Tech Firms Delay IPOs: Tariffs Cause Market Uncertainty

Table of Contents

Increased Market Volatility Due to Tariffs

Tariffs have introduced a considerable level of unpredictability into the market, making it increasingly difficult for investors to accurately assess risk and potential returns. This, in turn, is driving the wave of Tech IPO Delays.

Impact on Investor Sentiment

The uncertainty created by tariffs has led to a noticeable decrease in investor confidence within the tech sector. This manifests in several ways:

- Decreased investor confidence: Investors are hesitant to commit capital to ventures with uncertain futures.

- Heightened risk aversion: Venture capitalists and private equity firms are adopting a more cautious approach, delaying investments and reducing funding rounds.

- Reluctance to commit capital: The perceived risk associated with new IPOs, particularly in the tech sector, is significantly higher due to tariff-related unpredictability.

Supply Chain Disruptions

Tariffs directly increase the cost of imported components and materials crucial to the tech industry, significantly impacting profitability and potentially delaying product launches. This is a major factor contributing to Tech IPO Delays. The consequences include:

-

Increased manufacturing costs: Higher import duties translate directly into increased production expenses.

-

Delays in product development: Procuring necessary components becomes more complex and time-consuming, pushing back launch dates.

-

Reduced profit margins: The increased cost of goods sold significantly eats into potential profits, making IPOs less attractive.

-

Examples of specific tariffs affecting tech components: Tariffs on semiconductors, rare earth minerals, and other key components have created significant challenges for tech companies.

-

Case studies of tech companies delaying IPOs due to tariff-related concerns: Several high-profile tech companies have publicly cited tariff-related uncertainty as a major factor in postponing their IPO plans. Specific examples (with links to reliable news sources if available) would strengthen this point.

The Ripple Effect on Tech Investment and Innovation

The uncertainty caused by tariffs extends beyond immediate IPO delays. It creates a ripple effect impacting tech investment and innovation across the board.

Reduced Funding for Startups

The current uncertain investment climate is discouraging venture capital funding for startups, significantly hindering innovation and growth. This impacts the entire tech ecosystem, potentially leading to:

- Fewer startups seeking IPOs: With reduced funding, fewer startups reach the stage where an IPO is a viable option.

- Slower development of disruptive technologies: Lack of funding slows down research and development, potentially hindering the advancement of groundbreaking technologies.

- Potential decrease in overall economic growth: A slowdown in tech innovation can negatively impact the overall economic growth of nations heavily reliant on the tech sector.

Impact on Mergers and Acquisitions

The unpredictable market conditions are also causing companies to postpone mergers and acquisitions (M&A) activity. This impacts the consolidation and competition dynamics within the tech industry:

-

Postponed strategic partnerships: Companies are hesitant to commit to large-scale partnerships due to the increased uncertainty.

-

Altered landscape of the tech industry: The delay or cancellation of M&A deals reshapes the competitive landscape of the tech industry.

-

Statistics illustrating the decrease in tech funding rounds: Including data on funding rounds in recent years would add weight to this section.

-

Examples of postponed M&A deals: Citing specific examples of delayed or cancelled M&A deals would further illustrate the impact of tariffs.

Strategies for Navigating the Uncertain Market

Despite the challenges, tech companies and policymakers can employ strategies to mitigate the risks associated with tariffs and market uncertainty.

Risk Mitigation Strategies for Tech Companies

Tech companies can actively adopt several strategies to navigate the current uncertain climate:

- Diversifying supply chains: Reducing reliance on single-source suppliers mitigates the impact of tariffs on specific components.

- Focusing on domestic manufacturing: Shifting production to domestic facilities reduces vulnerability to import tariffs.

- Exploring alternative market entry strategies: Companies can explore other avenues for market entry beyond traditional IPOs, such as strategic partnerships or private placements.

Government Policy and its Role

Government intervention can play a crucial role in stabilizing the market and reducing the impact of tariffs on the tech sector:

-

Implementing policies to support domestic industries: Government incentives can encourage domestic manufacturing and reduce reliance on imports.

-

Negotiating trade agreements to reduce tariffs: International cooperation can lead to reduced tariffs and increased market stability.

-

Providing financial incentives to encourage investment: Government support can help boost investor confidence and encourage investment in the tech sector.

-

Examples of successful risk mitigation strategies adopted by tech firms: Highlighting successful examples would provide practical insights.

-

Potential policy interventions to address the issue: Suggesting potential government policies would offer valuable recommendations.

Conclusion

The delay of tech IPOs is a direct and significant consequence of the market uncertainty created by international trade tariffs. This uncertainty negatively impacts investor sentiment, disrupts supply chains, and significantly reduces investment in innovation. These Tech IPO Delays are a major concern demanding attention and strategic action.

Understanding the impact of tariffs on tech IPO delays is crucial for investors, entrepreneurs, and policymakers alike. Stay informed about evolving trade policies and market trends to make informed decisions about investing in or launching tech ventures during this period of Tech IPO Delays. Careful analysis and strategic planning are essential for navigating this complex landscape and capitalizing on opportunities within the tech sector.

Featured Posts

-

Joaquin Caparros Nuevo Entrenador Del Sevilla Fc Tras El Cese De Garcia Pimienta

May 14, 2025

Joaquin Caparros Nuevo Entrenador Del Sevilla Fc Tras El Cese De Garcia Pimienta

May 14, 2025 -

Sanremo Come Iscriversi Al Servizio Di Trasporto Scolastico

May 14, 2025

Sanremo Come Iscriversi Al Servizio Di Trasporto Scolastico

May 14, 2025 -

Trockenheit In Deutschland Nur Lokaler Regen Die Duerre Haelt An

May 14, 2025

Trockenheit In Deutschland Nur Lokaler Regen Die Duerre Haelt An

May 14, 2025 -

Yevrobachennya 2025 Scho Chekaye Nas V Sauni

May 14, 2025

Yevrobachennya 2025 Scho Chekaye Nas V Sauni

May 14, 2025 -

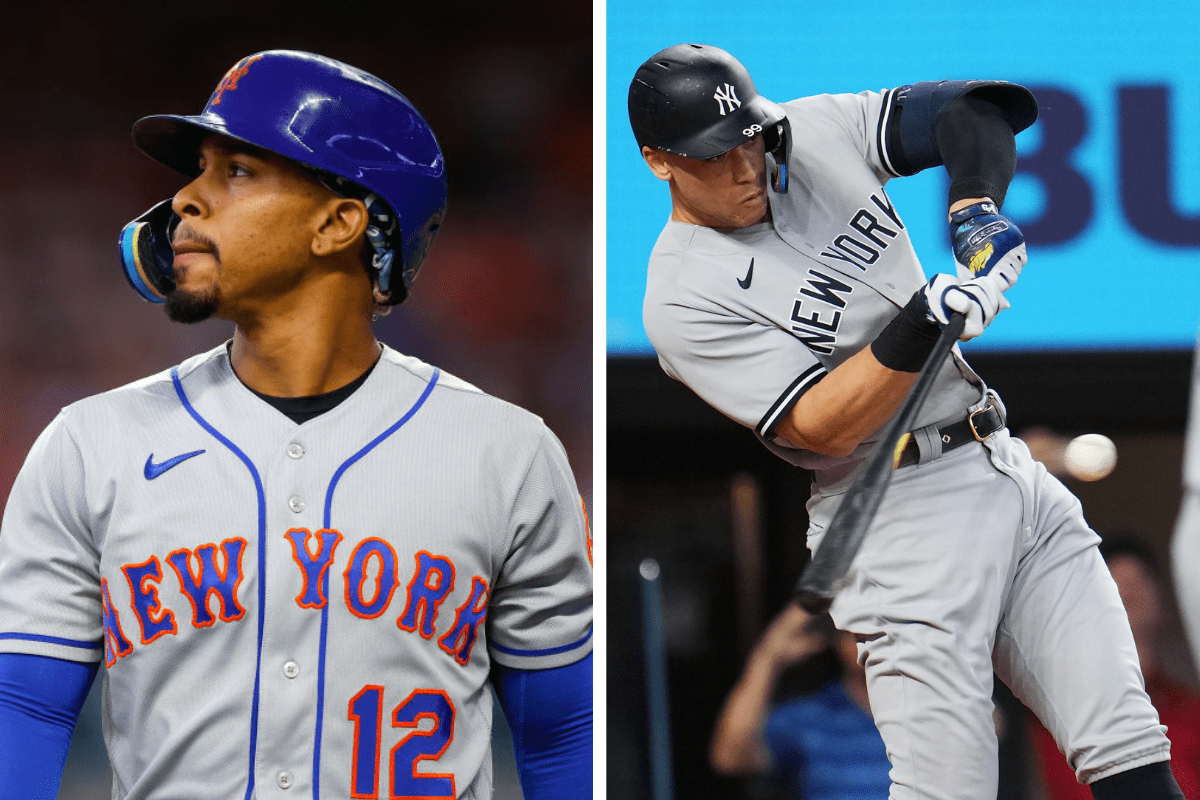

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025

Mlb Power Rankings Winners And Losers At The 30 Game Mark 2025

May 14, 2025