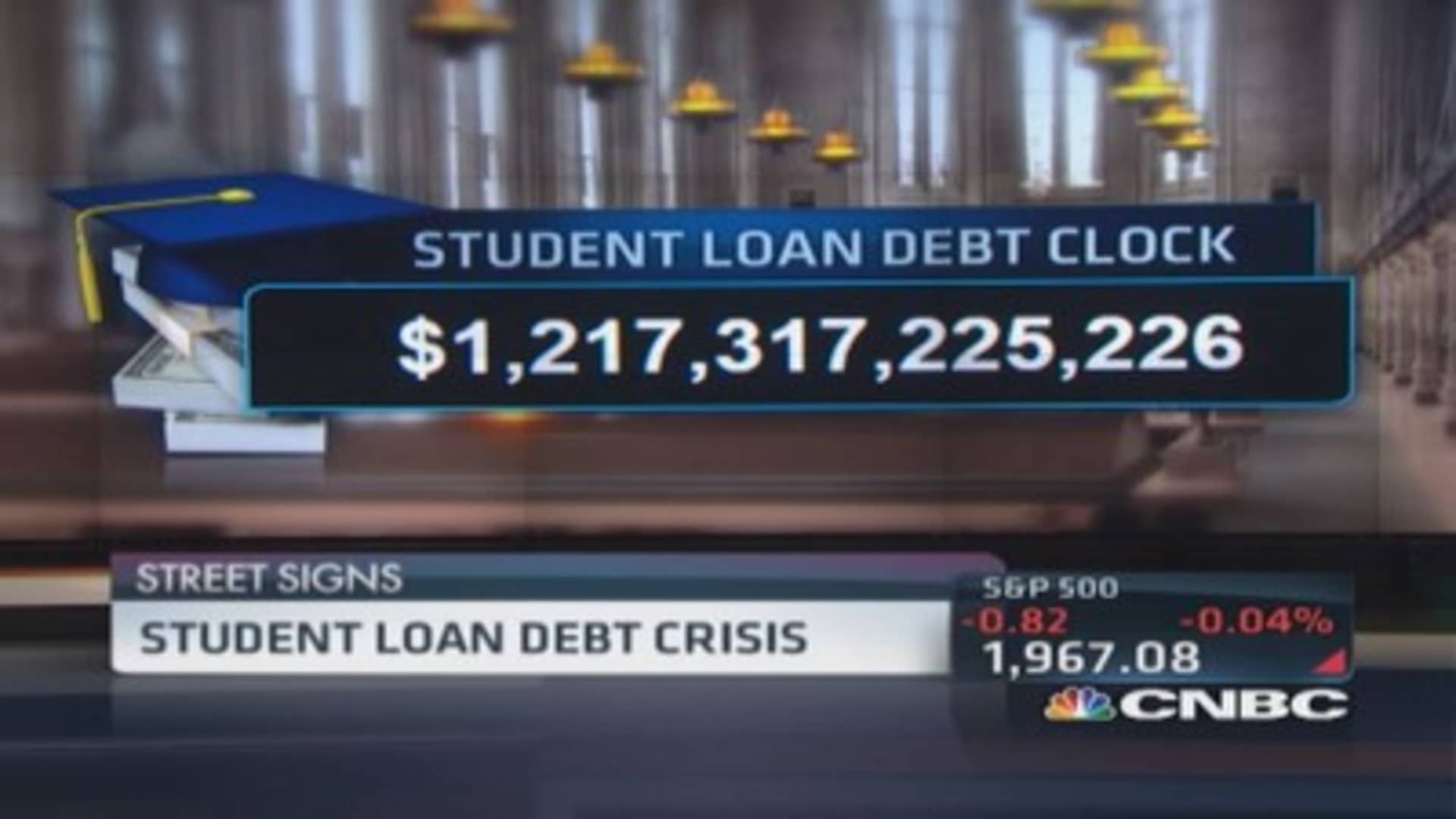

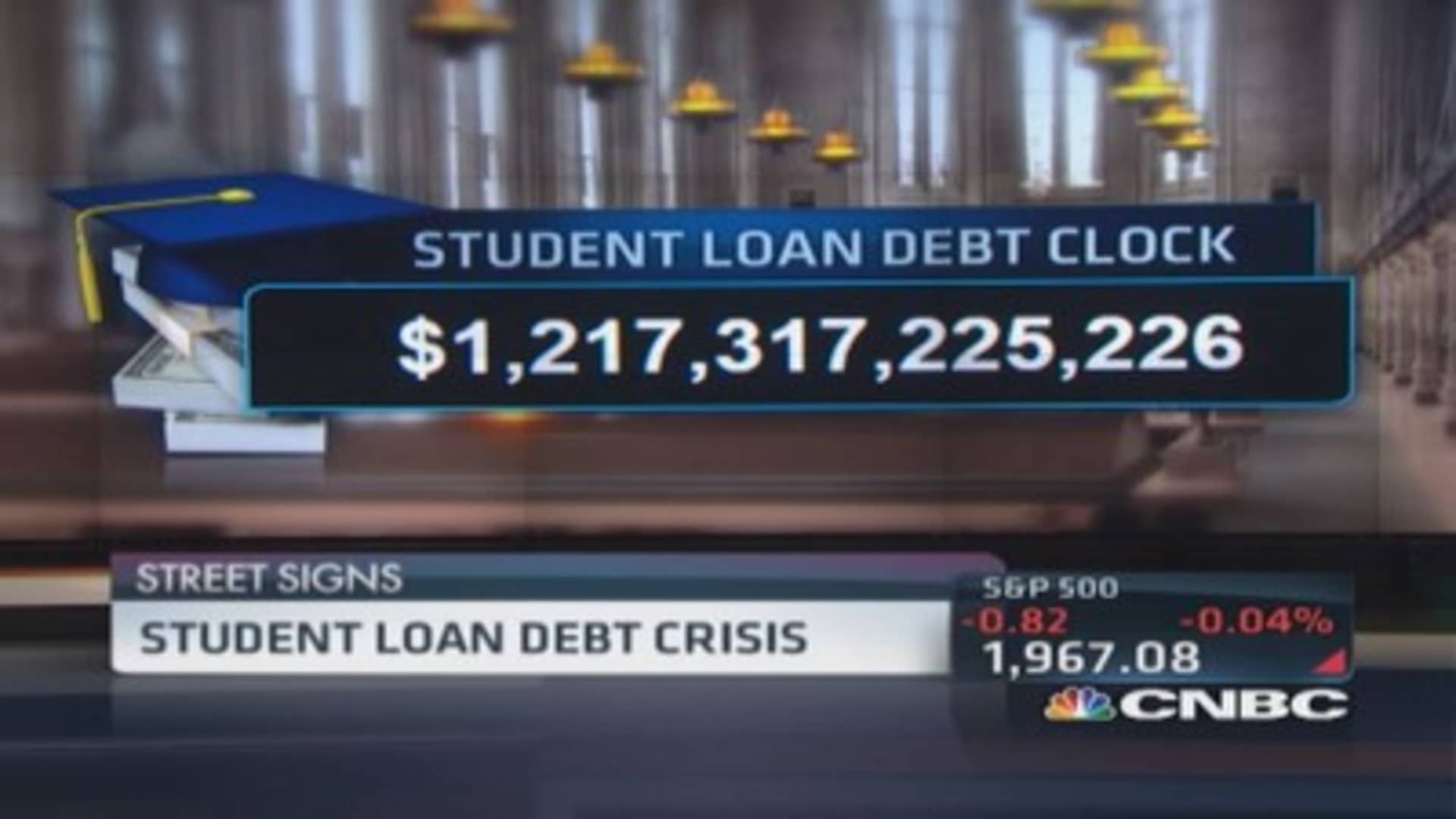

The Economic Ripple Effects Of The Student Loan Crisis

Table of Contents

The Impact on Consumer Spending and Economic Growth

The sheer weight of student loan repayment significantly impacts consumer spending and overall economic growth. High monthly payments eat into disposable income, leaving less money for other essential purchases and investments.

Reduced Disposable Income

- Reduced spending on non-essentials: Many borrowers find themselves foregoing restaurant meals, entertainment, and vacations to meet their loan obligations.

- Delayed major purchases: Aspirations like buying a car or renovating a home are often postponed indefinitely.

- Lower savings rates: The constant pressure of loan repayments leaves little room for saving for retirement or emergencies.

Data from the Federal Reserve shows that a significant percentage of borrowers allocate over 20% of their monthly income to student loan repayment, leaving less for discretionary spending. This reduced consumer spending directly impacts economic growth, creating a vicious cycle of debt and stagnation. The keyword "student loan repayment" is crucial here, as it directly links the burden to its effect on spending.

Delayed Major Life Purchases

Student loan debt often delays major life milestones, impacting not just individual well-being, but also broader economic activity.

- Delayed homeownership: The high cost of student loans significantly reduces the ability to save for a down payment and secure a mortgage.

- Postponed marriage and family: Many young adults delay marriage and starting a family due to the financial burden of student loans.

- Reduced investment opportunities: The lack of disposable income limits opportunities to invest in stocks, bonds, and other assets, hindering long-term financial growth.

Statistics indicate that first-time homebuyers are increasingly older, partly due to the challenges presented by substantial student loan debt. This "student loan burden" delays a crucial economic engine, as homeownership contributes significantly to wealth building and economic activity.

The Effect on Entrepreneurship and Small Business Growth

The student loan crisis significantly stifles entrepreneurship and small business growth, creating a ripple effect that hinders economic innovation and job creation.

Stifled Entrepreneurship

The prospect of starting a business becomes daunting under the weight of substantial student loan debt.

- Fear of failure: The risk of business failure becomes even more terrifying when facing significant loan repayments.

- Lack of capital: Existing loans consume funds that could otherwise be invested in starting or expanding a business.

- Fear of default: The fear of defaulting on student loans can discourage individuals from taking the risk of entrepreneurship.

Studies show a correlation between high levels of student loan debt and reduced rates of entrepreneurship. The keyword "entrepreneurship" is key here, highlighting the impact on a vital sector of the economy.

Reduced Investment in the Economy

Less entrepreneurship directly translates to reduced investment and fewer jobs created, negatively impacting economic growth.

- Slower job creation: Fewer startups mean fewer jobs created, impacting the overall employment rate.

- Reduced economic innovation: Entrepreneurs are often the drivers of innovation, and their reduced participation hinders progress.

- Economic stagnation: The lack of new businesses and investment can contribute to overall economic stagnation.

Comparing job creation rates in countries with varying levels of student loan debt reveals a clear correlation. The keyword "economic innovation" is vital to show the broader effects beyond just job numbers.

The Implications for the Housing Market and Real Estate

The student loan crisis is also impacting the housing market, with significant implications for real estate.

Decreased Homeownership Rates

High student loan debt makes it incredibly challenging for young adults to enter the housing market.

- Mortgage challenges: Lenders often consider student loan debt when assessing mortgage applications, making it harder to qualify.

- Reduced buying power: Even if approved for a mortgage, high student loan repayments limit the affordability of homes.

- Delayed homeownership: The combination of debt and limited buying power delays or prevents homeownership for many.

Data shows a significant drop in homeownership rates among millennials compared to previous generations, partly due to the burden of student loans. The keyword "homeownership rates" is essential for SEO in this section.

Impact on Housing Prices

Reduced demand due to the student loan crisis can influence housing prices.

- Slowdown in the market: Decreased buying power can lead to a slowdown in the housing market, potentially impacting prices.

- Regional variations: The impact may be more pronounced in areas with high concentrations of student loan debt.

- Long-term implications: The long-term effects on the housing market remain uncertain but could be significant.

The relationship between housing prices and student loan debt levels is a complex one. The keyword "housing prices" is necessary for search engine optimization in this part.

Conclusion

The student loan crisis is not just a personal financial problem; it's a significant economic issue with wide-ranging consequences. The reduced consumer spending, stifled entrepreneurship, and impacted housing market all contribute to a slower-growing, less dynamic economy. Understanding the far-reaching economic consequences of the student loan crisis is crucial. Learn more about potential solutions and join the conversation to address this pressing issue affecting our economy. Let's work together to find effective strategies for managing and alleviating the student loan crisis and fostering a healthier economic future.

Featured Posts

-

Alejandro Garnacho Snubs Young Fans Autograph Request

May 28, 2025

Alejandro Garnacho Snubs Young Fans Autograph Request

May 28, 2025 -

Pregame Notes San Diego Padres Arraez Rest Sheets Starts

May 28, 2025

Pregame Notes San Diego Padres Arraez Rest Sheets Starts

May 28, 2025 -

Romes Champion Ambition And Drive Fuel Continued Success

May 28, 2025

Romes Champion Ambition And Drive Fuel Continued Success

May 28, 2025 -

Trading California For Germany Was It The Right Decision

May 28, 2025

Trading California For Germany Was It The Right Decision

May 28, 2025 -

Goyes Anterson To Foinikiko Sxedio I Nea Tainia Apo Tis Kannes

May 28, 2025

Goyes Anterson To Foinikiko Sxedio I Nea Tainia Apo Tis Kannes

May 28, 2025