The Bond Crisis: A Growing Threat To Investors

Table of Contents

Rising Interest Rates and Their Impact on Bond Values

The relationship between interest rates and bond prices is inversely proportional. When interest rates rise, the value of existing bonds with lower coupon rates falls. This is because new bonds issued at higher rates become more attractive to investors, reducing the demand for older, lower-yielding bonds. The Federal Reserve's monetary policy plays a crucial role here. To combat inflation, the Fed often raises interest rates, directly impacting bond values. Global economic conditions also influence interest rates; a strong global economy might lead to higher rates, while a recession might lead to lower rates, but the uncertainty creates volatility.

- Increased borrowing costs for governments and corporations: Higher interest rates make it more expensive for governments and corporations to borrow money, potentially impacting their ability to repay bond obligations.

- Reduced demand for existing bonds, leading to price declines: As new, higher-yielding bonds are issued, investors shift their investments, leading to a decrease in demand and price for existing bonds.

- Potential for capital losses for bondholders: Investors holding bonds when interest rates rise may experience capital losses if they sell their bonds before maturity.

- Impact on different types of bonds: The impact of rising interest rates varies across different bond types. For example, longer-maturity bonds are generally more sensitive to interest rate changes than shorter-maturity bonds. Government bonds, considered less risky, might see less dramatic price falls compared to corporate bonds.

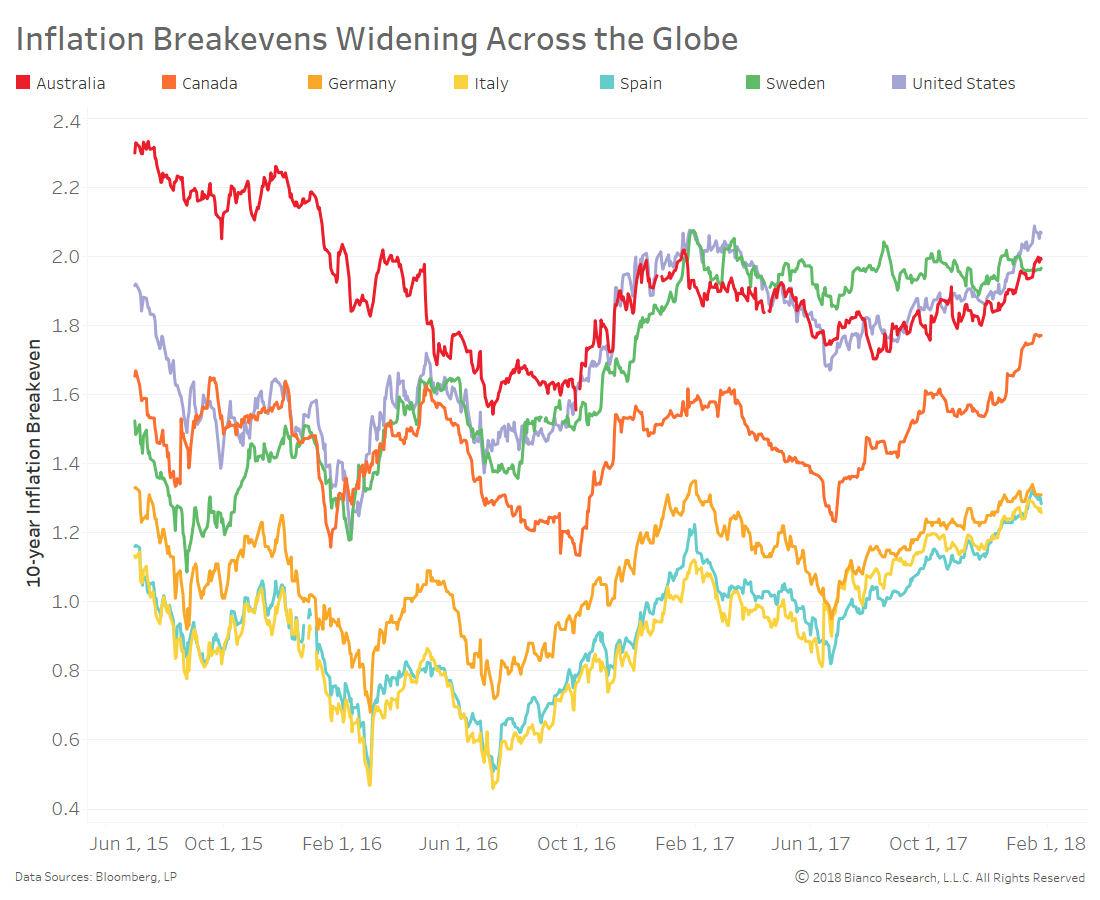

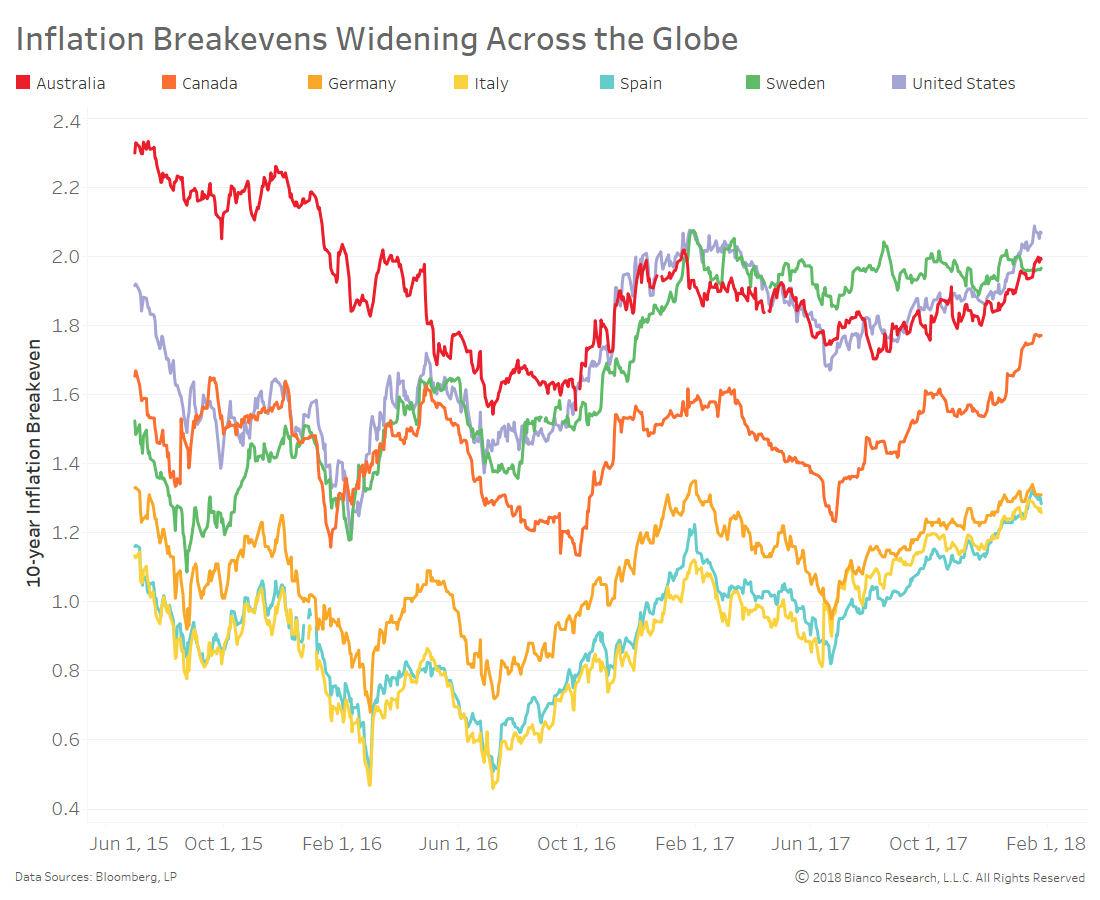

Inflation's Erosive Effect on Bond Returns

Inflation significantly erodes the real return on bond investments. Inflation reduces the purchasing power of future interest payments and the principal repayment at maturity. Unexpected inflation spikes are particularly damaging, as they reduce the real yield (nominal yield adjusted for inflation) even further.

- Decreased purchasing power of fixed income: If inflation is higher than the bond's interest rate, the investor's real return is negative, meaning they're losing purchasing power.

- The importance of considering real yields, not just nominal yields: Investors should focus on real yields to understand the true return on their investment after accounting for inflation.

- Strategies for protecting against inflation: Investors can consider inflation-protected securities (TIPS) which adjust their principal value based on inflation, thus offering protection against inflation's eroding effects.

Increased Default Risk and Credit Downgrades

The risk of bond issuers defaulting on their obligations is a significant concern, particularly during economic downturns. Factors such as economic slowdowns, geopolitical instability, and increased corporate leverage contribute to this increased default risk.

- Impact of credit ratings on bond prices: Credit rating agencies assess the creditworthiness of bond issuers. A downgrade in credit rating can trigger significant price declines in the affected bonds.

- Importance of diversification across different credit ratings: Diversifying across various credit ratings helps to mitigate the risk of default. Focusing solely on high-yield, high-risk bonds increases exposure to this danger.

- Strategies for mitigating default risk: Thorough due diligence and credit analysis are essential before investing in bonds. Understanding the financial health and stability of the issuer is paramount.

Navigating the Bond Crisis: Strategies for Investors

The current bond market environment requires proactive strategies from investors. Effectively managing bond portfolios during a potential bond crisis involves a multi-faceted approach.

- Diversification across asset classes: Diversifying into other asset classes like equities, real estate, or commodities can help reduce overall portfolio risk.

- Shortening the duration of bond holdings: Shorter-duration bonds are less sensitive to interest rate changes, minimizing potential capital losses.

- Investing in high-quality bonds with strong credit ratings: Focusing on bonds issued by financially sound entities with high credit ratings reduces the risk of default.

- Considering alternative investments: Explore alternatives like inflation-linked bonds (TIPS) or high-quality corporate bonds with strong fundamentals to mitigate the bond crisis.

- Seeking professional financial advice: A qualified financial advisor can provide personalized guidance based on individual risk tolerance and investment goals.

Conclusion: Mitigating the Threat of the Bond Crisis

The current bond market environment presents significant risks, including rising interest rates, inflation, and increased default risk. These factors pose a substantial threat to investors' portfolios. Proactive strategies, including diversification, duration management, and careful credit analysis, are crucial to navigating this challenging landscape. Don't let the growing threat of the bond crisis catch you off guard. Take control of your investment strategy today by seeking professional advice and understanding the risks associated with your bond holdings. Learn more about mitigating bond crisis risks and building a resilient portfolio.

Featured Posts

-

Todays Mlb Game Brewers Vs Diamondbacks Prediction And Betting Odds

May 28, 2025

Todays Mlb Game Brewers Vs Diamondbacks Prediction And Betting Odds

May 28, 2025 -

Arsenal Expected To Win Race For Key Target Over Real Madrid Man Utd

May 28, 2025

Arsenal Expected To Win Race For Key Target Over Real Madrid Man Utd

May 28, 2025 -

Kemenangan Dramatis Psv Juara Liga Belanda

May 28, 2025

Kemenangan Dramatis Psv Juara Liga Belanda

May 28, 2025 -

Romes Victor Beyond The Win A Legacy In The Making

May 28, 2025

Romes Victor Beyond The Win A Legacy In The Making

May 28, 2025 -

Psvs Eredivisie Title Win A Veterans Day Celebration For Perisic And De Jong

May 28, 2025

Psvs Eredivisie Title Win A Veterans Day Celebration For Perisic And De Jong

May 28, 2025