Taiwan's Economic Future: Navigating A Strong Dollar

Table of Contents

The Impact of a Strong Dollar on Taiwan's Exports

A strong US dollar significantly impacts Taiwan's export-oriented economy. The appreciation of the dollar against other currencies, including the Taiwanese dollar, makes Taiwanese products more expensive in international markets.

Reduced Export Competitiveness

A strong dollar directly reduces the competitiveness of Taiwanese exports. This is particularly true for goods priced in US dollars.

- Decreased demand for Taiwanese electronics and technology goods: Major markets for Taiwanese tech, such as the US and Europe, may see reduced purchasing power due to the higher dollar price of Taiwanese products, leading to decreased demand. This is especially concerning given Taiwan's reliance on exports of semiconductors and electronics.

- Increased pressure on profit margins for export-oriented businesses: Companies may struggle to maintain profitability as they face increased pressure to lower prices to remain competitive, potentially squeezing margins and impacting investment.

- Potential for job losses in export-dependent sectors: Reduced export orders may necessitate production cuts and, unfortunately, potential job losses in sectors heavily reliant on exports.

Strategies for Mitigating Export Challenges

Taiwan needs a multi-pronged approach to counter the negative effects of a strong dollar on its exports.

- Diversification of export markets beyond dollar-denominated economies: Expanding into markets where the dollar's strength is less impactful, such as those in Asia and emerging economies, is crucial for reducing reliance on any single market.

- Investment in innovation and higher value-added products to maintain price competitiveness: Focusing on research and development to produce higher-quality, more technologically advanced goods can help offset the price increase caused by the strong dollar.

- Government support for export promotion and market development: Government initiatives, including subsidies, tax incentives, and targeted marketing campaigns, can provide vital support to businesses navigating the challenging export environment.

- Exploring regional trade agreements to reduce reliance on the US dollar: Participating in regional trade pacts, such as the CPTPP, can help reduce reliance on the US dollar and potentially offer more favorable trading conditions.

The Influence of a Strong Dollar on Foreign Investment in Taiwan

The strong dollar's effect on foreign investment in Taiwan is complex. While it increases the cost for some foreign investors, it also offers advantages.

Attracting Foreign Direct Investment (FDI)

Despite the higher cost of investment in Taiwan due to the strong dollar for some, the island's advantages remain attractive to many foreign investors.

- Taiwan's robust technological sector continues to attract significant FDI: Taiwan’s globally leading position in semiconductor manufacturing and its strong technological ecosystem continues to lure significant foreign direct investment.

- Government initiatives to improve the investment climate are crucial: Government efforts to streamline regulations, reduce bureaucracy, and improve infrastructure can bolster Taiwan's attractiveness as an investment destination.

- Focusing on attracting high-tech and strategic investments is essential: Targeting investments in advanced technologies and strategic industries can ensure Taiwan benefits from high-value additions and long-term economic growth.

Managing Capital Flows

A strong dollar can influence capital flows in and out of Taiwan. The Central Bank of the Republic of China (Taiwan) plays a vital role in managing this.

- Monetary policy adjustments to stabilize the exchange rate: The central bank may utilize monetary policy tools to manage exchange rate volatility and mitigate the impacts of a strong dollar.

- Managing potential inflationary pressures resulting from capital inflows: A surge in capital inflows can lead to inflation. The central bank needs to monitor and manage this to prevent overheating.

- Maintaining financial market stability: Maintaining a stable and predictable financial market is essential to attract foreign investment and maintain confidence in Taiwan's economy.

Domestic Economic Implications of a Strong Dollar

A strong dollar also has significant implications for Taiwan's domestic economy.

Inflationary Pressures

Imported goods become more expensive when the dollar strengthens, leading to inflationary pressures.

- Government measures to control inflation, such as price controls or subsidies: The government may need to implement measures to mitigate the impact of increased import prices on consumers.

- Impact on consumer spending and economic growth: Higher prices can reduce consumer spending, potentially dampening economic growth.

Impact on the Tourism Sector

A strong dollar can make Taiwan a more expensive destination for tourists from certain countries, impacting revenue.

- Strategies to attract tourists from other regions: Diversifying tourism marketing efforts to attract visitors from regions with stronger currencies can help offset the decline in tourism from dollar-dominated economies.

- Promoting domestic tourism to offset the decline in foreign tourism: Encouraging domestic tourism can provide a cushion against potential declines in foreign visitor numbers.

Conclusion

Taiwan's economic future in the context of a strong dollar is multifaceted and requires a strategic response. Successfully navigating this necessitates proactive strategies including export diversification, attracting high-value foreign investment, effectively managing capital flows, and mitigating inflationary pressures. The government, businesses, and the Central Bank of the Republic of China (Taiwan) all have pivotal roles to play. Understanding the implications of Taiwan's strong dollar and implementing robust policies are crucial for securing a prosperous future. Stay informed on the latest developments regarding Taiwan's strong dollar and its impact on the economy. Proactive planning and adaptation are key to mitigating the risks and capitalizing on the opportunities presented by a strong US dollar.

Featured Posts

-

Superiorite Geometrique Des Corneilles Sur Les Babouins Etude Fascinante

May 08, 2025

Superiorite Geometrique Des Corneilles Sur Les Babouins Etude Fascinante

May 08, 2025 -

Dwps Six Month Universal Credit Rule What You Need To Know

May 08, 2025

Dwps Six Month Universal Credit Rule What You Need To Know

May 08, 2025 -

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025

Westbrook Trade Buzz A Nuggets Players Reaction

May 08, 2025 -

Lotto Plus Results Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025

Lotto Plus Results Winning Numbers For Lotto Lotto Plus 1 And 2

May 08, 2025 -

The Impact Of Saturday Night Live On Counting Crows Success

May 08, 2025

The Impact Of Saturday Night Live On Counting Crows Success

May 08, 2025

Latest Posts

-

Kenya Uber Update Cashback Offers And Increased Delivery Ride Opportunities

May 08, 2025

Kenya Uber Update Cashback Offers And Increased Delivery Ride Opportunities

May 08, 2025 -

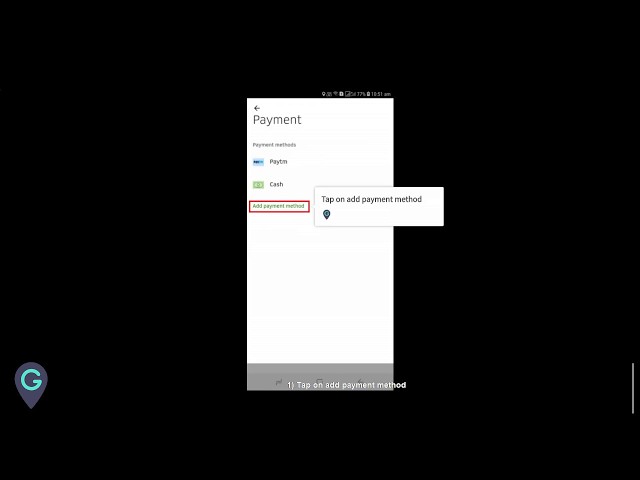

How To Pay For Uber Auto Rides A Guide To Upi And Alternatives

May 08, 2025

How To Pay For Uber Auto Rides A Guide To Upi And Alternatives

May 08, 2025 -

Ubers Kalanick Admits Abandoning Product Strategy Was A Mistake

May 08, 2025

Ubers Kalanick Admits Abandoning Product Strategy Was A Mistake

May 08, 2025 -

Get Cashback With Uber Kenya Good News For Drivers And Couriers Too

May 08, 2025

Get Cashback With Uber Kenya Good News For Drivers And Couriers Too

May 08, 2025 -

Uber Auto Understanding Payment Methods After Cash Removal

May 08, 2025

Uber Auto Understanding Payment Methods After Cash Removal

May 08, 2025