The Canadian Dollar's Dive: A Comprehensive Market Overview

Table of Contents

Understanding the Current State of the Canadian Dollar

The CAD has shown weakness against major currencies recently. Against the US dollar (USD), the CAD exchange rate has depreciated by X% in the past month/quarter, currently trading at approximately Y CAD per 1 USD. Similar declines are observed against the Euro (EUR) and British Pound (GBP), indicating a broader trend of CAD weakness in the forex market. The following chart illustrates the recent fluctuations:

[Insert chart/graph showing CAD fluctuations against USD, EUR, and GBP over the past period – ideally interactive]

- Current CAD exchange rates: (Insert up-to-date exchange rates against USD, EUR, GBP)

- Percentage change in CAD value: (Insert percentage change over the past month, quarter, and year)

- Comparison with historical trends: (Brief comparison with average exchange rates over the past 5 or 10 years)

These fluctuations highlight the dynamic nature of the Canadian dollar value and the importance of monitoring the CAD exchange rate for both businesses and individuals involved in international trade or investment.

Key Factors Driving the Canadian Dollar's Decline

Several macroeconomic factors are contributing to the Canadian dollar's decline. Understanding these factors is crucial for navigating the complexities of the currency markets and predicting future trends.

-

Impact of fluctuating oil prices: As a major exporter of oil, Canada's economy is highly sensitive to oil price fluctuations. A decline in global oil prices directly impacts export revenues and negatively influences the Canadian dollar.

-

Influence of interest rate differentials: Interest rate decisions by the Bank of Canada, relative to those of other central banks (like the Federal Reserve in the US), significantly affect the CAD. Higher interest rates generally attract foreign investment, strengthening the currency, while lower rates can weaken it.

-

Effect of inflation on CAD purchasing power: High inflation erodes the purchasing power of the CAD, making it less attractive to foreign investors and contributing to its decline.

-

Role of global economic uncertainty: Global economic uncertainty, such as geopolitical tensions or recessionary fears, often leads to a flight to safety, weakening currencies of countries perceived as riskier investments.

-

Impact of geopolitical events: Geopolitical events, both domestic and international, can significantly affect investor sentiment and influence the Canadian dollar's value. For example, political instability or trade disputes can cause the CAD to depreciate.

Impact of the CAD's Decline on the Canadian Economy

A weaker Canadian dollar has both positive and negative consequences for the Canadian economy:

-

Positive impacts: A weaker CAD boosts the competitiveness of Canadian exports, making them more affordable for international buyers. This can stimulate economic growth in export-oriented sectors.

-

Negative impacts: Conversely, a weaker CAD leads to higher import costs, potentially increasing inflation and reducing the purchasing power of Canadian consumers. This impact is particularly felt in sectors heavily reliant on imported goods.

-

Effect on specific industries: Industries like tourism may benefit from increased inbound tourism due to a cheaper CAD, while manufacturing sectors may face challenges due to increased raw material costs.

Predicting Future Trends for the Canadian Dollar

Predicting the future direction of the Canadian dollar is inherently challenging, as currency movements are influenced by a multitude of interconnected factors. However, analyzing current trends and potential future scenarios can provide a useful framework.

-

Potential scenarios: The CAD could strengthen if oil prices rise significantly, or if the Bank of Canada raises interest rates more aggressively than expected. Conversely, continued global economic uncertainty or further decreases in commodity prices could lead to further CAD depreciation.

-

Influencing factors: Future CAD movements will likely depend on factors such as changes in interest rates, global economic conditions, oil price fluctuations, and investor sentiment.

-

Expert opinions and market analyses: Consulting reputable economic forecasts and market analyses can offer valuable insights, though it is crucial to remember that even expert predictions carry inherent uncertainty.

Conclusion: Navigating the Canadian Dollar's Dive

The recent decline in the Canadian dollar is a complex issue driven by several interacting macroeconomic factors, including oil price volatility, interest rate differentials, inflation, and global economic uncertainty. This decline impacts the Canadian economy both positively and negatively, affecting export competitiveness, import costs, and various industries. While predicting the precise future direction of the CAD is impossible, understanding the key influencing factors and regularly monitoring market trends is crucial. Stay informed about Canadian dollar movements by regularly consulting reliable financial news sources and consider diversifying your investments to mitigate risks associated with Canadian dollar volatility and fluctuations in CAD market trends.

Featured Posts

-

Startup Airlines Controversial Choice Utilizing Deportation Flights For Profit

Apr 24, 2025

Startup Airlines Controversial Choice Utilizing Deportation Flights For Profit

Apr 24, 2025 -

Broadcoms V Mware Deal A 1 050 Price Hike Sparks Outcry From At And T

Apr 24, 2025

Broadcoms V Mware Deal A 1 050 Price Hike Sparks Outcry From At And T

Apr 24, 2025 -

Recent Gains In Indias Nifty Market Trends And Future Outlook

Apr 24, 2025

Recent Gains In Indias Nifty Market Trends And Future Outlook

Apr 24, 2025 -

Car Dealerships Increase Pressure Against Ev Sales Quotas

Apr 24, 2025

Car Dealerships Increase Pressure Against Ev Sales Quotas

Apr 24, 2025 -

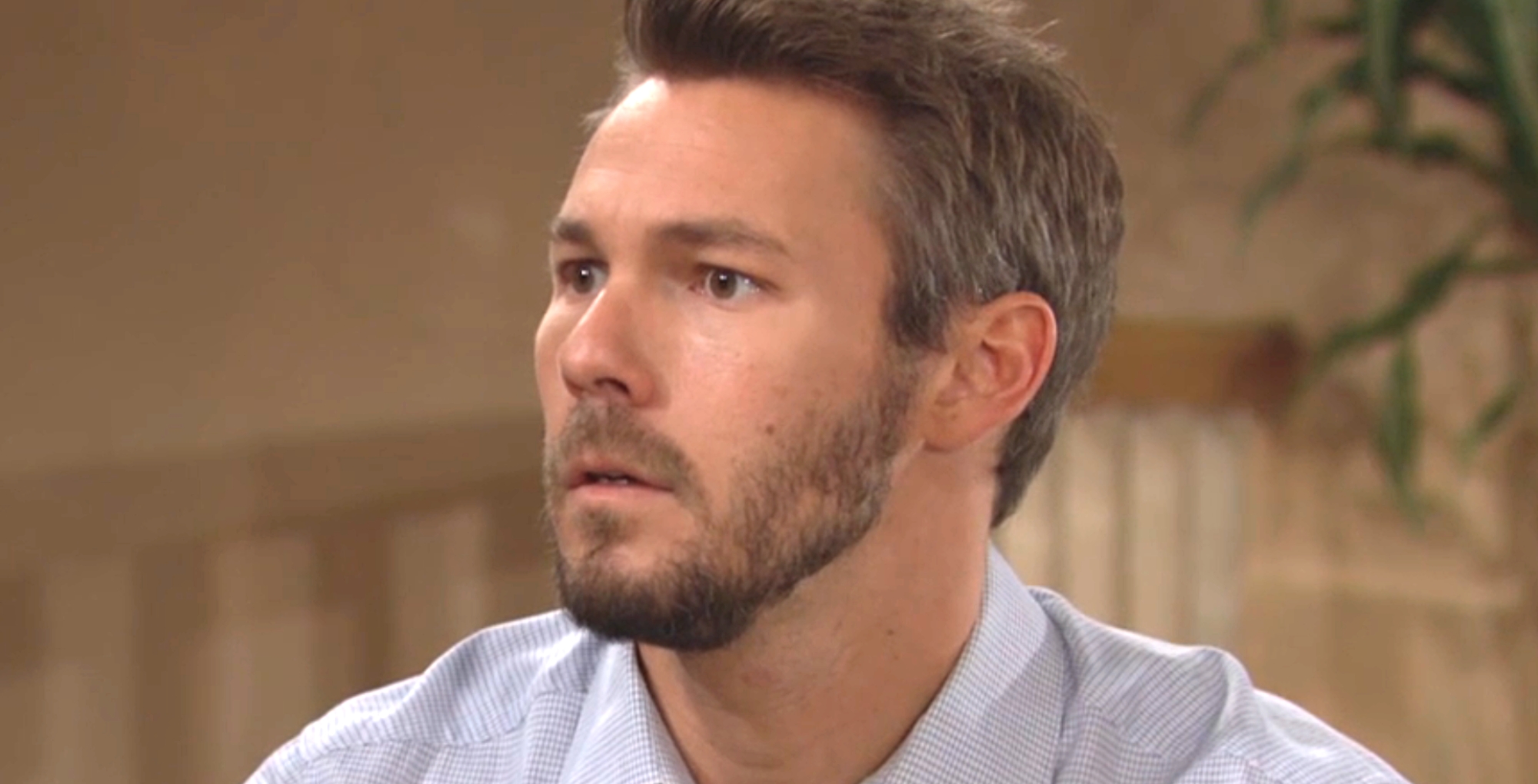

The Bold And The Beautiful Liams Collapse A Fight For Survival

Apr 24, 2025

The Bold And The Beautiful Liams Collapse A Fight For Survival

Apr 24, 2025