The Extreme Cost Of Broadcom's VMware Deal: AT&T's Perspective

Table of Contents

AT&T's Heavy Reliance on VMware's Virtualization Technology

AT&T, a global leader in telecommunications, relies heavily on VMware's virtualization technology to power its vast network infrastructure and data centers. Understanding the extent of this reliance is crucial to grasping the potential financial fallout from the Broadcom VMware acquisition.

Existing VMware Infrastructure and Investments

AT&T's infrastructure extensively utilizes VMware vSphere for server virtualization, vSAN for storage virtualization, and other VMware products for network management and cloud orchestration. While precise figures regarding AT&T's VMware investment aren't publicly available, the scale of their operations suggests a substantial commitment.

- VMware vSphere deployment: Used across numerous data centers to consolidate and manage servers, supporting critical voice, data, and video services.

- VMware vSAN deployment: Provides a software-defined storage solution for improved scalability and flexibility in managing AT&T's massive data storage needs.

- Significant investment in VMware licensing: The licensing costs alone for a company of AT&T's size, across their vast infrastructure, likely represent millions of dollars annually. This doesn't include support contracts or professional services.

- Ongoing professional services: AT&T likely employs a team of VMware experts or contracts with external consultants for ongoing maintenance, upgrades, and troubleshooting.

Potential for Increased Licensing Costs Post-Acquisition

Broadcom's history suggests a potential for significant price increases following acquisitions. This raises serious concerns about the future cost of VMware licensing, support, and professional services for AT&T.

- Broadcom's past acquisition patterns: Analyzing Broadcom's past acquisitions reveals a pattern of consolidating market share and subsequently increasing prices for acquired products.

- Potential for price gouging: Without robust competition, Broadcom may leverage its control of VMware to implement substantial price increases, impacting AT&T's IT budget significantly.

- Reduced negotiation power: AT&T's leverage in negotiating favorable licensing terms with VMware might significantly diminish under Broadcom's ownership, leading to less favorable contracts.

The Broader Impact on AT&T's Cloud Strategy and Network Modernization

The Broadcom VMware acquisition has significant implications for AT&T's broader cloud strategy and network modernization initiatives.

VMware's Role in AT&T's Cloud Initiatives

VMware plays a vital role in AT&T's hybrid and multi-cloud strategies. The acquisition casts a shadow over the stability and cost-effectiveness of this approach.

- Hybrid cloud management: VMware solutions are likely key to AT&T's ability to manage its on-premises infrastructure alongside public cloud services.

- Multi-cloud orchestration: VMware's tools may simplify managing workloads across different cloud providers. Increased costs could undermine this advantage.

- Migration challenges: Moving away from VMware if licensing costs become prohibitive would be an incredibly complex and expensive undertaking, representing significant time and resource costs.

Increased Vendor Lock-in and Reduced Choice

Broadcom's control of VMware creates a substantial risk of vendor lock-in for AT&T.

- Reduced negotiating power: The absence of a comparable, readily available alternative could significantly reduce AT&T's negotiating leverage, forcing them to accept less favorable terms.

- Limited innovation: Vendor lock-in may stifle innovation as AT&T may be less inclined to explore alternative solutions for fear of the disruption and cost associated with a transition.

- Strategic risk: Heavy reliance on a single vendor exposes AT&T to significant risk, including potential service disruptions, price hikes, and limited choice in technology advancements.

Competitive Implications and the Search for Alternatives

The increasing cost of VMware, as a result of the Broadcom acquisition, could negatively impact AT&T's competitive edge.

The Impact on AT&T's Competitiveness

Higher VMware costs could directly impact AT&T's competitiveness in the telecommunications market.

- Service pricing: Increased IT costs may necessitate higher prices for AT&T's services, potentially impacting customer acquisition and retention.

- Reduced innovation: The financial burden of higher VMware costs could force AT&T to prioritize cost reduction over innovation, hindering the development of new and competitive services.

Exploring Alternative Virtualization Technologies

AT&T might consider alternatives to VMware to mitigate the risks associated with the Broadcom acquisition.

- OpenStack: An open-source cloud computing platform offering a potential alternative to VMware vSphere.

- Kubernetes: A container orchestration platform offering flexibility and scalability.

- Other virtualization platforms: A variety of other virtualization solutions exist, but migration represents a significant undertaking.

- Migration challenges: Migrating away from VMware's ecosystem involves substantial technical challenges, potential downtime, and high resource expenditure.

Conclusion

The Broadcom VMware acquisition presents a significant challenge for AT&T and other large enterprises. This analysis highlights the potential for extreme cost increases in VMware licensing, the risks of increased vendor lock-in, and the impact on AT&T’s cloud strategy and overall competitiveness. Careful analysis of potential cost increases and the exploration of alternative virtualization solutions are crucial to mitigating the risks associated with this massive deal. The Broadcom VMware deal underscores the importance of diversifying vendor relationships and proactively assessing alternative technologies to safeguard against such unforeseen cost increases. Stay informed about the evolving landscape of enterprise software and the potential ramifications of the Broadcom VMware deal for your business.

Featured Posts

-

Analyzing Snape And Mc Gonagalls Influence The Harry Potter Remake And Its Core Narrative

May 29, 2025

Analyzing Snape And Mc Gonagalls Influence The Harry Potter Remake And Its Core Narrative

May 29, 2025 -

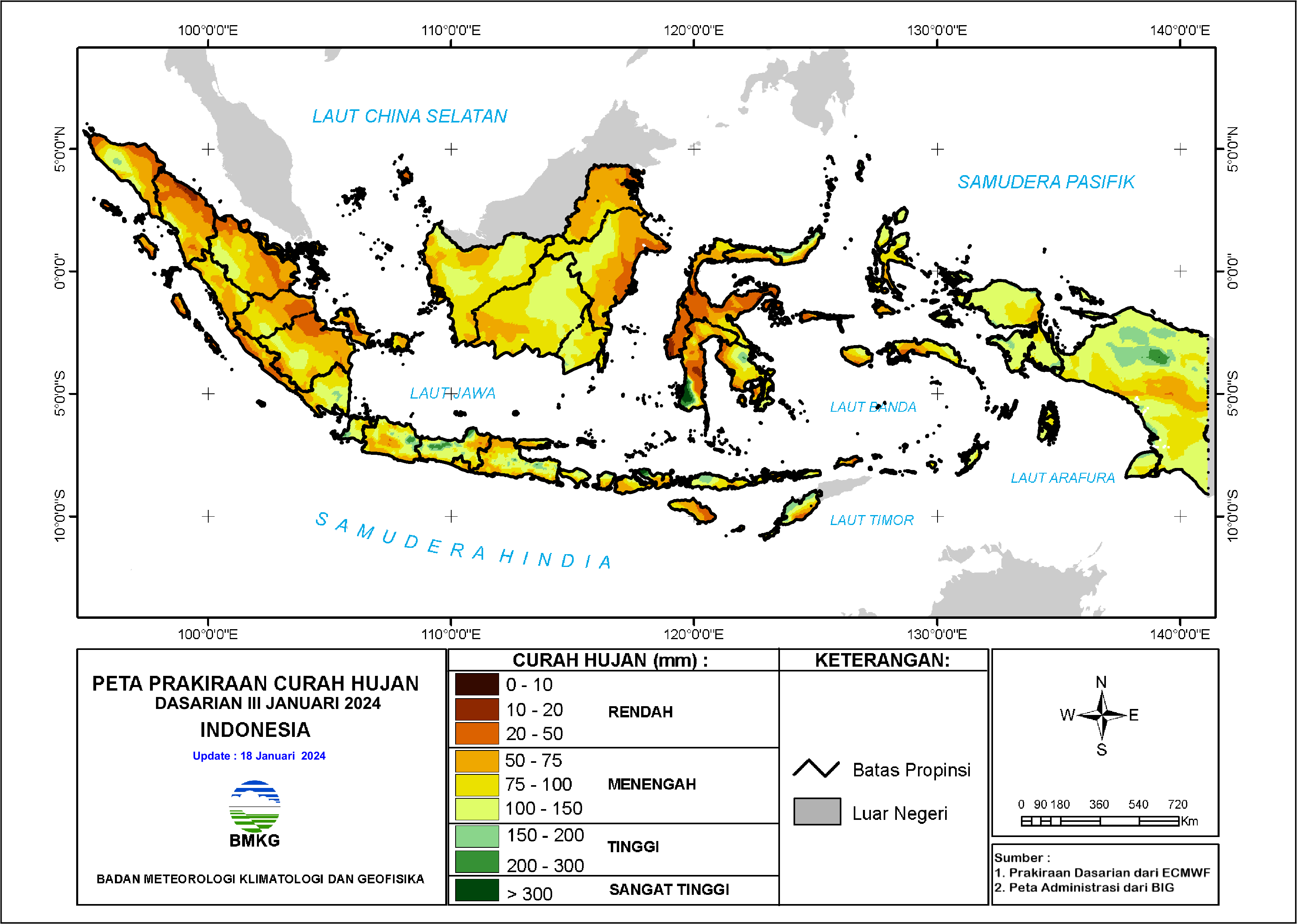

Prakiraan Hujan Di Jawa Tengah 23 April 2024

May 29, 2025

Prakiraan Hujan Di Jawa Tengah 23 April 2024

May 29, 2025 -

The Day I Was Fired An Australian Womans Story

May 29, 2025

The Day I Was Fired An Australian Womans Story

May 29, 2025 -

Schietincident Venlo 50 Jarige Man Vindt De Dood

May 29, 2025

Schietincident Venlo 50 Jarige Man Vindt De Dood

May 29, 2025 -

De Arne Slot Discussie Realistiche Kans Op Een Overstap Naar Ajax

May 29, 2025

De Arne Slot Discussie Realistiche Kans Op Een Overstap Naar Ajax

May 29, 2025