The Impact Of Saudi Arabia's New ABS Market Regulations

Table of Contents

Stimulating Growth in the Saudi ABS Market

The new ABS market regulations aim to create a more transparent and efficient environment for issuing and trading asset-backed securities. This, in turn, is expected to unlock significant growth potential within the Saudi financial sector.

Increased Transparency and Standardization

Clearer regulations are crucial for attracting both domestic and international investment. The improved regulatory framework fosters confidence by reducing ambiguity and uncertainty surrounding ABS transactions.

- Improved investor confidence: Standardized disclosure requirements and accounting standards provide investors with a clearer picture of the underlying assets and risks, making them more comfortable participating in the market.

- Reduced risk perception: Robust regulatory oversight minimizes the potential for fraud and misconduct, thereby reducing the perceived risk associated with ABS investments.

- Streamlined processes for issuance: Simplified issuance procedures reduce the time and cost associated with bringing ABS to market, encouraging greater participation.

- Enhanced market liquidity: A more liquid market benefits both issuers and investors by facilitating easier trading and price discovery.

Specific regulations promoting transparency include detailed disclosure requirements for underlying assets, stringent auditing standards, and clear guidelines for valuation methodologies. This enhanced transparency builds trust and encourages wider participation.

Boosting the Sukuk Market

The regulations specifically address the facilitation of Islamic asset-backed securities (sukuk), aligning with Saudi Arabia's prominence in Islamic finance. This targeted approach is crucial for expanding the reach and impact of the sukuk market.

- Clarification of Sharia-compliant structures: The regulations provide clear guidelines on structuring sukuk to ensure compliance with Islamic principles, removing ambiguity and facilitating their issuance.

- Simplified issuance procedures for sukuk: Streamlined processes specifically designed for sukuk issuance reduce the complexities involved, making them more accessible to issuers.

- Increased investor interest in Islamic finance: The growth of the sukuk market attracts a wider range of investors seeking Sharia-compliant investment opportunities.

The successful issuance of several large-scale sukuk following the implementation of the new regulations serves as a testament to their effectiveness in stimulating the market. These issuances have injected significant capital into the Saudi economy and demonstrated the market's capacity for growth.

Attracting Foreign Investment into Saudi Arabia

The new ABS market regulations are designed to attract considerable foreign direct investment (FDI) into the Kingdom. This is achieved by creating a regulatory environment that is both transparent and aligned with international best practices.

Improved Regulatory Framework

By aligning with international standards, Saudi Arabia presents a more attractive proposition to global investors. This enhanced regulatory framework signals a commitment to good governance and investor protection.

- Increased investor protection: Stronger investor rights and protection mechanisms reduce the risks associated with investing in the Saudi ABS market.

- Stronger regulatory oversight: Robust regulatory oversight ensures market integrity and stability, mitigating the risk of market manipulation or other irregularities.

- Reduced uncertainty for foreign investors: Clear and consistent regulations provide predictability and reduce the uncertainty often associated with emerging markets.

The new regulations compare favorably with those of other major financial centers, increasing investor confidence and making Saudi Arabia a more compelling investment destination.

Diversification of Investment Options

The expansion of the ABS market provides investors with a wider range of investment opportunities beyond traditional sectors, such as equities and bonds.

- Attracting investment in infrastructure projects: ABS can be used to finance large-scale infrastructure projects, attracting investment in crucial sectors for economic development.

- Real estate: Securitization of real estate assets offers new avenues for investment in the Saudi property market.

- Consumer finance: The ABS market can facilitate the growth of the consumer finance sector, providing access to credit for individuals and businesses.

- Other sectors: The potential for ABS to support various sectors promotes wider economic diversification and reduces reliance on oil revenue.

The potential projects backed by ABS range from renewable energy initiatives to healthcare developments, showcasing the diverse applications and economic benefits.

Challenges and Opportunities for Market Participants

While the new regulations offer significant opportunities, market participants will face challenges in adapting to the new requirements. However, the long-term benefits far outweigh these short-term hurdles.

Adapting to New Requirements

The transition to a new regulatory framework requires significant adjustments from market players. This involves both financial and operational changes.

- Need for training and development: Market participants need training and development to understand and comply with the new regulations.

- Investment in new technologies: New technologies and systems may be needed to comply with the enhanced reporting and disclosure requirements.

- Potential short-term disruptions: The implementation of new regulations may cause some short-term disruptions as market participants adjust their operations.

However, the Saudi Arabian Monetary Authority (SAMA) and other regulatory bodies are actively supporting market participants through workshops, training programs, and other initiatives to ease the transition.

Unlocking the Potential of the Saudi Economy

The development of a robust ABS market is a cornerstone of Saudi Arabia's economic diversification strategy. It presents significant long-term opportunities for economic growth and job creation.

- Creation of jobs: The expansion of the ABS market will create new jobs in various areas, including finance, law, and technology.

- Development of financial expertise: The market will drive the development of specialized financial expertise within the Kingdom.

- Enhanced economic competitiveness: A well-developed ABS market will enhance Saudi Arabia's competitiveness on the global stage.

The development of the ABS market is directly linked to Vision 2030, contributing significantly to the Kingdom's economic diversification goals and long-term prosperity.

Conclusion

Saudi Arabia's new ABS market regulations mark a pivotal moment for the Kingdom's financial sector. By increasing transparency, streamlining processes, and aligning with international best practices, these regulations are stimulating growth in the ABS market, attracting significant foreign investment, and boosting the sukuk market. While challenges exist for market participants in adapting to the new requirements, the long-term opportunities presented by a robust ABS market are considerable, contributing significantly to Saudi Arabia's economic diversification and sustainable growth. Discover the potential of Saudi Arabia's ABS market and explore the numerous investment opportunities presented by this transformative regulatory shift. Learn more about the transformative impact of Saudi Arabia's new ABS regulations by visiting [link to relevant resource].

Featured Posts

-

Reform Uk And The Conservatives A Growing Divide On Populism

May 03, 2025

Reform Uk And The Conservatives A Growing Divide On Populism

May 03, 2025 -

3 Key Questions Facing Sarina Wiegman And England Ahead Of Euro 2025

May 03, 2025

3 Key Questions Facing Sarina Wiegman And England Ahead Of Euro 2025

May 03, 2025 -

Fortnites Controversial Music Update Player Backlash

May 03, 2025

Fortnites Controversial Music Update Player Backlash

May 03, 2025 -

Dont Miss Out Free Cowboy Bebop Gear In Fortnite

May 03, 2025

Dont Miss Out Free Cowboy Bebop Gear In Fortnite

May 03, 2025 -

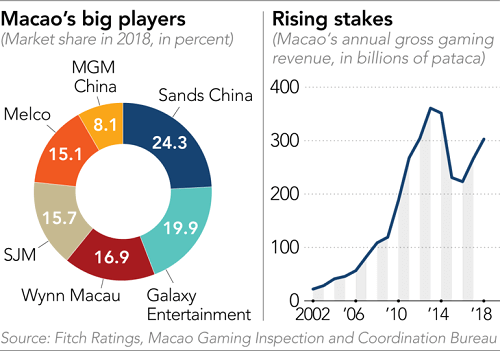

Stronger Than Predicted Macaus Gaming Revenue Before Golden Week

May 03, 2025

Stronger Than Predicted Macaus Gaming Revenue Before Golden Week

May 03, 2025