The Financial Realities Of Being A Star Married To An A-List Celebrity

Table of Contents

Prenuptial Agreements: Protecting Assets Before "I Do"

For high-net-worth individuals, a prenuptial agreement is not merely a formality; it's a crucial legal document safeguarding assets and setting clear expectations before marriage. A well-drafted prenuptial agreement protects both parties' pre-marital assets and clarifies how assets acquired during the marriage will be divided in case of separation or divorce.

Common provisions within prenups for high-profile couples often include:

- Protecting pre-marital assets: This ensures that each party retains ownership of their property, investments, and businesses accumulated before the marriage.

- Defining separate property vs. marital property: This crucial distinction clarifies which assets belong solely to each individual and which are considered jointly owned.

- Negotiating spousal support terms (alimony): Prenups can outline the terms and conditions of spousal support, including duration and amount, preventing future disputes.

- Choosing the right legal counsel: It's vital to engage experienced legal counsel specializing in high-net-worth prenuptial agreements to ensure the agreement is legally sound and protects your interests.

Joint Finances and the Challenges of Shared Wealth

Managing joint finances when one spouse has significantly higher earning potential presents unique challenges. Even with a prenuptial agreement in place, open communication and shared financial goals are paramount. Transparency and understanding are crucial for a successful financial partnership.

Key considerations for managing joint finances include:

- Opening joint bank accounts and investment accounts: While convenient, this requires careful consideration of the implications for tax reporting and asset management.

- Managing household expenses and budgeting: Developing a realistic budget that accounts for both partners' income and expenses is essential.

- Investment strategies for couples with vastly different income levels: A holistic investment approach that aligns with the couple's overall financial goals is necessary.

- Potential for financial disagreements: Disagreements are inevitable; having a proactive approach and seeking professional financial advice can prevent conflicts.

Tax Implications: Navigating the Complexities of High Income

The combined income of a celebrity couple often pushes them into the highest tax brackets, resulting in complex tax filings and the need for specialized tax planning. Understanding federal, state, and local tax laws is crucial.

Strategies for tax minimization include:

- Understanding federal, state, and local tax implications: Consulting with tax professionals experienced in high-net-worth individuals' taxation is essential.

- Utilizing tax deductions and credits appropriately: Maximizing deductions and credits can significantly reduce tax liabilities.

- Estate planning considerations for high-net-worth couples: Proactive estate planning is vital for minimizing estate taxes and ensuring a smooth transfer of assets.

- Specialized tax attorneys and financial advisors: The complexities of high-income taxation often necessitate the expertise of specialized professionals.

Maintaining Separate Careers and Financial Independence

While being married to a celebrity can offer opportunities, maintaining a separate career and financial independence is essential. This ensures personal fulfillment and financial security, regardless of the relationship's status.

Balancing personal ambitions with a high-profile relationship requires:

- Balancing personal ambitions with the demands of a high-profile relationship: This requires careful time management and prioritizing personal goals.

- Building and maintaining separate financial portfolios: Independent investments provide financial security and personal autonomy.

- Exploring entrepreneurial ventures and personal branding: Leveraging individual talents and expertise can create independent income streams.

- The risks of relying solely on a spouse's income: Over-reliance on a single income source can leave one vulnerable in case of unforeseen circumstances.

Seeking Expert Financial Advice: The Importance of Professional Guidance

Navigating the complex financial landscape of celebrity marriage necessitates a team of specialized professionals. Their expertise helps make informed decisions and protect financial well-being.

The benefits of professional guidance include:

- Finding qualified professionals experienced in high-net-worth individuals' financial planning: Experience in this specific area is paramount.

- Regular financial reviews and updates: Regular reviews ensure the financial plan remains aligned with the couple's changing needs and goals.

- Developing a comprehensive financial plan tailored to the couple's unique circumstances: A personalized plan addresses specific needs and challenges.

- Proactive estate and legacy planning: Careful planning ensures a smooth transfer of assets and minimizes potential disputes.

Conclusion

The financial realities of being a star married to an A-list celebrity are intricate and demand careful planning. From prenuptial agreements to tax implications and the importance of maintaining financial independence, navigating this landscape requires proactive measures and professional guidance. By understanding the complexities and seeking expert advice, stars can safeguard their financial well-being and build a secure financial future. Don't navigate the financial complexities of celebrity marriage alone – seek professional help and secure your financial future. Learn more about navigating the financial realities of being a star married to an A-list celebrity today!

Featured Posts

-

Police Investigation Launched Following Man City Mascot Injury Haaland Involved

May 19, 2025

Police Investigation Launched Following Man City Mascot Injury Haaland Involved

May 19, 2025 -

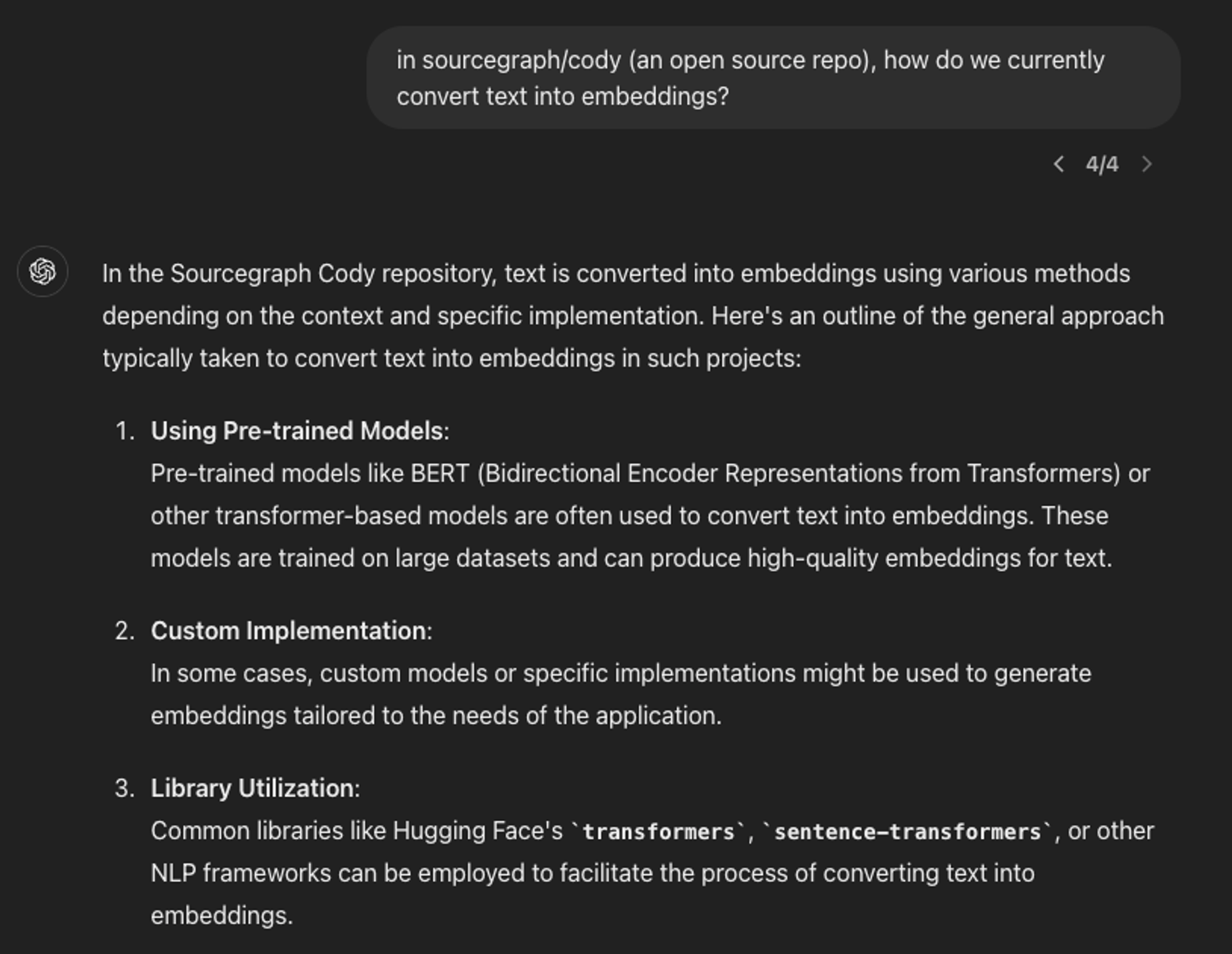

Revolutionizing Coding With Chat Gpts New Ai Coding Agent

May 19, 2025

Revolutionizing Coding With Chat Gpts New Ai Coding Agent

May 19, 2025 -

Martin Lewis Postal Warning Four Weeks To Take Action

May 19, 2025

Martin Lewis Postal Warning Four Weeks To Take Action

May 19, 2025 -

Nyt Mini Crossword March 16 2025 Complete Solutions

May 19, 2025

Nyt Mini Crossword March 16 2025 Complete Solutions

May 19, 2025 -

New York Mets Owner Steve Cohen On Alonso And Sotos Performance

May 19, 2025

New York Mets Owner Steve Cohen On Alonso And Sotos Performance

May 19, 2025