The D-Wave Quantum (QBTS) Stock Market Crash On Monday: Causes And Effects

Table of Contents

H2: Potential Triggers for the D-Wave Quantum Stock Crash

H3: Disappointing Earnings Report

D-Wave Quantum's recent earnings report significantly underperformed expectations, triggering a sell-off in QBTS stock. Key underperformances included:

- Lower-than-expected revenue: The company's revenue fell short of analyst projections, indicating weaker-than-anticipated market demand for their quantum computing solutions. This shortfall raised concerns about the company's ability to generate sufficient cash flow for future growth.

- Missed profit targets: D-Wave failed to meet its projected profit margins, further fueling investor anxieties. The widening gap between projected and actual profits signaled potential operational inefficiencies or challenges in scaling their business model.

- Negative outlook for future quarters: The company's guidance for upcoming quarters was also less optimistic than anticipated, suggesting a continuation of the current financial difficulties. This pessimistic forecast contributed to the negative investor sentiment and the subsequent QBTS stock crash.

These factors combined created a perfect storm, leading to a significant drop in QBTS stock price. The market reacted negatively to the apparent inability of D-Wave to translate its technological advancements into substantial financial gains.

H3: Increased Competition in the Quantum Computing Market

The quantum computing landscape is becoming increasingly competitive, with major players like IBM, Google, and numerous startups vying for market share. This intensifying competition directly impacts D-Wave's prospects:

- Growing competition from IBM: IBM's consistent advancements in quantum computing technology and its robust ecosystem of partners pose a significant challenge to D-Wave's market dominance.

- Google's advancements in quantum supremacy: Google's claims of achieving "quantum supremacy" – surpassing the capabilities of classical computers – have shifted investor focus towards its technologies, potentially diverting attention and capital away from D-Wave.

- Emergence of new quantum computing startups: The emergence of innovative startups with potentially disruptive technologies also adds pressure on established players like D-Wave, increasing the overall competitive intensity within the sector.

This heightened competition creates a challenging environment for D-Wave, making it harder to attract investors and maintain its market position.

H3: Wider Market Downturn/Sector-Specific Sell-Off

The D-Wave Quantum stock crash coincided with a broader market downturn and a sector-specific sell-off in technology stocks. This context is crucial to understanding the scale of the decline:

- Overall market volatility: A general climate of uncertainty in the broader financial markets contributed to increased risk aversion among investors, triggering selling across various sectors, including technology.

- Tech sector downturn: The technology sector, as a whole, experienced a period of correction, with many tech stocks experiencing significant price drops. This broader trend amplified the downward pressure on QBTS stock.

- Investor sentiment impacting QBTS: Negative investor sentiment towards the technology sector as a whole likely exacerbated the decline in D-Wave's stock price, contributing to the severity of the QBTS stock crash.

The confluence of a broader market correction and sector-specific sell-off significantly amplified the impact of D-Wave's internal challenges.

H3: Lack of Significant New Technological Advancements

The absence of substantial new product announcements or technological breakthroughs may have also contributed to the decline in investor confidence.

- Delayed product launches: Any delays in launching new, innovative products could have fueled concerns about D-Wave's ability to remain competitive and meet market demands.

- Unmet expectations in R&D advancements: If D-Wave's research and development efforts failed to deliver on promised advancements, this would likely negatively impact investor perception and fuel selling pressure.

- Limited demonstrable progress: Without clear demonstrations of significant progress in overcoming key technological hurdles, investors may have become less optimistic about D-Wave's long-term prospects.

The perception of slower-than-expected technological progress played a role in the market's reaction to the D-Wave Quantum stock crash.

H2: Effects of the D-Wave Quantum Stock Crash

H3: Impact on Investors

The D-Wave Quantum stock crash had significant consequences for investors:

- Significant loss for short-term investors: Short-term investors holding QBTS stock experienced substantial financial losses due to the sudden and sharp decline in the share price.

- Erosion of investor confidence in QBTS: The crash significantly eroded investor confidence in D-Wave's future prospects, making it harder for the company to attract further investment.

- Potential impact on future funding rounds: The negative market reaction could make it more difficult for D-Wave to secure funding in future rounds, potentially hindering its growth and development.

H3: Consequences for D-Wave Quantum (Company)

The stock crash presents substantial challenges for D-Wave:

- Challenges in securing further investment: The negative market sentiment will likely make it harder for D-Wave to attract new investors and secure the capital needed for continued growth and development.

- Pressure to demonstrate profitability: The company will face increased pressure to demonstrate profitability and sustainable growth to regain investor confidence.

- Potential for job cuts or restructuring: To address financial challenges, D-Wave may be forced to undertake cost-cutting measures, including potential job losses or restructuring of its operations.

H3: Wider Implications for the Quantum Computing Industry

The QBTS stock crash has broader implications for the quantum computing sector:

- Reduced investor enthusiasm for quantum computing: The sharp decline in D-Wave's stock price could dampen investor enthusiasm for the entire quantum computing industry, making it harder for other companies in the sector to attract investment.

- Potential slowdown in investment in the sector: The negative market reaction may lead to a slowdown in investment in the quantum computing sector, potentially hindering its growth and development.

- Focus shift towards more mature quantum computing companies: Investors may shift their focus towards more established and financially stable companies in the quantum computing field, potentially leaving less mature companies like D-Wave struggling to secure funding.

Conclusion:

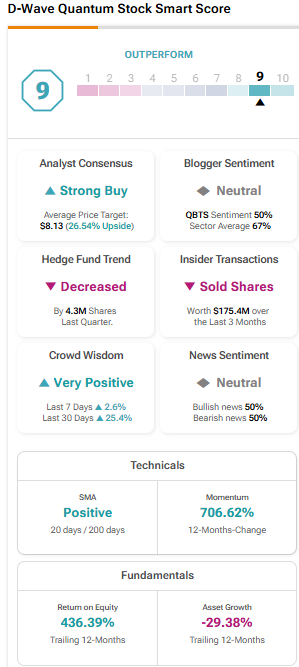

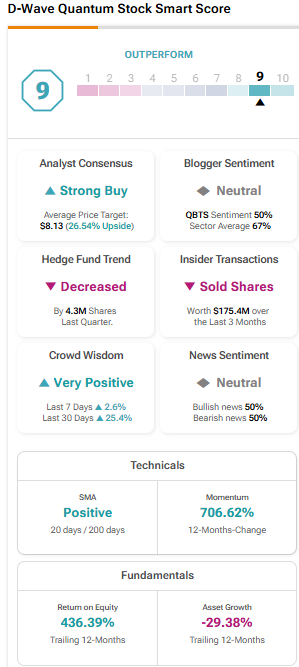

The sudden D-Wave Quantum (QBTS) stock market crash highlights the risks inherent in investing in emerging technologies like quantum computing. Several factors contributed to this decline, including disappointing earnings, increased competition, and broader market trends. While the long-term impact on D-Wave and the quantum computing sector remains uncertain, understanding the factors behind the D-Wave Quantum stock crash is crucial for making informed investment decisions. Careful analysis of financial reports, competitive landscapes, and market sentiment is essential for navigating the complexities of the Quantum Computing Stock Market and investing in QBTS and similar ventures. Stay informed about D-Wave Quantum (QBTS) and other quantum computing stocks to make better investment choices.

Featured Posts

-

The Traverso Family Legacy Cannes Film Festival Photography

May 21, 2025

The Traverso Family Legacy Cannes Film Festival Photography

May 21, 2025 -

Updated Forecast Precise On And Off Times For Rain

May 21, 2025

Updated Forecast Precise On And Off Times For Rain

May 21, 2025 -

A Beloved Villains Return In Dexter Resurrection

May 21, 2025

A Beloved Villains Return In Dexter Resurrection

May 21, 2025 -

The Gretzky Loyalty Question Examining Trumps Impact On Canada Us Relations

May 21, 2025

The Gretzky Loyalty Question Examining Trumps Impact On Canada Us Relations

May 21, 2025 -

High Winds And Fast Storms A Guide To Staying Safe

May 21, 2025

High Winds And Fast Storms A Guide To Staying Safe

May 21, 2025