The Euro's Global Profile: Lagarde's Actions And Their Implications For EUR/USD Trading

Table of Contents

Lagarde's Monetary Policy and its Effect on the Euro

The ECB's monetary policy, spearheaded by Christine Lagarde, plays a dominant role in shaping the Euro's trajectory. Her decisions directly impact the EUR/USD exchange rate, creating both opportunities and challenges for traders.

Interest Rate Decisions and EUR/USD

Interest rate adjustments are a primary tool used by the ECB to influence the Euro's value. Higher interest rates generally attract foreign investment, increasing demand for the Euro and strengthening its value against other currencies, including the US dollar. Conversely, lower interest rates can weaken the Euro.

- Interest rates and currency value: A direct relationship exists; higher rates attract investment, increasing demand and strengthening the currency.

- Market reactions to past ECB rate decisions: Previous rate hikes by the ECB have often led to short-term appreciation of the Euro against the USD, while rate cuts have had the opposite effect. The market reaction, however, is not always immediate and depends on various factors.

- Examples of rate change impacts: For instance, the ECB's 2022 interest rate hikes initially boosted the EUR/USD, but the impact was moderated by other economic factors.

Quantitative Easing (QE) and its Implications

Quantitative easing (QE), a monetary policy tool involving the injection of money into the economy by the central bank, can significantly impact the Euro's strength. While QE aims to stimulate economic growth, its effects on currency exchange rates are complex.

- QE and money supply/inflation: QE increases the money supply, potentially leading to inflation. High inflation generally weakens a currency.

- Past QE policies and EUR/USD: Previous ECB QE programs have often been associated with a weaker Euro, though the effect can be nuanced and depends on the market's perception of the policy's effectiveness.

- Potential for future QE measures: The possibility of future QE programs by the ECB is a key factor traders consider when forecasting EUR/USD movements.

Forward Guidance and Market Expectations

The ECB's communication strategy, often termed "forward guidance," plays a crucial role in shaping market expectations and influencing EUR/USD trading. Clear and consistent communication can stabilize the market, while ambiguous statements can lead to volatility.

- Importance of clear communication: Transparency from the ECB helps traders anticipate future policy moves, reducing uncertainty and potentially minimizing volatility.

- Past instances of forward guidance impacting the market: Examples of Lagarde's statements influencing market sentiment and subsequent EUR/USD price movements can be studied for insights into future trading strategies.

- Role of press conferences and speeches: Lagarde's press conferences and public speeches are closely scrutinized by traders for hints about future monetary policy decisions.

Geopolitical Factors Influencing the Euro and EUR/USD

Beyond the ECB's monetary policy, various geopolitical factors exert a substantial influence on the Euro and the EUR/USD exchange rate.

Eurozone Economic Performance and the Euro

The overall economic health of the Eurozone significantly impacts the Euro's value. Strong GDP growth, low unemployment, and stable inflation generally support a stronger Euro.

- Key economic indicators and EUR/USD: GDP growth, inflation rates (CPI), unemployment figures, and consumer confidence are crucial indicators that traders track.

- Impact of economic crises or strong growth: Economic crises within the Eurozone tend to weaken the Euro, while periods of strong, coordinated growth can strengthen it.

Global Events and EUR/USD Volatility

External shocks and global events create significant volatility in the EUR/USD market. Geopolitical instability, trade wars, energy crises, and global economic slowdowns can all negatively impact the Euro.

- Examples of global events and their impact: The war in Ukraine, global supply chain disruptions, and rising energy prices have all contributed to EUR/USD volatility.

- Interconnectedness of global markets: The forex market is highly interconnected. Events in one region can have ripple effects globally, influencing currency valuations.

Strategies for EUR/USD Trading Based on Lagarde's Actions

Successful EUR/USD trading requires a nuanced understanding of both Lagarde's actions and broader market forces. A combination of technical and fundamental analysis, coupled with robust risk management, is essential.

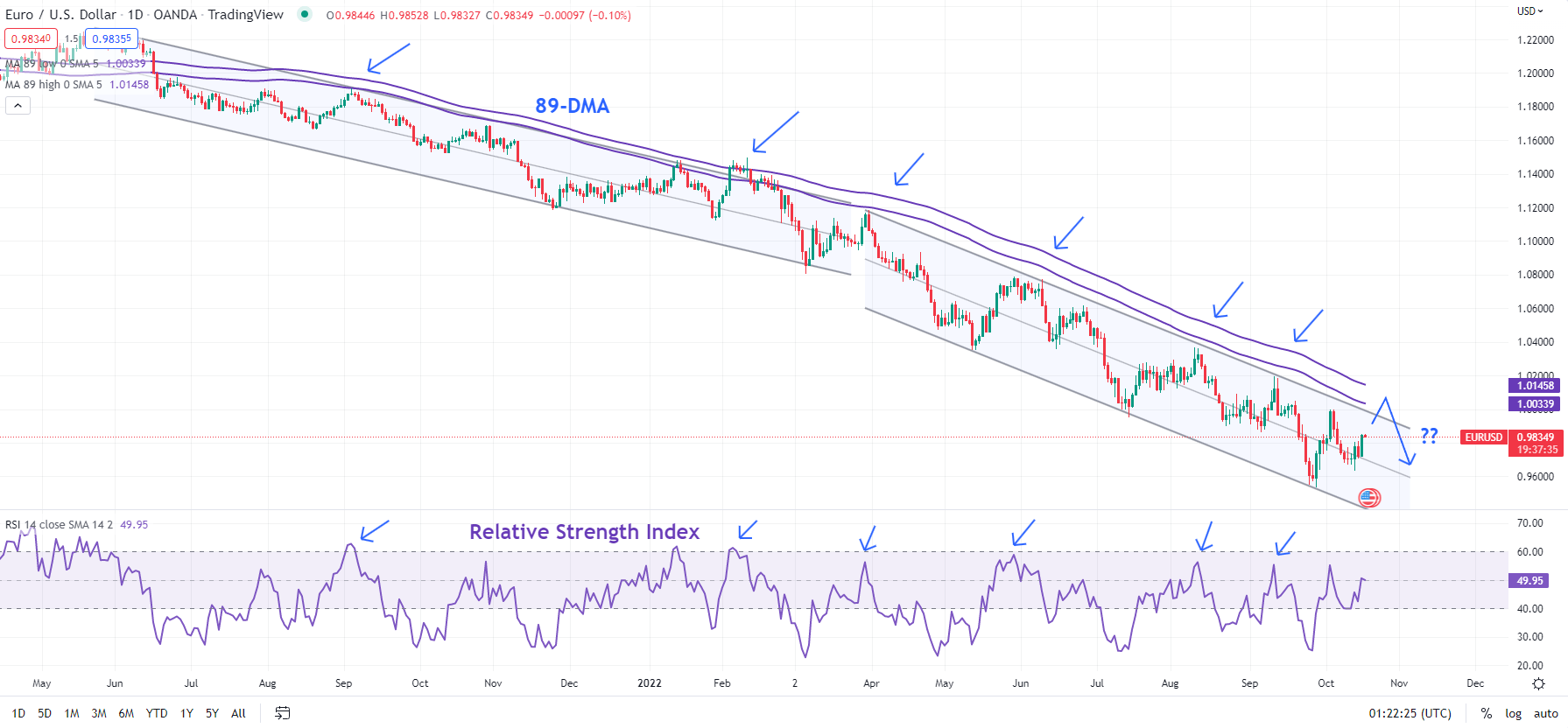

Technical Analysis and Chart Patterns

Technical analysis involves studying price charts and using indicators to predict future price movements. Traders can use this to anticipate reactions to ECB announcements and Lagarde's statements.

- Key technical indicators: Moving averages, support and resistance levels, candlestick patterns, and relative strength index (RSI) are commonly used tools.

- Identifying trends and potential reversals: Technical analysis can help identify potential turning points in the EUR/USD exchange rate.

Fundamental Analysis and Economic Indicators

Fundamental analysis focuses on economic data and underlying factors that influence currency values. Close monitoring of economic indicators and ECB policy announcements is critical.

- Using economic calendars: Economic calendars provide a schedule of upcoming economic data releases, which can impact the EUR/USD.

- Inflation reports and other data: Data on inflation, unemployment, GDP growth, and manufacturing PMI are crucial inputs for fundamental analysis.

Risk Management and Position Sizing

Given the volatility associated with Lagarde's announcements and broader geopolitical events, robust risk management is paramount in EUR/USD trading.

- Stop-loss orders and take-profit targets: These help limit potential losses and secure profits.

- Diversification and position sizing: Spreading investments across different assets and controlling position size minimizes risk.

Conclusion

Christine Lagarde's leadership at the ECB significantly impacts the Euro and the EUR/USD exchange rate. Effective EUR/USD trading requires a deep understanding of both the ECB's monetary policy decisions and the broader geopolitical landscape. Successful strategies combine technical and fundamental analysis, allowing traders to anticipate market movements based on Lagarde's actions and economic indicators. Always prioritize risk management to navigate the inherent volatility of this currency pair. Stay informed about the ECB's actions and their impact on the Euro to develop a comprehensive trading strategy and stay ahead of market trends in EUR/USD trading.

Featured Posts

-

Padres Aim To Dominate Rockies In Upcoming Games

May 28, 2025

Padres Aim To Dominate Rockies In Upcoming Games

May 28, 2025 -

Update On Rayan Cherki From A German Source

May 28, 2025

Update On Rayan Cherki From A German Source

May 28, 2025 -

Eur Usd Outlook Lagardes Initiatives To Enhance The Euros Global Presence

May 28, 2025

Eur Usd Outlook Lagardes Initiatives To Enhance The Euros Global Presence

May 28, 2025 -

Following Split Claims Kanye West And Bianca Censori Enjoy Dinner Date In Spain

May 28, 2025

Following Split Claims Kanye West And Bianca Censori Enjoy Dinner Date In Spain

May 28, 2025 -

Prakiraan Cuaca Akurat Sumatra Utara Medan Karo Nias Toba

May 28, 2025

Prakiraan Cuaca Akurat Sumatra Utara Medan Karo Nias Toba

May 28, 2025