Taiwan Dollar Strength: Catalyst For Critical Economic Adjustments

Table of Contents

Factors Contributing to Taiwan Dollar Strength

Several intertwined factors have propelled the Taiwan dollar's appreciation. Understanding these underlying causes is crucial to formulating effective economic strategies. Key drivers include:

- Increased Foreign Investment: Taiwan's reputation as a global technology hub, bolstered by its robust economic fundamentals and political stability, continues to attract significant foreign direct investment (FDI). This influx of capital boosts demand for the Taiwan dollar, pushing its value higher.

- Robust Export Demand: Taiwan's dominance in semiconductor manufacturing and electronics has fueled high demand for its exports. This strong export performance generates a significant trade surplus, further strengthening the Taiwan dollar. The global tech boom significantly contributes to this demand.

- Higher Interest Rates: Compared to many other economies, Taiwan's relatively higher interest rates make it an attractive destination for foreign capital. Investors seek higher returns, leading to capital inflows and increased demand for the Taiwan dollar.

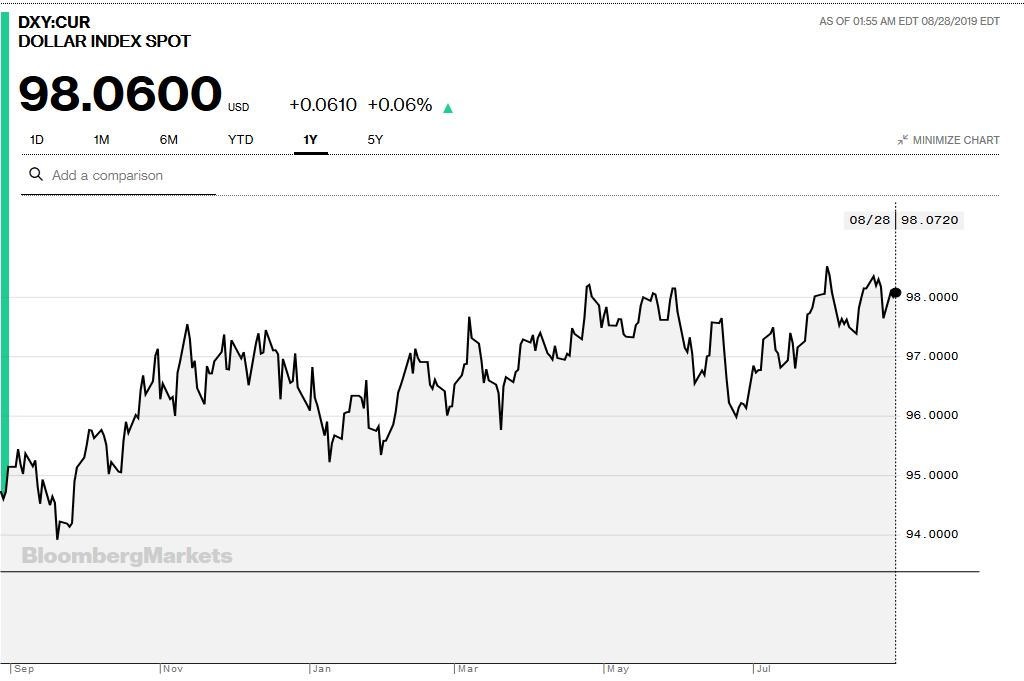

- US Dollar Dynamics: The strength (or weakness) of the US dollar significantly influences the Taiwan dollar's value. A strong US dollar generally puts downward pressure on many currencies, but the underlying factors supporting the Taiwan dollar often offset this pressure.

- Trade Surplus: A consistent trade surplus, driven primarily by strong export performance, creates upward pressure on the Taiwan dollar. This surplus reflects the high demand for Taiwanese goods and services in the global market.

Impact on Key Economic Sectors

The strengthening Taiwan dollar presents a mixed bag for various sectors of the Taiwanese economy. While some sectors benefit, others face significant headwinds:

Export Industries

The appreciation of the Taiwan dollar directly impacts export competitiveness. Higher prices for foreign buyers make Taiwanese goods more expensive, potentially reducing export volumes and impacting revenue for businesses in sectors like:

- Semiconductors: While global demand remains high, increased costs could erode profit margins.

- Electronics Manufacturing: Facing competition from countries with weaker currencies, Taiwanese manufacturers must adapt to maintain their market share.

- Textiles and Garments: This sector is particularly vulnerable to currency fluctuations and increased competition from lower-cost producers.

Manufacturing

The manufacturing sector faces squeezed profit margins due to higher input costs. The increased cost of imported raw materials and components directly impacts production costs, potentially leading to:

- Reduced Profitability: Businesses may struggle to maintain profit levels in the face of higher production costs.

- Production Slowdowns: Some manufacturers might consider slowing production or even relocating operations to countries with more favorable exchange rates.

- Job Losses: In worst-case scenarios, reduced profitability and competitiveness could lead to job losses within the manufacturing sector.

Technology Sector

While Taiwan's technology sector remains a global leader, the strong Taiwan dollar could impact the competitiveness of its leading companies. They might need to explore strategies such as:

- Price Adjustments: Adjusting prices to maintain competitiveness in the global market.

- Cost Optimization: Improving efficiency and reducing costs to offset the impact of currency fluctuations.

- Innovation and Diversification: Focusing on technological innovation and diversifying product lines to maintain a competitive edge.

Tourism

Conversely, a stronger Taiwan dollar is generally positive for inbound tourism. Foreign tourists find their money goes further, potentially leading to increased tourist spending and benefiting the tourism sector.

Inflation

The impact of the strong Taiwan dollar on inflation is complex. While lower import prices could help to offset inflationary pressures, reduced export competitiveness could lead to stagflation – a combination of slow economic growth and high inflation.

Necessary Economic Adjustments and Policy Responses

To mitigate the negative impacts of the strong Taiwan dollar and harness the positive ones, Taiwan needs a multi-pronged approach involving both government policy and proactive adjustments by businesses:

Diversification of Export Markets

Reducing reliance on specific markets is crucial. Taiwan needs to actively explore and cultivate new export markets in:

- Southeast Asia: Expanding trade relationships with rapidly growing economies in the region.

- India: Tap into India's burgeoning market for technology and electronics.

- Africa: Explore opportunities in developing markets with significant growth potential.

Technological Innovation and Upgrading

Maintaining a competitive edge requires continuous investment in R&D and technological upgrades to produce higher-value-added goods and services.

Monetary Policy Adjustments

The central bank plays a critical role in managing the exchange rate and inflation. Strategies could include:

- Interest Rate Adjustments: Careful management of interest rates to balance economic growth and inflation.

- Intervention in the Foreign Exchange Market: Limited intervention to manage excessive volatility in the exchange rate.

Fiscal Policy Measures

Government support for affected industries and investment in new technologies are vital. This includes:

- Subsidies and Tax Incentives: Supporting businesses in adapting to the changing economic environment.

- Investment in Infrastructure: Improving infrastructure to support innovation and economic growth.

Conclusion:

The strengthening Taiwan dollar presents a complex economic challenge. While it offers some benefits, particularly for inbound tourism, the impact on export-oriented industries and overall competitiveness necessitates proactive adjustments. The Taiwanese government and businesses must pursue a comprehensive strategy involving diversification, technological innovation, and carefully calibrated monetary and fiscal policies to navigate these shifts successfully. Staying tuned for further analysis on the evolving dynamics of the Taiwan dollar and its implications for critical economic adjustments is crucial for all stakeholders. Learn more about navigating the challenges and opportunities presented by the strong Taiwan dollar.

Featured Posts

-

Saturday Night Live A Pivotal Platform For Counting Crows Success 1995

May 08, 2025

Saturday Night Live A Pivotal Platform For Counting Crows Success 1995

May 08, 2025 -

Nc State Recruiting Setback Loss Of Kendrick Raphael

May 08, 2025

Nc State Recruiting Setback Loss Of Kendrick Raphael

May 08, 2025 -

Thunder Vs Pacers Latest Injury News For March 29th

May 08, 2025

Thunder Vs Pacers Latest Injury News For March 29th

May 08, 2025 -

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025

Why Are Dogecoin Shiba Inu And Sui Cryptocurrencies Rising

May 08, 2025 -

Nba Game Thunder Vs Trail Blazers Time Tv Channel And Streaming Guide March 7

May 08, 2025

Nba Game Thunder Vs Trail Blazers Time Tv Channel And Streaming Guide March 7

May 08, 2025

Latest Posts

-

Get Your Psl 10 Tickets Before They Re Gone

May 08, 2025

Get Your Psl 10 Tickets Before They Re Gone

May 08, 2025 -

Psl 10 Tickets Official Sale Commences Today

May 08, 2025

Psl 10 Tickets Official Sale Commences Today

May 08, 2025 -

Pakistan Super League 2024 Tickets Purchase Now

May 08, 2025

Pakistan Super League 2024 Tickets Purchase Now

May 08, 2025 -

Secure Your Psl 10 Tickets Sale Opens Today

May 08, 2025

Secure Your Psl 10 Tickets Sale Opens Today

May 08, 2025 -

Psl 10 Ticket Sales Begin Today

May 08, 2025

Psl 10 Ticket Sales Begin Today

May 08, 2025