Swissquote Bank's Perspective On Recent Sovereign Bond Market Movements

Table of Contents

Rising Interest Rates and Their Impact on Sovereign Bonds

The correlation between interest rate hikes and sovereign bond yields is undeniable. As central banks raise interest rates to combat inflation, yields on sovereign bonds generally rise. This is because newly issued bonds offer higher yields to compete with the increased returns available from higher interest rate environments. This impact varies across different sovereign bond maturities.

- Short-term bonds: These are generally more sensitive to interest rate changes than longer-term bonds. A rate hike will quickly impact their yields and valuations.

- Long-term bonds: While affected, long-term bonds are less immediately sensitive to interest rate changes. However, the overall impact can be substantial over time.

Examples of the impact:

- The United States has seen a significant increase in Treasury bond yields following several interest rate hikes by the Federal Reserve.

- German Bund yields have also risen, reflecting the European Central Bank's monetary policy adjustments.

- This rise in yields leads to a decrease in the valuation of existing bonds, as their fixed coupon payments become less attractive relative to newer, higher-yielding bonds. This is particularly true for bonds held until maturity.

Geopolitical Risks and Their Influence on Sovereign Bond Markets

Geopolitical events significantly influence sovereign bond markets. Uncertainty stemming from war, political instability, or other unforeseen events can trigger a "flight-to-safety" phenomenon. Investors often seek the perceived safety of government bonds from countries deemed politically stable, leading to increased demand and lower yields for those bonds.

- Examples: Bonds issued by countries experiencing political turmoil or conflict often see a sharp increase in yields as investors demand higher compensation for the increased risk.

- Risk premiums: The difference in yield between a "safe-haven" bond (e.g., U.S. Treasuries) and a bond from a country with higher geopolitical risk reflects the risk premium investors demand.

- Investor sentiment: Market sentiment plays a significant role. Negative news can trigger large capital outflows and increased volatility, even in countries previously considered safe.

Inflationary Pressures and Their Effect on Sovereign Bond Yields

Inflation and bond prices have an inverse relationship. When inflation rises, the real value of future bond payments decreases, leading to lower bond prices and higher yields. Conversely, falling inflation generally leads to higher bond prices and lower yields. Inflation expectations are crucial; if investors anticipate higher inflation, they will demand higher yields to compensate for the erosion of purchasing power.

- Impact of inflation levels: High inflation significantly erodes the returns from traditional fixed-income investments.

- Inflation-indexed bonds: These bonds help mitigate inflation risk, as their payments adjust with inflation.

- Central bank measures: Central banks' actions to control inflation directly impact bond yields. Aggressive monetary tightening can push yields higher in the short term, while effective inflation control can lead to lower yields in the long run.

Swissquote Bank's Strategic Recommendations for Sovereign Bond Investing

Based on our analysis, Swissquote Bank recommends a diversified approach to sovereign bond investing to mitigate risks. Actively managing your portfolio in response to market fluctuations is critical.

- Diversification: Don't put all your eggs in one basket. Diversify across different countries, currencies, and maturities to reduce overall portfolio risk.

- Hedging strategies: Consider hedging strategies to mitigate interest rate risk and inflation risk. This might involve using derivatives or investing in inflation-protected securities.

- Risk assessment: Thoroughly assess the creditworthiness and political stability of each country before investing in its sovereign bonds.

Understanding Sovereign Bond Market Movements with Swissquote Bank

In summary, rising interest rates, geopolitical risks, and inflationary pressures significantly impact sovereign bond markets. Understanding these factors is essential for successful investing. Swissquote Bank's analysis highlights the need for diversification and proactive risk management strategies. To gain a deeper understanding of sovereign bond market dynamics and explore tailored investment strategies, consult our expert team. For further analysis and investment advice on sovereign bonds, including in-depth Sovereign Bond Market Analysis and strategies for Investing in Sovereign Bonds, please visit our website [link to Swissquote resources]. Develop a robust Sovereign Bond strategy today with Swissquote Bank.

Featured Posts

-

Growing Protests And Violence In Tripoli Libyas Response To Militia Power

May 19, 2025

Growing Protests And Violence In Tripoli Libyas Response To Militia Power

May 19, 2025 -

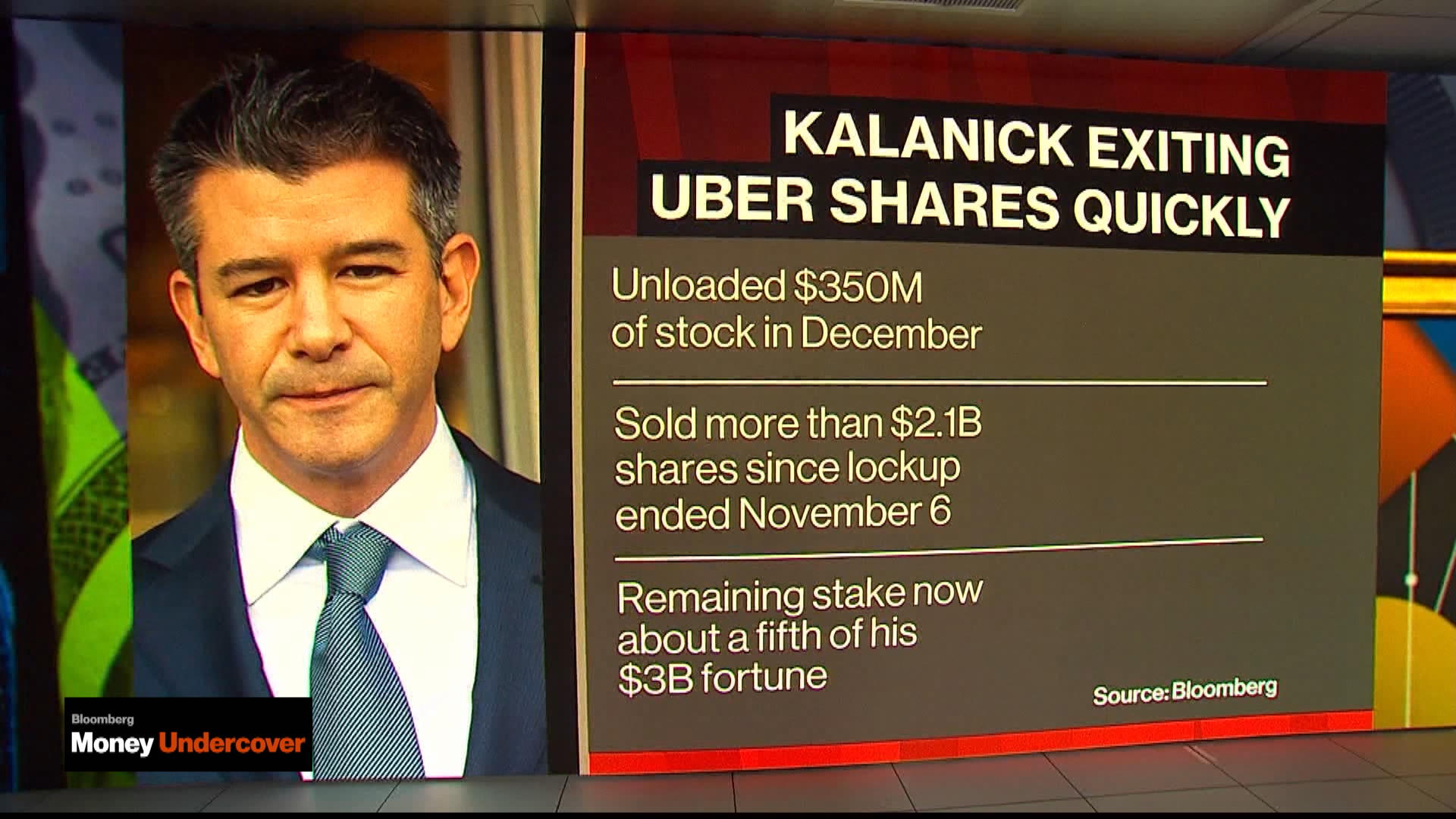

Ubers Kalanick Reveals Regret Over Project Name S Termination

May 19, 2025

Ubers Kalanick Reveals Regret Over Project Name S Termination

May 19, 2025 -

Povratak Baby Lasagne Na Eurosong Je Li To Moguce

May 19, 2025

Povratak Baby Lasagne Na Eurosong Je Li To Moguce

May 19, 2025 -

Apprendre A Faire Un Salami Au Chocolat Francais

May 19, 2025

Apprendre A Faire Un Salami Au Chocolat Francais

May 19, 2025 -

Royal Mail Doubled Stamp Prices Is It Unfair Have Your Say

May 19, 2025

Royal Mail Doubled Stamp Prices Is It Unfair Have Your Say

May 19, 2025