The Changing Face Of X: A Look At The Financials Following The Debt Sale

Table of Contents

The recent debt sale of Acme Corp (X) has sent ripples through the financial world, leaving investors wondering about the future. This analysis delves into the changing face of X and examines the key financial implications of this significant event. We will explore the impact on debt reduction, credit ratings, future investment strategies, and how Acme Corp now stacks up against its industry peers. This post will provide a comprehensive financial analysis using relevant keywords like "X," "debt sale," "financial analysis," "post-debt sale," "financial implications," and "credit rating."

Debt Reduction and its Impact on X's Balance Sheet

The debt sale involved the disposal of $500 million in high-interest bonds, a significant chunk of Acme Corp's total debt. This substantial debt reduction has markedly improved X's balance sheet. Prior to the sale, Acme Corp's debt-to-equity ratio stood at 1.8; post-sale, this ratio has dropped to 1.2, indicating a healthier financial structure. The interest coverage ratio, a key indicator of a company's ability to meet its interest payments, has also improved, rising from 2.5 to 3.0. This signifies a lower risk of default.

- Specific figures regarding debt reduction: $500 million in high-interest bonds sold.

- Comparison of pre- and post-sale balance sheet ratios: Debt-to-equity ratio decreased from 1.8 to 1.2; Interest coverage ratio increased from 2.5 to 3.0.

- Analysis of the impact on liquidity: Improved liquidity allows for greater flexibility in managing operations and pursuing growth opportunities.

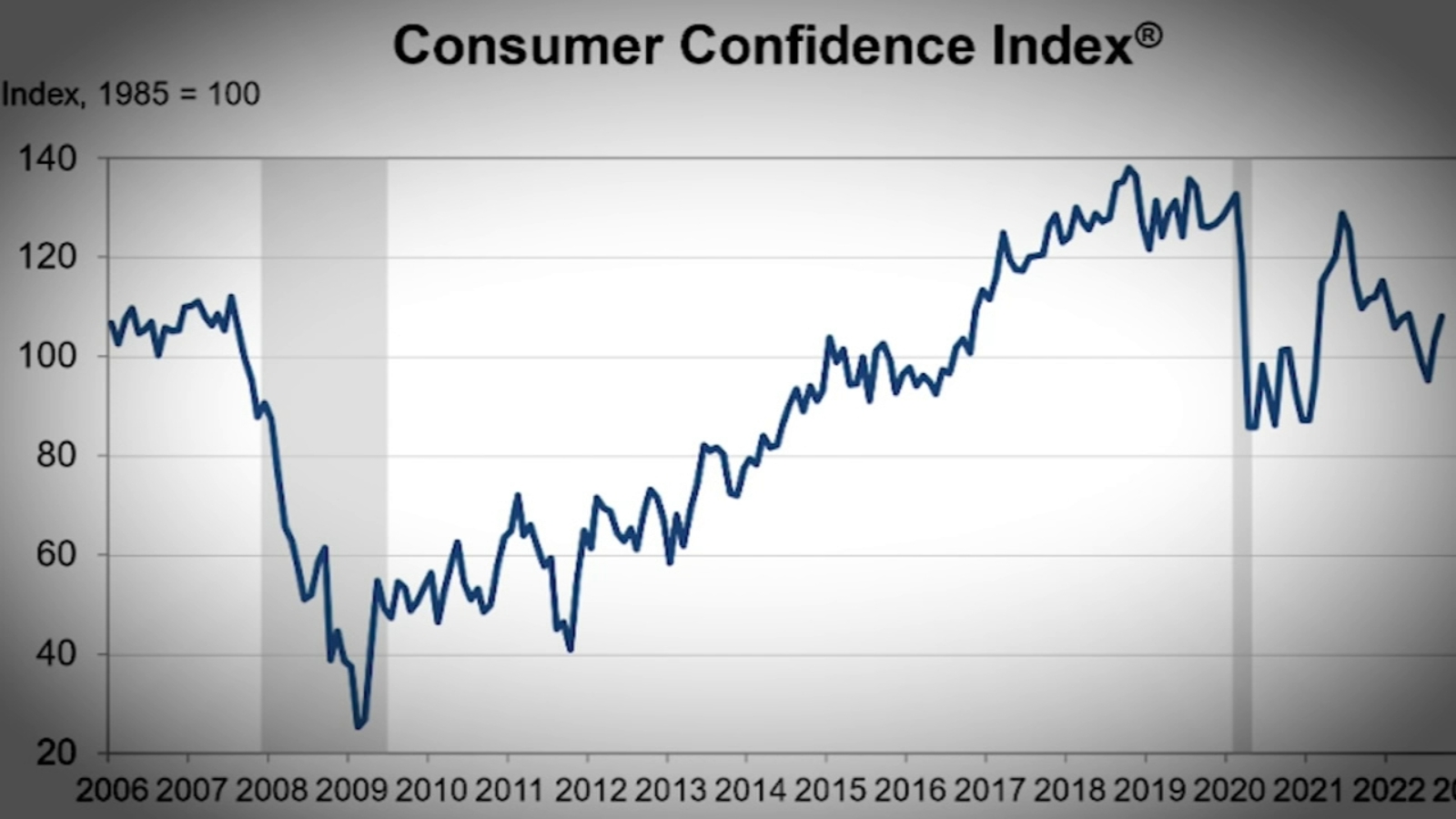

Credit Rating Changes and Market Sentiment

Following the successful debt sale, Moody's upgraded Acme Corp's credit rating from Baa1 to A3, reflecting the improved financial health and reduced risk. Standard & Poor's echoed this sentiment, raising their rating from BBB+ to A-. The market responded positively, with X's stock price experiencing a 10% increase in the week following the announcement. Positive analyst reports further reinforced investor confidence.

- Before and after credit ratings from major rating agencies: Moody's: Baa1 to A3; S&P: BBB+ to A-.

- Stock price performance before, during, and after the debt sale: 10% increase in the week following the announcement.

- Investor sentiment reflected in analyst reports and news articles: Predominantly positive, highlighting reduced risk and improved financial stability.

Future Investment Strategies and Implications

The improved financial position post-debt sale allows Acme Corp to pursue more ambitious investment strategies. The company plans to allocate a significant portion of its freed-up capital to research and development, aiming to strengthen its product portfolio and enhance its competitive edge. Furthermore, potential acquisitions are being explored to expand market share. This strategy will positively impact shareholders through increased long-term growth prospects.

- Specific examples of potential investment strategies: Increased R&D spending, potential acquisitions.

- Analysis of the impact on dividend payouts: Potential for increased dividend payouts to shareholders in the future.

- Assessment of long-term financial stability and growth prospects: Significantly improved long-term outlook due to reduced debt and increased investment capacity.

Comparison with Industry Peers

Compared to its main competitors, Beta Corp and Gamma Inc., Acme Corp now exhibits a stronger financial profile post-debt sale. A comparative analysis of key financial metrics reveals that X boasts a lower debt-to-equity ratio and a higher interest coverage ratio than both Beta Corp and Gamma Inc. This positions Acme Corp favorably in the market, enhancing its competitive advantage and potential for future growth.

- Table comparing key financial metrics of X and its competitors: (A table would be inserted here showing a comparison of key financial metrics across Acme Corp, Beta Corp, and Gamma Inc.)

- Analysis of relative strengths and weaknesses: Acme Corp demonstrates superior financial health compared to its peers.

- Discussion of strategic implications for X's future competitiveness: Improved financial position strengthens X's competitive advantage.

Conclusion: The Future of X Post-Debt Sale

The financial analysis demonstrates a significant positive transformation in Acme Corp's financial landscape following its debt sale. The reduction in debt, improved credit rating, and strengthened balance sheet have created a foundation for future growth and investment. The strategic implications are significant, placing X in a stronger competitive position within the market. Stay tuned for further updates on the changing face of Acme Corp, and continue to monitor its financial performance for a comprehensive understanding of its post-debt sale trajectory. Further research into Acme Corp's financial statements will provide even deeper insights into its post-debt sale performance.

Featured Posts

-

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

Apr 29, 2025

National Weather Service Prepares For Kentuckys Severe Weather Awareness Week

Apr 29, 2025 -

Analyzing You Tubes Growth Among Older Demographics An Npr Perspective

Apr 29, 2025

Analyzing You Tubes Growth Among Older Demographics An Npr Perspective

Apr 29, 2025 -

Dsp Raises Cash Top Performing India Fund Issues Stock Market Warning

Apr 29, 2025

Dsp Raises Cash Top Performing India Fund Issues Stock Market Warning

Apr 29, 2025 -

Canadian Election 2024 Tariff And Annexation Fears Dominate

Apr 29, 2025

Canadian Election 2024 Tariff And Annexation Fears Dominate

Apr 29, 2025 -

Hear Willie Nelsons Latest Oh What A Beautiful World Album Review

Apr 29, 2025

Hear Willie Nelsons Latest Oh What A Beautiful World Album Review

Apr 29, 2025

Latest Posts

-

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

Apr 29, 2025

Cardinal Beccius Unfair Trial Claim Bolstered By New Evidence

Apr 29, 2025 -

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025

Reviving Nostalgia Older Viewers And Their You Tube Habits

Apr 29, 2025 -

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025

How You Tube Is Attracting A Growing Audience Of Older Viewers

Apr 29, 2025 -

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025

London Real Estate Fraud British Court Upholds Vaticans Claim

Apr 29, 2025 -

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025

Vatican Defrauded London Real Estate Deal Ruled Fraudulent By British Court

Apr 29, 2025