The Impact Of Japan's Steepening Bond Yield Curve On Investors And The Economy

Table of Contents

Factors Contributing to the Steepening of Japan's Bond Yield Curve

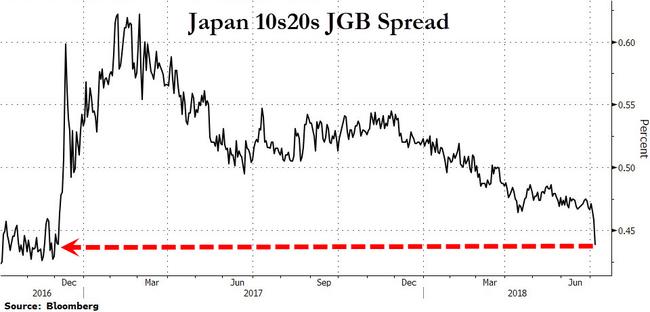

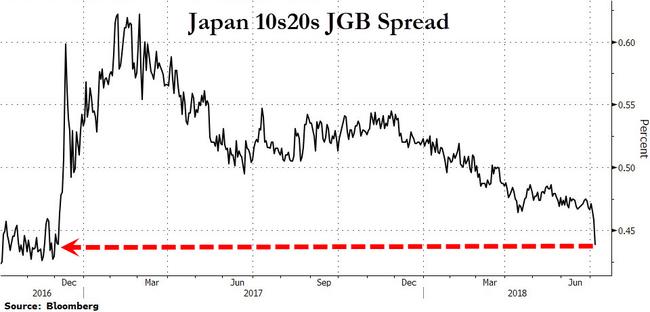

The Bank of Japan's (BOJ) Policy Shift

The Bank of Japan's (BOJ) recent adjustments to its yield curve control (YCC) policy are a primary driver of the steepening curve. For years, the BOJ maintained ultra-low interest rates and capped the 10-year Japanese government bond (JGB) yield, effectively flattening the yield curve. However, the recent modifications allow for greater flexibility in long-term interest rates. This shift signifies a move away from its extremely accommodative monetary policy, allowing long-term yields to rise more freely.

This policy shift has had several consequences:

- Increased market volatility: The removal of the yield cap introduced increased uncertainty and volatility into the JGB market.

- Higher borrowing costs for businesses: Rising long-term yields translate to higher borrowing costs for corporations, potentially impacting investment and economic growth.

- Potential for inflation: While the BOJ aims for a controlled level of inflation, the rising yields could contribute to inflationary pressures if not managed carefully.

Global Inflationary Pressures

Global inflationary pressures, fueled by factors like supply chain disruptions and increased energy prices, have significantly influenced Japanese bond yields. Rising inflation worldwide has led central banks in many countries, including the US Federal Reserve, to aggressively raise interest rates. This makes Japanese government bonds (JGBs), which historically offered low yields, less attractive to international investors seeking higher returns.

The impact of global inflation on Japan's bond market includes:

- Flight to safety diminishes: The traditional "flight to safety" towards JGBs during periods of global uncertainty is less pronounced as other assets offer more competitive yields.

- Increased demand for higher-yielding assets: Investors are increasingly seeking assets offering returns that keep pace with or exceed inflation, leading to reduced demand for JGBs.

- Strengthening of the US dollar: A stronger US dollar relative to the Yen further reduces the attractiveness of JGBs for foreign investors.

Increased Investor Confidence

Improved economic forecasts for Japan have also contributed to the steepening yield curve. Rising corporate profits and strengthening consumer spending suggest a more robust economic outlook, boosting investor confidence in the Japanese economy. This increased confidence translates into higher demand for Japanese assets, including JGBs, driving up yields across the curve.

This renewed investor confidence is reflected in:

- Increased demand for Japanese assets: Both domestic and international investors are showing increased appetite for Japanese equities and bonds.

- Reduction in risk aversion: Investors are less averse to risk, leading to a greater willingness to invest in higher-yielding assets.

- Strengthening of the Yen: A stronger Yen, partially driven by rising interest rates, makes Japanese assets more appealing to foreign investors.

Impact on Investors

Impact on Bond Investors

The steepening yield curve presents both opportunities and risks for bond investors holding JGBs. Investors holding longer-term JGBs may experience capital losses as yields rise, while those holding shorter-term bonds might see smaller price fluctuations.

Key implications for bond investors include:

- Increased potential for capital gains: Investors who anticipate further yield increases may profit from buying JGBs at lower prices.

- Increased interest rate risk: Rising interest rates increase the risk of capital losses on existing bond holdings.

- Need for portfolio diversification: Bond investors need to diversify their portfolios to mitigate the risks associated with a steepening yield curve.

Impact on Equity Investors

The steepening yield curve indirectly impacts equity valuations. Higher bond yields increase the cost of capital for companies, potentially reducing corporate investment and slowing economic growth. This can lead to lower equity valuations.

The relationship between bond yields and the equity market includes:

- Potential for reduced equity valuations: Higher borrowing costs can reduce corporate profitability and depress stock prices.

- Increased cost of capital for companies: Businesses may postpone expansion plans due to the higher cost of borrowing.

- Shift in investor preferences: Investors may shift their allocations from equities to higher-yielding bonds.

Impact on Currency Traders

The steepening yield curve significantly influences the Yen's exchange rate. Rising Japanese interest rates make the Yen more attractive to foreign investors seeking higher returns, potentially leading to Yen appreciation.

The impact on currency traders includes:

- Yen appreciation or depreciation: The direction of the Yen's movement depends on the interplay of interest rate differentials and other economic factors.

- Increased volatility in currency markets: The shift in monetary policy increases uncertainty and volatility in the foreign exchange market.

- Carry trade implications: The carry trade, which involves borrowing in low-yielding currencies and investing in higher-yielding ones, becomes less attractive with rising Japanese interest rates.

Impact on the Japanese Economy

Impact on Economic Growth

Higher interest rates resulting from the steepening yield curve can impact both business investment and consumer spending. Increased borrowing costs can dampen economic growth, while inflationary pressures could erode purchasing power.

Potential impacts on economic growth include:

- Slower economic growth: Higher borrowing costs can restrain business investment and consumer spending.

- Increased borrowing costs: Businesses and consumers face higher costs for loans, mortgages, and other forms of credit.

- Potential for overheating economy: If inflation accelerates significantly, it could necessitate further interest rate hikes, potentially leading to a recession.

Impact on Government Borrowing Costs

The steepening yield curve increases the cost for the Japanese government to borrow money. This rise in borrowing costs has implications for government finances and spending plans.

The implications for government finances include:

- Increased budget deficits: The government may face higher interest payments on its debt, increasing budget deficits.

- Potential for austerity measures: To control debt levels, the government may need to implement austerity measures, potentially impacting social programs.

- Impact on social programs: Reduced government spending due to higher borrowing costs could affect social welfare programs.

Conclusion

The steepening of Japan's bond yield curve is a complex phenomenon driven by a confluence of factors, including the BOJ's policy shift, global inflationary pressures, and increased investor confidence. This shift has significant repercussions for investors across asset classes and the broader Japanese economy. Understanding the dynamics of Japan's bond yield curve is crucial for investors seeking to navigate the evolving market landscape and for policymakers aiming to manage economic growth effectively. To stay informed about the ongoing impact of Japan's Bond Yield Curve and make informed investment decisions, continue monitoring key economic indicators and policy changes. Stay tuned for further analyses and updates on this crucial aspect of the Japanese Japanese bond market and its yield curve.

Featured Posts

-

Find Your Angel Reese Wnba Jersey A Guide For Opening Weekend

May 17, 2025

Find Your Angel Reese Wnba Jersey A Guide For Opening Weekend

May 17, 2025 -

Cassie Ventura Testifies In Diddy Trial Details On Sean Combs Alleged Behavior

May 17, 2025

Cassie Ventura Testifies In Diddy Trial Details On Sean Combs Alleged Behavior

May 17, 2025 -

Reebok X Angel Reese Collaboration Unveiling The Collection

May 17, 2025

Reebok X Angel Reese Collaboration Unveiling The Collection

May 17, 2025 -

Barcelona Match Car Crash 13 Injured Police Call It Accidental

May 17, 2025

Barcelona Match Car Crash 13 Injured Police Call It Accidental

May 17, 2025 -

Thibodeaus Humorous Pope Remark A Deeper Look At The Knicks

May 17, 2025

Thibodeaus Humorous Pope Remark A Deeper Look At The Knicks

May 17, 2025

Latest Posts

-

Austintown And Boardman Police Blotter Your Local Crime News Source

May 17, 2025

Austintown And Boardman Police Blotter Your Local Crime News Source

May 17, 2025 -

Weekly Review Identifying And Learning From Failures

May 17, 2025

Weekly Review Identifying And Learning From Failures

May 17, 2025 -

Reta Nba Klaida Teisejas Pripazino Itaka Pistons Ir Knicks Rungtyniu Rezultatui

May 17, 2025

Reta Nba Klaida Teisejas Pripazino Itaka Pistons Ir Knicks Rungtyniu Rezultatui

May 17, 2025 -

Nba Teisejo Klaida Pistons Ir Knicks Rungtyniu Baigtis Pakoreguota

May 17, 2025

Nba Teisejo Klaida Pistons Ir Knicks Rungtyniu Baigtis Pakoreguota

May 17, 2025 -

Track Season Roundup All Conference Athletes Recognized

May 17, 2025

Track Season Roundup All Conference Athletes Recognized

May 17, 2025