Tech Sector Propels US Stock Market Higher: Tesla's Impact

Table of Contents

Tesla's Stock Performance and Market Influence

Tesla's recent stock price movements have been nothing short of dramatic, and its performance is strongly correlated with the overall market's trajectory. The company's massive market capitalization places it firmly among the world's most valuable companies, solidifying its position as a tech giant and a key indicator of market health.

- Specific examples: Tesla's stock experienced significant gains in [Month, Year] following the announcement of [positive news event, e.g., record-breaking quarterly earnings]. Conversely, periods of market uncertainty often see Tesla's stock price fluctuate, reflecting its sensitivity to investor sentiment.

- News and Events: Announcements regarding new product launches (e.g., Cybertruck production updates), expansion into new markets, and regulatory changes directly impact Tesla's stock price and, subsequently, the broader market.

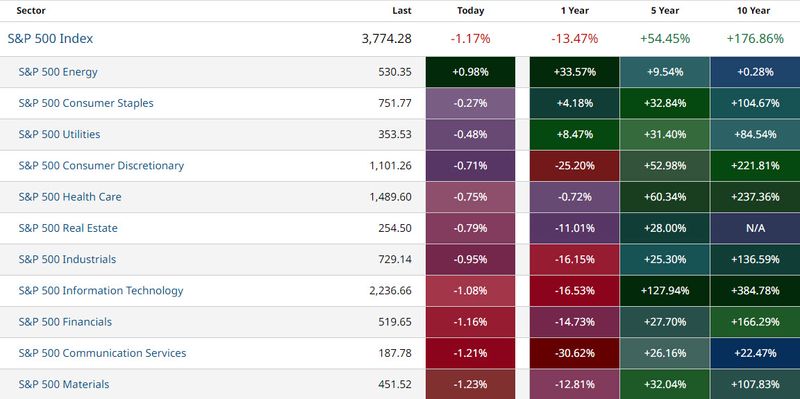

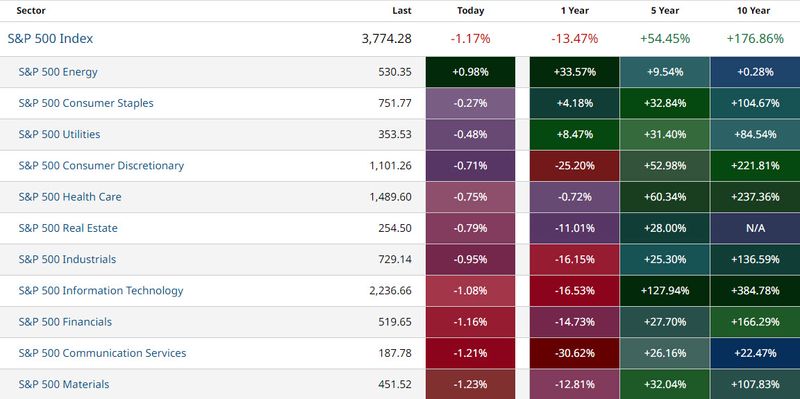

- Quantifiable Influence: While precisely quantifying Tesla's contribution to overall market growth is complex, analysts suggest its influence is substantial, particularly within the electric vehicle (EV) and renewable energy sectors, contributing significantly to the overall tech sector's growth. Further research is needed to fully analyze its direct contribution to market indices such as the S&P 500.

The Broader Tech Sector's Contribution

Tesla's success is not an isolated phenomenon. The broader tech sector, encompassing giants like Apple, Microsoft, Google, Amazon, and Meta, has collectively contributed significantly to the upward trend of the US stock market. The performance of these companies, as reflected in indices like the Nasdaq Composite, paints a clear picture of the sector's strength.

- Successful Tech Companies: Apple's consistent product innovation, Microsoft's dominance in software and cloud computing, and Google's leading role in search and advertising all contribute to the sector's robust growth.

- Emerging Tech Trends: The rise of artificial intelligence (AI), the expanding electric vehicle (EV) market, and advancements in renewable energy are key factors driving the tech sector's growth and influencing investor confidence.

- Statistical Data: The Nasdaq Composite, a key indicator of the tech sector's performance, has shown consistent growth over [time period], further highlighting the sector's contribution to the overall market’s positive trend.

Economic Factors Influencing the Tech Sector and Market Growth

The flourishing tech sector isn't immune to macroeconomic influences. Several economic factors play a crucial role in shaping its performance and contributing to the overall market's growth.

- Economic Indicators: Interest rate changes, consumer spending patterns, inflation rates, and global economic stability directly impact investor confidence and willingness to invest in the tech sector.

- Investor Sentiment: Positive economic indicators often translate into increased investor confidence, leading to higher valuations for tech stocks. Conversely, negative economic news can trigger sell-offs.

- Potential Risks and Challenges: Geopolitical instability, supply chain disruptions, and regulatory changes pose significant challenges to the tech sector's sustained growth.

Tesla's Innovation and its Ripple Effect

Tesla's groundbreaking innovations haven't just propelled its own stock price; they've had a significant ripple effect across related industries. The company's advancements in battery technology, autonomous driving, and overall EV design have reshaped the competitive landscape.

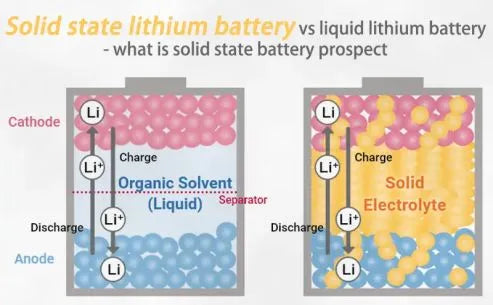

- Tesla's Innovations: Tesla's advancements in battery technology have spurred innovation in battery production and related fields, pushing the boundaries of energy storage and efficiency. Its Autopilot system has accelerated the development of autonomous driving technology within the automotive sector.

- Competitive Landscape: Tesla's success has spurred increased competition in the EV market, leading to faster innovation and more affordable options for consumers.

- Ripple Effect: The growth of the EV market has created a ripple effect, boosting demand for charging infrastructure, battery materials, and related technologies.

Conclusion: Sustained Growth and the Future of the Tech Sector

The tech sector's contribution to the recent surge in the US stock market is undeniable, with companies like Tesla playing a pivotal role. Tesla's performance, driven by innovation and strong investor sentiment, is closely tied to the broader market's trends. While future growth is promising, challenges remain. Staying informed about the tech sector's influence on the market and following updates on Tesla and other tech giants' performance is crucial for investors. For further insights, explore resources on electric vehicle investments and tech stock analysis. The future of the US stock market is significantly tied to the continued success and innovation within the tech sector.

Featured Posts

-

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 29, 2025

Kuxius Solid State Power Bank Higher Cost Longer Life

Apr 29, 2025 -

The Price Of Stardom Willie Nelson And The Risks Of Non Stop Touring

Apr 29, 2025

The Price Of Stardom Willie Nelson And The Risks Of Non Stop Touring

Apr 29, 2025 -

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

Hudsons Bay Liquidation Sale Final Markdowns Up To 70

Apr 29, 2025

Hudsons Bay Liquidation Sale Final Markdowns Up To 70

Apr 29, 2025 -

Natural Gas Leak Prompts Downtown Louisville Evacuations

Apr 29, 2025

Natural Gas Leak Prompts Downtown Louisville Evacuations

Apr 29, 2025

Latest Posts

-

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

Apr 29, 2025

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

Apr 29, 2025 -

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025 -

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025 -

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025 -

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025