Telus Reports Higher Q1 Profit And Dividend Hike

Table of Contents

Strong Q1 Profit Growth Fuels Dividend Hike

Telus's Q1 2024 financial performance showcased robust growth, fueling a substantial dividend increase. The company reported a significant percentage increase in net income compared to the same period last year, exceeding analyst expectations and signaling strong financial health. This impressive Q1 earnings report reflects the company's effective strategies and efficient operations.

- Net Income: [Insert specific figure for net income, e.g., $500 million] representing a [Insert percentage, e.g., 15%] increase year-over-year.

- Earnings Per Share (EPS): [Insert specific figure for EPS, e.g., $1.25], exceeding analyst consensus estimates of [Insert analyst estimate, e.g., $1.10].

- Contributing Factors: This surge in profitability can be attributed to several factors, including a rise in the number of subscribers across its wireless and internet services, effective cost-cutting measures, and successful product launches.

- Dividend Increase: Telus announced a [Insert percentage, e.g., 7%] increase in its quarterly dividend, raising the payout to [Insert new dividend amount, e.g., $0.35] per share. This translates to a higher dividend yield, making it an even more attractive investment for income-seeking investors.

Revenue Growth Across Key Business Segments

Telus demonstrated strong revenue growth across its key business segments – wireless, wireline, and internet services – further solidifying its position in the Canadian telecommunications market. This broad-based growth reflects the company's ability to adapt to evolving market demands and cater to a diverse customer base.

- Wireless Segment: The wireless segment experienced a [Insert percentage, e.g., 10%] increase in revenue driven by [Insert reasons, e.g., strong customer additions and increased average revenue per user (ARPU)].

- Wireline Segment: The wireline segment also saw positive growth, with revenue increasing by [Insert percentage, e.g., 5%] due to [Insert reasons, e.g., growth in high-speed internet subscriptions and business services].

- Internet Services: Growth in internet services contributed significantly to overall revenue, reflecting the increasing demand for high-speed internet connectivity. [Insert percentage growth and contributing factors].

- Customer Acquisition and Churn: Telus maintained healthy customer acquisition rates and low churn rates across all segments, indicating strong customer satisfaction and loyalty.

Future Outlook and Investor Sentiment

Telus's management expressed confidence in the company's future prospects, projecting continued revenue growth and profitability for the remainder of the year. Their positive outlook has been well-received by investors, contributing to a positive market reaction.

- Management Commentary: Management highlighted [Insert key elements from management's statements regarding future plans, potential challenges, and growth opportunities].

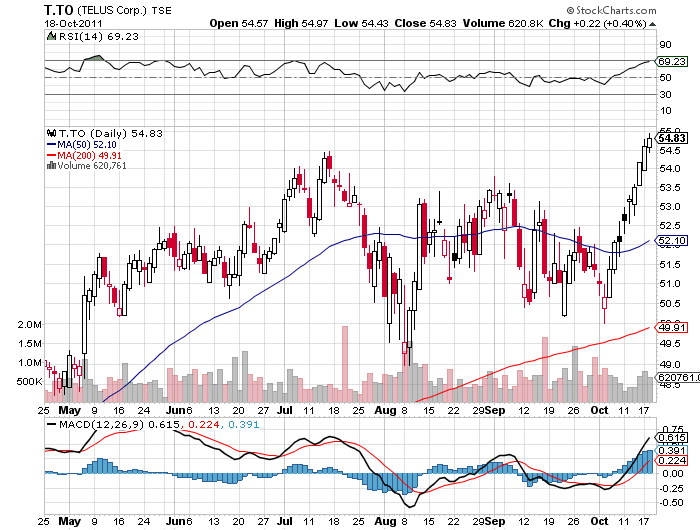

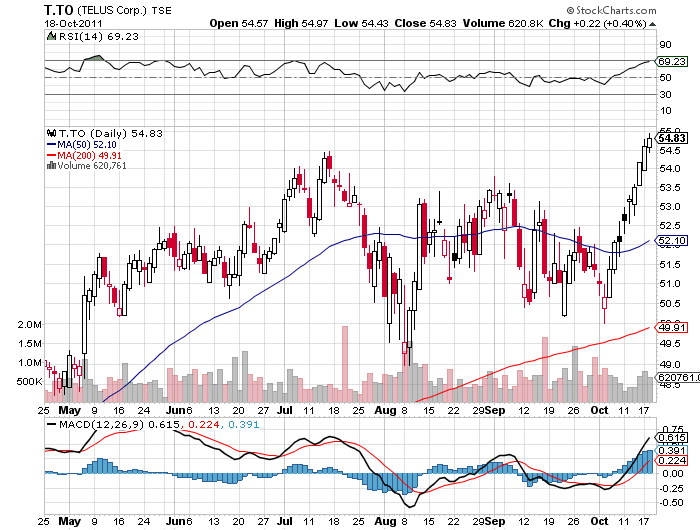

- Stock Price Impact: Following the announcement, Telus's stock price experienced a [Insert percentage and direction, e.g., 3% increase], reflecting positive investor sentiment.

- Analyst Ratings: Several analysts have upgraded their ratings on Telus stock, citing the strong Q1 results and positive outlook. [Insert examples of analyst ratings and predictions if available].

- Potential Challenges: While the outlook is positive, the company acknowledged potential challenges such as increased competition and regulatory changes. These factors will need to be monitored closely.

Conclusion

Telus's Q1 2024 report paints a picture of strong financial performance, marked by significant profit growth, a substantial dividend increase, and a positive outlook for the future. The increased dividend is particularly good news for investors seeking reliable income streams. The company’s diversified revenue streams across wireless, wireline, and internet services demonstrate its resilience and ability to navigate a dynamic market. This Telus dividend increase reinforces its commitment to shareholder value.

Call to Action: Stay informed about future developments at Telus and the Canadian telecommunications sector. Consider researching Telus's investment opportunities further. Learn more about the company's Q1 earnings report and the implications of this positive Telus dividend increase. For detailed financial information, visit the official Telus investor relations website.

Featured Posts

-

Is Grown Ups 2 Worth Watching A Critical Look

May 11, 2025

Is Grown Ups 2 Worth Watching A Critical Look

May 11, 2025 -

Verbesserung Der Asylunterbringung Einsparungspotenzial Von Einer Milliarde Euro

May 11, 2025

Verbesserung Der Asylunterbringung Einsparungspotenzial Von Einer Milliarde Euro

May 11, 2025 -

Ru Pauls Drag Race S17 Episode 13 Drag Baby Mamas Preview And Discussion

May 11, 2025

Ru Pauls Drag Race S17 Episode 13 Drag Baby Mamas Preview And Discussion

May 11, 2025 -

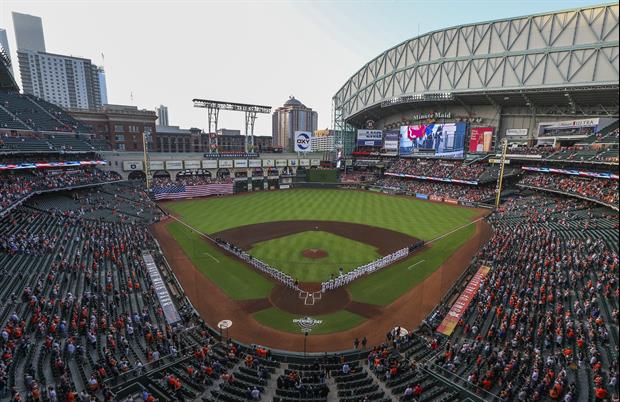

Witness The Future Of Baseball The Houston Astros Foundation College Classic

May 11, 2025

Witness The Future Of Baseball The Houston Astros Foundation College Classic

May 11, 2025 -

Predictions Ufc 315 Montreal Zahabi Aldo Depassera Les 13 Secondes

May 11, 2025

Predictions Ufc 315 Montreal Zahabi Aldo Depassera Les 13 Secondes

May 11, 2025