Suncor: High Production, Low Sales – Understanding The Inventory Discrepancy

Table of Contents

Suncor's Production Capacity and Output

Record-High Production Levels

Suncor has consistently reported impressive oil production numbers in recent quarters. For example, [insert specific data from recent Suncor reports, e.g., "Q3 2023 saw a production increase of X% compared to Q3 2022, reaching Y barrels per day"]. This surge is largely attributed to the successful operation of key oil sands projects like [mention specific projects, e.g., Fort Hills, Base Mine].

- Production Data: [Insert specific production figures from reliable sources, such as Suncor's financial reports or press releases].

- Project Contributions: [List key projects and their contribution to the overall production increase].

- Increased Efficiency Initiatives: [Mention any recent operational improvements contributing to the higher output].

Operational Efficiency and Challenges

Despite the record-high production, challenges persist in maintaining optimal operational efficiency. Factors such as unscheduled maintenance, extreme weather conditions in the oil sands region, and occasional labor disruptions can all impact production output.

- Maintenance Schedules: [Discuss the impact of planned and unplanned downtime on overall production].

- Weather-Related Impacts: [Explain how extreme temperatures and harsh weather conditions affect operations].

- Labor Relations: [Briefly address any labor issues that may have affected production].

- Technological Advancements: [Mention any new technologies or initiatives aimed at improving production efficiency].

The Sales Side of the Equation: Low Revenue Despite High Production

Weakening Demand and Market Fluctuations

The global oil market is a dynamic and complex entity. Fluctuations in demand significantly impact Suncor's sales. Recently, [mention current oil prices and trends]. This price volatility, combined with concerns about a potential global economic slowdown and the increasing adoption of alternative energy sources, has dampened demand for oil.

- Global Oil Prices: [Provide current oil price data and explain the trends].

- Economic Slowdown: [Explain how a potential recession could impact oil demand].

- Alternative Energy Sources: [Discuss the role of renewable energy sources in reducing oil demand].

- Geopolitical Factors: [Mention any geopolitical events impacting global oil prices (e.g., political instability, sanctions)].

Refinery Capacity and Utilization

Suncor's refinery network plays a crucial role in processing its raw oil into marketable products. However, limitations in refinery capacity and utilization rates could be contributing to the low sales figures. [Mention any recent reports on refinery utilization rates].

- Refinery Throughput: [Provide data on Suncor's refinery throughput and capacity].

- Planned Upgrades: [Discuss any planned expansions or upgrades to Suncor's refining capacity].

- Bottlenecks and Inefficiencies: [Highlight any areas of concern regarding refinery efficiency].

Supply Chain Disruptions

Logistical challenges can significantly impact the timely delivery of oil products to market. Pipeline capacity constraints, increased transportation costs, and potential delays can all contribute to lower sales.

- Pipeline Capacity: [Discuss any limitations in pipeline capacity affecting Suncor's oil transportation].

- Transportation Costs: [Explain how increased transportation costs impact profitability].

- Supply Chain Initiatives: [Mention any strategies Suncor is implementing to improve its supply chain efficiency].

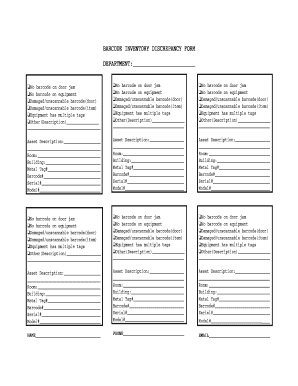

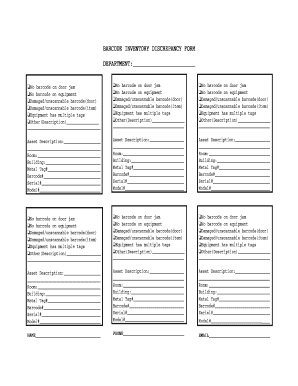

Analyzing the Inventory Discrepancy: Building Inventory vs. Strategic Stockpiling

Inventory Levels and Their Implications

Suncor's current oil inventory levels are likely significantly higher than in previous periods. This high inventory level translates to increased storage costs and financial risks, particularly if oil prices continue to fall.

- Inventory Figures: [If available, provide data on Suncor's current oil inventory].

- Carrying Costs: [Explain the costs associated with storing large amounts of oil].

- Price Risk: [Discuss the risks associated with holding large oil inventories during price volatility].

Strategic Considerations

It's possible that Suncor's high inventory levels reflect a strategic decision to stockpile oil in anticipation of future price increases or to manage market uncertainties. This is a common hedging strategy employed by energy companies.

- Market Forecasting: [Explain how market forecasts might influence Suncor's inventory management decisions].

- Hedging Strategies: [Discuss the role of hedging in mitigating price risk].

- Long-Term Outlook: [Analyze the potential benefits and drawbacks of Suncor's inventory management strategy].

Conclusion

Suncor's high production, low sales paradox is a multifaceted issue influenced by a confluence of factors. These include weakening global oil demand, refinery capacity limitations, supply chain challenges, and potentially, a strategic inventory management approach. Further investigation into Suncor's inventory management and sales strategies is crucial for understanding the long-term implications of this discrepancy. Stay tuned for updates on Suncor's performance and analysis of the Suncor high production, low sales issue as the situation unfolds. Continue to monitor this crucial aspect of Suncor's oil production and sales performance to understand the complete picture.

Featured Posts

-

Becoming A Better Ally A Guide For International Transgender Day Of Visibility

May 10, 2025

Becoming A Better Ally A Guide For International Transgender Day Of Visibility

May 10, 2025 -

Once Rejected Now A Heartbeat The Story Of A Footballing Star

May 10, 2025

Once Rejected Now A Heartbeat The Story Of A Footballing Star

May 10, 2025 -

Discovering Untapped Potential The Countrys New Business Hot Spots

May 10, 2025

Discovering Untapped Potential The Countrys New Business Hot Spots

May 10, 2025 -

Draisaitl Injury Update Oilers Take Cautious Approach With Star Player

May 10, 2025

Draisaitl Injury Update Oilers Take Cautious Approach With Star Player

May 10, 2025 -

Discover The Perfect Venue Olly Murs At A Magnificent Castle Near Manchester Music Festival

May 10, 2025

Discover The Perfect Venue Olly Murs At A Magnificent Castle Near Manchester Music Festival

May 10, 2025