The Chilling Effect Of Trump Tariffs: Affirm's Stalled IPO And The Future Of Fintech

Table of Contents

The Trump Tariffs and Their Economic Ripple Effect

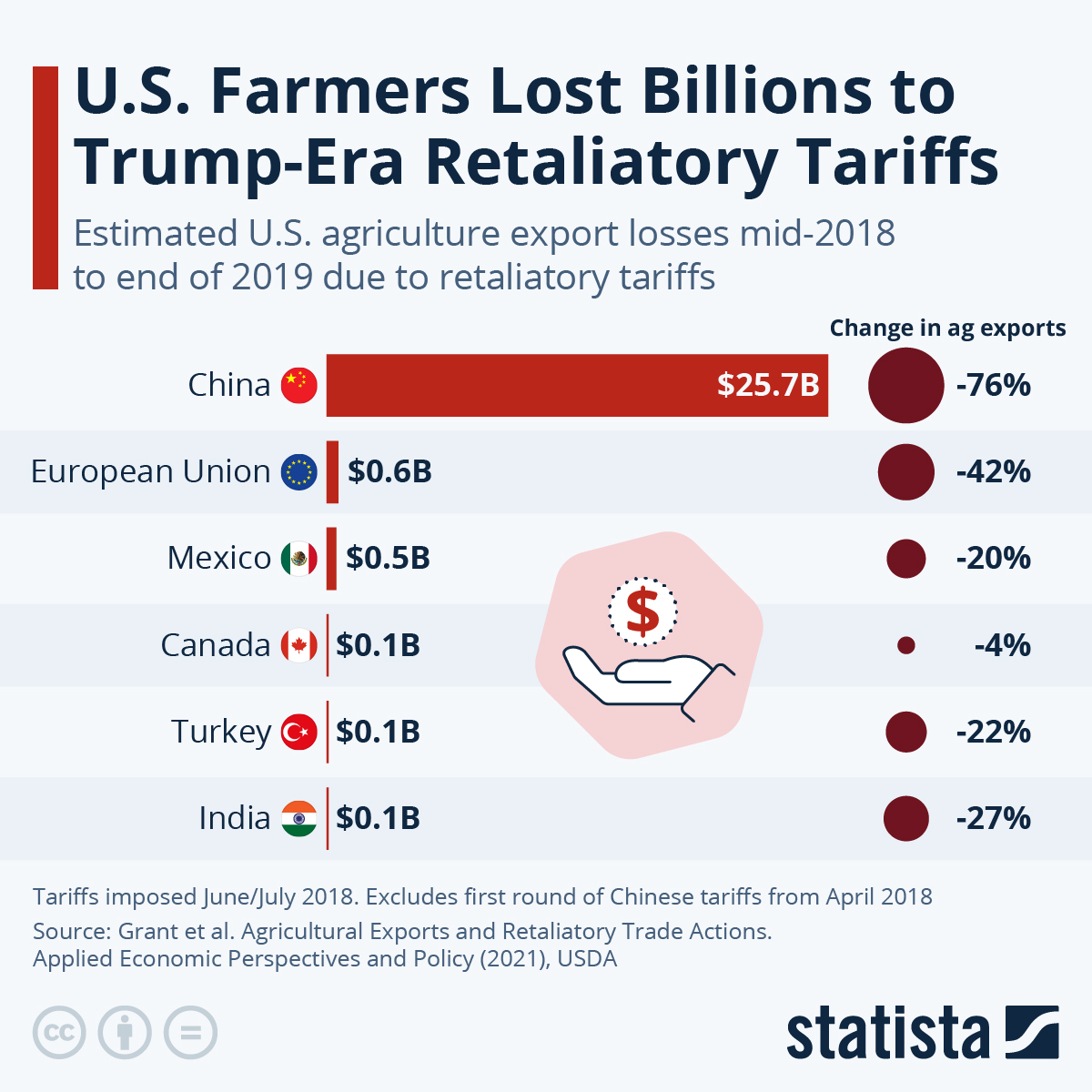

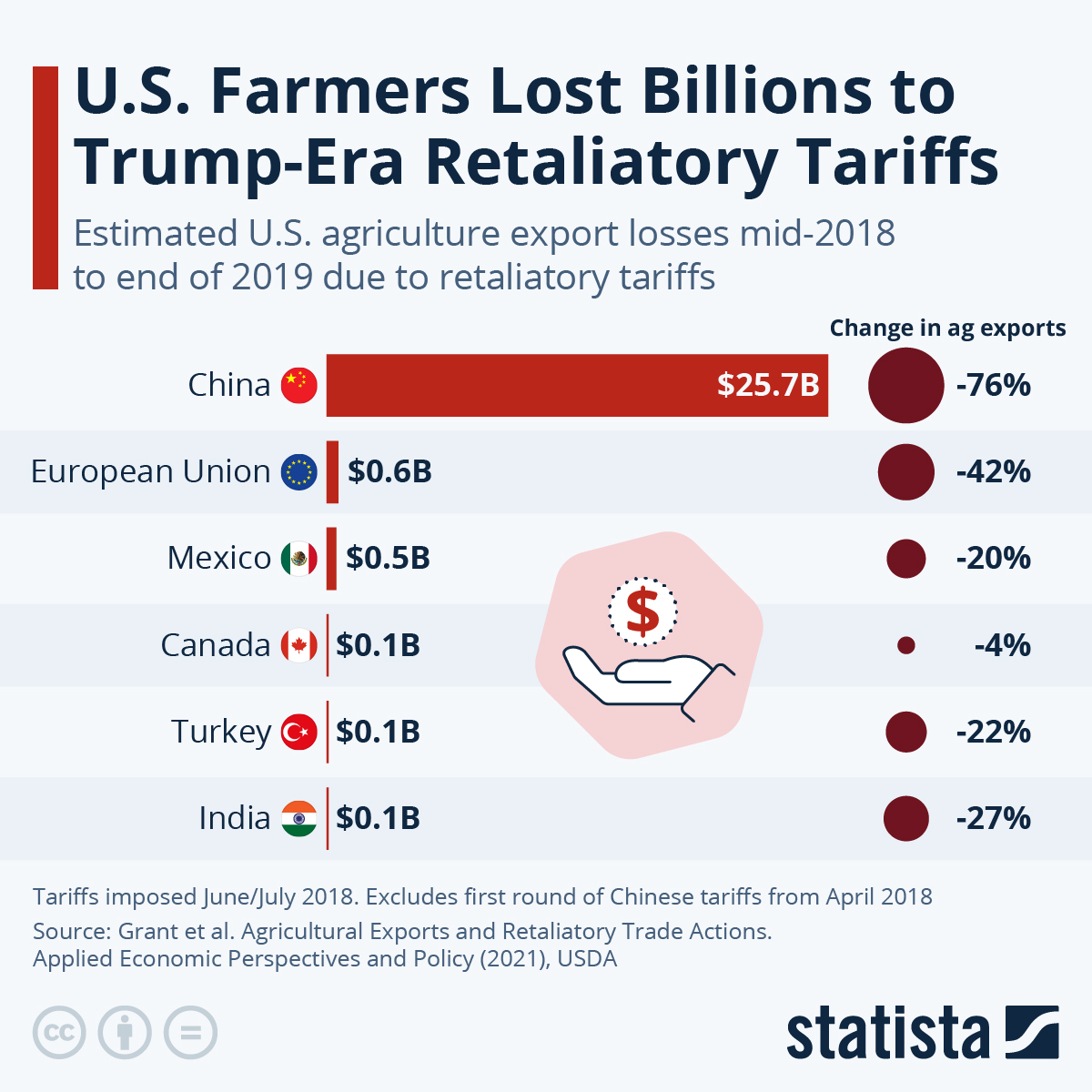

The Trump administration imposed significant tariffs on imported goods from various countries, aiming to protect American industries and jobs. These tariffs, often part of a broader "trade war," significantly increased the cost of imported goods and components. The intended goal was to bolster domestic manufacturing and reduce the US trade deficit. However, the reality was far more complex and ultimately detrimental to global economic health.

The impact extended far beyond the targeted industries. Global supply chains, intricately woven across borders, were severely disrupted. This led to:

- Increased costs for imported goods and components: Businesses faced higher input costs, forcing them to either absorb the increased expenses or pass them on to consumers in the form of higher prices.

- Reduced global economic growth: The uncertainty surrounding tariffs dampened investment and slowed economic growth worldwide. Businesses hesitated to commit to long-term projects due to the unpredictable trade environment.

- Uncertainty in international markets: The fluctuating nature of tariff policies created instability and unpredictability in international markets, making it difficult for businesses to plan and invest.

- Impact on inflation and consumer spending: The increased cost of goods led to higher inflation, impacting consumer spending and potentially slowing economic growth further.

These factors, fueled by the Trump tariffs and the resulting trade war, created a climate of economic uncertainty that had far-reaching consequences, including the ripple effect felt by companies like Affirm. The keyword "Trump tariffs" is deeply intertwined with the resulting "trade war" and "global supply chain" disruptions.

Affirm's Stalled IPO: A Case Study in Tariffs' Indirect Impact

Affirm, a prominent player in the fintech space offering flexible payment options, relies on robust global supply chains. This includes manufacturing components for its technological infrastructure and sourcing software components from international markets. The Trump tariffs directly impacted Affirm's operational costs.

The tariff-related increase in import costs had a significant impact on Affirm's bottom line:

- Increased operational expenses due to tariff-inflated import costs: Higher prices for imported components directly increased Affirm's operational expenditure, squeezing its profit margins.

- Pressure on profit margins and reduced investor appetite: The reduced profitability made Affirm a less attractive investment prospect for many potential investors.

- Delay in achieving projected financial milestones for the IPO: The unexpected increase in operational costs hindered Affirm's ability to meet its projected financial targets, delaying its highly anticipated IPO.

- The broader impact on the fintech investment climate: Affirm's experience highlights the broader impact of trade uncertainties on investor sentiment towards fintech companies. Uncertainty breeds risk aversion.

The impact on Affirm underscores how even companies seemingly insulated from direct tariff impacts can suffer from the broader economic consequences of protectionist trade policies. The keywords "Affirm IPO," "Fintech investment," and "supply chain disruptions" are intrinsically linked in this case study.

The Role of Geopolitical Uncertainty

The uncertainty generated by the Trump tariffs significantly amplified the risk assessment of investors. The unpredictable nature of trade policy created a climate of fear, impacting market sentiment towards not just Affirm, but the entire fintech sector.

- Heightened risk aversion among investors: Investors became more cautious, demanding higher returns to compensate for the increased risk in an unstable global economy.

- Reduced capital availability for fintech startups: The decreased investor appetite translated into reduced capital availability for smaller, emerging fintech companies, hindering their growth and innovation.

- Increased difficulty in securing funding for expansion: Even established fintech companies, like Affirm, found it harder to secure funding for expansion projects due to the uncertain economic outlook.

- Long-term implications for fintech innovation: The overall chill in the investment climate could stifle innovation and slow the growth of the fintech sector in the long term.

The keywords "Geopolitical risk," "investor sentiment," "Fintech funding," and "market volatility" perfectly encapsulate the challenges faced by the fintech industry during this period.

Long-Term Implications for the Fintech Sector

The Trump tariffs' lasting effects on the fintech landscape are significant and far-reaching. The experience serves as a cautionary tale, illustrating the interconnectedness of global trade and the fintech industry.

- Increased focus on domestic sourcing and manufacturing: Fintech companies may increasingly prioritize domestic sourcing to mitigate future risks associated with international trade disputes. This could lead to a reshoring of some operations.

- Restructuring of global supply chains within the fintech sector: Companies may diversify their supply chains, reducing reliance on single sources and regions to mitigate future disruptions.

- Greater regulatory scrutiny of fintech companies: The increased economic uncertainty might lead to greater regulatory oversight of the fintech sector to ensure financial stability.

- Potential for future trade disputes and their impact: The experience with the Trump tariffs highlights the vulnerability of the fintech sector to future trade disputes and the need for robust risk management strategies.

The keywords "Fintech regulation," "domestic manufacturing," "global supply chain restructuring," and "trade policy" are crucial for understanding the long-term effects on the industry.

Conclusion

The chilling effect of Trump tariffs extended beyond traditional industries, significantly impacting the promising fintech sector. Affirm's delayed IPO serves as a stark reminder of the unintended consequences of protectionist trade policies. The increased costs, economic uncertainty, and reduced investor confidence created a challenging environment for fintech companies. Understanding the long-term implications of these policies is crucial for navigating the future of financial technology. By analyzing the impacts of past trade disputes, stakeholders can better prepare for future economic volatility and ensure the continued growth and innovation within the fintech space. To stay informed about the evolving landscape and the ongoing implications of Trump tariffs and similar trade policies on the future of fintech, continue to follow industry news and analysis.

Featured Posts

-

Liverpool Transfer News Latest On Dean Huijsen

May 14, 2025

Liverpool Transfer News Latest On Dean Huijsen

May 14, 2025 -

Vandaag Inside Derksens Onthullingen Over De Vader Van Dean Huijsen Donny Huijsen

May 14, 2025

Vandaag Inside Derksens Onthullingen Over De Vader Van Dean Huijsen Donny Huijsen

May 14, 2025 -

Coco Gauff And Peyton Stearns Us Duo Dominates In Rome

May 14, 2025

Coco Gauff And Peyton Stearns Us Duo Dominates In Rome

May 14, 2025 -

Lindts Central London Chocolate Shop A Sweet New Opening

May 14, 2025

Lindts Central London Chocolate Shop A Sweet New Opening

May 14, 2025 -

Bucci Il Festival Di Sanremo Un Piano B Per La Regione Liguria

May 14, 2025

Bucci Il Festival Di Sanremo Un Piano B Per La Regione Liguria

May 14, 2025