Taiwan Dollar's Surge: A Necessary Economic Overhaul?

Table of Contents

Factors Contributing to the Taiwan Dollar's Appreciation

Several interconnected factors have fueled the recent appreciation of the Taiwan dollar. Understanding these drivers is crucial for assessing the overall economic health of the nation and its future prospects.

Strong Export Performance

Taiwan boasts a robust export sector, significantly driven by its dominance in the technology and semiconductor industries. This strong export performance is a major contributor to the TWD's strength.

- Record Export Numbers: In [Insert Year], Taiwan's exports reached a record high of [Insert Value], exceeding expectations by [Insert Percentage].

- TSMC's Global Dominance: Taiwan Semiconductor Manufacturing Company (TSMC), a global leader in semiconductor fabrication, plays a pivotal role. Its continued success significantly boosts export revenue and increases demand for the TWD.

- Trade Surpluses: Consistent trade surpluses further strengthen the TWD. The surplus in [Insert Year] reached [Insert Value], indicating a strong inflow of foreign currency.

Foreign Investment Influx

Significant foreign direct investment (FDI) continues to pour into Taiwan, particularly in its thriving tech sector. This influx of capital further boosts demand for the TWD.

- Tech Sector Investment: [Insert examples of major foreign investments in Taiwanese tech companies]. These investments highlight the global confidence in Taiwan's technological prowess and its future potential.

- Stable Investment Climate: Taiwan is perceived as a politically stable and economically sound investment destination, attracting both long-term and short-term capital. This perception strengthens the TWD.

Global Economic Uncertainty

Global economic instability, including soaring inflation rates in many developed nations, has pushed investors towards the perceived safety of the TWD.

- Safe-Haven Asset: The TWD is increasingly seen as a safe-haven asset, attracting investors seeking refuge from global economic turmoil.

- Interest Rate Differentials: Higher interest rates in Taiwan compared to some other countries attract foreign capital seeking higher returns, further strengthening the TWD.

Potential Economic Consequences of a Strong Taiwan Dollar

While a strong TWD might seem positive at first glance, its appreciation also carries potential economic consequences that warrant careful consideration.

Impact on Exports

A strong TWD makes Taiwanese products more expensive in international markets, potentially impacting export competitiveness.

- Reduced Export Volume: Higher prices may lead to a decline in export volume and revenue, especially in industries facing intense global competition.

- Price Competitiveness: The strength of the TWD directly impacts the price competitiveness of Taiwanese goods globally, potentially harming export-oriented industries.

Inflationary Pressures

While a stronger TWD can lead to lower prices for imported goods, potentially mitigating inflation, the overall impact on inflation is complex.

- Cheaper Imports: The influx of cheaper imports can offset inflationary pressures stemming from domestic factors.

- Monetary Policy Adjustments: The Central Bank of Taiwan might need to adjust its monetary policy to manage the interplay between exchange rate movements and domestic inflation.

Challenges for Domestic Industries

Domestic industries may struggle to compete with cheaper imports, leading to potential economic challenges.

- Job Losses: Industries unable to compete with cheaper imports may face job losses and reduced production.

- Industrial Upgrading: Government support for industrial upgrading and diversification is essential to help domestic industries adapt and remain competitive.

The Case for Economic Overhaul

The sustained appreciation of the TWD highlights the need for a strategic economic overhaul to ensure sustainable and inclusive growth.

Diversification of the Economy

Taiwan's over-reliance on technology and semiconductors creates vulnerability. Economic diversification is crucial.

- Green Energy Investment: Investing in renewable energy sources can create new industries and reduce reliance on traditional energy sources.

- Biotechnology and Pharmaceuticals: Developing the biotechnology and pharmaceutical sectors can diversify Taiwan's economic base.

Investment in Human Capital

Investing in education and training is vital to enhance the skills of the workforce and adapt to technological advancements.

- Upskilling and Reskilling Programs: Government-led initiatives can help workers acquire new skills needed for the future economy.

- Attracting and Retaining Talent: Implementing policies to attract and retain skilled workers is crucial for long-term economic success.

Sustainable Economic Growth

Sustainable and inclusive growth benefits all segments of society, reducing income inequality.

- Social Equity Policies: Implementing policies to promote social equity and reduce the wealth gap is crucial for long-term stability.

- Environmental Sustainability: Integrating environmental sustainability into economic planning ensures long-term prosperity.

Conclusion: Navigating the Taiwan Dollar's Surge

The surge in the Taiwan dollar is a complex phenomenon with both positive and negative implications. While reflecting the strength of certain sectors, it also underscores the need for strategic economic adjustments. The TWD's appreciation doesn't automatically necessitate a complete overhaul, but it does highlight the urgency for proactive economic diversification, investment in human capital, and a focus on sustainable and inclusive growth. The sustained strength of the TWD presents both opportunities and challenges. Further discussion on the implications of TWD appreciation and the implementation of proactive economic strategies, including economic reforms to manage the Taiwan dollar's surge, is essential. We encourage you to explore further resources on related economic topics to gain a deeper understanding of this crucial issue.

Featured Posts

-

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemlerini Uyariyor Guevenlik Ve Yasal Riskler

May 08, 2025 -

Finding A Ps 5 Before The Price Jumps Best Retailers And Tips

May 08, 2025

Finding A Ps 5 Before The Price Jumps Best Retailers And Tips

May 08, 2025 -

Top Ps 5 Pro Enhanced Games A Must Play List For Owners

May 08, 2025

Top Ps 5 Pro Enhanced Games A Must Play List For Owners

May 08, 2025 -

Soulja Boy Ordered To Pay 6 Million In Sexual Assault Case

May 08, 2025

Soulja Boy Ordered To Pay 6 Million In Sexual Assault Case

May 08, 2025 -

Ps 5 Pro Disassembly Inside Look At The Liquid Metal Cooling

May 08, 2025

Ps 5 Pro Disassembly Inside Look At The Liquid Metal Cooling

May 08, 2025

Latest Posts

-

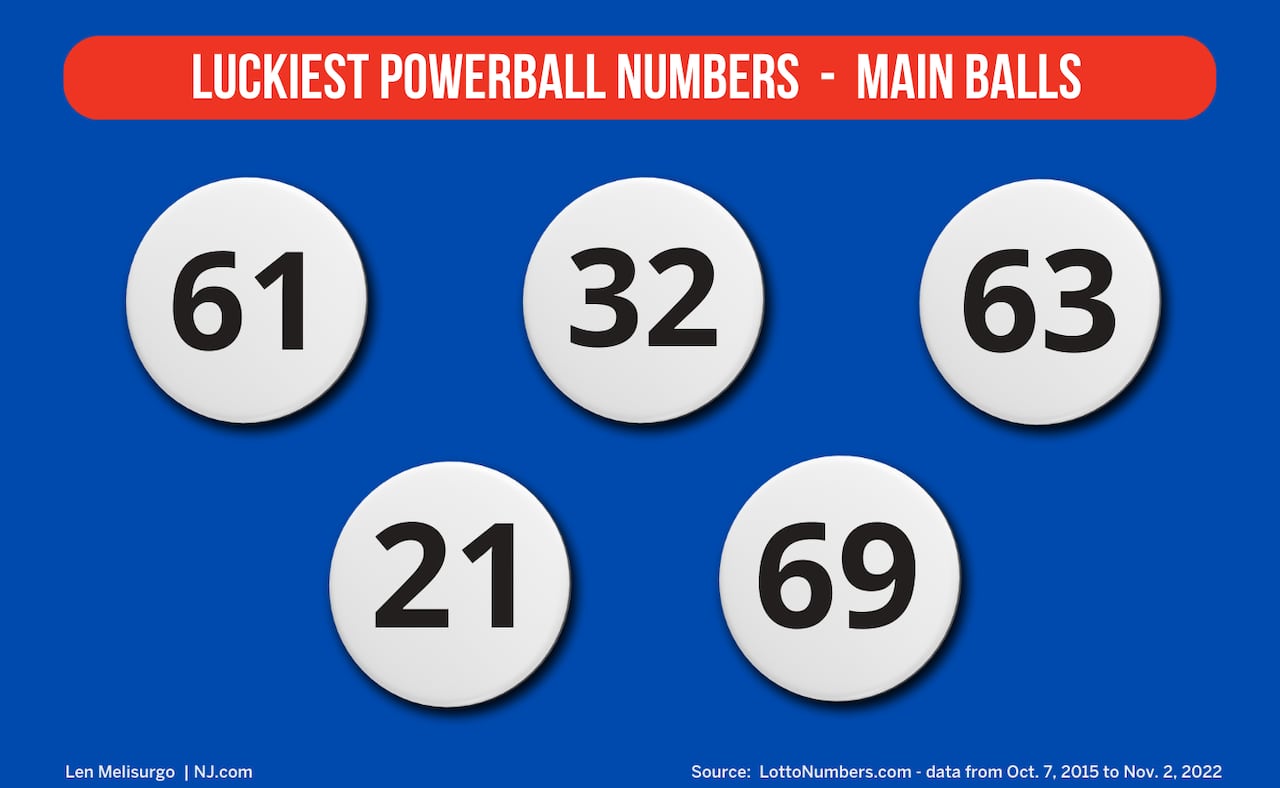

April 9th Lotto Jackpot Results Check The Winning Numbers

May 08, 2025

April 9th Lotto Jackpot Results Check The Winning Numbers

May 08, 2025 -

Saturday April 12 2025 Lotto Results Winning Numbers Announced

May 08, 2025

Saturday April 12 2025 Lotto Results Winning Numbers Announced

May 08, 2025 -

Lotto Plus Results Saturday April 12 2025 Check Winning Numbers

May 08, 2025

Lotto Plus Results Saturday April 12 2025 Check Winning Numbers

May 08, 2025 -

Tuesday April 15 2025 Daily Lotto Numbers

May 08, 2025

Tuesday April 15 2025 Daily Lotto Numbers

May 08, 2025 -

Lotto Jackpot Results Wednesday April 9th Winning Numbers

May 08, 2025

Lotto Jackpot Results Wednesday April 9th Winning Numbers

May 08, 2025