The Growing Appeal Of The Venture Capital Secondary Market

Table of Contents

Increased Liquidity for Limited Partners (LPs)

The venture capital secondary market offers LPs a powerful tool to manage their private equity investments more effectively. Traditionally, LPs are locked into their commitments for the duration of a fund's life, often 10 years or more. The secondary market provides an exit strategy, allowing them to sell their stakes before the fund's natural end, thereby unlocking capital. This liquidity offers significant advantages:

- Access to capital before the fund's natural life cycle: LPs can access their invested capital earlier than anticipated, allowing for greater flexibility in managing their overall portfolio.

- Improved portfolio diversification by reinvesting proceeds: The proceeds from a secondary sale can be reinvested into other opportunities, thereby diversifying the LP's portfolio and potentially improving overall returns.

- Addressing capital calls and managing cash flow: The secondary market helps LPs manage unforeseen capital calls, ensuring smoother cash flow management and reducing financial strain.

- Reducing overall portfolio risk: By selectively selling portions of their holdings, LPs can reduce their exposure to specific funds or asset classes, mitigating potential risks.

Types of LP Secondary Transactions

LPs can participate in various secondary transactions, each offering a different approach to liquidity:

- Direct Sales: Selling shares directly to another LP or an institutional investor.

- Fund-Level Transactions: Selling an entire stake in a specific venture capital fund.

- Portfolio Company Sales: Selling shares in individual portfolio companies held within a fund. This is often more complex but can offer potentially higher returns.

Enhanced Portfolio Management for General Partners (GPs)

The secondary market also provides substantial benefits for GPs, allowing for more active and strategic portfolio management. By participating in secondary transactions, GPs can reshape their portfolios, focusing resources on their most promising investments and improving the overall fund performance.

- Improving fund concentration and reducing risk: Selling underperforming assets allows GPs to focus capital on high-growth opportunities, improving the overall risk-adjusted return of the fund.

- Securing additional capital for high-growth companies: Secondary transactions can free up capital for reinvestment in promising portfolio companies requiring further funding.

- Addressing underperforming assets or non-core investments: GPs can strategically offload underperforming assets, cleaning up their portfolio and improving overall fund performance.

- Strengthening investor relations through demonstrating proactive portfolio management: Proactive portfolio management, facilitated by secondary transactions, shows LPs that the GP is actively managing risk and optimizing returns.

Strategic Uses of Secondary Transactions for GPs

GPs can utilize secondary transactions strategically to achieve various goals, such as:

- Focusing on a particular sector or geographic area: Selling off investments outside of their core competency allows them to concentrate on their areas of expertise.

- Addressing liquidity needs for portfolio companies: Secondary sales can provide liquidity for portfolio companies needing additional funding or seeking an exit.

Navigating the Venture Capital Secondary Market: Key Considerations

While the venture capital secondary market presents significant opportunities, navigating it requires careful consideration of several factors:

- Valuation challenges and determining fair market value: Accurately valuing private company stakes can be complex and requires specialized expertise.

- Thorough due diligence processes: Due diligence is crucial to ensure the accuracy of valuations and identify any potential risks.

- Understanding transaction costs and fees: Various fees and costs are associated with secondary transactions, which need to be carefully considered.

- Regulatory compliance and legal considerations: Navigating regulatory complexities and ensuring legal compliance is paramount.

- Identifying reputable buyers and sellers in the VC secondary market: Selecting experienced and reputable partners is vital to successful transactions.

The Future of the Venture Capital Secondary Market

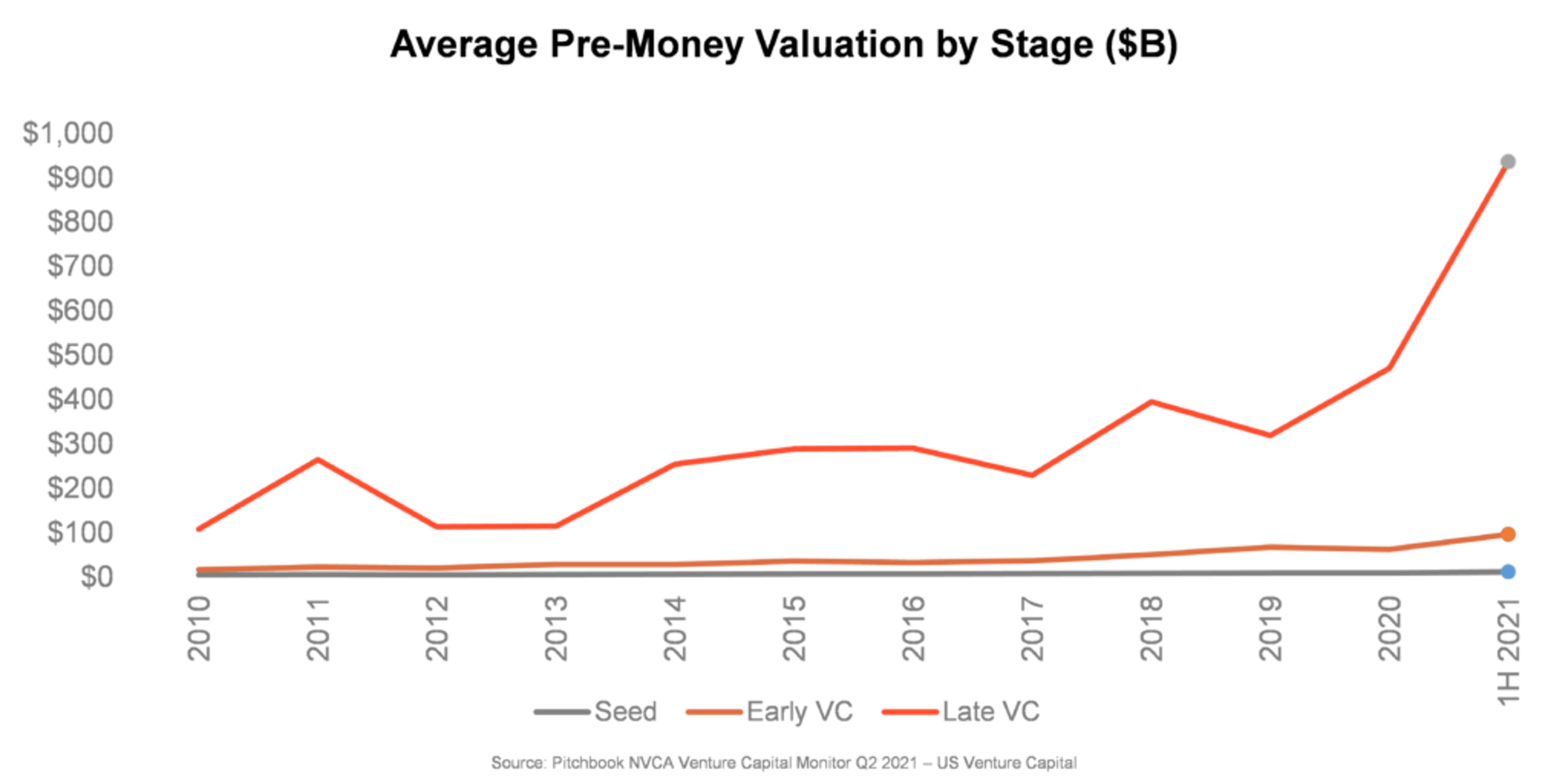

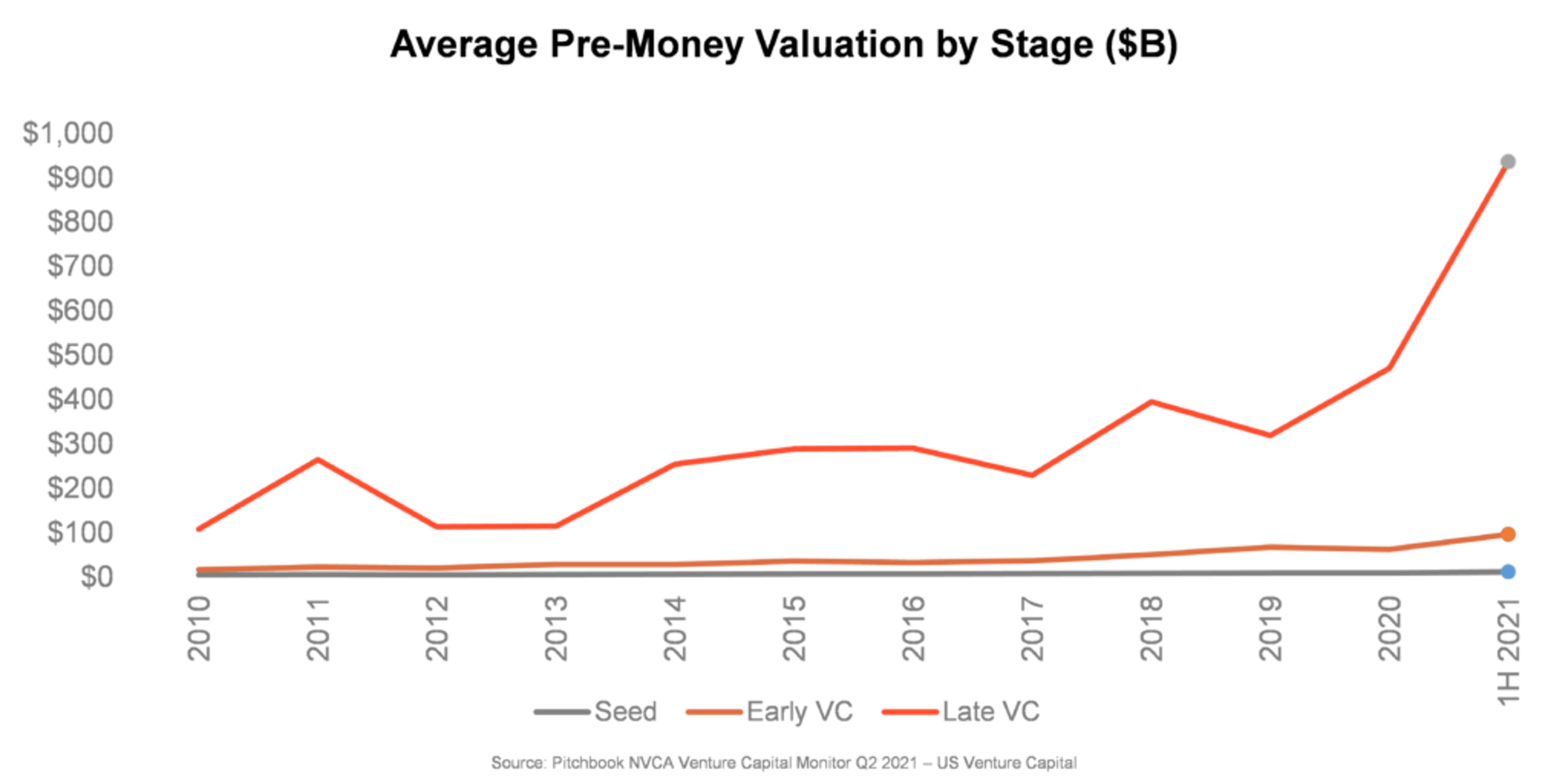

The venture capital secondary market is poised for significant growth, driven by several key trends:

- Increased use of technology to streamline transactions: Technological advancements are making secondary transactions more efficient and transparent.

- Growing institutional investor participation: Institutional investors are increasingly recognizing the value proposition of the secondary market.

- Potential for increased regulatory clarity and standardization: Greater regulatory clarity could further accelerate market growth.

- Expansion into new asset classes beyond traditional venture capital: The secondary market may expand to include other asset classes, further broadening its reach.

Conclusion

The venture capital secondary market offers compelling benefits for both LPs and GPs. For LPs, it provides increased liquidity, portfolio diversification, and improved cash flow management. For GPs, it facilitates proactive portfolio management, allowing them to optimize fund performance and strengthen investor relations. The rising importance of this market is undeniable, and its role in shaping the future of private equity investing is only set to expand. Explore the opportunities presented by the venture capital secondary market and learn how to leverage this dynamic space to achieve your investment goals. Contact us today to discuss your specific needs and explore secondary market transactions. Learn more about VC secondary market investments.

Featured Posts

-

Canada Election 2023 Mark Carneys Faltering Campaign Momentum

Apr 29, 2025

Canada Election 2023 Mark Carneys Faltering Campaign Momentum

Apr 29, 2025 -

La Fires Landlords Exploiting Crisis Claims Reality Tv Star

Apr 29, 2025

La Fires Landlords Exploiting Crisis Claims Reality Tv Star

Apr 29, 2025 -

The Price Of Stardom Willie Nelson And The Risks Of Non Stop Touring

Apr 29, 2025

The Price Of Stardom Willie Nelson And The Risks Of Non Stop Touring

Apr 29, 2025 -

Dubais Khazna Targets Saudi Market Following Silver Lake Partnership

Apr 29, 2025

Dubais Khazna Targets Saudi Market Following Silver Lake Partnership

Apr 29, 2025 -

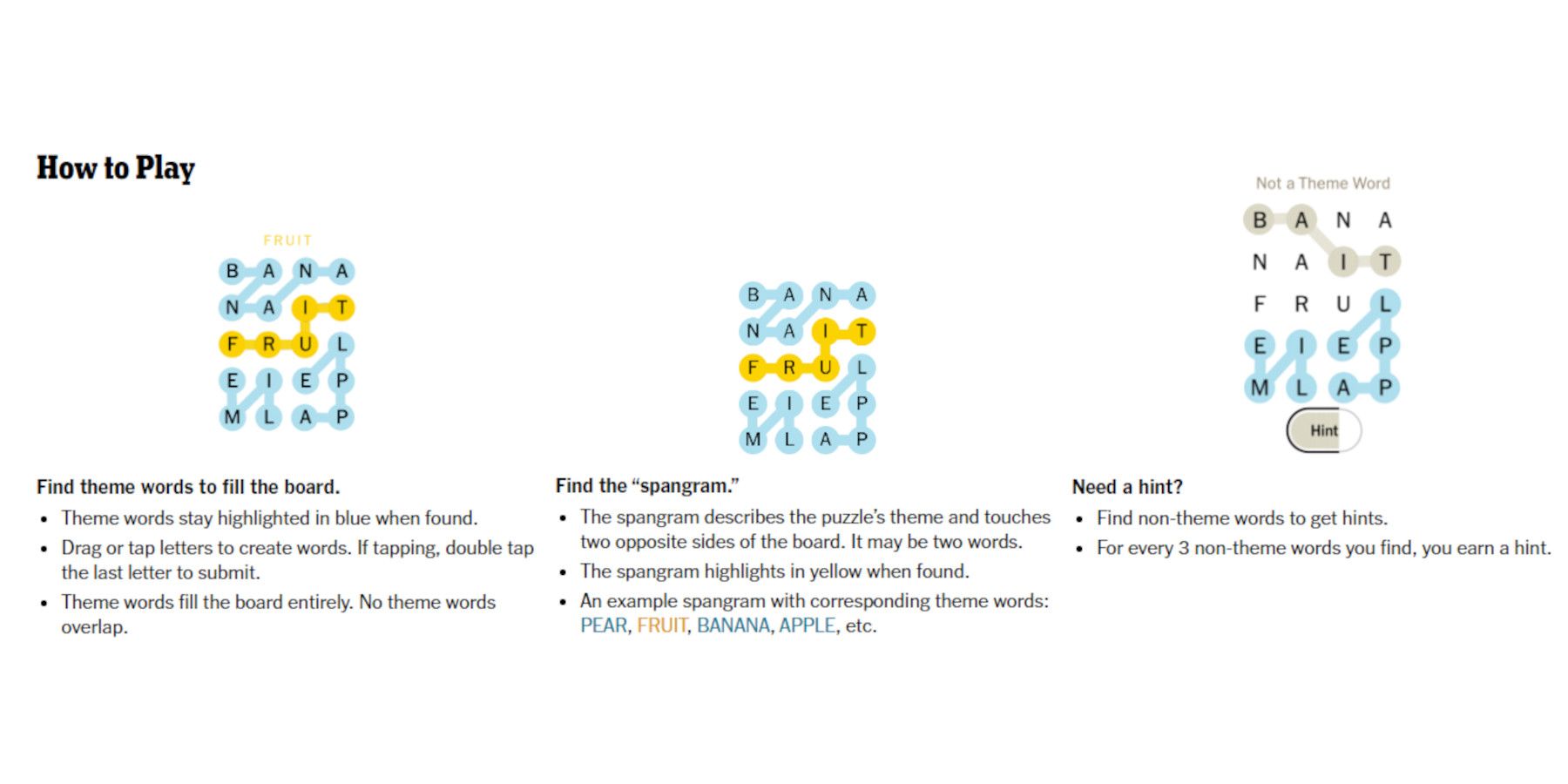

Solve Nyt Strands Hints And Answers For March 3 2025

Apr 29, 2025

Solve Nyt Strands Hints And Answers For March 3 2025

Apr 29, 2025

Latest Posts

-

Concern Mounts For Missing Midland Athlete In Las Vegas

Apr 29, 2025

Concern Mounts For Missing Midland Athlete In Las Vegas

Apr 29, 2025 -

Midland Athlete Vanishes In Las Vegas Urgent Search Underway

Apr 29, 2025

Midland Athlete Vanishes In Las Vegas Urgent Search Underway

Apr 29, 2025 -

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025

Convicted Cardinal Claims Right To Participate In Papal Conclave

Apr 29, 2025 -

Update Missing Brit Paralympian Found Following Wrestle Mania Disappearance

Apr 29, 2025

Update Missing Brit Paralympian Found Following Wrestle Mania Disappearance

Apr 29, 2025 -

Papal Conclave Legal Battle Over Convicted Cardinals Voting Eligibility

Apr 29, 2025

Papal Conclave Legal Battle Over Convicted Cardinals Voting Eligibility

Apr 29, 2025