The Future Of XRP (Ripple): Opportunities And Challenges For Investors

Table of Contents

XRP's Technological Advantages and Use Cases

XRP's underlying technology offers several compelling advantages over other cryptocurrencies, potentially positioning it for significant growth.

RippleNet and On-Demand Liquidity (ODL)

RippleNet is Ripple's global payments network, facilitating faster and cheaper cross-border transactions for financial institutions. At the heart of this network is On-Demand Liquidity (ODL), a revolutionary system that uses XRP to reduce transaction costs and processing times.

-

Benefits of ODL for Banks and Financial Institutions:

- Reduced transaction costs compared to traditional SWIFT payments.

- Faster settlement times, enabling quicker access to funds.

- Improved liquidity management.

- Reduced reliance on nostro/vostro accounts.

-

Banks Currently Using RippleNet and ODL: Several major banks, including Banco Santander, MoneyGram, and others, have already integrated RippleNet and ODL into their operations.

-

Potential for Wider Adoption: The potential for wider adoption of ODL is vast. As more financial institutions seek efficient and cost-effective solutions for cross-border payments, RippleNet's appeal is likely to grow, boosting XRP's demand.

XRP's Scalability and Speed

Compared to Bitcoin and Ethereum, XRP boasts significantly faster transaction speeds and higher scalability. Its unique consensus mechanism allows for thousands of transactions per second, while Bitcoin and Ethereum struggle to handle a fraction of that volume.

-

Energy Efficiency: XRP's energy efficiency is another key advantage, contrasting sharply with the high energy consumption of proof-of-work blockchains like Bitcoin.

-

Faster and Cheaper Transactions: This speed and efficiency translate directly into faster and cheaper transactions, a major draw for both businesses and consumers.

Potential Future Applications Beyond Payments

XRP's technology isn't limited to payments. Emerging use cases are constantly expanding.

-

NFTs (Non-Fungible Tokens): XRP's speed and scalability make it a potential candidate for NFT transactions, enabling faster and cheaper NFT creation and trading.

-

DeFi (Decentralized Finance): While still in its early stages, there's exploration of integrating XRP into DeFi applications, potentially boosting liquidity and accessibility within the DeFi ecosystem.

These emerging applications could significantly boost XRP's value and overall demand, making it a more versatile and attractive asset in the broader crypto market.

Regulatory Landscape and Legal Challenges

The regulatory landscape surrounding cryptocurrencies remains complex and dynamic, posing a significant challenge to XRP's future.

The SEC Lawsuit and its Implications

The ongoing legal battle between Ripple and the SEC casts a long shadow over XRP's price and future. The SEC alleges that XRP is an unregistered security, a claim that Ripple vehemently denies.

-

Potential Outcomes and Impact on Price: The outcome of this lawsuit could significantly impact XRP's price. A favorable ruling for Ripple could lead to a surge in price, while an unfavorable ruling could result in a considerable drop.

-

Shaping the Regulatory Landscape: The ruling will also significantly influence the regulatory landscape for cryptocurrencies in general, setting precedents that will affect other digital assets.

Regulatory Uncertainty and its Effect on Investment

Regulatory uncertainty significantly impacts investor confidence and the price of XRP. The lack of clear, consistent regulations creates a volatile and unpredictable environment.

-

Need for Clear Regulatory Frameworks: The crypto industry needs clearer and more harmonized regulatory frameworks to foster growth and attract institutional investment.

-

Impact of Different Regulatory Scenarios: Different regulatory scenarios will have varied impacts on XRP's future. A clear, favorable regulatory environment would likely boost investor confidence and drive price appreciation. Conversely, a restrictive or overly cautious approach could hinder XRP's growth.

Market Analysis and Price Predictions

Understanding current market sentiment and predicting future price movements is crucial for any investor.

Current Market Sentiment and Price Trends

Current market sentiment toward XRP is highly influenced by the SEC lawsuit and its ongoing developments. Other influencing factors include overall market conditions, adoption rates, and XRP's market capitalization. Analyzing historical price performance provides valuable insights but doesn't guarantee future trends.

Factors Influencing Future Price Growth

Several factors could drive XRP's price upwards:

- Increased adoption by financial institutions.

- A favorable resolution of the SEC lawsuit.

- Technological advancements and new use cases.

However, potential risks could hinder price growth:

- Further regulatory crackdowns.

- Increased competition from other cryptocurrencies.

- Negative market sentiment.

Expert Opinions and Price Predictions (with Disclaimer)

Several experts offer varying predictions on XRP's future price. It is crucial to remember that these are opinions, not financial advice. The cryptocurrency market is inherently volatile, and any price prediction carries significant uncertainty.

Conclusion: Investing in the Future of XRP – A Balanced Perspective

Investing in XRP presents both significant opportunities and substantial risks. The technology behind XRP offers considerable advantages in speed, scalability, and cost-effectiveness, particularly in the realm of cross-border payments. However, the ongoing SEC lawsuit and regulatory uncertainty create a highly volatile investment environment.

Thorough research and risk assessment are paramount before investing in XRP or any other cryptocurrency. While the long-term growth potential of XRP is considerable, investors must acknowledge the inherent risks associated with such a volatile asset. Before making any XRP investment decisions, conduct your own in-depth research and consult with a qualified financial advisor. Carefully consider the future of XRP investing in light of the opportunities and challenges presented here. Make informed decisions about XRP's future prospects.

Featured Posts

-

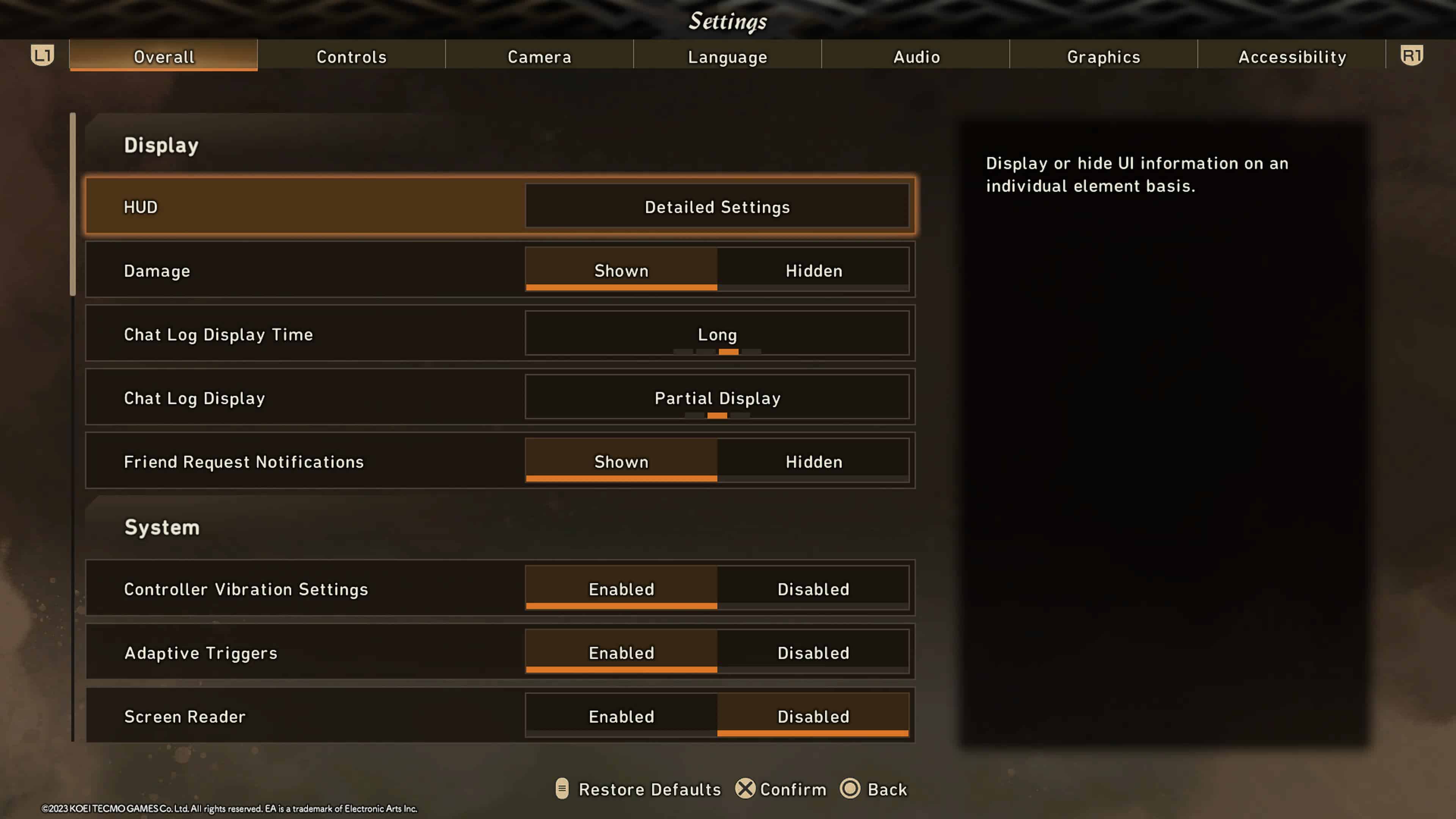

Official Play Station Podcast Episode 512 True Blue Key Takeaways And Analysis

May 08, 2025

Official Play Station Podcast Episode 512 True Blue Key Takeaways And Analysis

May 08, 2025 -

Mookie Betts Illness Keeps Him Out Of Freeway Series Game

May 08, 2025

Mookie Betts Illness Keeps Him Out Of Freeway Series Game

May 08, 2025 -

The Nba Playoffs Triple Doubles Quiz How Well Do You Know The Stats

May 08, 2025

The Nba Playoffs Triple Doubles Quiz How Well Do You Know The Stats

May 08, 2025 -

Addressing Ps 5 Stutter A Gamers Guide To Improved Performance

May 08, 2025

Addressing Ps 5 Stutter A Gamers Guide To Improved Performance

May 08, 2025 -

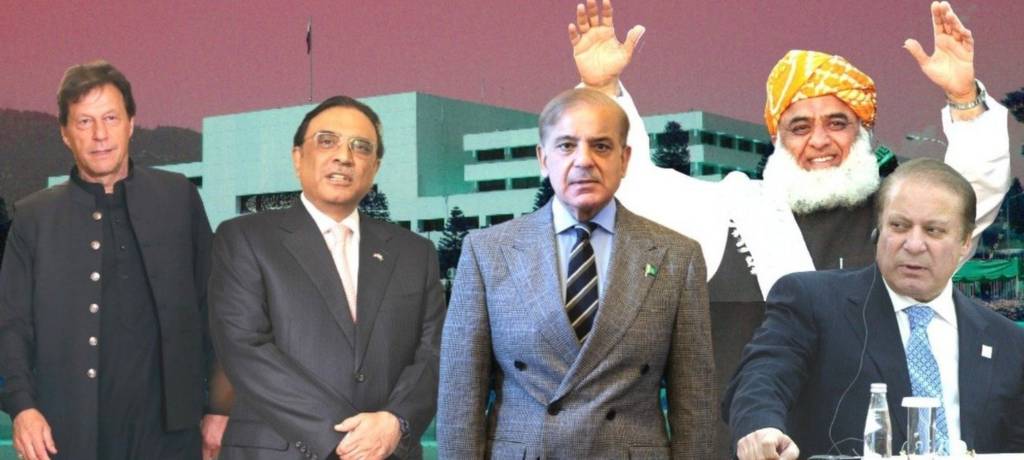

Lahwr Ahtsab Edaltwn Ky Tedad Myn Kmy Athrat W Tjzyh

May 08, 2025

Lahwr Ahtsab Edaltwn Ky Tedad Myn Kmy Athrat W Tjzyh

May 08, 2025

Latest Posts

-

Tatum Under Fire Colin Cowherds Post Game 1 Critique

May 08, 2025

Tatum Under Fire Colin Cowherds Post Game 1 Critique

May 08, 2025 -

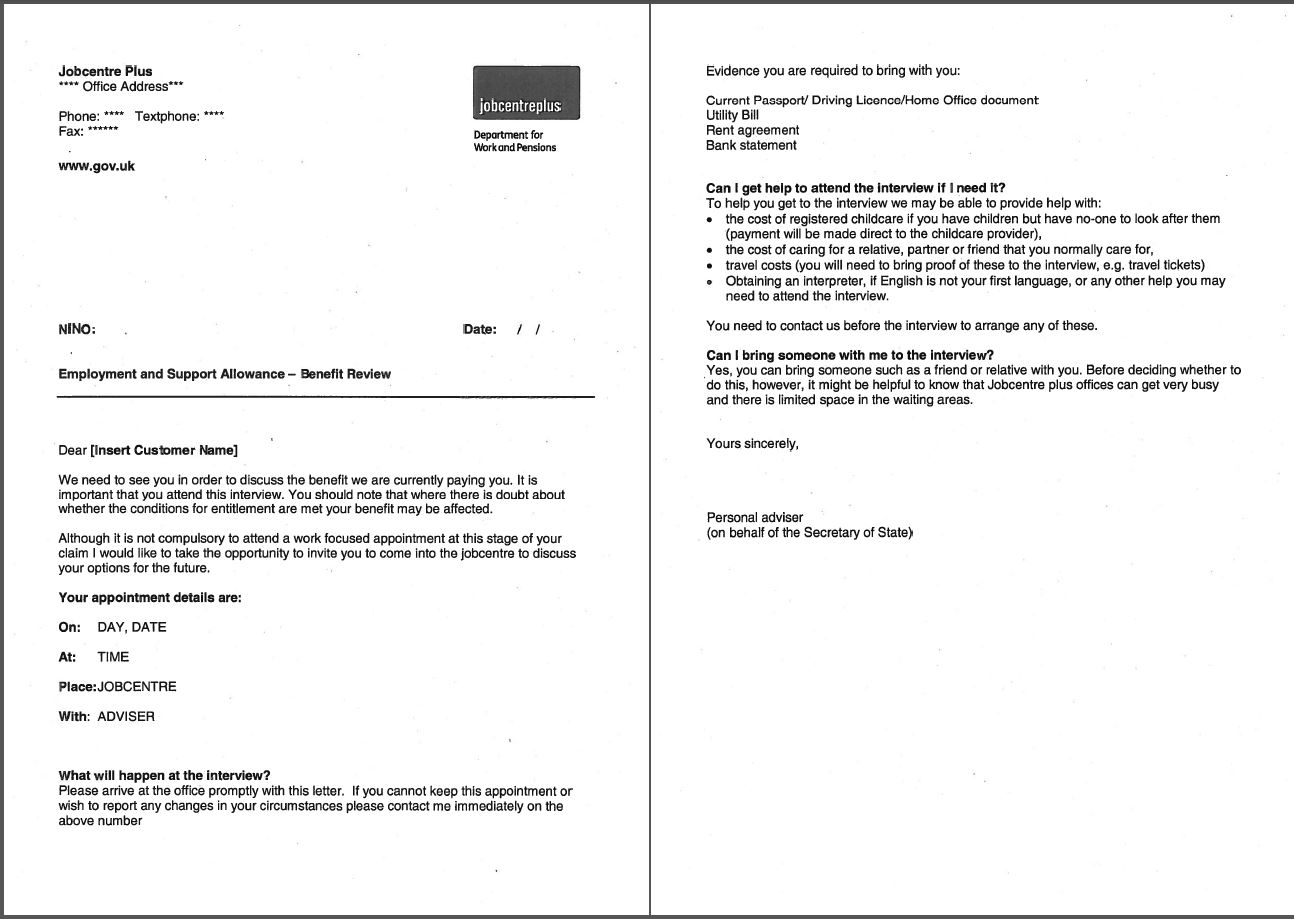

Dont Lose Your Benefits What To Do If Your Dwp Letter Is Missing

May 08, 2025

Dont Lose Your Benefits What To Do If Your Dwp Letter Is Missing

May 08, 2025 -

Dwp Universal Credit Refunds Check If You Re Owed Money

May 08, 2025

Dwp Universal Credit Refunds Check If You Re Owed Money

May 08, 2025 -

Jayson Tatums Honest Assessment Of Larry Birds Legacy

May 08, 2025

Jayson Tatums Honest Assessment Of Larry Birds Legacy

May 08, 2025 -

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025

Cowherds Harsh Words For Tatum After Celtics Game 1 Loss

May 08, 2025