The Grim Truth About Retail Sales And The Bank Of Canada's Next Move

Table of Contents

Weakening Retail Sales: A Sign of Economic Slowdown?

The latest figures paint a worrying picture. Canadian retail sales have declined for [insert number] consecutive months, signaling a potential economic slowdown. This isn't isolated to one sector; it's a broad trend impacting various aspects of consumer spending.

Analyzing Recent Retail Sales Data

Statistics Canada recently reported a [insert percentage]% decrease in retail sales in [insert month, year], following a [insert percentage]% drop in [insert previous month, year]. This represents a significant decline compared to the same period last year.

- Durable Goods: Sales of durable goods, such as appliances and furniture, experienced a particularly sharp decline of [insert percentage]%, indicating consumers are tightening their belts on big-ticket items.

- Non-Durable Goods: While not as drastic, the decline in non-durable goods like clothing and groceries still points to a reduction in overall consumer spending. This suggests that even essential purchases are being impacted.

These figures, coupled with other key economic indicators, paint a clear picture: Canadian consumer spending is weakening. Understanding these trends is critical for grasping the implications for the Canadian economy. Keywords associated with this section include: Canadian retail sales, consumer spending, economic indicators, and retail sector.

Factors Contributing to the Decline

Several factors contribute to this decline in Canadian retail sales. The current economic climate is a complex interplay of multiple pressures.

- High Inflation: Persistent high inflation continues to erode consumer purchasing power, leaving less disposable income for discretionary spending.

- Rising Interest Rates: The Bank of Canada's recent interest rate hikes have increased borrowing costs, making it more expensive for consumers to finance purchases, impacting both big-ticket items and everyday spending.

- Decreased Consumer Confidence: Uncertainty about the future and concerns about job security have led to a decrease in consumer confidence, further dampening spending.

- Global Economic Uncertainty: Geopolitical instability and global economic slowdowns are also impacting the Canadian economy, creating uncertainty and reducing consumer spending.

- Supply Chain Issues: Although easing, lingering supply chain disruptions continue to contribute to higher prices and limited product availability.

These interconnected factors collectively contribute to the weakening retail sales figures and highlight the challenging economic landscape. Keywords here include: inflation, interest rates, consumer confidence, global economy, and supply chain.

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's response to weakening retail sales and persistent inflation is crucial to understanding the economic outlook. Their recent actions and stated goals significantly influence the future trajectory of the economy.

Recent Interest Rate Decisions and Their Impact

The Bank of Canada has implemented [insert number] interest rate hikes since [insert date], raising the benchmark interest rate to [insert current rate]%. This aggressive approach aims to curb inflation by reducing borrowing costs and cooling down economic activity.

- Rationale: The Bank's rationale centers around controlling inflation and preventing it from becoming entrenched. They aim to bring inflation back to their 2% target.

- Impact: Higher interest rates are directly impacting consumer spending, as mentioned above, contributing to the observed weakening retail sales figures.

Keywords used here include: Bank of Canada, monetary policy, interest rate hikes, and inflation targeting.

The Bank's Inflation Target and Its Challenges

The Bank of Canada's primary mandate is to maintain price stability, with an inflation target of 2%. However, achieving this target in the current environment proves challenging.

- Current Inflation Rate: The current inflation rate remains stubbornly high at [insert current inflation rate]%, significantly above the Bank's target.

- Persistence of Inflation: The persistence of inflation, driven by factors like supply chain disruptions and global energy prices, complicates the Bank's efforts.

- Future Scenarios: The Bank faces a difficult balancing act: controlling inflation without triggering a significant economic downturn.

Keywords for this section include: inflation rate, inflation control, economic growth, and monetary policy tools.

Predicting the Bank of Canada's Next Move

Predicting the Bank of Canada's next move requires careful consideration of various economic indicators, going beyond retail sales figures alone.

Interpreting Economic Indicators Beyond Retail Sales

The Bank of Canada's decisions are informed by a wide range of economic data.

- Employment Data: Strong employment numbers might indicate a resilient economy, potentially prompting further rate hikes. Conversely, weakening employment could lead to a pause or even a rate cut.

- Housing Market Activity: The housing market's performance also influences the Bank’s decisions, as it's a significant driver of economic activity.

- GDP Growth: GDP growth figures provide a broader picture of the overall health of the economy and are a key factor influencing the Bank's decisions.

- Economic Forecast: The Bank's own economic forecast, encompassing multiple indicators and models, plays a significant role in shaping their monetary policy decisions.

Keywords for this section include: employment rate, housing market, GDP growth, and economic forecast.

Potential Scenarios and Their Implications

Several scenarios are possible for the Bank of Canada's next move:

- Further Interest Rate Hikes: If inflation remains stubbornly high and economic growth is strong, further interest rate hikes are likely. This would likely further dampen consumer spending and retail sales.

- A Pause: If inflation shows signs of cooling and economic growth slows, the Bank might pause rate hikes to assess the impact of previous increases.

- A Rate Cut: This is less likely in the near term, given the current inflation levels, but a rate cut could become a possibility if the economy enters a significant downturn.

The implications of each scenario are significant for retail sales and the broader economy. Each choice carries risks and potential rewards. Keywords used here include: interest rate forecast, economic outlook, market predictions, and central bank policy.

Conclusion

The weakening Canadian retail sales data presents a grim truth: consumer spending is under pressure, largely driven by high inflation and rising interest rates. This situation significantly influences the Bank of Canada's next move. While predicting the future is inherently challenging, analyzing current economic indicators suggests several potential scenarios, each carrying significant implications for the economy.

Call to Action: Stay informed about the latest developments regarding Canadian retail sales and the Bank of Canada's monetary policy decisions. Subscribe to our newsletter for regular updates and insights, or follow the Bank of Canada's announcements directly. Understanding these trends is vital for making informed financial and investment decisions in the current challenging economic climate. Stay updated on Canadian retail sales and the Bank of Canada's next move to navigate the economic landscape effectively.

Featured Posts

-

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

Apr 28, 2025

Pandemic Fraud Lab Owner Convicted For Fake Covid Test Results

Apr 28, 2025 -

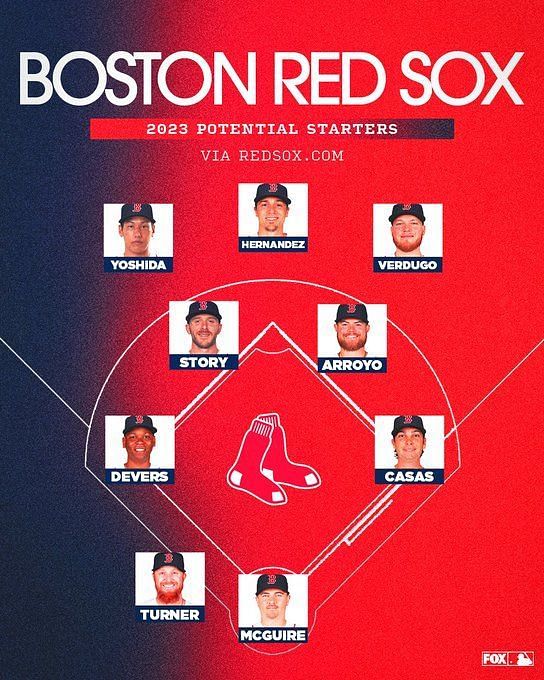

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025

Open Ais Chat Gpt An Ftc Investigation And Its Potential Consequences

Apr 28, 2025 -

Investing In The Future The Countrys Promising Business Hubs

Apr 28, 2025

Investing In The Future The Countrys Promising Business Hubs

Apr 28, 2025 -

Silent Divorce Are These Subtle Signs Showing Up In Your Marriage

Apr 28, 2025

Silent Divorce Are These Subtle Signs Showing Up In Your Marriage

Apr 28, 2025

Latest Posts

-

75

Apr 28, 2025

75

Apr 28, 2025 -

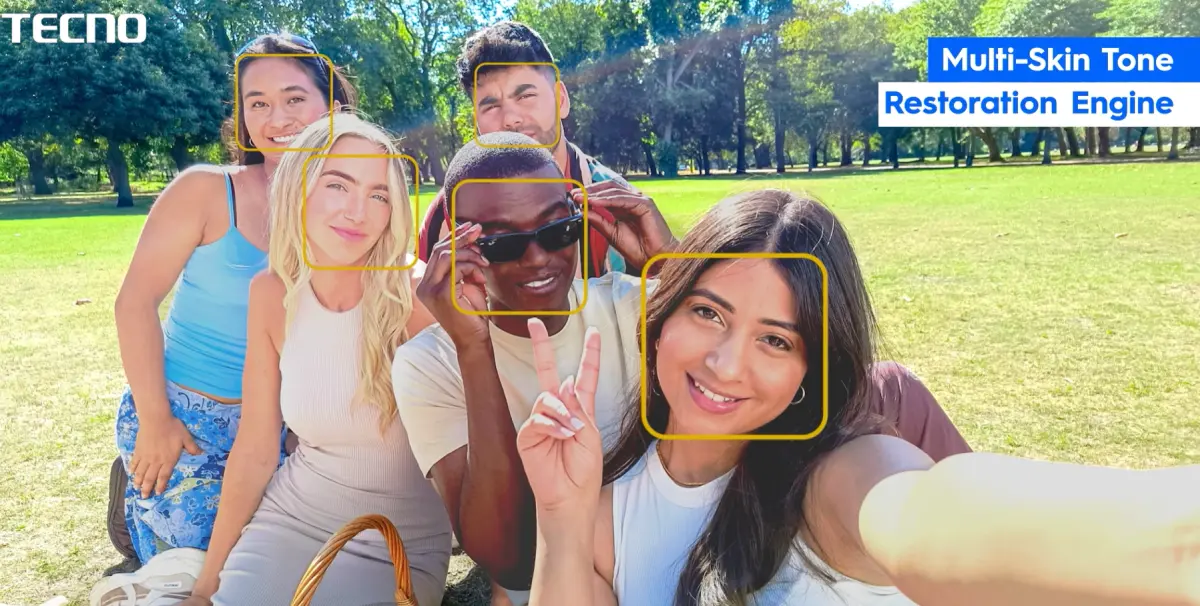

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025