The House's Approval Of The Trump Tax Bill: A Comprehensive Overview

Table of Contents

Key Provisions of the Trump Tax Bill

The Trump Tax Cuts and Jobs Act of 2017 significantly altered the US tax code, implementing substantial changes to both individual and corporate taxation. These changes aimed to stimulate economic growth through tax cuts, but their impact remains a subject of ongoing debate.

-

Individual Income Tax Rate Reductions: The bill reduced individual income tax rates across seven brackets. This resulted in lower tax burdens for many Americans, although the extent of the reduction varied significantly depending on income level and tax bracket. Keywords: tax brackets, tax cuts, individual tax rates.

-

Standard Deduction Increases: The standard deduction was significantly increased, benefiting lower and middle-income taxpayers who previously itemized deductions. This simplification aimed to reduce the complexity of tax filing for many.

-

Changes to Itemized Deductions: While the standard deduction increased, several itemized deductions were altered. Notably, the state and local tax (SALT) deduction was capped at $10,000, impacting taxpayers in high-tax states disproportionately. This change sparked significant controversy. Keywords: itemized deductions, SALT deduction, tax reform.

-

Corporate Tax Rate Reduction: The most significant change was the reduction of the corporate tax rate from 35% to 21%. Proponents argued this would boost business investment and job creation. Keywords: corporate tax reform, corporate tax rate, business tax cuts.

-

Changes to the Alternative Minimum Tax (AMT): The AMT, designed to ensure high-income taxpayers pay a minimum amount of tax, was also modified. These changes affected the number of taxpayers subject to the AMT and altered its calculation.

The Legislative Process and Political Landscape

The Trump Tax Bill's journey through the House was swift and politically charged. It faced significant opposition, particularly from Democrats who raised concerns about its economic consequences and its impact on income inequality.

-

Committee Hearings and Markups: The bill underwent committee hearings and markups, where various amendments were proposed and debated. These sessions involved intense negotiations and compromises. Keywords: House Ways and Means Committee, Congressional hearings, legislative process.

-

House Floor Debates and Amendments: The bill faced extensive debate on the House floor, with numerous amendments proposed and voted upon. This stage highlighted the deep partisan divisions surrounding the legislation. Keywords: House of Representatives, floor debate, amendments.

-

Voting Process and Final Passage: The bill ultimately passed the House with a majority vote, largely along party lines. The Republican party held a majority in the House at the time, enabling the bill's passage. Keywords: House vote, Republican party, Congressional approval.

Economic Impacts and Consequences of the Trump Tax Bill

The economic impacts of the Trump Tax Bill are complex and continue to be debated by economists. Both short-term and long-term effects are being assessed.

-

Impact on Economic Growth (GDP): Proponents argued the tax cuts would stimulate economic growth through increased investment and consumer spending. However, the actual impact on GDP growth remains a subject of ongoing analysis and differing interpretations. Keywords: economic stimulus, GDP growth, fiscal policy.

-

Effects on Employment and Wages: While proponents predicted job creation, the bill's effect on employment and wages has been less clear-cut. Some studies have shown modest positive effects, while others have found limited impact.

-

National Debt Implications: The tax cuts significantly increased the national debt. Critics argued that the revenue losses resulting from the tax cuts were unsustainable and would exacerbate the nation's fiscal challenges. Keywords: national debt, fiscal deficit, budget deficit.

-

Distribution of Tax Benefits: The tax cuts disproportionately benefited high-income individuals and corporations, exacerbating income inequality, according to several analyses. This aspect drew substantial criticism from opponents of the bill.

Public Opinion and Criticism of the Trump Tax Bill

Public opinion on the Trump Tax Bill was sharply divided. While some welcomed the tax cuts, others criticized their effects on the national debt and income inequality.

-

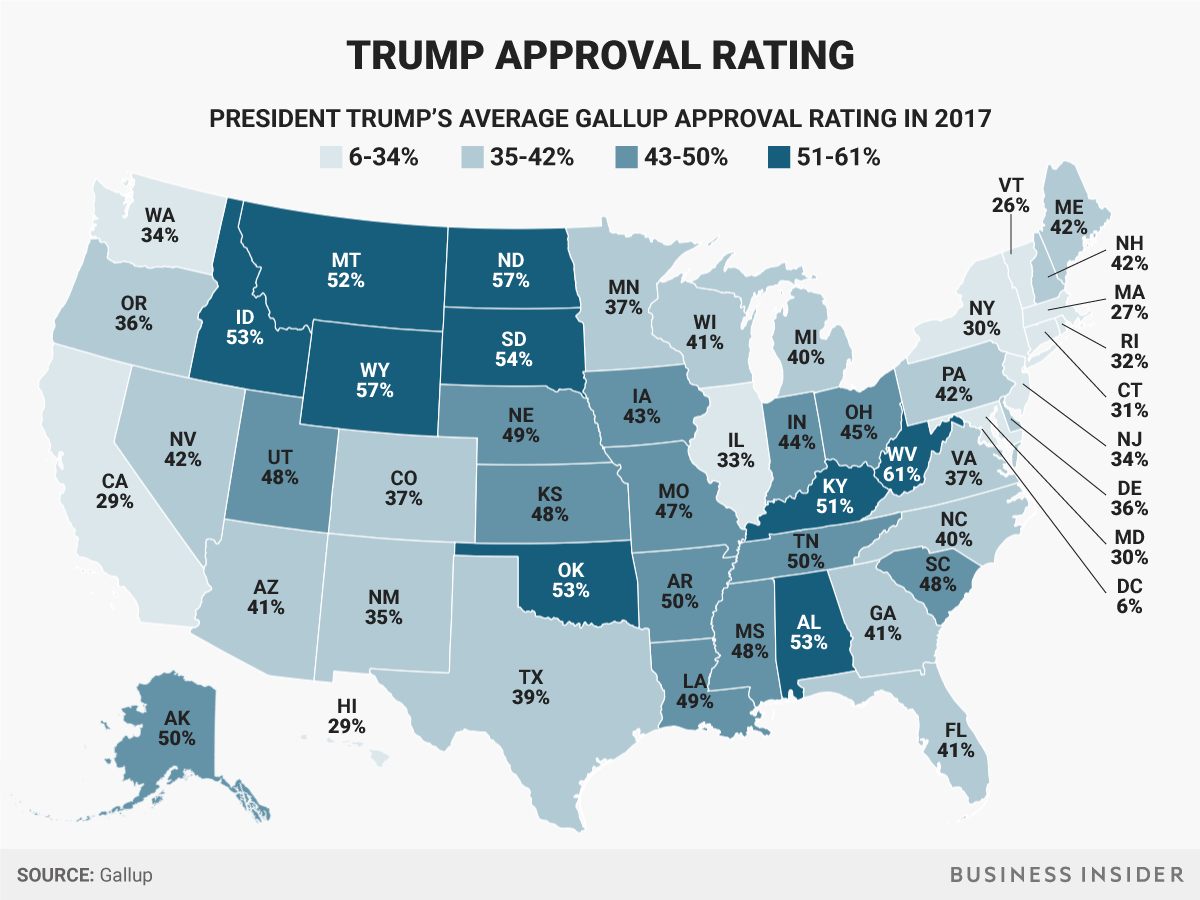

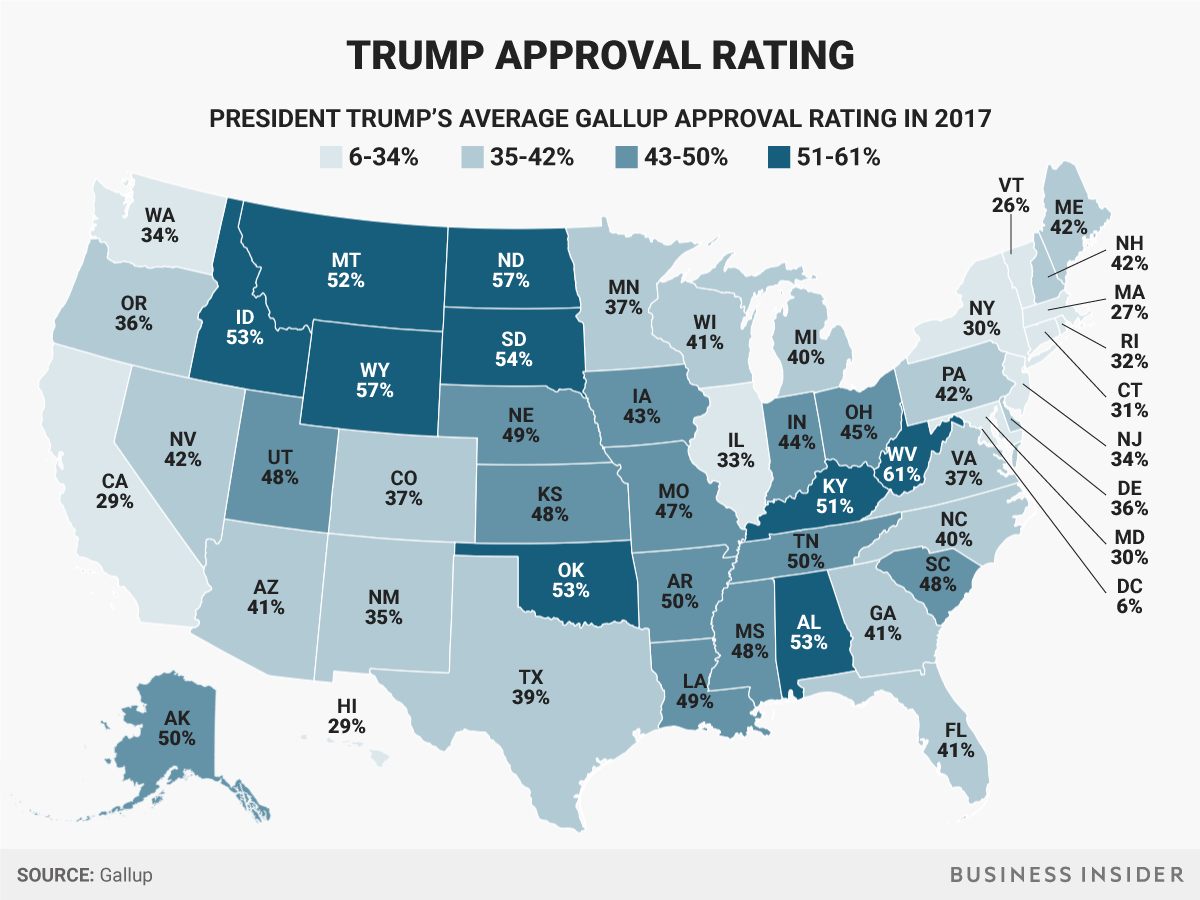

Public Perception of the Tax Cuts: Polls revealed mixed public sentiment. Some supported the tax cuts, while others viewed them negatively. The level of support often correlated with political affiliation. Keywords: tax reform debate, public opinion, polling data.

-

Arguments Against the Bill: Critics argued the bill unfairly benefited the wealthy while increasing the national debt. Concerns were also raised about the long-term sustainability of the tax cuts and their potential impact on essential government services. Keywords: income inequality, tax fairness, economic justice.

-

Media Coverage and Public Discourse: The Trump Tax Bill generated extensive media coverage and public discourse, with various news outlets and commentators offering differing perspectives on its merits and drawbacks. This intense scrutiny reflects the bill's significance and controversial nature.

Conclusion

The Trump Tax Bill, passed by the House of Representatives, represented a profound reshaping of the US tax code. This overview has examined its key provisions, the intense political battles surrounding its passage, and its projected – and debated – economic impact. While supporters championed its stimulative effects, critics voiced significant concerns about its contribution to the national debt and its exacerbation of income inequality. To gain a deeper understanding of the ongoing ramifications of this landmark legislation, further research into the Trump Tax Bill's long-term effects is essential. Continue exploring the complexities of this significant piece of legislation and its continuing impact on the American economy.

Featured Posts

-

12 Mz

May 23, 2025

12 Mz

May 23, 2025 -

Chanted Free Palestine Before Attack Who Is Elias Rodriguez Accused In Jewish Museum Shooting

May 23, 2025

Chanted Free Palestine Before Attack Who Is Elias Rodriguez Accused In Jewish Museum Shooting

May 23, 2025 -

Last Minute Dress Trouble For This Morning Host Cat Deeley

May 23, 2025

Last Minute Dress Trouble For This Morning Host Cat Deeley

May 23, 2025 -

Englands Unwavering Faith In Zak Crawley A Look At His Future

May 23, 2025

Englands Unwavering Faith In Zak Crawley A Look At His Future

May 23, 2025 -

Transformation Maxine Developper La Confiance En Soi Pour L Avenir

May 23, 2025

Transformation Maxine Developper La Confiance En Soi Pour L Avenir

May 23, 2025