Tesla Stock Decline And Tariffs Contribute To Elon Musk's Reduced Net Worth

Table of Contents

Tesla Stock Price Volatility and its Impact on Elon Musk's Net Worth

Tesla's stock performance (TSLA stock) is intrinsically linked to Elon Musk's net worth. His substantial wealth is largely tied up in his Tesla ownership, meaning fluctuations in the stock market directly impact his overall financial picture. Recent declines in Tesla's stock price, driven by a complex interplay of factors, have consequently reduced Musk's wealth.

-

The Recent Decline: Tesla's stock has experienced periods of significant volatility. Several factors contribute to these fluctuations, making accurate prediction challenging. Investor sentiment plays a crucial role, with positive news and strong earnings reports boosting the stock while negative press or production setbacks can lead to sharp drops.

-

Correlation with Elon Musk's Net Worth: Because a significant portion of Musk's wealth is tied to his Tesla shares, any drop in TSLA stock translates directly into a decrease in his net worth. This highlights the inherent risk associated with such a heavily concentrated investment portfolio.

-

Contributing Factors to Volatility: The electric vehicle market is highly competitive, and Tesla faces increasing pressure from established automakers and new EV startups. Production challenges, including supply chain disruptions and manufacturing bottlenecks, have also impacted the company's ability to meet demand, affecting investor confidence. Macroeconomic uncertainty and global economic slowdowns further amplify stock market fluctuations, impacting Tesla's performance and, by extension, Musk's net worth.

-

Analyst Ratings and News Headlines: Analyst ratings and news headlines significantly influence investor sentiment and, subsequently, Tesla's stock price. Positive reviews and bullish predictions tend to drive the price up, while negative assessments or critical news can trigger sell-offs. This makes navigating the ever-changing landscape of Tesla stock a demanding endeavor for both investors and Musk himself.

[Include a relevant chart or graph illustrating Tesla stock price fluctuations here.]

The Role of Tariffs in Affecting Tesla's Profitability and Elon Musk's Wealth

The imposition of tariffs on imported and exported goods plays a significant role in shaping Tesla's profitability and, consequently, Elon Musk's wealth. These trade barriers impact various aspects of Tesla's global operations, influencing its manufacturing costs and overall competitiveness.

-

Impact on Import and Export Operations: Tariffs increase the cost of importing raw materials and exporting finished vehicles, directly affecting Tesla's bottom line. This is particularly relevant given Tesla's global manufacturing footprint and extensive export activities.

-

Increased Manufacturing Costs: Higher tariffs on imported components translate into elevated manufacturing costs, reducing profit margins. This necessitates either absorbing these costs or passing them on to consumers through higher vehicle prices, impacting market competitiveness.

-

Effect on Pricing Strategies: To maintain profitability in the face of tariffs, Tesla might need to adjust its pricing strategies, potentially increasing the cost of its vehicles in certain markets. This could lead to reduced sales and market share, indirectly influencing the company's overall financial performance.

-

Specific Examples: For example, tariffs imposed on certain components in specific countries have directly impacted Tesla’s production costs and market competitiveness in those regions. Analyzing these country-specific impacts is crucial to fully understanding the extent of tariffs' effects.

-

Long-Term Implications: The continued imposition or escalation of tariffs could significantly hamper Tesla's long-term growth and market share, potentially diminishing Musk's net worth further.

Other Contributing Factors to Elon Musk's Reduced Net Worth

Beyond Tesla stock performance and tariffs, other factors contribute to fluctuations in Elon Musk's net worth. These include his investments in SpaceX, other entrepreneurial ventures, personal spending habits, and philanthropic activities. While less immediately quantifiable than Tesla's stock price, these factors collectively play a role in his overall financial picture. Significant investments in SpaceX, for example, while potentially lucrative in the long run, may temporarily tie up substantial capital, affecting his immediately available liquid assets. Similarly, personal spending and philanthropic donations can also influence his overall net worth.

Conclusion

The recent decline in Elon Musk's net worth is a complex story, driven primarily by the volatility of Tesla's stock price and the substantial impact of tariffs on the company's global operations. Other factors, including investments in other ventures and personal financial decisions, also play a role. The interplay between Tesla stock market performance and global trade policies significantly impacts Elon Musk's net worth. To understand the fluctuations in Elon Musk's net worth, staying informed about the latest developments in the Tesla stock market and global trade is crucial. Continue to follow our coverage for further analysis on Elon Musk's net worth and the factors driving its changes.

Featured Posts

-

Us Sees Largest Fentanyl Seizure Ever Led By Pam Bondi

May 10, 2025

Us Sees Largest Fentanyl Seizure Ever Led By Pam Bondi

May 10, 2025 -

7 Year Reunion Two Abc Actors Reunite In High Potential Finale

May 10, 2025

7 Year Reunion Two Abc Actors Reunite In High Potential Finale

May 10, 2025 -

West Ham United And The 25 Million Financial Challenge

May 10, 2025

West Ham United And The 25 Million Financial Challenge

May 10, 2025 -

Addressing West Hams 25 Million Financial Shortfall

May 10, 2025

Addressing West Hams 25 Million Financial Shortfall

May 10, 2025 -

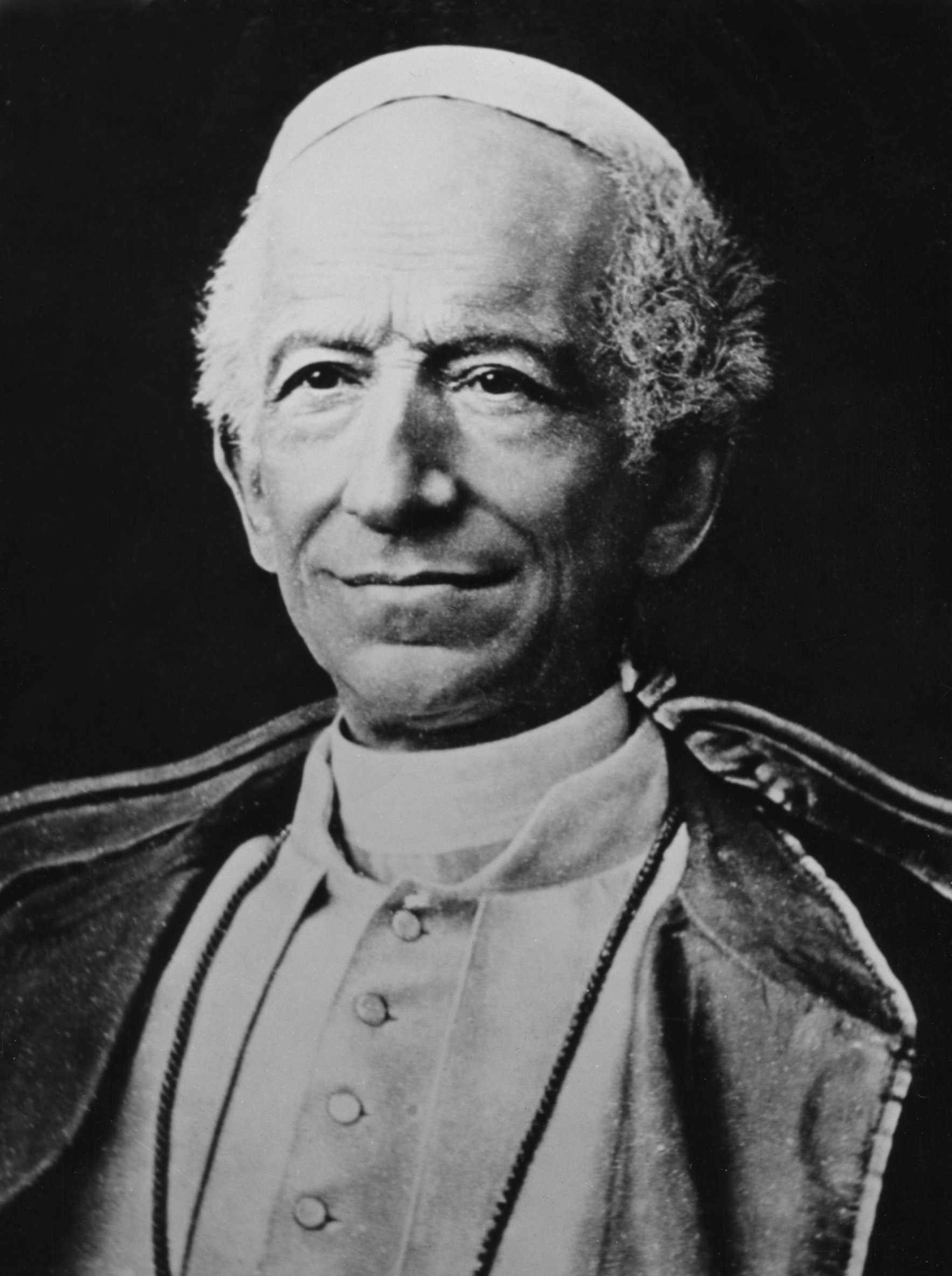

De Facto Atheism Pope Leos Concerns In First Papal Mass

May 10, 2025

De Facto Atheism Pope Leos Concerns In First Papal Mass

May 10, 2025