Tesla's Falling Profits: The Musk-Trump Administration Connection

Table of Contents

The Impact of Trump-Era Trade Wars on Tesla's Supply Chain

The Trump administration's trade wars, particularly the escalating tensions with China, significantly disrupted Tesla's carefully constructed global supply chain. Increased tariffs on imported materials, essential for Tesla's battery production and vehicle manufacturing, directly increased manufacturing costs. This impacted profitability and forced Tesla to reconsider its sourcing strategies.

- Increased tariffs on lithium-ion battery components: These tariffs, imposed as part of the trade war, made crucial battery materials significantly more expensive, adding a substantial burden to Tesla's already high production costs.

- Disruptions to the supply of rare earth minerals from China: China is a dominant player in the rare earth mineral market, crucial for various components in Tesla vehicles. The trade war created uncertainty and disruptions in the supply of these vital materials.

- Higher transportation costs due to trade restrictions: Trade restrictions and increased scrutiny added to the cost of transporting materials and components across borders, further impacting Tesla's bottom line.

- Potential delays in project timelines due to supply chain bottlenecks: Supply chain disruptions, caused by tariffs and geopolitical uncertainty, led to potential delays in Tesla's production timelines and project deliveries.

Government Subsidies and Incentives: A Shifting Landscape

Government subsidies and tax credits for electric vehicles were instrumental in Tesla's early growth and market dominance. However, changes in policy under the Trump administration, or the lack thereof, introduced uncertainty and potentially hindered Tesla's expansion plans. The shifting landscape of incentives created challenges for Tesla's long-term profitability.

- Potential reductions or uncertainties surrounding federal EV tax credits: The Trump administration's approach to clean energy incentives created uncertainty regarding the future of federal EV tax credits, impacting consumer demand and Tesla's sales.

- State-level variations in EV incentives creating market inconsistencies: Inconsistent state-level policies on EV incentives led to a fragmented market, making it more challenging for Tesla to effectively plan its sales strategies across different regions.

- Impact of reduced federal funding for clean energy initiatives: Reduced federal funding for clean energy research and development programs impacted the broader EV ecosystem, potentially slowing down innovation and creating challenges for Tesla's long-term competitiveness.

Elon Musk's Public Persona and its Influence on Investor Sentiment

Elon Musk's highly visible and often controversial public persona significantly influenced investor sentiment and Tesla's stock price volatility. This volatility, potentially amplified by the already turbulent political climate during the Trump administration, likely contributed to investor uncertainty and negatively affected profitability.

- Instances of controversial tweets affecting Tesla's stock price: Musk's tweets, often unpredictable and sometimes controversial, frequently caused significant swings in Tesla's stock price, creating a volatile investment environment.

- Potential negative impact of public disagreements with the government: Public disagreements between Musk and the Trump administration, or other governmental bodies, could have negatively affected investor confidence and damaged Tesla's public image.

- Effect of unpredictable management decisions on investor confidence: Unpredictable management decisions and rapid shifts in strategy could have further eroded investor confidence, contributing to the volatility of Tesla's stock price and potentially impacting its ability to secure funding.

Navigating Geopolitical Uncertainty

The Trump administration's unpredictable foreign policy and trade practices created a climate of geopolitical uncertainty, significantly impacting Tesla's efforts to expand into new international markets. Regulatory hurdles and political instability in various regions presented significant obstacles to Tesla's growth ambitions.

- Challenges in expanding into countries with trade tensions with the US: Trade tensions between the US and other countries hampered Tesla's ability to seamlessly expand into new international markets, adding complexity and cost to its global operations.

- Increased regulatory scrutiny and hurdles in international markets: Increased regulatory scrutiny and bureaucratic hurdles in various countries added time and cost to Tesla's expansion efforts, slowing down its progress in key markets.

- Potential delays or cancellations of international projects due to political instability: Political instability in various regions led to potential delays or cancellations of Tesla's international projects, impacting the company's overall growth trajectory and profitability.

Conclusion

Tesla's falling profits are a multifaceted issue with several contributing factors. This analysis highlights the potential connection between the Trump administration's policies – impacting trade, subsidies, and overall market stability – and the challenges faced by Tesla. Elon Musk's leadership style and its impact on investor sentiment also played a crucial role. Understanding the interplay of these factors is vital for comprehending Tesla's recent financial performance and predicting its future. Further research into Tesla's falling profits and the broader economic policies of the Trump administration is crucial to fully understand the long-term effects. Analyzing these factors will provide insights into how to mitigate future risks for Tesla and other companies operating in a dynamic global landscape.

Featured Posts

-

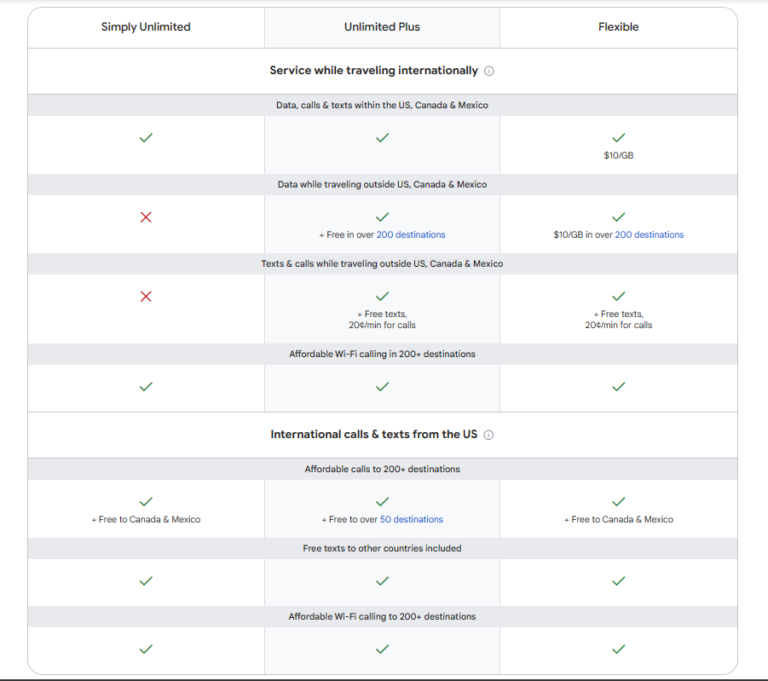

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025

Is Google Fis 35 Unlimited Plan Right For You A Detailed Review

Apr 24, 2025 -

John Travoltas Heartfelt Tribute Photo Marks Late Sons Birthday

Apr 24, 2025

John Travoltas Heartfelt Tribute Photo Marks Late Sons Birthday

Apr 24, 2025 -

Elon Musk Doge And The Epa A Tesla And Space X Investigation Aftermath

Apr 24, 2025

Elon Musk Doge And The Epa A Tesla And Space X Investigation Aftermath

Apr 24, 2025 -

Chinas Lpg Reliance Shifts East Impact Of Us Tariffs On Energy Imports

Apr 24, 2025

Chinas Lpg Reliance Shifts East Impact Of Us Tariffs On Energy Imports

Apr 24, 2025 -

7

Apr 24, 2025

7

Apr 24, 2025