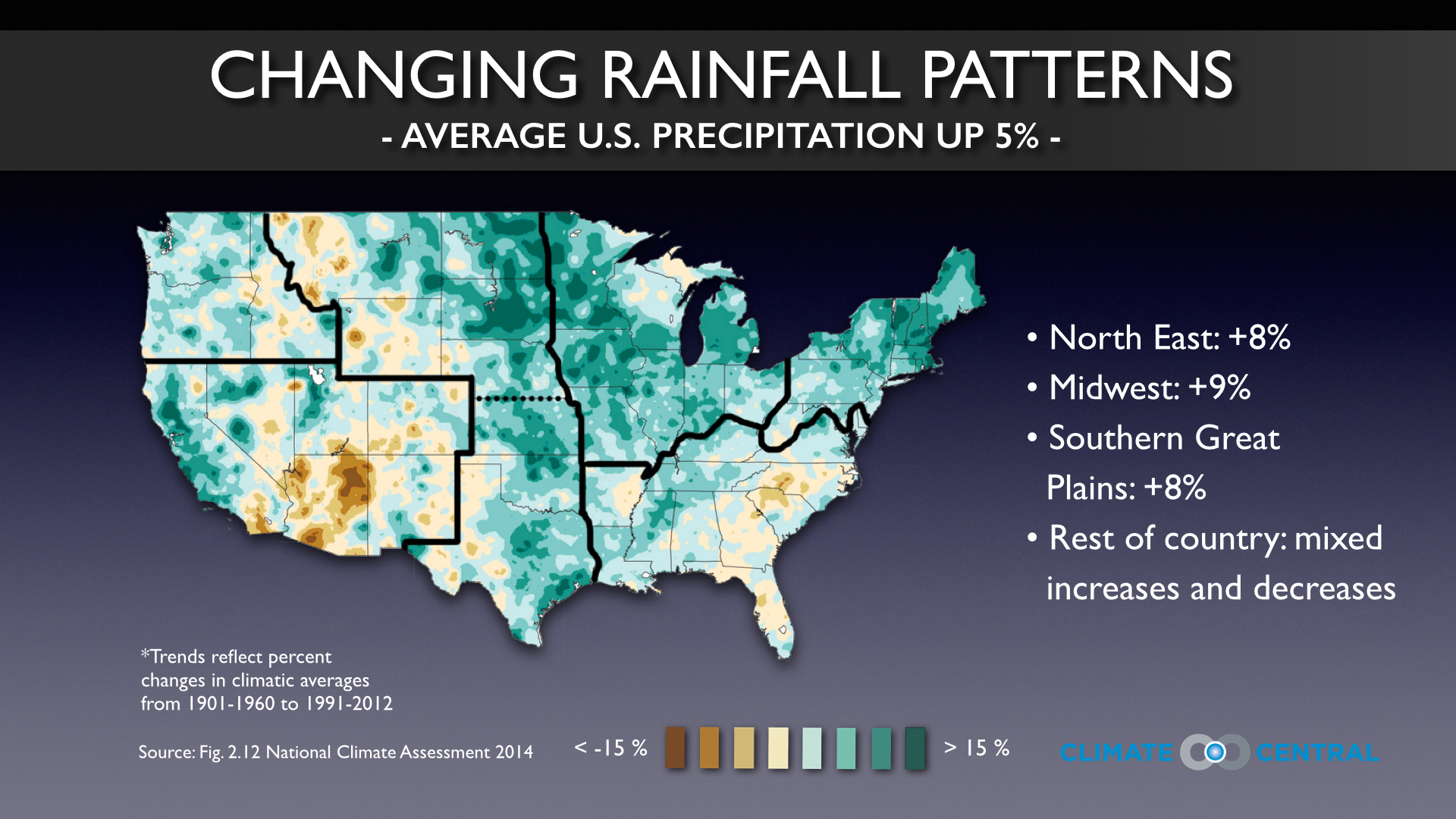

Climate Change More Rainfall For Western Massachusetts

May 28, 2025

Climate Change More Rainfall For Western Massachusetts

May 28, 2025 -

Serah Terima Jabatan 7 Pamen Polda Bali Irjen Daniel Sampaikan Pesan Inspiratif

May 28, 2025

Serah Terima Jabatan 7 Pamen Polda Bali Irjen Daniel Sampaikan Pesan Inspiratif

May 28, 2025