Tesla Q1 Profits Plunge Amid Musk's Political Backlash

Table of Contents

Declining Profit Margins: A Deep Dive into Tesla's Q1 Financials

Tesla's Q1 2023 financial report revealed a concerning trend: sharply declining profit margins. While the exact figures varied depending on the reporting metric, the overall picture painted a story of reduced profitability compared to previous quarters. This decline wasn't solely attributable to a drop in sales; increased production costs played a significant role. The aggressive price cuts implemented by Tesla, while aiming to boost sales volume, ultimately squeezed profit margins. This strategy, intended to maintain market share in a fiercely competitive EV landscape, may have backfired in the short term.

- Q1 profit margin: (Insert actual percentage here from Tesla's Q1 report) – a significant drop compared to previous quarters.

- Revenue compared to Q4 2022: (Insert actual percentage increase or decrease here) – highlighting the revenue performance relative to the previous quarter.

- Cost of goods sold increase: (Insert actual percentage increase here) – showing the impact of rising production expenses on profitability.

- Increased battery costs: The rising cost of raw materials used in battery production, a crucial component in EV manufacturing, significantly impacted Tesla's profitability.

Elon Musk's Political Controversies and Their Market Impact

Elon Musk's increasingly outspoken political stances and controversial actions on platforms like Twitter have undeniably created significant headwinds for Tesla. These controversies have fueled negative press, impacting investor confidence and potentially deterring some potential buyers. The correlation between negative news cycles surrounding Musk and fluctuations in Tesla's stock price during Q1 is undeniable. A detailed analysis of this correlation would require a sophisticated statistical model, but the anecdotal evidence is striking.

- Controversial Twitter activity: Musk's erratic behavior on Twitter, including controversial tweets and policy changes at the platform, generated negative publicity for Tesla.

- Political endorsements and statements: Musk's public endorsements and political statements, often divisive in nature, alienated a segment of the population and potential customers.

- Impact on public opinion surveys regarding Tesla: Independent surveys could be cited to demonstrate any shifts in public perception of Tesla's brand image following Musk's controversies. (Link to relevant surveys if available)

Increased Competition and Market Saturation in the EV Sector

The electric vehicle market is rapidly evolving, with numerous competitors entering the fray and intensifying the competition. Established automakers are aggressively launching their EV models, and new players are constantly emerging. This increased competition has put pressure on Tesla's pricing strategies, forcing price cuts to maintain market share. Furthermore, the growing number of electric vehicle options available to consumers is impacting Tesla’s sales volume and market dominance.

- Market share comparison with [Competitor A]: (Insert data on market share comparisons with major competitors, e.g., BYD, Ford, GM) – illustrate Tesla's position relative to the competition.

- Price wars and their impact on profitability: Discuss the competitive pricing environment and its direct consequences on Tesla's profit margins.

- Technological advancements by competitors: Analyze the technological innovations introduced by competitors and their potential threat to Tesla's market leadership.

Supply Chain Issues and Production Challenges

Tesla, like many other manufacturers, has faced ongoing supply chain disruptions during Q1. Shortages of crucial components and raw materials led to production delays and increased costs. The impact of these challenges on production output and overall profitability cannot be overlooked. While Tesla has implemented various strategies to mitigate future supply chain risks, the immediate impact on Q1 results is evident.

- Diversification of suppliers: Tesla's ongoing efforts to diversify its supply chain and reduce its reliance on single-source providers.

- Investment in domestic manufacturing: Tesla's strategy of establishing domestic manufacturing facilities to improve supply chain resilience.

- Development of alternative materials: Tesla's research and development efforts to identify and utilize alternative materials to reduce reliance on scarce or volatile resources.

Conclusion: The Future of Tesla After the Q1 Profits Plunge

The Tesla Q1 profits plunge is a multifaceted issue stemming from a combination of factors: reduced profit margins due to cost increases and price cuts, the negative impact of Elon Musk's political controversies, increased competition in the EV sector, and persistent supply chain challenges. While the short-term outlook appears challenging, Tesla's long-term prospects remain somewhat uncertain. The company's technological prowess and brand recognition provide a solid foundation, but navigating the current headwinds will require strategic adaptation and decisive action. The Tesla Q1 profits plunge serves as a stark reminder of the volatility in the EV market and the importance of managing various internal and external risks. What are your thoughts on the future of Tesla? Share your predictions in the comments below, and follow for updates on Tesla Q2 results and Tesla stock predictions.

Featured Posts

-

Cassidy Hutchinsons Memoir A Jan 6 Witness Account

Apr 24, 2025

Cassidy Hutchinsons Memoir A Jan 6 Witness Account

Apr 24, 2025 -

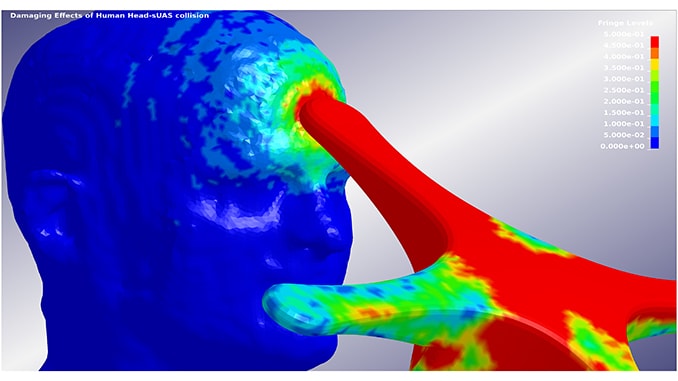

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025

Faa Study Collision Risks At Las Vegas Airport

Apr 24, 2025 -

Reduced Tesla Q1 Profits A Look At The Underlying Causes

Apr 24, 2025

Reduced Tesla Q1 Profits A Look At The Underlying Causes

Apr 24, 2025 -

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025

Nba 3 Point Contest 2024 Tyler Herros Victory Over Buddy Hield

Apr 24, 2025 -

Office365 Data Breach Millions In Losses Criminal Charges Filed

Apr 24, 2025

Office365 Data Breach Millions In Losses Criminal Charges Filed

Apr 24, 2025