The Changing Face Of X: Financial Implications Of Musk's Debt Deal

Table of Contents

The Acquisition's Debt Structure

Musk's acquisition of X was a leveraged buyout, meaning it was primarily financed with debt rather than equity. This resulted in a high debt-to-equity ratio, significantly increasing X's financial risk. The financing for Musk's acquisition involved a complex mix of:

- High-yield bonds: These are considered riskier investments, reflecting the substantial financial burden taken on by X.

- Bank loans: Several financial institutions provided substantial loans to facilitate the acquisition.

- Equity contributions: While a significant portion was debt-financed, Musk and other investors also contributed equity.

The substantial debt load immediately impacted X's creditworthiness. Credit rating agencies downgraded X's credit rating, signaling increased risk to lenders and investors. This increased the cost of borrowing for X, making future financing more expensive and potentially hindering its growth prospects. The massive debt associated with "Musk's acquisition financing" and "X debt" presents a significant challenge for the company's future financial stability.

Impact on X's Financial Performance

The high levels of "X debt" translate to a substantial increase in interest expense, directly impacting X's profitability. This increased expense eats into the company's operating income, potentially leading to reduced profits or even losses. Further challenges include:

- Cash flow challenges: Meeting the substantial debt obligations requires significant cash flow. Any downturn in revenue could severely impact X's ability to service its debt.

- Reduced investment capacity: The considerable financial burden limits X's ability to invest in crucial areas like product development, marketing, and talent acquisition, potentially hindering its long-term growth.

- Vulnerability to economic downturns: In a volatile economic climate, servicing substantial debt becomes even more challenging, potentially leading to financial distress. This "cash flow challenges" and the strain on "X profitability" are major concerns.

Strategic Implications and Restructuring Efforts

To mitigate the risks associated with the substantial "X debt," Musk is likely to pursue several strategies:

- Cost-cutting measures: Expect reductions in operational expenses, potential layoffs, and a focus on efficiency.

- Increased revenue generation: Musk may focus on aggressively growing X's revenue streams through measures like subscription services and enhanced advertising offerings.

- Asset sales: Non-core assets could be sold to generate cash and reduce the overall debt burden.

- Debt restructuring or refinancing: X might explore options to restructure its debt, potentially extending repayment terms or securing more favorable interest rates.

These "cost-cutting measures" and efforts to boost "X revenue" are crucial for reducing the debt burden and improving the company's financial health. The success of these "strategic implications" will be critical in determining X's future.

Long-Term Outlook and Investor Sentiment

The market's reaction to the substantial debt burden has been mixed. While some investors remain optimistic about Musk's vision and potential for growth, others harbor concerns about the financial risks involved. "Investor sentiment" is cautious, and the "X stock valuation" (if applicable) reflects this uncertainty.

- Potential risks: Failure to manage the debt effectively, economic downturns, and competition could significantly impact X's financial stability.

- Potential opportunities: Successful implementation of cost-cutting measures, revenue growth strategies, and debt restructuring could lead to improved financial performance and increased investor confidence. The "long-term outlook" remains uncertain, making it vital to monitor developments closely.

The "financial stability" of X hinges on successfully navigating these challenges and capitalizing on opportunities.

Conclusion: Navigating the Changing Face of X: The Future of Musk's Debt Deal

Musk's debt deal has undeniably reshaped the financial landscape of X, presenting both significant challenges and potential opportunities. The high levels of debt impose a considerable financial burden, impacting profitability, cash flow, and investment capacity. However, strategic initiatives aimed at cost reduction, revenue growth, and debt restructuring could improve X's financial trajectory. The "changing face of X" will be defined by its success in navigating this complex financial situation. To stay updated on the ongoing developments concerning "Musk's debt deal" and the "financial implications" for X, subscribe to our newsletter or follow reputable financial news outlets.

Featured Posts

-

Yankees Judge And Cardinals Goldschmidt Lead In Crucial Series Victory

Apr 28, 2025

Yankees Judge And Cardinals Goldschmidt Lead In Crucial Series Victory

Apr 28, 2025 -

2000 Yankees Season Joe Torre Andy Pettitte And A Twin City Shutout

Apr 28, 2025

2000 Yankees Season Joe Torre Andy Pettitte And A Twin City Shutout

Apr 28, 2025 -

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 28, 2025

Aaron Judge And Paul Goldschmidt Power Yankees To Series Salvaging Win

Apr 28, 2025 -

Hollywood Shutdown Writers And Actors On Strike What It Means For The Industry

Apr 28, 2025

Hollywood Shutdown Writers And Actors On Strike What It Means For The Industry

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Latest Posts

-

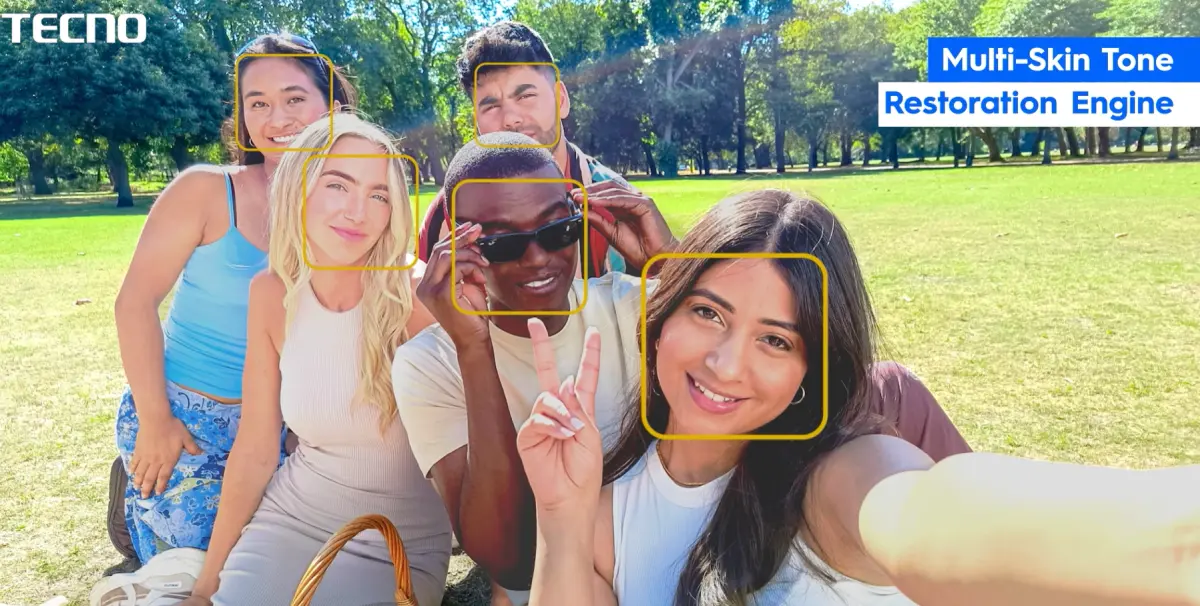

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025 -

Coras Subtle Lineup Changes For Red Sox Doubleheader

Apr 28, 2025

Coras Subtle Lineup Changes For Red Sox Doubleheader

Apr 28, 2025