Tech Stock Losses: Seven Giants Down $2.5 Trillion This Year

Table of Contents

H2: The Seven Tech Giants Facing Massive Losses

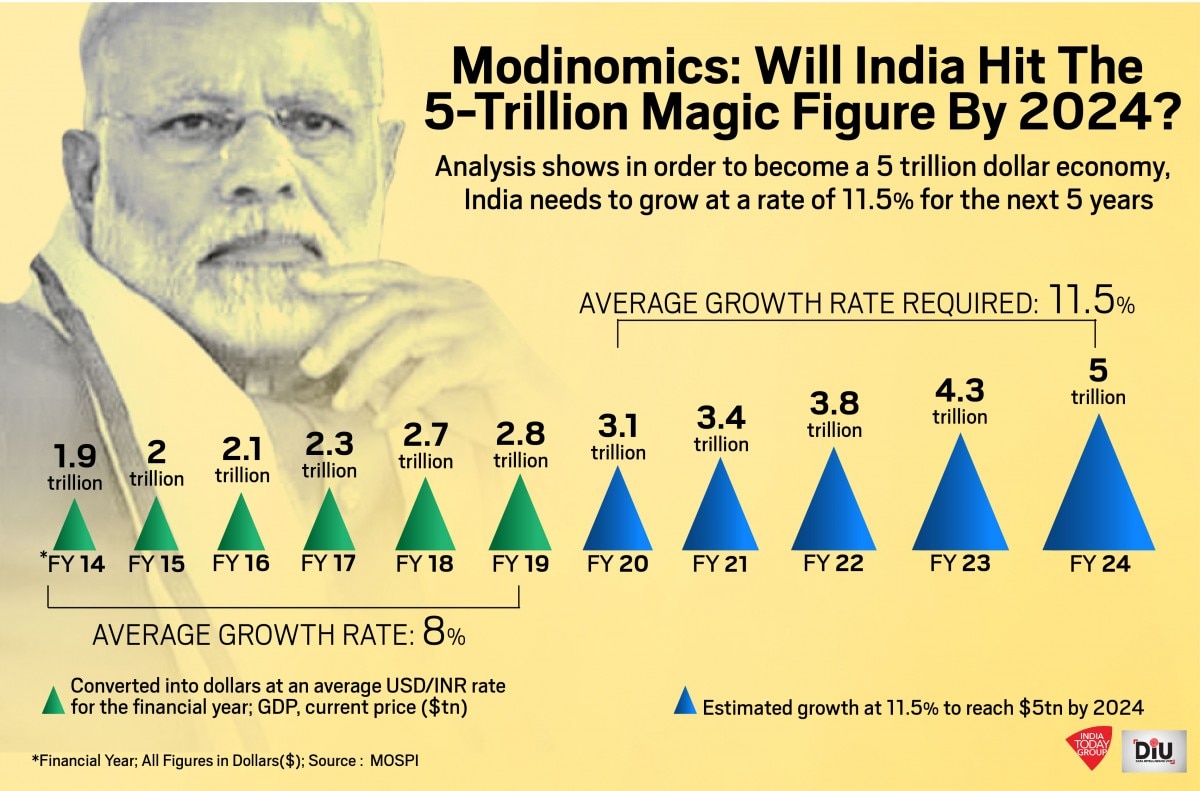

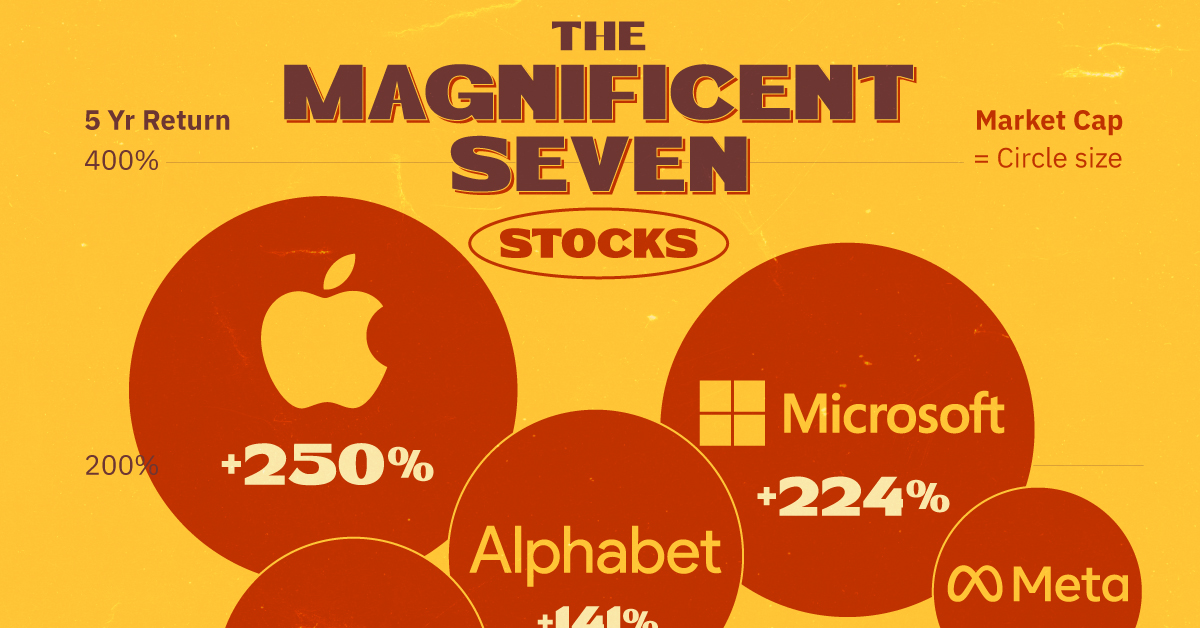

This year's tech stock market decline has disproportionately affected some of the largest players. Seven companies – Apple, Microsoft, Amazon, Alphabet (Google), Meta (Facebook), Tesla, and Nvidia – have borne the brunt of the losses. While precise figures fluctuate daily, these companies have collectively lost trillions of dollars in market value. Let's look at a snapshot:

- Apple: A significant portion of Apple's loss stems from concerns about slowing iPhone sales and increased competition in the smartphone market.

- Microsoft: Microsoft's cloud computing division, Azure, while still a growth engine, has faced pressure from increased competition and slowing growth rates.

- Amazon: Amazon has experienced pressure on its e-commerce business and its cloud computing division, AWS, has faced margin compression.

- Alphabet (Google): Google’s advertising revenue, a cornerstone of its business, is showing signs of slowing growth. Increased competition and regulatory scrutiny also contribute to the losses.

- Meta (Facebook): Meta has struggled with declining user engagement and increased competition from other social media platforms. The metaverse investment also presents a significant risk.

- Tesla: Tesla's stock price has been heavily impacted by Elon Musk’s actions, including his acquisition of Twitter, and concerns about production and delivery challenges.

- Nvidia: Despite strong growth in its data center business, Nvidia's stock price has fallen alongside other tech stocks, influenced by broader market trends.

Percentage Losses (Approximate): (Note: These are approximate and subject to change. Consult current financial data for the most up-to-date information.)

- Apple: -X%

- Microsoft: -Y%

- Amazon: -Z%

- Alphabet: -A%

- Meta: -B%

- Tesla: -C%

- Nvidia: -D%

[Insert chart/graph visually comparing percentage losses of the seven companies]

H2: Underlying Causes of the Tech Stock Market Decline

Several interconnected factors have contributed to the dramatic tech stock losses:

H3: Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes to combat inflation have significantly impacted tech valuations. Higher interest rates increase borrowing costs for companies, reducing investment and slowing growth. Furthermore, investors are shifting from growth stocks (like many tech companies) to more conservative investments offering higher returns in a higher interest rate environment. Inflation also erodes consumer spending power, negatively impacting demand for tech products and services.

H3: Geopolitical Instability and Supply Chain Disruptions

The war in Ukraine, ongoing trade tensions, and lingering pandemic-related disruptions have created significant supply chain challenges, impacting the production and delivery of tech products. Geopolitical uncertainty also increases investor risk aversion, leading to a sell-off in riskier assets, including tech stocks.

H3: Overvaluation and Market Correction

Some analysts argue that the tech sector was overvalued in previous years, leading to a necessary market correction. Market cycles are characterized by periods of growth followed by corrections, and the current downturn may simply be a natural part of this cycle.

H2: Impact on Investors and the Broader Economy

The tech stock losses have significant repercussions:

H3: Investor Sentiment and Portfolio Diversification

The dramatic decline in tech stock values has shaken investor confidence. The importance of portfolio diversification, spreading investments across different asset classes and sectors, is now more apparent than ever. A concentrated portfolio heavily weighted in tech stocks is particularly vulnerable to such market downturns.

H3: Ripple Effects on Related Industries

The tech sector downturn is not isolated. Related industries such as semiconductors, software development, and consumer electronics are also feeling the impact. Reduced demand for tech products translates into lower demand for components and services from these related industries.

H2: Potential Recovery Strategies and Future Outlook

Despite the current challenges, the tech sector retains significant long-term growth potential.

H3: Analyzing Long-Term Growth Potential

The tech sector continues to drive innovation in areas such as artificial intelligence, cloud computing, and renewable energy. Identifying companies positioned to benefit from these trends is crucial for long-term investment success.

H3: Identifying Undervalued Tech Stocks

The current market downturn presents opportunities for investors to identify undervalued tech companies with strong growth potential. Analyzing financial statements, evaluating management teams, and assessing competitive landscapes are key to identifying such companies.

H3: Considering Sector Rotation

Diversifying investments beyond the tech sector is a prudent strategy. Sectors like healthcare, energy, or infrastructure might offer better returns in the current market climate.

3. Conclusion

The $2.5 trillion loss across seven tech giants highlights the volatility inherent in the tech stock market. Rising interest rates, inflation, geopolitical instability, and potential overvaluation have contributed to this significant downturn. However, the long-term growth potential of the tech sector remains significant. By understanding the underlying causes of these tech stock losses and implementing diversified investment strategies, investors can navigate the current market turbulence and position themselves for future opportunities. To effectively mitigate tech investment risks and navigate tech stock losses, thorough research and a well-defined investment strategy are essential. Invest wisely in the tech sector by carefully considering your risk tolerance and diversifying your portfolio.

Featured Posts

-

Millions Stolen Inside The Office 365 Executive Hacking Ring

Apr 29, 2025

Millions Stolen Inside The Office 365 Executive Hacking Ring

Apr 29, 2025 -

Understanding The Value Of Middle Management In Todays Workplace

Apr 29, 2025

Understanding The Value Of Middle Management In Todays Workplace

Apr 29, 2025 -

Magnificent Seven Stocks A 2 5 Trillion Market Value Loss In 2024

Apr 29, 2025

Magnificent Seven Stocks A 2 5 Trillion Market Value Loss In 2024

Apr 29, 2025 -

Chinas Huawei Unveils New Ai Chip Technology

Apr 29, 2025

Chinas Huawei Unveils New Ai Chip Technology

Apr 29, 2025 -

Data Centers Negeri Sembilans Growing Tech Hub

Apr 29, 2025

Data Centers Negeri Sembilans Growing Tech Hub

Apr 29, 2025

Latest Posts

-

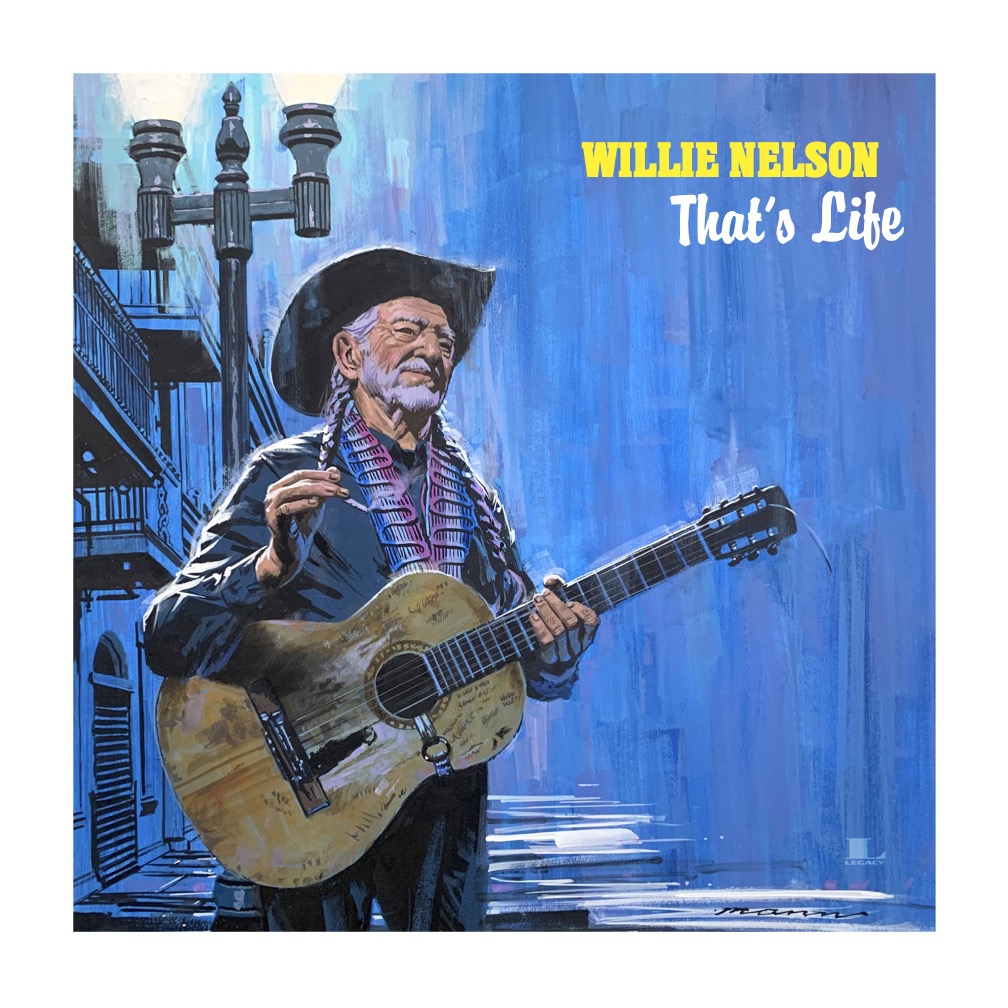

New Willie Nelson Album Wifes Statement On Sons Role In Care

Apr 29, 2025

New Willie Nelson Album Wifes Statement On Sons Role In Care

Apr 29, 2025 -

Willie Nelsons Health Concerns Rise Amidst Rigorous Touring Schedule

Apr 29, 2025

Willie Nelsons Health Concerns Rise Amidst Rigorous Touring Schedule

Apr 29, 2025 -

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

Willie Nelson New Album Release Overshadowed By Family Drama

Apr 29, 2025

Willie Nelson New Album Release Overshadowed By Family Drama

Apr 29, 2025 -

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

Apr 29, 2025

At And T Sounds Alarm On Broadcoms Extreme V Mware Price Increase

Apr 29, 2025