The Definitive Guide To Proxy Statements (Form DEF 14A)

Table of Contents

What is a Proxy Statement (Form DEF 14A)?

A proxy statement is a crucial document companies file with the Securities and Exchange Commission (SEC) before a shareholder meeting. Its primary purpose is to inform shareholders about matters that will be voted on at the meeting and to solicit their votes. The SEC, the regulatory body overseeing US financial markets, mandates the filing of Form DEF 14A to ensure transparency and protect shareholder rights. Proxy statements are essential for shareholder voting rights because they provide the information necessary for shareholders to make informed decisions on important corporate matters. Without them, shareholder participation in corporate governance would be severely hampered.

- Provides information to shareholders before a shareholder meeting.

- Details proposals up for a vote (e.g., electing directors, approving executive compensation, mergers and acquisitions).

- Contains information on company performance, executive compensation, and other relevant matters, including significant accounting changes or legal proceedings.

- Is a critical tool for informed shareholder participation in corporate governance. Understanding and acting upon this information helps ensure accountability and good corporate governance practices.

Key Information Contained within a DEF 14A Filing

Proxy statements are multifaceted documents containing a wealth of information relevant to investors. Understanding each section is critical for effective shareholder engagement and responsible investment. Let's explore the major sections:

- Executive compensation: A detailed breakdown of salaries, bonuses, stock options, restricted stock units (RSUs), and other benefits received by executive officers. Analyzing this section allows shareholders to assess the fairness and reasonableness of executive pay relative to company performance.

- Director nominations and biographies: Provides information about candidates for the board of directors, including their qualifications, experience, and potential conflicts of interest. This section is crucial for evaluating the board's composition and its ability to effectively oversee management.

- Shareholder proposals: Proposals submitted by shareholders for consideration at the meeting. These proposals can cover a wide range of topics, including environmental, social, and governance (ESG) issues, executive compensation, and corporate social responsibility.

- Auditor reports: Reports from the company’s independent auditors, providing an independent assessment of the company's financial statements. This section is vital for verifying the accuracy and reliability of the company’s financial disclosures.

- Company performance and financial information: Key financial data and performance metrics, such as revenue, net income, earnings per share (EPS), and cash flow. This information is essential for evaluating the company's overall financial health and prospects.

Understanding Executive Compensation Disclosures

Executive compensation disclosure within DEF 14A filings often involves complex information. Understanding this section is key to assessing whether executive pay aligns with company performance and shareholder interests.

- Analysis of salary, bonuses, stock options, and other forms of compensation: Carefully examining each component of executive pay helps identify potential excessive compensation or misalignment of incentives.

- Comparison to industry benchmarks and peer companies: Comparing executive compensation to similar companies helps determine if the company's executive pay is competitive or excessive.

- Identification of potential conflicts of interest: Analyzing potential conflicts of interest in executive compensation packages is crucial for assessing the integrity and fairness of the compensation structure.

How to Effectively Use a Proxy Statement for Informed Voting

Effectively using a proxy statement requires careful review and analysis. It’s not just about skimming the surface; understanding the context and implications is crucial for informed voting.

- Read the entire document carefully, focusing on key sections like executive compensation, director nominations, and shareholder proposals.

- Compare proposed executive compensation to industry averages, past performance, and the company's stated goals. Look for any inconsistencies or excessive payouts.

- Review shareholder proposals thoroughly, understanding their potential impact on the company's strategy, financial performance, and overall value.

- Contact the company's investor relations department if you have any questions or require clarification on specific information within the proxy statement. They're there to help you understand the document.

Where to Find and Access Proxy Statements (Form DEF 14A)

Accessing proxy statements is straightforward thanks to the SEC's online resources and company websites.

- The SEC's EDGAR database (www.sec.gov/edgar/searchedgar/companysearch.html): The EDGAR database is a comprehensive repository of SEC filings, including proxy statements. You can search for filings by company name or ticker symbol.

- Company investor relations websites: Most publicly traded companies post their proxy statements on their investor relations websites. This is often the most convenient way to access the document.

- Proxy voting platforms used by brokerage firms: Many brokerage firms provide online platforms that allow you to review and vote on proxy statements for the companies you own.

Conclusion

Understanding and effectively utilizing proxy statements (Form DEF 14A) is crucial for all shareholders to participate actively in corporate governance. This guide has highlighted the key information within these SEC filings and provided practical advice for informed decision-making. By carefully reviewing the information contained in a proxy statement, particularly executive compensation and shareholder proposals, you can make informed voting choices that align with your investment goals. Don't hesitate to use this knowledge to fully engage with your proxy voting rights. Become a more informed shareholder by mastering the art of reading and understanding proxy statements (Form DEF 14A).

Featured Posts

-

New York Daily News Back Pages May 2025

May 17, 2025

New York Daily News Back Pages May 2025

May 17, 2025 -

Budget Friendly Finds Quality On A Dime

May 17, 2025

Budget Friendly Finds Quality On A Dime

May 17, 2025 -

Detroit Pistons Vs New York Knicks Key Factors For Success In 2023 2024

May 17, 2025

Detroit Pistons Vs New York Knicks Key Factors For Success In 2023 2024

May 17, 2025 -

Ny Knicks Vs Brooklyn Nets Free Live Stream April 13 2025 Time Tv Channel And Nba Season Finale Details

May 17, 2025

Ny Knicks Vs Brooklyn Nets Free Live Stream April 13 2025 Time Tv Channel And Nba Season Finale Details

May 17, 2025 -

Microsoft Surface Simplification Another Product Cut

May 17, 2025

Microsoft Surface Simplification Another Product Cut

May 17, 2025

Latest Posts

-

Upad U Teslin Showroom U Berlinu Prosvjednici I Poruka O Planetarnoj Prijetnji

May 17, 2025

Upad U Teslin Showroom U Berlinu Prosvjednici I Poruka O Planetarnoj Prijetnji

May 17, 2025 -

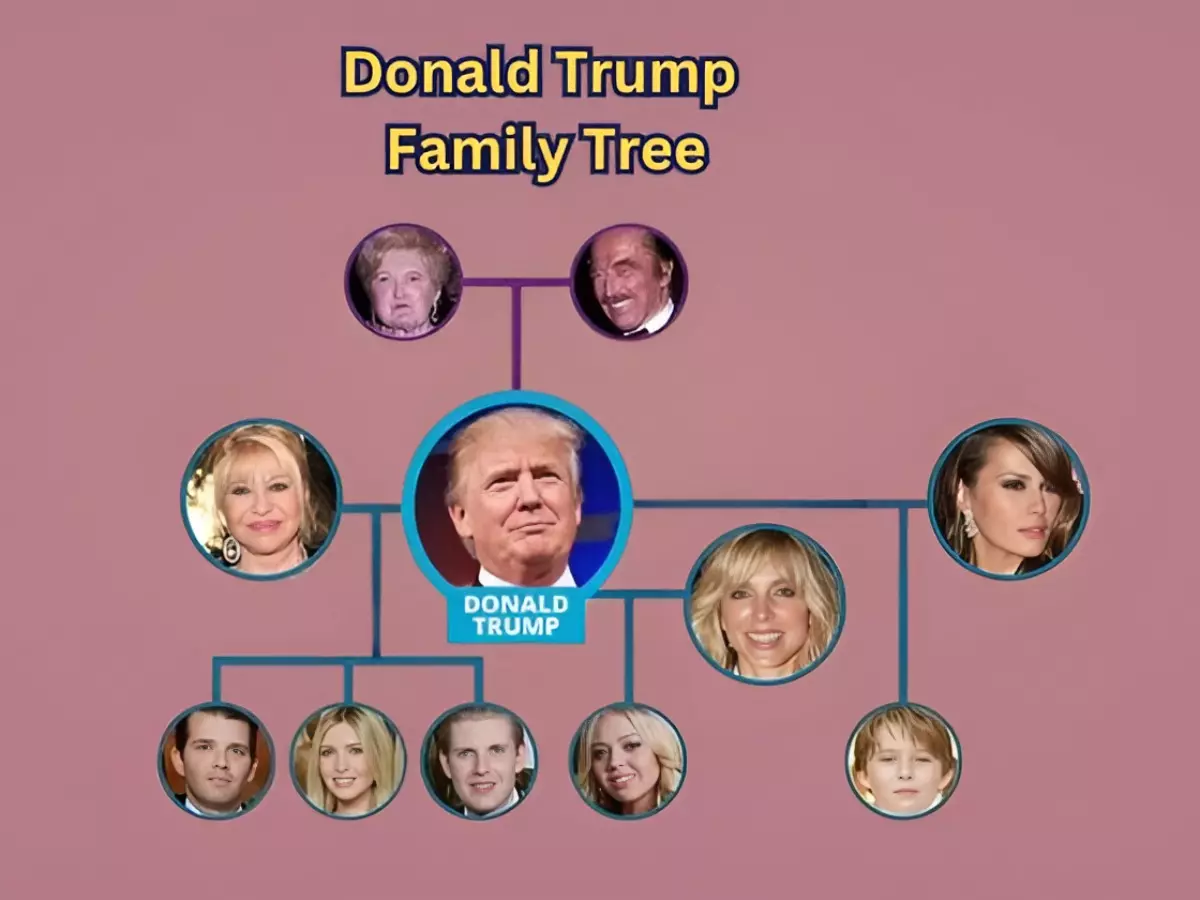

Alexander Boulos Arrives Exploring The Expanding Trump Family Tree

May 17, 2025

Alexander Boulos Arrives Exploring The Expanding Trump Family Tree

May 17, 2025 -

The Night Trump Was Humiliated Lawrence O Donnells Unforgettable Broadcast

May 17, 2025

The Night Trump Was Humiliated Lawrence O Donnells Unforgettable Broadcast

May 17, 2025 -

Melania Trumps Current Role And Public Appearances

May 17, 2025

Melania Trumps Current Role And Public Appearances

May 17, 2025 -

Witness Trumps Humiliation A Defining Moment On Lawrence O Donnells Show

May 17, 2025

Witness Trumps Humiliation A Defining Moment On Lawrence O Donnells Show

May 17, 2025