The Falling Dollar And Its Consequences For Asian Economies

Table of Contents

<p><b>Meta Description:</b> Explore the impact of a weakening US dollar on Asian economies, including trade imbalances, inflation, and investment flows. Learn how Asian nations are adapting to this volatile currency landscape.</p>

<p>The US dollar's recent decline is sending ripples throughout the global economy, significantly impacting Asian economies heavily reliant on trade and dollar-denominated assets. This article analyzes the multifaceted consequences of a falling dollar for Asian nations, examining the challenges and opportunities presented by this shifting currency landscape. Understanding the implications of a falling dollar is crucial for navigating the complexities of the global financial market.</p>

<h2>Impact on Trade and Exports</h2>

<h3>Increased Export Competitiveness</h3>

A weaker dollar makes US goods more expensive internationally, potentially boosting demand for Asian exports. This translates to several key benefits for export-oriented Asian economies:

- Increased export volumes: Companies in countries like Vietnam, Bangladesh, and China, which are major exporters of textiles, electronics, and manufactured goods, could see a surge in orders.

- Improved trade balance: For some Asian nations, the falling dollar could lead to a more favorable trade balance, as exports become more competitive.

- Potential for higher profits: Export-oriented businesses in Asia may experience increased profitability due to higher demand and potentially better margins.

For example, the electronics sector in South Korea and Taiwan could see a significant boost in export orders as US consumers find imported electronics more attractive than domestically-produced ones. Similarly, the textile industry in Bangladesh and Vietnam could experience an increase in demand.

<h3>Challenges for Import-Dependent Economies</h3>

Conversely, a falling dollar increases the cost of imports for many Asian nations heavily reliant on imported raw materials, intermediate goods, and energy. This presents several challenges:

- Rising import prices: The increased cost of imports directly impacts the prices of goods and services within these economies.

- Increased inflation: This surge in import prices can fuel inflation, eroding purchasing power and impacting consumer spending.

- Pressure on consumer spending: Higher prices for essential goods can lead to reduced consumer spending and potentially slower economic growth.

- Potential for trade deficits: The combination of increased import costs and potentially lower export demand could lead to widening trade deficits for some Asian economies.

Countries like Singapore and Japan, with significant reliance on imported energy and raw materials, are particularly vulnerable to these inflationary pressures driven by a falling dollar.

<h3>Shifting Global Trade Dynamics</h3>

The falling dollar necessitates a reassessment of trade partnerships and strategies for Asian economies. This includes:

- Diversification of trade partners: Reducing dependence on the US market by exploring new trading relationships with other countries in Asia and beyond.

- Exploration of new markets: Actively seeking new markets for exports to mitigate the impact of reduced demand from the US.

- Renegotiation of trade agreements: Reviewing and potentially renegotiating existing trade agreements to reflect the changed currency landscape.

The weakening dollar could accelerate the trend of increased trade between Asian nations themselves, fostering stronger regional economic ties and reducing reliance on the US market.

<h2>Consequences for Investment and Capital Flows</h2>

<h3>Impact on Foreign Direct Investment (FDI)</h3>

A weaker dollar can make investments in Asian markets more attractive to foreign investors seeking higher returns, potentially leading to:

- Increased FDI inflows: Foreign investors may find Asian assets more affordable, stimulating investment in various sectors.

- Potential for job creation: Increased FDI can lead to job creation and economic growth in recipient countries.

- Stimulation of economic growth: The influx of capital can boost infrastructure development, technological advancement, and overall economic expansion.

Sectors likely to attract increased FDI include manufacturing, technology, and infrastructure development in countries with strong growth potential.

<h3>Volatility in Capital Markets</h3>

Currency fluctuations can lead to significant instability in Asian stock markets and capital flows:

- Increased market volatility: The uncertainty surrounding exchange rates can create volatility in stock markets, making investments riskier.

- Potential for capital flight: Investors may withdraw funds from Asian markets if they anticipate further currency depreciation.

- Impact on investor confidence: The volatility can negatively affect investor confidence, hindering long-term investment and economic growth.

Effective risk management strategies are crucial for Asian economies to navigate this volatility and maintain stability in their capital markets.

<h3>Debt Repayment Challenges</h3>

Asian nations with significant dollar-denominated debt face increased repayment burdens as the dollar weakens:

- Increased debt servicing costs: Repaying debt becomes more expensive when the domestic currency depreciates against the dollar.

- Potential for financial strain: Increased debt servicing costs can strain government budgets and potentially lead to fiscal crises.

- Need for prudent fiscal policies: Countries need to implement prudent fiscal policies to manage their debt and mitigate the risks associated with a weaker dollar.

Countries with high levels of dollar-denominated debt need to carefully monitor their fiscal positions and implement strategies to manage the increased repayment burden.

<h2>Inflationary Pressures and Monetary Policy Responses</h2>

<h3>Rising Import Prices Fuel Inflation</h3>

The rising cost of imports directly translates to higher consumer prices in many Asian economies:

- Higher consumer prices: This leads to reduced purchasing power for consumers, potentially impacting living standards.

- Reduced purchasing power: Consumers may have to spend a larger portion of their income on essential goods, leaving less for discretionary spending.

- Potential for social unrest: Sustained high inflation can lead to social unrest and political instability.

The degree to which import prices translate to consumer price inflation will vary across Asian economies, depending on their individual economic structures and import dependency.

<h3>Monetary Policy Adjustments</h3>

Central banks in Asia may need to adjust their monetary policies to combat inflation caused by the falling dollar:

- Interest rate hikes: Raising interest rates can curb inflation but could also slow economic growth.

- Managing exchange rates: Central banks may intervene in the foreign exchange market to manage exchange rate volatility.

- Controlling inflation: The primary goal is to control inflation without severely impacting economic growth.

Finding the right balance between controlling inflation and maintaining economic growth will be a significant challenge for central banks in Asia.

<h2>Conclusion</h2>

The falling dollar presents a complex and multifaceted challenge for Asian economies. While some nations may benefit from increased export competitiveness, many others face significant risks from rising import costs, inflation, and capital market volatility. Effective policy responses, including diversification of trade partners, prudent fiscal management, and carefully calibrated monetary policies, are crucial for navigating this volatile currency landscape. Understanding the intricate consequences of a falling dollar is essential for Asian nations to safeguard their economic stability and capitalize on emerging opportunities in a rapidly changing global economy. Further research into the specific impact on individual Asian economies is recommended to fully grasp the implications of this significant currency shift. Staying informed about US dollar exchange rates and their impact on Asian economic growth is vital for businesses and policymakers alike.

Featured Posts

-

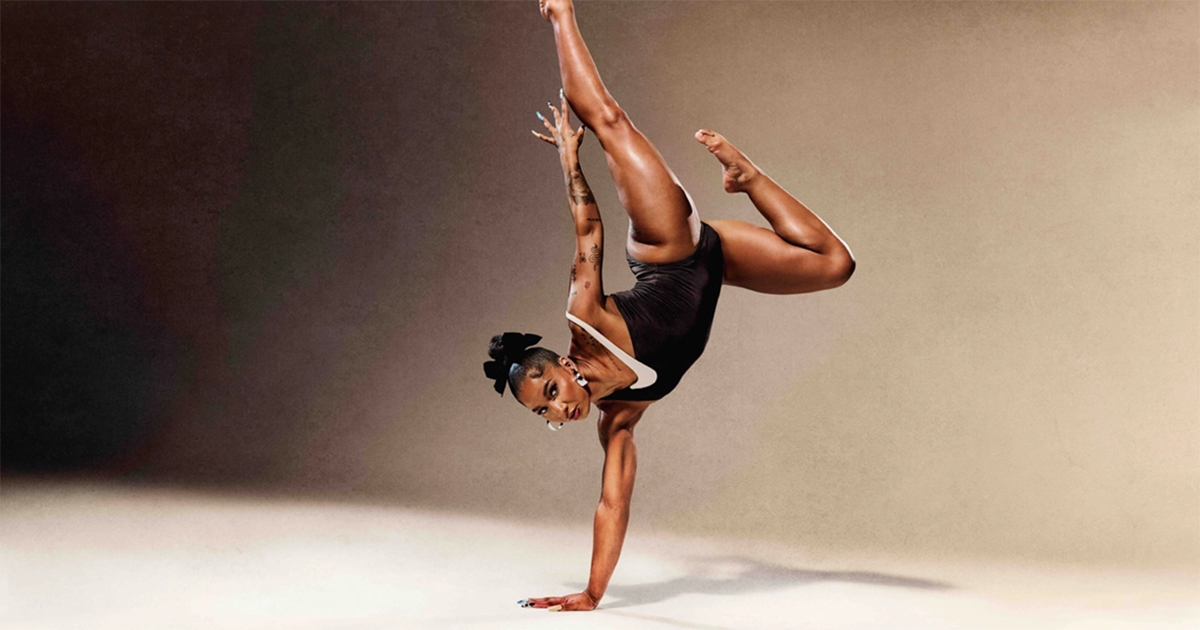

Nikes Super Bowl Ad 2024 Doechiis Powerful Narration

May 06, 2025

Nikes Super Bowl Ad 2024 Doechiis Powerful Narration

May 06, 2025 -

Zendayas New Space Movie Buckle Up For A Thrilling Ride

May 06, 2025

Zendayas New Space Movie Buckle Up For A Thrilling Ride

May 06, 2025 -

Priyanka Chopra And Nick Jonas Holi Celebrations A Festive Look Back

May 06, 2025

Priyanka Chopra And Nick Jonas Holi Celebrations A Festive Look Back

May 06, 2025 -

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025 -

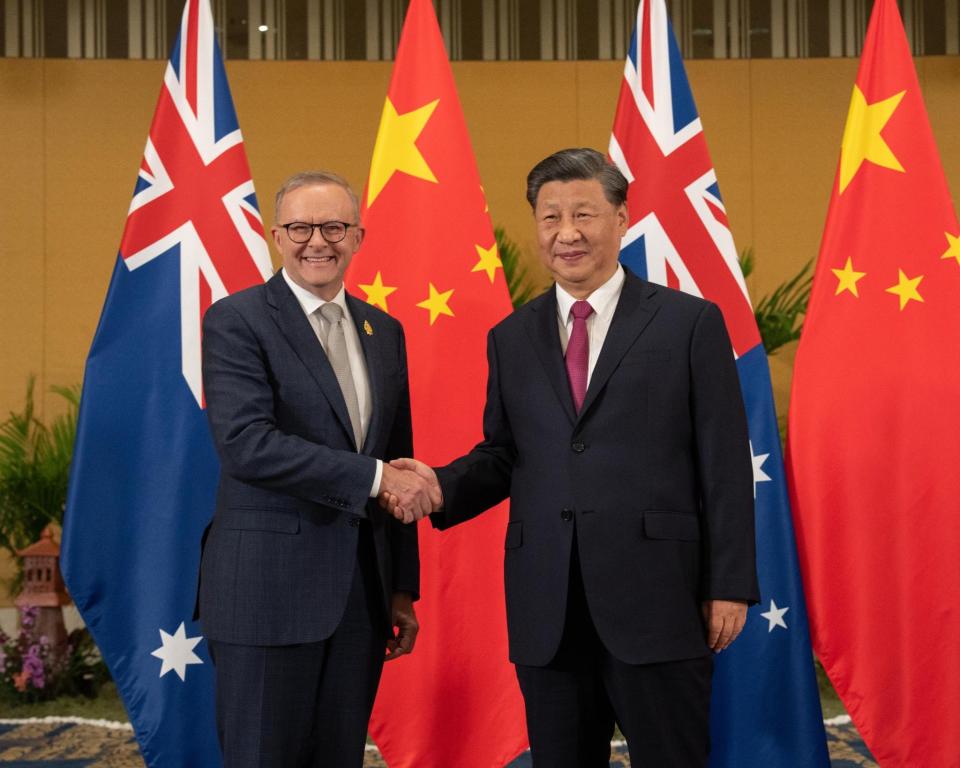

Australias Economy Albanese Faces Crucial Post Election Test

May 06, 2025

Australias Economy Albanese Faces Crucial Post Election Test

May 06, 2025