Telus' Q1 2024 Financial Report: Increased Profit And Dividend

Table of Contents

Strong Revenue Growth Across Key Segments

Telus reported significant revenue growth across its key segments in Q1 2024, driven by strong customer acquisition and increased demand for its services. This positive trend reflects the company's success in various markets and its ability to adapt to evolving customer needs.

-

Wireless Segment: The wireless segment experienced a substantial revenue increase, fueled by strong customer additions and a higher average revenue per user (ARPU). This suggests that Telus is successfully attracting new customers while also increasing the value derived from its existing subscriber base through higher-value plans and added services. The successful rollout of new mobile phone plans and improved network coverage played a pivotal role in this success.

-

Wireline Business: The wireline business continued its growth trajectory, driven by increasing demand for high-speed internet and fibre optic services. The expanding adoption of high-bandwidth applications, like streaming and online gaming, has fueled the demand for Telus' reliable and fast internet services. Expansion into new underserved markets also contributed to this growth, enabling Telus to tap into previously untapped customer bases.

-

Overall Growth Drivers: The expansion into new markets, coupled with the successful launch of new products and service bundles, contributed significantly to the overall revenue growth. Telus' strategic focus on innovation and customer experience has proven effective in driving customer acquisition and enhancing revenue streams. However, it's crucial to also analyze potential headwinds such as increased competition and regulatory changes that may impact future performance. A detailed analysis of ARPU increases and subscriber growth across all service lines, provided in the full report, paints a clear picture of this growth.

Increased Profitability and Operating Income

The strong revenue growth translated directly into significantly improved profitability and operating income for Telus in Q1 2024. This improvement demonstrates the effectiveness of Telus' operational efficiency strategies.

-

Net Income Improvement: Net income showed a significant improvement compared to Q1 2023, underscoring the success of cost-cutting measures and increased operational efficiency. This improved profitability is a testament to Telus’s ability to manage expenses while driving revenue growth.

-

EBITDA Contribution: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) also demonstrated considerable growth, contributing significantly to the overall profit increase. This key metric provides a clear picture of the company's core operating performance, excluding the impact of financing and accounting adjustments.

-

Margin Improvement: The improvement in profit margins is a key indicator of Telus' ability to manage costs effectively while maintaining high revenue generation. The implementation of targeted cost-cutting measures, without compromising service quality or customer experience, contributed significantly to this margin improvement. A comparison of key profitability metrics against industry benchmarks and previous quarters reveals Telus' strong performance relative to its competitors.

Higher Dividend Announcement and Shareholder Returns

Telus announced a substantial increase in its quarterly dividend payout, reflecting its strong financial performance and confidence in future growth. This move demonstrates a clear commitment to rewarding its shareholders.

-

Dividend Increase Rationale: The rationale behind the dividend increase stems from the company's robust financial position and its positive outlook for the future. This signifies strong investor confidence in the company's ability to sustain and grow its earnings.

-

Dividend Yield Analysis: The increased dividend translates into a competitive dividend yield compared to other companies in the telecom sector. This makes Telus' stock even more attractive to investors seeking both capital appreciation and a reliable income stream.

-

Impact on Investor Sentiment: The dividend increase has positively impacted investor sentiment and has generally resulted in a positive stock price reaction. This highlights the importance of dividend payouts in influencing investor confidence and attracting further investment. The projected future growth further strengthens the attractiveness of this increased dividend for long-term investors.

Future Outlook and Strategic Initiatives

Telus' management has expressed a positive outlook for the remainder of 2024 and beyond, driven by strategic investments in key areas.

-

Investment in 5G and Innovation: Telus plans to continue investing in its 5G infrastructure and other technological advancements to maintain its competitive edge in the rapidly evolving telecommunications landscape. These investments are crucial for supporting future growth and providing cutting-edge services to its customers.

-

Strategic Initiatives and Acquisitions: The company is actively exploring new strategic initiatives and potential acquisitions that could further enhance its market position and drive future growth. These initiatives are expected to support both organic growth and expansion through strategic partnerships or acquisitions.

-

Risk Assessment: While the outlook is optimistic, Telus acknowledges potential risks and challenges, such as increased competition, regulatory changes, and economic fluctuations. A thorough risk assessment and mitigation strategy are in place to address these potential hurdles.

Conclusion

Telus' Q1 2024 financial report paints a picture of robust financial health, with increased profitability across key segments and a notable dividend increase. The strong revenue growth, improved operating income, and enhanced shareholder returns showcase Telus' commitment to delivering value to its investors. The company's strategic investments and positive outlook suggest promising growth potential for the future. Stay informed about Telus' financial performance and future developments by regularly reviewing their investor relations materials. Understand the implications of the increased profit and dividend for your investment strategy. Learn more about the Telus Q1 2024 financial report and its impact on the telecom sector.

Featured Posts

-

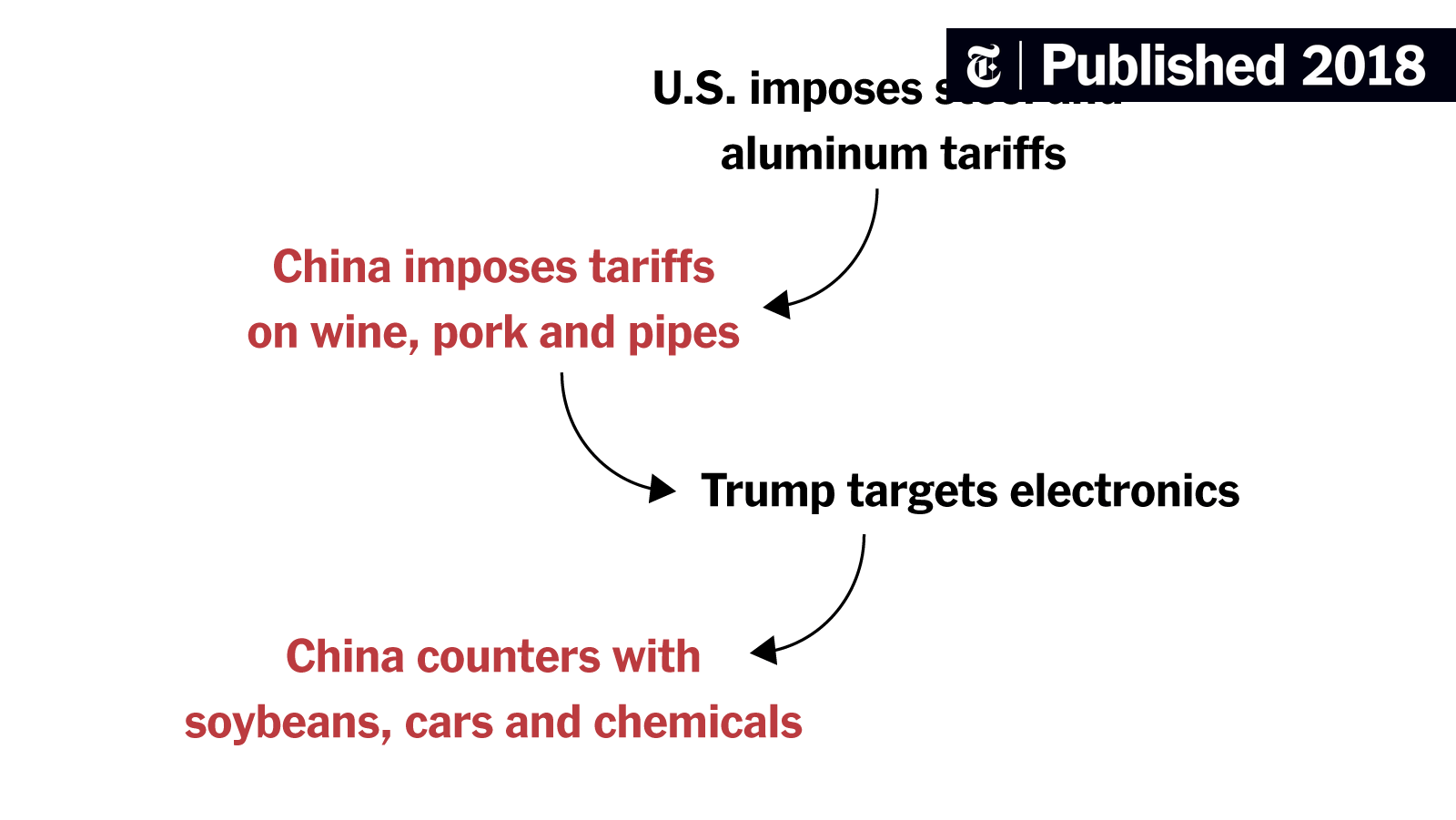

Substantial Progress Made In Us China Trade Negotiations

May 12, 2025

Substantial Progress Made In Us China Trade Negotiations

May 12, 2025 -

Het Afscheid Van Mueller Bayern Muenchen Verliest Een Icoon

May 12, 2025

Het Afscheid Van Mueller Bayern Muenchen Verliest Een Icoon

May 12, 2025 -

Concerns Over Uk Trade Deal White House Response To North American Auto Industry

May 12, 2025

Concerns Over Uk Trade Deal White House Response To North American Auto Industry

May 12, 2025 -

Henry Cavills Potential As Wolverine A Look At Marvels World War Hulk

May 12, 2025

Henry Cavills Potential As Wolverine A Look At Marvels World War Hulk

May 12, 2025 -

Hamas Hostage Edan Alexander Family Reaction And International Efforts

May 12, 2025

Hamas Hostage Edan Alexander Family Reaction And International Efforts

May 12, 2025