The Fed's Rationale: Why Rate Cuts Remain Unlikely

Table of Contents

Persistent Inflation Remains a Primary Concern

The Fed's primary mandate is price stability. Despite recent moderation, inflation remains stubbornly above the target rate. Core inflation, which excludes volatile food and energy prices, continues to show stickiness, indicating that underlying inflationary pressures persist. This is a key reason why Fed rate cuts are off the table for now.

- CPI and PCE data still indicate elevated inflation. While headline inflation numbers may show some decline, underlying measures like the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index remain elevated.

- Core inflation remains a key concern for the Fed. The persistence of core inflation demonstrates that price increases are not solely driven by temporary factors.

- Wage growth, a contributing factor to inflation, remains robust. Strong wage growth, while positive for workers, can contribute to upward pressure on prices if not balanced by productivity gains.

- The Fed needs to see sustained evidence of disinflation before considering rate cuts. A single month or two of lower inflation is not enough to convince the Fed that the battle against inflation is won. They need to see a consistent downward trend.

The Labor Market Remains Strong, Limiting the Need for Immediate Stimulus

A strong labor market, characterized by low unemployment and robust job growth, reduces the urgency for immediate Fed rate cuts. The Fed recognizes that a tight labor market can contribute to inflationary pressures through increased wage demands. This makes stimulating the economy through lower interest rates less appealing.

- The unemployment rate remains historically low. This indicates a healthy economy, but also contributes to upward wage pressures.

- Job openings continue to outnumber available workers. This tight labor market gives workers significant leverage in wage negotiations, contributing to inflation.

- Robust wage growth contributes to inflationary pressures. As mentioned earlier, strong wage growth without corresponding productivity increases fuels inflation.

- A strong labor market reduces the immediate need for monetary easing. The Fed's focus remains on cooling inflation, even if it means risking some economic slowdown.

Risks of Premature Easing and Renewed Inflationary Pressures

The Federal Reserve is wary of prematurely easing monetary policy. A premature rate cut could reignite inflationary pressures, potentially leading to a more painful adjustment later. This would jeopardize the credibility of the Fed's commitment to price stability and could lead to a more volatile economic environment.

- Premature easing could lead to a resurgence of inflation. If inflation expectations become unanchored, even a small easing of monetary policy could reignite inflationary pressures.

- The Fed wants to avoid anchoring high inflation expectations. The Fed aims to ensure that expectations of continued high inflation do not become ingrained in economic decision-making.

- The risk of second-round effects (wage-price spiral) remains a concern. A wage-price spiral occurs when rising wages lead to higher prices, which in turn lead to further wage increases, creating a self-perpetuating cycle of inflation.

Data Dependence and Gradual Approach to Policy Adjustments

The Fed’s approach is data-dependent. They are closely monitoring key economic indicators, including inflation, employment, and consumer spending, before making any decisions on rate cuts. They prefer a gradual approach to adjustments to minimize market disruptions and allow for course correction if needed.

- The Fed will continue to analyze incoming economic data. This includes CPI, PCE, unemployment figures, and other relevant indicators.

- Future policy decisions will depend on the evolution of inflation and economic growth. The Fed will not act precipitously; instead, they will carefully assess the data before making any decisions.

- Gradual adjustments minimize market disruptions and allow for course correction. A slow and steady approach helps to avoid large and sudden shifts in the economy.

Conclusion

Despite potential economic slowdown concerns, the Fed's rationale for resisting rate cuts remains clear. Persistent inflation, a strong labor market, and the risks of premature easing are key factors influencing their decision-making process. The Fed's data-dependent approach suggests that any shifts in monetary policy will be gradual and contingent on sustained improvement in key economic indicators. To stay informed on the evolving situation and the potential for future Fed rate cuts, continue to monitor economic data releases and official statements from the Federal Reserve. Understanding the Fed's rationale regarding Fed rate cuts is crucial for navigating the complexities of the current economic landscape.

Featured Posts

-

Alaskan Protests Against Doge And Trump Administration A Deep Dive

May 09, 2025

Alaskan Protests Against Doge And Trump Administration A Deep Dive

May 09, 2025 -

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025

Iditarod 2024 Following Seven Rookie Teams To Nome

May 09, 2025 -

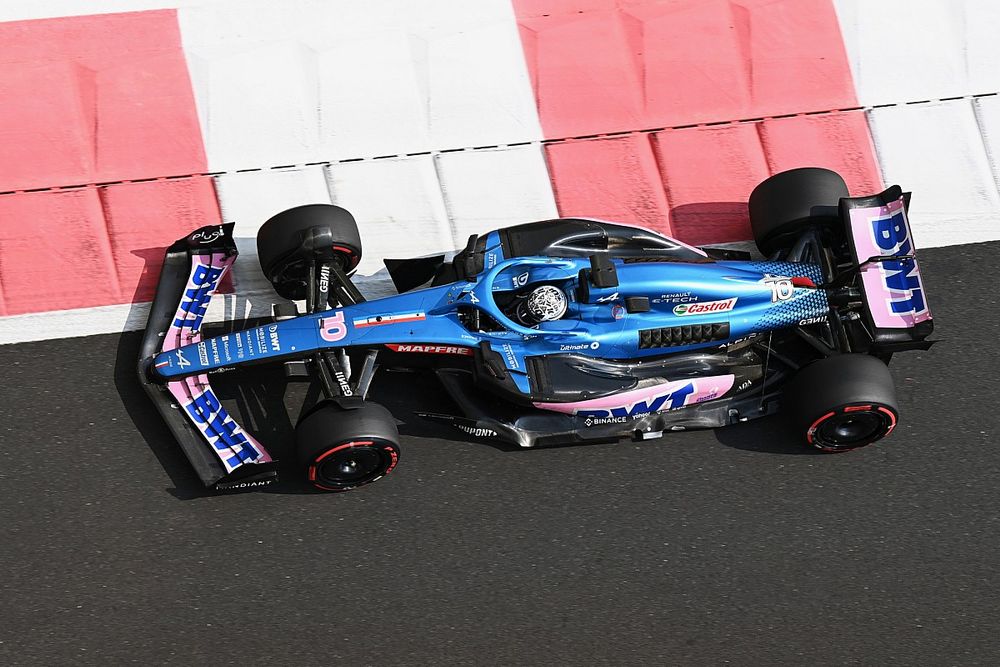

Revealed Colapintos Private Alpine F1 Test Session At Monza

May 09, 2025

Revealed Colapintos Private Alpine F1 Test Session At Monza

May 09, 2025 -

Extreme Price Hike Broadcoms V Mware Proposal Angers At And T 1 050 Increase

May 09, 2025

Extreme Price Hike Broadcoms V Mware Proposal Angers At And T 1 050 Increase

May 09, 2025 -

Bayern Munich Stunned By Inter Milan In Champions League First Leg

May 09, 2025

Bayern Munich Stunned By Inter Milan In Champions League First Leg

May 09, 2025

Latest Posts

-

Rethinking Stephen King 4 Unconventional Randall Flagg Theories

May 09, 2025

Rethinking Stephen King 4 Unconventional Randall Flagg Theories

May 09, 2025 -

Povernennya Kinga Zayavi Pro Politiku Ta Trampa Z Maskom

May 09, 2025

Povernennya Kinga Zayavi Pro Politiku Ta Trampa Z Maskom

May 09, 2025 -

3 6

May 09, 2025

3 6

May 09, 2025 -

Nova Kniga Kinga Pismennik Komentuye Trampa Ta Maska

May 09, 2025

Nova Kniga Kinga Pismennik Komentuye Trampa Ta Maska

May 09, 2025 -

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025

Zvernennya Stivena Kinga Politichni Poglyadi Na Trampa Ta Maska

May 09, 2025